Foreign investment for a developing country is the fuel to the vehicle of economy, but just like the actual fuel prices in India right now, this fuels also looks out-of-league now

Foreign investment for a developing country is the fuel to the vehicle of economy, but just like the actual fuel prices in India right now, this fuels also looks out-of-league now

Self-sustaining i.e. Atmanirbhar country, global manufacturing hub or a 5 Trillion-dollar economy- no promise or agenda that the government of the country has made over the years would be able to become possible if the country doesn’t attract, retain and leverage a good amount of Foreign Direct Investment, which apparently the government has made unreal claims about. Foreign investment for a developing country is that driving force to the vehicle that takes it to the desired finish line, by contributing in a number of factors including better workforce skills, advanced technology and technical know-how, improved productivity, creation of better paying opportunities and development of businesses.

And if we see at the picture from a few years ago, India did make its place as a potential foreign direct investment destination by attracting healthy overseas investments and some key global players. However, it is important to note that as fancy as attracting foreign investment may sound, the real deal is retaining foreign investors and direct investments, and leveraging them to help assist in building a developing, sustainable economy. Unfortunately for India, so wasn’t and neither is the case. Here’s why.

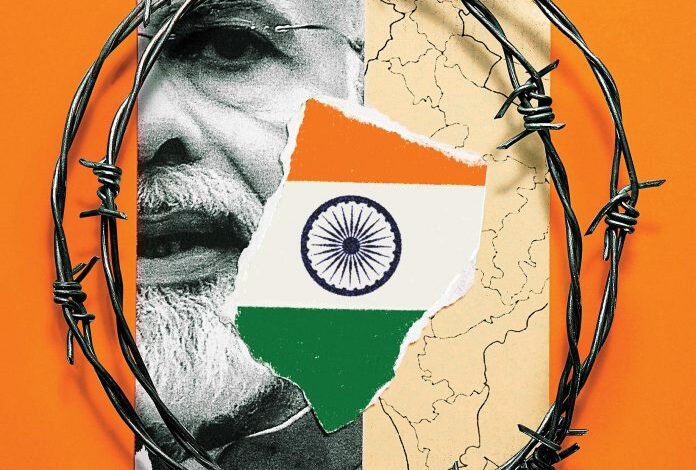

One of the most important criteria for healthy investment inflow is the political stability of the business environment and thus, the country. However, as is confronted loud and clear, the country is clearly in a political turmoil, far from stable. With protest on streets and violence in broad daylight, the country’s political system has failed miserably to show stability to its own citizens, let alone foreign investors that value global reputation and stability over anything.

Another important aspect to retain and grow foreign direct investment is financial stability and promising economic position, which is self-explanatory in more ways than can be mentioned. With India standing at a position of one of the lowest economic growth in decades, investor confidence is shaken down to the core, not only because of the current position and a number of other factors but also because of the fact that no healthy and promising economic recovery can be expected in the near future keeping in view the lack of government’s action reforms to uplift economy in terms of inflation, unemployment and market conditions.

While a foreign investor expects the potential country to provide legal protection against political and regulatory risks, the Modi-led NDA government has been eerily sitting in on touching any major policy reforms that could help bolster the otherwise downward-facing investments, like the Goods and Service tax, and the bankruptcy and insolvency law. Leaving it on fate, are we? Looking at a broader picture, India emerged as a potential foreign investment destination owing to its increased propensity to consume and abundantly available cheap labour.

This means that any stabilisation in the global economy would mean investors running back to other countries. Not just that, the pandemic has made people spend out of their savings and thus, one of the key factors making India an attractive site, the propensity to consume can be seen taking a downward trend unless otherwise effective stimulating reforms are undertaken.

Now there’s only one problem with this conversation of reforms. Modi led NDA government has proved time and again that economy is not their strong side and we can’t deny it. The inability of the government to undertake timely, effective economic stimulus to bolster the degrading economy has set foreseeable economic problems, both industrially and institutionally, in the near future. The potential investors however can readily predict them.

Not only that, now that the government has found itself in this deep pit of economic slowdown, further deepened because of ineffective decisions, the country’s only resort to actually implement infrastructure creation for attracting FDI can be through deepened deficits, which would make it difficult for the country to procure foreign loans owing to worsened credit ratings. Along with other prominent things, this would heavily impact the country’s yield, risk appetite and growth. So while we’re still discussing religious issues, it is time the government prioritise what is more important.

Oh, and while we are on the topic of prioritising, how can we not talk about the inability of the judiciary to handle corporate matters. SEBI along with a number of other duties also handles corporate and marker related redressal matters. In other words, key governance factors like business regulation reforms, dispute settlement mechanisms and secured operations, are all missing in the country, with the government in no apparent mood to fix them.

This is one of the major touch points of foreign direct investment attraction and their irresponsible absence stands like a big question mark on India’s dreams of being a prominent foreign investment destination. While the judicial system’s inability and government’s lack of accountability are some key parameters in making India not fit for foreign direct investment, the media’s repetitive ignorance is merely adding to it and we’re all its witnesses.

We would be lying if we say we can’t see the government’s bias towards the Ambani’s owned Reliance and Adani businesses, and well, other corporations too have raised questions about it. If this bias is so apparent and the government does nothing about it, we can fairly say the foreign institutions cannot deem fit India for their investment projects and joint ventures. This bias only adds to the country’s corrupt systems and religiously volatile environment.

Any potential foreign investor avoids putting their hands in communal countries because of how restricting the nature becomes and the union government’s evident focus on religious stronghold points at nothing but that. So we may choose to ignore it as much as we can but the truth is, we are intentionally tilting our heads to not see how India isn’t a safe country for foreign investment, any more.