Airpay partners with InstaReM to power FX payments

Mumbai/Singapore, 1 October, 2019: Mumbai-based Airpay Payment Services, India’s only omni-channel payments platform, has announced a partnership with InstaReM, one of the world’s fastest-growing digital cross-border payments companies, to launch “FX Payment”, an international payments solution for its merchants.

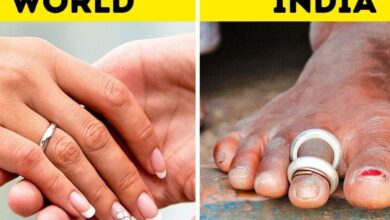

Airpay’s “FX payment” is an alternative to credit cards used for international payments and is currently available to customers in 27 countries across the globe. This highly efficient and cost-effective payment solution benefits Airpays’ marquee Indian merchants in the hospitality, retail, and education sectors, and their overseas customers. With an option to make payments via InstaReM on Airpay payment platform, customers will save on high credit card processing fees, sneaky margins on FX rates and service fees.

The “FX Payment” service from Airpay benefits merchants by removing their compliance overhead as well as significantly reducing the cost and time of the transaction. Customers enjoy the benefit of paying in their local currency, competitive exchange rates, and avoid bank or credit card charges associated with international payments.

Prajit Nanu, co-founder and CEO of InstaReM, said, “InstaReM’s innovative payments solutions enable individual and enterprise users to send, spend and receive money efficiently, to and from different parts of the world, while saving on high transaction costs that are traditionally associated with cross-border money movements. We are now extending our capabilities to payment gateways, thereby offering a fast, secure and cost-effective payment option to customers buying on e-commerce sites. With this partnership, consumers all over the world will be able to make payments in real-time to some of the highly-reputed merchant brands in India.”

“International payments via credit cards are opaque and expensive due to high credit card processing charges and hidden fees that are not typically known or explained to the consumers. By leveraging InstaReM’s global presence and capabilities in cross-border payments, we are offering a seamless and transparent payment option which is going to be immensely beneficial to the merchants using our platform as well as their customers,” added Kunal Jhunjhunwala, Principal Founder and Managing Director of Airpay.

By making overseas payments to India seamless and cost-effective, the Airpay-InstaReM partnership is looking to offer much-needed support to India’s global trade ambitions.

About InstaReM

Singapore-headquartered InstaReM is the digital cross-border payments company with presence across Asia-Pacific, North America and Europe, covering 40+ countries. InstaReM’s mission is to democratize money movements across the globe by developing innovative products that provide individual and enterprise users with seamless digital payments experiences. It has created a unique global payment mesh which is being leveraged by individuals, SMEs and financial institutions to make fast, low-cost cross-border payments. Since starting in 2015, InstaReM has acquired licenses, technology and entered into partnerships with global payment leaders such as Ripple, Visa and First Data, which it has packaged into an “open-money” platform that allows anyone to save, spend and receive money across 55+ countries. InstaReM has raised US$ 65 million from the marquee investors who include Global Founders Capital, Vertex Ventures, Fullerton Financial Holdings, GSR Ventures, SBI-FMO Emerging Asia Financial Sector Fund, MDI Ventures, Beacon Venture Capital, Vertex Growth Fund and Atinum Investment.

About Airpay

India’s only omni-channel payments facilitator. Airpay’s platform enables 360 degrees payment management for enterprises allowing them to improve their cash flow through seamless management of accounts receivables and accounts payable. Mumbai-based Airpay was founded in 2012 with a focus of fixing payment problems for enterprise customers.