10 Minute To Delivery, 10 Seconds To Burn Cash- That’s The Formula Of Quick Commerce, Which Is Quickly Sliding Into A Black Hole!

10-Minute Delivery: How India’s Quick Commerce Dreams Are Racing Toward a Cash-Burning Dead End?

Quick commerce—India’s shiny new startup obsession. The promise is enchanting, isn’t it? Press a button, and poof! Your oat milk appears at your doorstep before you can finish doom-scrolling through Instagram. It’s technological magic that makes even the laziest parts of ourselves feel justified. Why walk to the nearby shop when a gig worker on a two-wheeler can brave Bangalore traffic for you? Is it Progress, Hmm, doubtful!!!

Let’s talk about the elephant trampling through the venture capital boardrooms: these quick commerce darlings are setting fire to mountains of cash with the enthusiasm of pyromaniacs at a matchstick convention. According to recent reports, the quick commerce sector is burning approximately Rs 5,000 crore each quarter. Not annually. Not semi-annually. Quarterly. That’s roughly Rs 1,500 crore going up in smoke every month—money that could build hospitals, schools, or at least fix some of those potholes that quick commerce delivery partners navigate daily.

The Cash Bonfire Olympics Among Quick Commerce Giants: Who’s Burning Brightest?

In an exclusive, recent interview, Zomato’s founder and CEO Deepinder Goyal casually mentioned that Blinkit (their quick commerce arm) accounts for only 2-3% of this sector-wide cash conflagration. It’s almost like saying, “Sure, we’re burning cash, but look at those other guys—they’re using flamethrowers!”

“We’re focused on sustaining growth while ensuring discipline in how we invest cash,” Goyal explained, presumably with a straight face. Translation: “We’re trying to figure out how to stop the money hemorrhage without anyone noticing we’ve been bleeding all along.”

Meanwhile, Goyal couldn’t resist taking a jab at competitor Zepto: “They’ve burned Rs 2,200-2,300 crore last quarter, and we’ve burned just 4% of that but still gained market share, so how does it matter?” Ah, the classic “they’re worse than us” defense—a strategy as old as playground disputes.

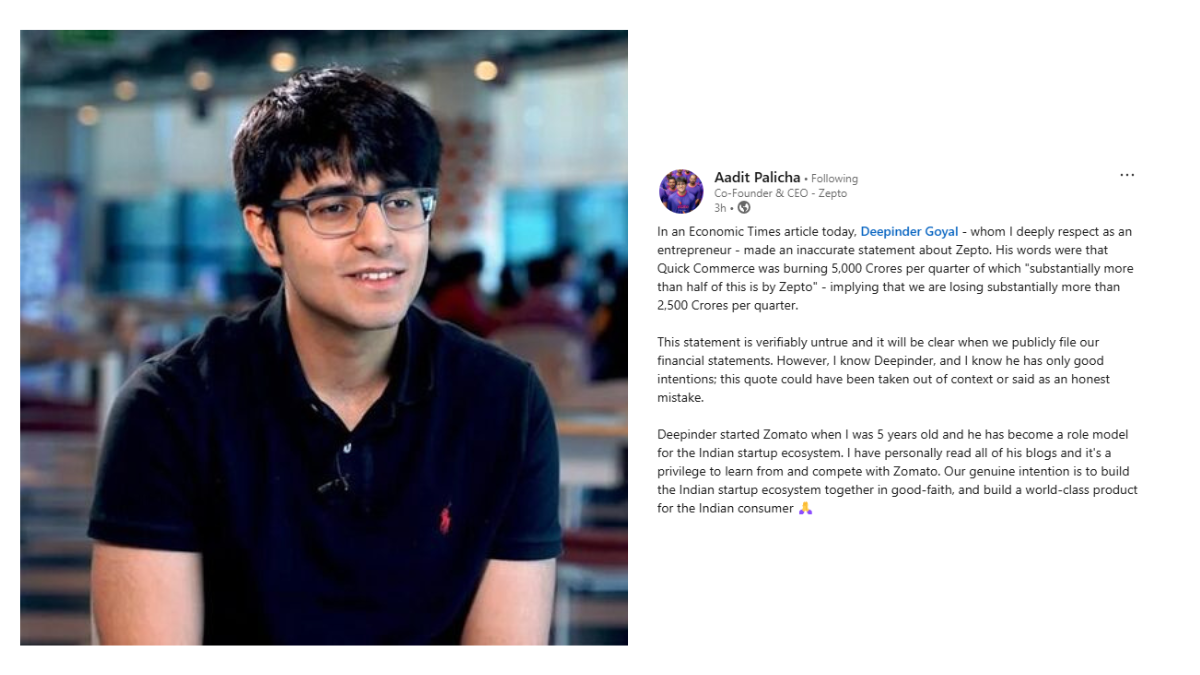

Not one to take accusations lying down, Zepto’s chief executive Aadit Palicha hopped onto LinkedIn faster than a 10-minute delivery to call Goyal’s statement “inaccurate” and “verifiably untrue.”

But here’s the thing: while these founders bicker about whose cash bonfire is more controlled, the real concern is why we’re celebrating any cash bonfires at all.

Let Me take You To A Brief Tour of the Burning Grounds

Let’s take a stroll through the smoldering landscape of India’s quick commerce behemoths:

Zepto: Reports from December 2024 suggest they’ve burned approximately Rs 1,200 crore in just one quarter. That’s a cool Rs 400 crore monthly—probably more than the GDP of several small towns combined.

Zomato’s Blinkit: When Zomato served up its quarterly earnings in January 2025, investors found the dish rather unpalatable. Revenue was up, yes, but profits took a nosedive faster than a delivery executive racing against a 10-minute timer. The culprit? Losses from Blinkit, their quick commerce golden child.

Swiggy Instamart: Not to be outdone in this cash-burning competition, Swiggy reported in February 2025 that its Q3 losses widened by 40% to Rs 799 crore, thanks largely to investments in its quick commerce arm, Instamart.

This escalating cash burn—the rate at which companies enthusiastically deplete their reserves before generating positive cash flow—coincides with these players collectively raising nearly $3 billion. It’s like watching someone pour water into a bucket with a hole in the bottom, then celebrating when more water is added from the top.

History Doesn’t Repeat, But It Rhymes (With a Very Expensive Beat)

Does any of this sound familiar? Cast your mind back to 2014-16, when e-commerce giants Amazon, Flipkart, and the now-diminished Snapdeal were engaged in their own cash-burning Olympics. Fast forward to 2025, and these e-commerce veterans are still struggling with profitability. So how is quick commerce supposed to be different?

Oh, and just to make things more interesting, those same e-commerce giants—Amazon and Flipkart—have now jumped into the quick commerce pool, along with domestic heavyweights like Tata’s BigBasket and Reliance’s Jio Mart. It’s getting crowded in here, and everyone’s splashing cash around like there’s no tomorrow.

Satish Meena, an adviser at e-commerce consultancy firm Datum Intelligence, offers this gem of insight that “given the competition, we can’t expect much on the profitability front in the near term.” He adds, “The proposition of quick commerce companies is convenience, that is what they are likely to focus on.” For context, e-commerce companies were burning $1.5-2 billion annually during their peak discount wars of 2016-2017. If we take hints from the past, the subject of profitability is nowhere near in the quick commerce sector. That’s like saying your house is on fire, but at least it’s not burning as quickly as your neighbor’s.

And let’s not forget Union Minister Piyush Goyal’s concerns about Indians becoming “couch potatoes” because of e-commerce. If he was worried about people shopping online, wait till he sees an entire generation unable to walk to the corner store for milk.

The Harsh Reality Check: It’s Not All Unicorns and Rainbows

Quick commerce promised to revolutionize retail with its tantalizing 10-minute deliveries. But the reality is sobering: this sector is already approaching saturation, and here’s why:

The Market Isn’t as Big as Investors Fantasize: Out of 1.4 billion Indians, a significant portion don’t have the discretionary income to pay premium prices for convenience. If most of the country can barely afford essentials, the total addressable market for paying extra for quick delivery is tiny. It’s like trying to sell luxury watches in a country where most people are checking the time on basic feature phones.

Tier 2/3 Expansion? Good Luck With That: Lower order volumes, cost-conscious buyers, and deeply entrenched kirana stores mean quick commerce can’t scale profitably beyond metros. The economics simply don’t work. The infrastructure costs, the delivery logistics—they all become prohibitively expensive when you’re not operating in dense urban centers.

Urban Markets Are Already Maxed Out: The top 10-15% of earners in major cities are already using quick commerce—there’s little room for new users. Sure, companies can try to increase the Average Order Value (AOV), but there’s a ceiling to how many overpriced midnight ice cream pints one person can order.

The VC Subsidy Era Is Coming to an End: As funding dries up and investors start demanding that radical concept called “profitability,” the true economics of quick commerce will be exposed, which is pointless, as described by another famous startup founder and controversial shark! As companies inevitably increase delivery fees or cut discounts, price-sensitive Indian consumers will switch back to bulk buying or traditional e-commerce faster than you can say “free delivery.”

Do Not Overlook The Traditional Champions, The Kirana Stores

While venture capitalists pour billions into quick commerce startups, let’s remember a fundamental truth: most Indians still rely on local kirana stores for quick purchases. These neighborhood fixtures have been providing “quick commerce” for decades, without fancy apps or billion-dollar funding rounds.

Take this real-world example: Ms. A, a Bangalore techie, ordered fresh vegetables at 9 AM. By the time her morning chai was ready, her groceries had arrived—not from a quick commerce giant, but from her trusted local kirana store owner. This isn’t just about convenience; it’s about hyperlocal retail turning the tables on startups with nine-figure valuations.

Why are kiranas quietly outperforming quick commerce?

They’ve Embraced Technology: WhatsApp orders, computerized billing—these stores abandoned old-school methods long ago. They’ve adapted without the fanfare or funding rounds.

Hyperlocal Dominance: These stores aren’t just in your neighborhood; they are your neighborhood. Decades of trust, personalized service, and community relationships create loyalty that no app can replicate. Your kirana uncle knows you prefer Amul butter over Britannia and will call you when fresh mangoes arrive—try getting that level of service from an algorithm.

Cost Efficiency: No fancy offices, no million-dollar marketing campaigns, no bloated executive salaries. Just efficiently run small businesses that have transformed their shelves into hyperlocal fulfillment centers, often delivering faster than any 10-minute promise.

Here’s the reality check: 85% of FMCG sales in India STILL come from kirana stores. They’re evolving and adapting, while quick commerce giants are burning cash just to stay relevant. The irony? The platforms that once aimed to disrupt kiranas are now their biggest enablers, with B2B services trying to digitize these very stores.

The Dopamine Economy: Should We Really Be Celebrating?

A week ago, Zepto Cafe crossed the 100,000 orders/day mark, and the startup ecosystem erupted in celebration. LinkedIn was awash with congratulatory posts, investors were patting themselves on the back, and business publications wrote glowing profiles.

But should we really be celebrating?

Yes, it’s impressive for any business to scale so quickly. The operational complexity behind delivering hot coffee in minutes is mind-boggling. But here’s the uncomfortable question: Why are we celebrating businesses that might not be fundamentally good for us?

The standard response is that these businesses are simply giving consumers what they want. But that’s a convenient excuse that absolves companies of responsibility. Anything that delivers a quick dopamine hit will find eager consumers. It’s just that in India, companies have access to cheap resources to deliver these hits at scale.

If consumers were left entirely to their own devices, they’d often choose immediate gratification over long-term well-being. Between the 1920s and 1940s, cigarette companies actively targeted women in advertising campaigns once the male market was saturated. In 1923, only 5% of American women were smokers. By World War II, about a third of all women smoked. This wasn’t coincidence—it was calculated marketing.

Making unhealthy food available at the tap of a button isn’t much better than promoting smoking. Yes, we can admire the operational excellence, but should we celebrate it? Is a society where people can’t be bothered to walk 100 meters to buy bread really progress?

The Inevitable Consolidation: Winter Is Coming

The quick commerce bubble won’t burst dramatically—it will deflate slowly. Here’s what’s likely to happen:

- Consolidation: The sector can’t sustain five major players burning cash simultaneously. Expect mergers, acquisitions, and some quiet shutdowns.

- Price Hikes: As investor patience wears thin, delivery fees will rise and discounts will vanish. When that happens, consumers will suddenly rediscover the joy of planning ahead or—gasp—walking to nearby stores.

- Restricted Service Areas: Coverage will contract to only the most profitable zones in major metros. Those glowing radius circles on app maps will shrink faster than ice cream melting in Mumbai’s heat.

- Reduced SKU Selection: The dream of having 10,000+ items available in 10 minutes will give way to a more limited selection of high-margin, fast-moving products. That obscure Japanese snack you love? Sorry, not profitable enough for the dark store shelf.

So Where Does That Leave Us?

Quick commerce won’t disappear entirely, it will eventually disappear into a black hole. There will always be a market for convenience among time-strapped, affluent urbanites. But the days of exponential growth are numbered. The sector will soon stagnate in terms of new users, and only profitability-focused models will survive.

The winners will be those who can efficiently manage their dark store operations, optimize delivery routes, and—most importantly—wean customers off discounts without losing them. It’s a delicate balancing act that most will fail to achieve.

Meanwhile, kirana stores will continue to adapt and evolve, incorporating the best elements of technology while maintaining their community connections. The future of retail in India isn’t just quick commerce or just traditional retail—it’s a hybrid model that combines efficiency with human touch.

As investors push for profitability and the cash bonfires start to dim, we’ll see which quick commerce players have built sustainable businesses and which were merely good at spending other people’s money. My bet? Most fall into the latter category.

The quick commerce race isn’t about who delivers fastest anymore—it’s about who can stop burning cash quickest. And in that race, the tortoise might just beat the hare.

The Final Delivery: A Reality Check

Let’s end with a thought experiment: What if all the billions poured into quick commerce had instead gone into solving real problems? Improving India’s agricultural supply chain to reduce food waste. Developing sustainable packaging solutions. Creating technology that helps small retailers compete in the digital economy.

Instead, we’ve funded an ecosystem where urbanites can get Maggi noodles delivered in 10 minutes instead of walking to the store. Is this really the innovation India needs?

Don’t get me wrong—convenience has its place. But perhaps it’s time we asked whether all this cash being burned is creating genuine value or just feeding our collective impatience. Maybe the true innovation isn’t delivering groceries faster, but building business models that generate actual profits while solving real problems.

Until then, I’ll watch with bemused skepticism as quick commerce founders continue their cash-burning Olympics, each claiming their bonfire is more controlled than their competitors’. And when the inevitable consolidation comes, remember: you heard it here first.

Now, if you’ll excuse me, I need to order some overpriced ice cream at midnight. For research purposes, of course.