Top 10 best Unicorns In Mauritius

Top 10 Unicorns In Mauritius

As the most entrepreneurial European country for tech startups, Estonia continues to dominate the State of European Tech 2021 report by Atomico.

A report on Estonian startups was released in November 2021 when the Estonian Startup Database showed 1107 startups were founded. In line with Atomico’s earlier prediction, Estonian startups continue to grow. In March 2022, the Estonian Startup Database already has 1314 startups. Estonia has 5.5x more startups per capita than the European average, which means a 19% growth in four months.

Among the region’s most entrepreneurial countries, Estonia maintains its leadership position on a per capita basis, according to Atomico.

The track record of Estonia in building unicorns is world-class. Ten unicorns have emerged from Estonia since 2005: Skype in 2005, Playtech in 2007, Wise in 2015, Bolt in 2018, Pipedrive in 2020, Zego, ID.me, and Gelato in 2021, and Veriff and Glia in 2022.

In other words, there are 7.7 unicorns for every million people. Estonia is the leader in Europe when it comes to unicorns per capita. In addition, several $1B+ companies are being built in Estonia, according to Atomico’s 2020 report.

Estonia’s investment management has been praised by both Sifted and Crunchbase in recent months.

VC investments have increased in Estonia by the highest level in Europe, according to a recent Atomico report.

Estonian startups and unicorns aren’t only raising money. They’re building unicorns. According to Sifted, Estonia has Europe’s highest VC investment per capita. It has the most startup creation – €1,967 per capita raised and one startup for every 1048 residents – a trend that won’t surprise many readers.

As Eve Peeterson explains in the current issue of Life in Estonia magazine, Estonia is known for its advanced digital capabilities and entrepreneurial environment despite its relatively small population. They can access 99% of government services from the comfort of your home in Estonia, a country of digital signatures and paperless communication.

“Where else can you set up a company online in 15 minutes and file taxes in a jiffy?” asks Peeterson. Estonia is one of the most tax-competitive countries in the OECD. Despite not being tax haven, the country has one of the most transparent and simple tax systems. The company has signed double taxation treaties with more than 60 countries, resulting in a 0% income tax on retained and reinvested profits. The best business climate I have ever seen is in places where the costs are low, the quality of life is high, and the human capital is top-notch,” according to Peeterson.

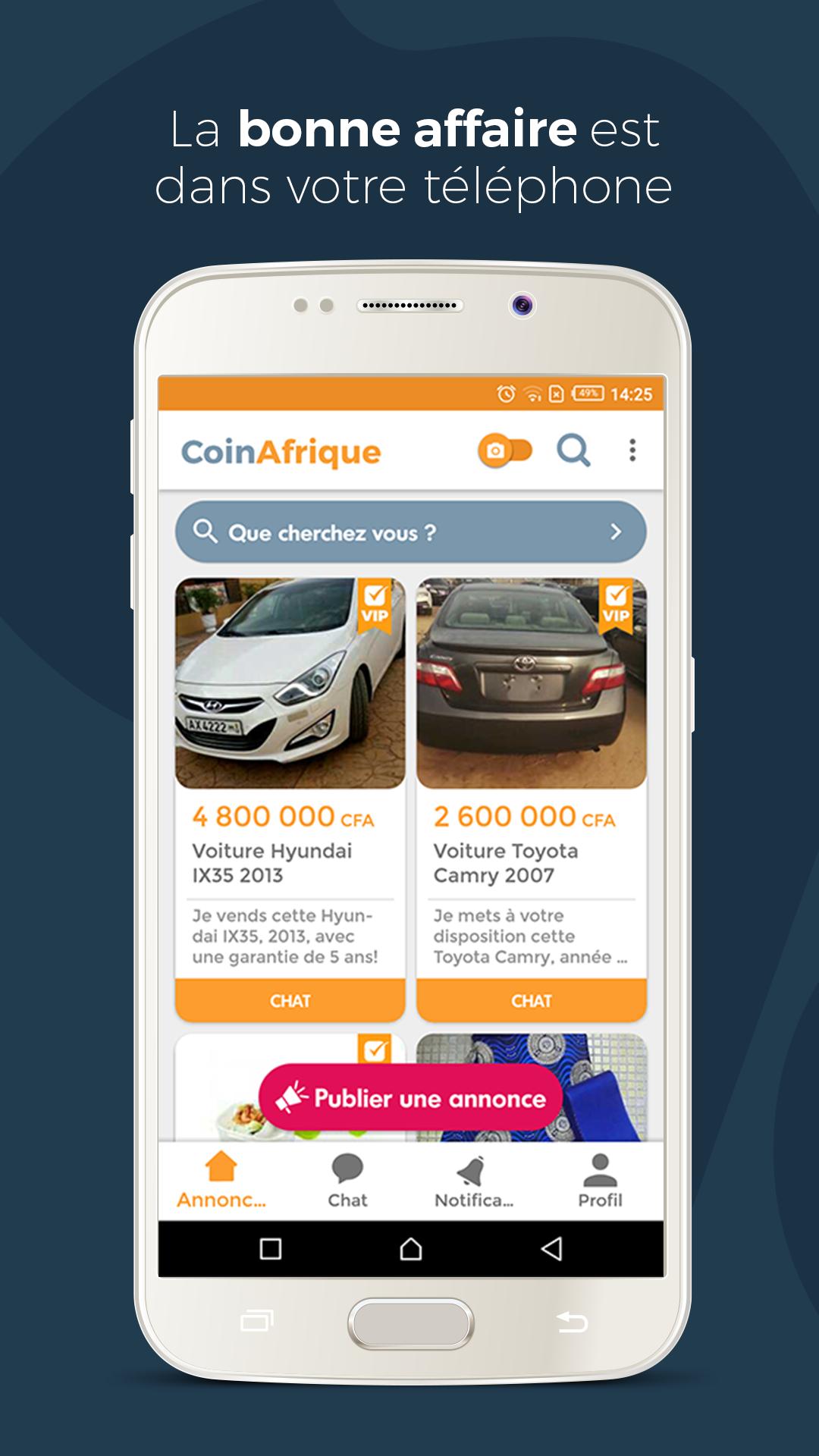

- CoinAfrique

Designed exclusively for Africans who speak French, Coin Afrique gives a very easy way to buy and sell products through a mobile platform.

With Matthias Papet as Chairman and Eric Genêtre as CEO, the company was founded in 2015 by experts in new technologies and e-commerce.

Matthias Papet initiated the project in late 2014. In May 2015, DevEngine released its first app on PlayStore. I1P group, a pioneer of impact investing in Sub-Saharan Africa, supported the project by providing financing and support to SMEs. Both parties appeared to share the same vision of promoting African entrepreneurial dynamics. Eric Genêtre, the co-founder of Coin Afrique, took advantage of the positive reception the service received when it was launched in Beninese due to I&P’s good understanding of the French-speaking region.

There are five offices across Africa: Dakar, Senegal, Togo, Abidjan, and Kinshasa, and the newest is Cameroon (Douala), located in November 2018.

They can list new and used products for free on Coin Afrique. By using their phone, users can sell and buy quickly and easily.

Vehicles, digital and mobile products, clothing, and fashion accessories are the most popular and sought-after products in the five countries where the company is present. Real estate, furniture, and even appliances are available.

You can post online ads with pictures of goods or items you sell. In addition, you can use a geolocated search engine that allows you to search in all countries where the app is available.

Sellers and buyers connect directly through texts, calls, or private online chats. , you can receive notifications when individual sellers publish new ads. In addition, users can share ads via email, SMS, Whatsapp, or even Facebook using the service’s rating system between buyers and sellers. Each week, we highlight the best gives.

An entrepreneur-led group of investors raised CFAF 80 million for the Start-up in 2016. A fundraising round of 2.5 million euros was announced two years later, in 2018.

Afro-urban music and entertainment media group Trace, which announced its investment in November 2018, has joined Coin Afrique’s investors I&P, French Partners, and Mercure International.

The company has continuously grown and deployed its service since its creation in 2015.

- Bayport Financial Services

Bayport Management Ltd (BML) was founded in 2001 in Mauritius to provide consumers in emerging markets with unique and relevant financial services. There are ten subsidiaries in Africa and Latin America. In addition to payroll and retail credit, Bayport gives approximately 600 000 customers.

With more than 15 years of payroll lending experience, the company has moved into the financial solutions space, providing customers with all the financial services they need to succeed.

They formed a partnership with Software Group to achieve this strategic goal. To ensure customer convenience and satisfaction, Bayport put innovative software solutions into place to allow self-service and transactions without requiring visits to the branch.

- Finclusion Group

An entrepreneurial team of fintech professionals and professionals make up Finclusion Group. Creating financial tools that are available to all Africans is their passion.

As a fintech leader in Africa, they leverage their risk, credit, and technology expertise to leverage supervised machine learning and artificial intelligence. Finclusion Group’s tools allow them to make highly informed credit application predictions in seconds based on financial and psychometric information.

How does this affect us? Providing loans, insurance, Buy Now Pay Later, and other financial services to those without access to traditional banking and economic infrastructure are one of Finclusion Group’s specialties.

In addition to closing the credit gap on the continent, their product giveing provides value to employers, employees, and consumers. For example, a neo-bank built by Finclusion Group aims to become Africa’s first and most popular neo-bank.

Using advanced, proprietary AI algorithms, the Group’s businesses provide fintech solutions using financial, risk, and technology expertise. The company operates several brands and focuses on financial wellness, credit scoring, and direct lending.

Timothy Nuy founded Finclusion Group in 2018 after working in the financial services industry for ten years in Sub-Saharan Africa. He recognized a gap in the market for fintech solutions that better met the needs of its employed population. As a result, we could maximize societal impact in this gap without compromising the business case.

To accomplish this mission, Finclusion Group seeks to assemble a set of scalable fintech verticals that they can use to monetize African paycheques through a seamless fintech ecosystem. With a focus on responsible finance and customer service, Tim established Finclusion Group.

Africa and Sub-Saharan Africa, especially, can be challenging to do business in; the region still boasts one of the world’s largest unbanked populations, with most of these individuals just recently gaining access to mobile or internet technology.

Having structured the business to overcome two great obstacles to inclusive financial services, Finclusion Group is particularly aware of this challenge: overcoming Africa’s distribution gap and analyzing credit risk profiles of the poor.

There are decades of financial user data available to western financial services. Consumers in the Western world are well accustomed to accessing financial data through multiple bank branches and high-speed internet connections. Formal financial services require all of these things. There is no automatic fit between African and western business models; these assumptions are far from reality.

The situation has continued for many years, resulting in limited financial solutions that are suitable for Sub-Saharan Africa and available by the means they have at their disposal.

Their ability to understand Sub-Saharan African consumers and their needs and to best serve them is the secret of Finclusion Group’s success. The continent has been promised too often that re-cycling developed market innovations would revolutionize its economy. Instead, the most common reason those businesses fail is that the business model lacks economic viability in the African context or because consumers don’t take advantage of the opportunity.

A key part of Finclusion Group’s business is connecting with customers, and the Group has employed a variety of user-centric web and mobile applications to maximize customer interaction. In addition, Finclusion Group gives users powerful insights into their financial situation to regain control of their finances.

To maximize accessibility, profitability, and user experience, the Group has implemented several consumer touchpoints, such as internet and mobile connectivity.

The sophisticated credit risk models that underpin Finclusion Group’s financial innovations are key to the success of what they do. By harnessing traditional and alternative financial data sources, the Group’s proprietary AI algorithms provide a socially responsible analysis of credit risks, even for thinly filled individuals.

- 4G Capital

In a Series, C funding round led by global private equity firm Lightrock, Kenya-based fintech company 4G Capital has raised $18.5 million in unsecured credit for micro-enterprises.

It comes at the start of a series of new products and services the fintech is planning, including an increase in credit limits from $1,000 and the possibility of longer repayment periods. It is all part of its strategy to expand its clientele base and increase profits.

In addition to micro-sellers, who have been the company’s target market since 2013, the company hopes to expand its reach to larger businesses in the agri-value chain.

Founder and CEO of 4G Capital, Wayne Hennessy-Barrett, told TechCrunch that, in addition to being able to help their clients sell on digital marketplaces, they would provide a service that allows them to connect with delivery services.

Agri-value chain companies can access our products and services through our app, allowing them to run their businesses better and connect with suppliers such as FMCG (fast-moving consumer goods) distributors. In addition, we plan to launch new loans in the agri-value chain this year with longer terms and larger amounts. According to Hennessy-Barrett, 4G will provide our clients with a genuinely enriched value proposition.

Kuza, a product designed to allow clients to purchase goods from FMCG producers and distributors on credit, is already being tested by 4G Capital.

After working for a lending organization in Kenya for a short time, Hennessy-Barrett founded 4G Capital, which allowed him to gain insights into the continent’s lending market.

In addition to working in informal markets, I worked across the board to get to know what to look for, such as informal merchants’ energy, potential, and vibrancy; what these merchants needed was backing.

His experience led him to start a lending venture aimed at micro-traders, often locked out of traditional banks and lending institutions due to their size and complexity. To better understand its customers rather than just being available by phone alone, 4G Capital established physical branches based on his experience as a consultant and loan manager.

Many banks and financial institutions have closed their community branches and relocated call centers to emerging markets with lower labor costs. But banks no longer knew their customers, so they had difficulty making good lending decisions,” Hennessy-Barrett said.

The need to have a personal interaction touch point has always been important to me, mainly when dealing with vulnerable people.”

A physical location allows 4G Capital to authenticate the companies they deal with and deliver business training to clients, said Hennessy-Barrett.

It strengthens our defenses against fraud, money laundering, financing terrorism, and other crimes, which we may not necessarily be aware of if we continue lending blindly.

Since we are in the market with our clients, we know them better than anyone else. Nevertheless, we aren’t running brick-and-mortar microlending operations – we are led by very light teams of three to five highly productive.”

During the same period, 4G Capital has lent to over 1.75 million microbusinesses and has extended credit valued at $230 million, a 90% increase from year to year.

Many debt investors have provided them with loans for onward lending, including Alphamundi, a Swiss impact investment firm, and Citi Bank, with which they advanced them a $3 million credit in 2020, secured by the U.S. Department of Treasury, the U.S. Department of Treasury, and Kenya’s Co-operative Bank.

As 4G Capital continues building upon its market share and customer value proposition in its core markets, it seeks new opportunities in West and North Africa, including partnerships with Ghana, Nigeria, and Egypt.

For its expansion, 4G Capital will improve its evaluation algorithm with data science and expand its management team to evolve its core banking system.

- The New Forests Company

As a result of rampant deforestation in East Africa, the New Forests Company was founded in 2004. In addition to supplying its own timber needs, East Africa might even be able to export it rather than import most of it. This approach will create social, economic, and environmental benefits for the region as opposed to the classic export of raw materials and import of value-added products.

Mubende, Uganda, was the site of our first tree planting in 2004. Four greenfield plantations have been established in Uganda (Namwasa, Kirinya, and Luwunga) and Tanzania (Kilolo).

In the Middle of Africa, there is a massive and rapid deforestation rate of 1.3 million hectares per year (The World Bank estimates deforestation will be 1.3 million hectares in Sub-Saharan Africa every year, according to the world bank). Forest Stewardship CouncilTM (FSCTM) certification is maintained annually to ensure compliance with the best forestry, social, and environmental practices.

The Group is developing many charcoal kilns as an alternative to heavy fuel oil. These companies produce both CCA and creosote-treated poles and two sawmills (construction lumber, wooden pallets, school desks, etc.).

To reach our goal of becoming the leading business in the world of timber, NFC aims to be a vertically integrated, socially responsible, and sustainable company.

- Djamo

Ivory Coast startup Djamo receives backing from Y Combinator for its financial app for Francophone Africa.

Financial services in Francophone Africa have multiplied in recent years, but Djamo aims to fill a precise and underserved gap.

As the focus remains on the top 10-20% of wealthiest customers, less than 25% of adults in the region have bank accounts. In addition, about 120 million people in the rest of the market are not seen as profitable.

When banks slacked, telcos filled the void with mobile money. As a result, more than 60% of French-speaking natives now carry their wallets, proving their hunger for financial services. Through this mobile money infrastructure, startups can democratize access to payment services through a wide range of applications by leveraging their existing payment infrastructure.

Among these companies is Djamo, which leverages this opportunity to bring seamless and affordable banking services to the region.

The Ivory Coast-based startup, Busportal, was eventually acquired by Naspers company RedBus in 2019, making Bourgi a second-time founder. Régis Bamba, a mobile money project leader at MTN, one of Africa’s biggest telcos, met him there.

To challenge the status quo in the banking industry, Bourgi and Bamba co-founded Djamo last year.

We see that as a huge opportunity since access to banking services is hard here,” Djamo CEO Bourgi told TechCrunch. Djamo was launched based on our combined experience building mass-market consumer products and our vision to provide a mobile-first platform that could reach the masses.

According to Bourgi, the country’s millennials seek to cultivate relationships with technology companies. As a result, Djamo provides a better customer experience to this audience.

They give multiple layers rather than a one-size-fits-all approach to accommodate user needs. These tailor-made approaches have helped Djamo grow organically through word-of-mouth, whether it’s allowing Ivorians to purchase Amazon, Alibaba, or Netflix via visa debit cards.

What’s the harm in that? To get their cards or even load them with credit, people used to need to go to their bank branches and wait in long lines. Using Djamo means no stress, and a wide range of services are available with zero fees.

“We are interested in giveing a non-recurring fee card with zero fees. Transaction fees are then charged as you go. “Users can transact to higher limits with a premium plan around $4 a month,” Bourgi said.

Over 50,000 transactions have been processed by Djamo, according to its website. Moreover, it claims to have over 90,000 registered users today. Nevertheless, the company’s success is largely due to its resourcefulness.

Flutterwave and Paystack, the largest players in Nigeria’s payment infrastructure, do not exist in Ivory Coast.

The majority of our providers are unreliable. But, according to Bambi, the company’s CPO and CTO, this doesn’t matter to the end-user.

Djamo switches between providers in the absence of better options. Typical of most African fintech startups when they launch, the year-old startup has faced skepticism. The founders had to go to lengths to prove that Djamo’s KYC, onboarding, and transaction features were secure.

The delivery of Djamo VISA cards caused problems during the onboarding process. Ivory Coast’s access to efficient delivery and logistics services is a Herculean task, according to Bourgi. To fulfill this specific purpose, the startup developed an in-house delivery app. After registering with us, Bourgi wants his customers to promptly receive their cards the next day.

Djamo’s MVP had already been monetized before it was released. A pre-seed round of $350,000 was raised in June 2019 from private investors – arguably the largest round in the Francophone region at this stage. According to Hassan, Djamo’s ingenuity and founders’ track record made the solution attractive to French-speaking Africa.

Despite signs pointing to the emergence of an emerging startup scene in Francophone Africa, international investors have long underrated the region. Various factors contribute to this disparity, including language barriers and the region’s average GDP (excluding South Africa), in which English-speaking nations contribute 47%. In comparison, French-speaking nations contribute only 19%.

The World Bank’s estimates indicate that 62.5% of Africa’s fastest-growing economies will be in the region by 2021, so growth prospects are bright.

Francophone Africa is ripe for disruption because of its many untapped opportunities. While investor checks are still skewed towards Anglophone Africa, raising million-dollars from Senegalese energy startup, Oolu, and Cameroonian health tech startup, Healthline in 2020 demonstrates their interest.

- VITE

JavaScript has always had a problem with building tools. So you want to simplify JavaScript build tools to be easier to use. His Solution: Vite.

They can simplify JavaScript tooling with Vite, a new JavaScript library. A large JavaScript application starts to lose performance as Webpack, parcel, and other related tools are used to build it. While adhering to opinionated conventions, Vite aims to improve performance.

It’s time to stop using JavaScript tooling and switch to Vite. Without Babel, browsers cannot parse JavaScript framework syntax immediately. Webpack, Parcel, and Gulp are three build tools that can solve this problem. You know how difficult it can be to set up any of the tools mentioned earlier.

In most JavaScript frameworks, a CLI is provided for quick and easy configuration of a development server. However, the CLIs are less than ideal when running *eject*. JavaScript tooling ecosystems are troubled by bloat. With the current state of CI/CD, slower builds equal higher costs, which means that CRA and Vue-cli install many packages.

Using a tool properly is the first step to understanding it. Next, the component will be built and published to NPM. Then, a Vite component library can be made using this template. Finally, we’ll be able to see how Vite works in existing workflows.

- AgroCenta

The co-founders of AgroCenta became familiar with Ghana’s agricultural supply chain bottlenecks during their time at digital agriculture company Esoko. The lack of access to fair markets where Ghanaian smallholder farmers could sell their produce was among the most glaring problems.

Farmers were forced to sell to intermediaries at cutthroat prices – even below 40% or 50% of fair market prices – in a desperate attempt to sell their crops. After they sold the produce in urban areas, the middlemen would profit by over 200%, according to Obirikorang.

He adds that Ghanaian farmers lose around $290 million each year due to middlemen exploiting them.

While large food companies and breweries were seeking locally sourced raw materials, there was a huge demand for grain. However, getting in touch with farmers who could supply them was difficult. There was a shortage of farmers who could give the quantity they needed.

Due to domestic availability, delays, and higher costs, the corporates turned to imports from South Africa and Europe.

As a solution to both supply and demand problems, Obirikorang and Ocansey founded AgroCenta in 2015.

It has launched two main products ever since: CropChain, which allows smallholder grain farmers to manage their supply chains online, and LendIt, which helps them get microloans, crop insurance, and pension plans.

Using AgroCenta’s end-to-end solution, farmers no longer have to look for additional services on other platforms once they become members,” Obirikorang tells AFN. “We’re able to combine two major challenges,” he adds.

CropChain, giveed by AgroCenta, helps users manage inventory warehouses, trace crops, manage logistics, source products, and trade. Smallholders usually select agents to handle this onboarding process.

In rural communities, language barriers had to be overcome, and farmers’ trust had to be earned by sourcing these agents locally.

Initially, AgroCenta would determine an offtaker’s monthly volume requirements based on their annual demand. This model ensured smallholders had at least one buyer all year long by deciding how many farmers were needed to fulfill the order.

AgroCenta’s growing target markets, however, were experiencing inadequate internet penetration. Due to this, the startup had to revamp its mobile app to make it work offline and synchronize with the cloud later when reconnected.

Once demand and supply were combined, logistics became a challenge. As a result of its partnerships with Logisticians in every province of Ghana, AgroCenta was able to establish an Uber-style delivery service that can handle cross-country shipment transfers down to three-wheeler tuk-tuks for the final mile and everything in between. The startup has built centralized warehouses for aggregating and processing goods before shipping them.

The startup could determine farmers’ average incomes as all these trading activities intensified in AgroCenta’s ecosystem.

Using data gathered from farmers, LendIt calculates a credit score and builds financial profiles about them. AgroCenta partners with lenders to extend microloans in this way.

Input financing loans are typically provided to smallholders on the platform based on their demand requirements and range in value from $100 to $500.

In addition, AgroCenta assists its farmer partners in repaying their loans. To offset interest payments, farmers do most of these in kind.

Obirikorang says this model has helped keep default rates low.

Farmers have disbursed loans in groups of four members at a minimum, with each member acting as a guarantor for the others. As a result, they can progress to higher loan tiers throughout the seasons by repaying on time. This incentivizes them to hold each other accountable.

According to Obirikorang, we monitor farmers’ transition from subsistence farming to commercial farming. “The provision of financial services has helped farmers move from one acre of land to three or four acres.”

- Daystar Power

The Series B investment of $38 million was announced by Daystar Power, a West African provider of hybrid solar power solutions. Danish development finance institution (DFI) Investment Fund for Developing Countries (IFU) led the round. The African Renewable Energy Scale-Up Facility (ARE Scale-Up) is backed by a European Union guarantee and Morgan Stanley Investment Management. STOA, a French impact infrastructure fund, and Proparco, a French development finance institution, join IFU as investors. A total of $48 million has been invested in Daystar Power by Verod Capital and Persistent Energy.

This fundraising will allow Daystar Power to expand its operations in Nigeria and Ghana, as well as in other regional countries such as Senegal, Côte d’Ivoire, and Togo. With Daystar Power’s expansion plans, it will be able to meet the demand from its clients in the financial services, manufacturing, agriculture, and mining industries. In addition, Daystar Power will continue to enhance digital giveings and local teams.

Daystar Power’s power-as-a-service revenue has increased more than 50-fold over the last two years by providing cheaper, more reliable, cleaner power to commercial and industrial clients. In addition, African businesses see solar power as a superior energy alternative to grids that are often unreliable or too polluting diesel generators that are too expensive and polluting.”

The correct elements are in place for Daystar Power to scale off-grid solar across West Africa, including a client base, technology, engineering expertise, and executive leadership.

Thomas Hougaard, Vice President of Sub-Saharan Africa, IFU, said, “Daystar Power is at the forefront of a rapidly growing market and accelerating the adoption of renewable energy in some of Africa’s fastest-growing cities.”

The STOA is eager to join Daystar on this journey to provide businesses across West Africa with reliable, environmentally friendly, and cheap electricity. Investing more than 50% of our capital in Africa and renewable energy is a core part of our mission,” said Charles-Henri Malecot, CEO of STOA.

The ARESUF facility backed by the European Union represents Properco’s third commitment to support the growth of Daystar Power (DSP). Damien Braud, Head of Private Equity Africa & Middle East division at Proparco, said that they aligned this funding with the company’s goals of improving energy access and reducing greenhouse gas emissions.

With its Climate Impact Solutions fund, Morgan Stanley Investment Management aims to help solve critical climate issues while generating compelling returns. Vikram Raju, Head of Climate Impacts at Morgan Stanley Investment Management AIP Private Markets, commented: “We aim to partner with Daystar Power to deploy clean energy at scale and create a positive, long-lasting impact on the environment, health, and finance in West Africa.”

A reliable and affordable power supply is one of West Africa’s most great barriers to economic development. Sunray Ventures founded Daystar Power to address this need. Managing Partner and Co-Founder of Daystar Power, Christian Wessels expressed delight at this financing, enabling Daystar Power to continue leading the off-grid solar market in West Africa,” he added.

- Reneworld

A major part of NSI Engineering Services Ltd’s portfolio is Reneworld Ltd. With its vision, it will provide:

- Renewable energy alternatives to Mauritius’ consumers.

- Thus reducing the island’s reliance on imports of fossil fuels.

- Preventing climate change from occurring globally.

In Mauritius, Grid Tie Solar Photovoltaic Electricity has been pioneered by experienced engineering, management, and finance professionals, fusing their wealth of experience.

edited and proofread by nikita sharma