Within a span of a few months, before vaccinations arrived, India has transitioned into an economy that has been severely battered by the Covid 19 pandemic, so much so, that it has faced acute medical crisis and plummeting economic growth. The economic slump caused by the pandemic has been so immense that the economy, in decades, saw itself slipping into a technical recession. But since then, the economy has recuperated, to such an extent that viral videos of jam-packed roads to hill stations and lethally packed markets are making rounds on social media.

It is to be noted that this is symptomatic of the rapid recovery in India’s economic activity. This is also true due to the partial lockdowns that were placed in the economy during the second wave, which according to experts, hasn’t been as crippling for India’s economy as the first wave had been.

Growth indicators indicate a certain kind of economy in short term i.e. a “Teflon economy”. The teflon economy is the name that has been given to a shallow dent in May’s economic activity that was positively followed by a recovery in June. The recovery in the month of June has been so significant that it has led to the resumption of activity back to April’s levels.

According to reports, it is to be noted that the sectors which were seen to be resilient are the investment, external and industrial sectors. But on the other hand, the consumption and services sector has borne the brunt. During the pandemic, contact intensive and aviation sectors were the worst hit, these also included MSME sectors in the economy. If various economic indicators are scrutinized with diligence, signs of fatigue witnessed in the month of July during the second wave seem to be largely limited to the April-June 2021 quarter.

Nevertheless, a K-shaped recovery has been predicted by the experts. A K-shaped economy suggests that light cracks on the top will conceal much larger structural fault lines below.

The aversive effects of the pandemic

Given, that economy has not been as severely battered as the first wave, it is to be noted that it has wreaked havoc on India’s medical sector and its middle class. Research by the Pew Research Centre estimates revealed that the odious pandemic has effectively led India’s poor to rise by 75 million. Similarly, India’s middle and upper-middle class too has shrunk by 39 million, which is quite significant. Talking about the worst-hit sector in the economy, it is to be noted that MSMEs and their informal workforce have struggled the most not just to continue functioning but to also access the government’s pandemic support programmers.

Such a claim has also been corroborated by the ILO which conducted a survey for the same. Here it is to be also noted that maybe more structural scars have become increasingly blurred in the GDP data. This is due to the fact that most of the data for the financial year are based on low base of the previous year. But it is also a possibility that in coming quarters as the economy rapidly grows alongside global growth, the economic health of the country might improve. This can be due to easy financial credit and fiscal activism.

The solution- vaccination and accommodative monetary policy

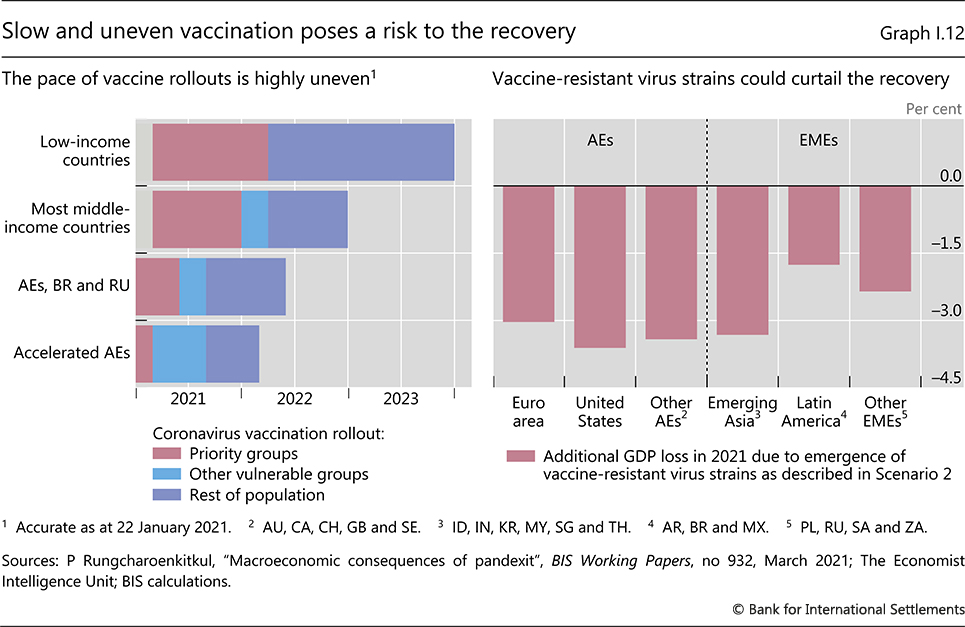

One solution that perhaps is the most essential too is vaccination. In the near-term period, the “ultimate unlocking” of the economy remains essential to revamp economic activities. But a prerequisite demand for the same is the vaccination of a critical percentage in the economy. The increased vaccination and opening of the economy will lead to a revival in consumer and business sentiment which is much needed by the economy right now.

Secondly, it is to be noted that in addition to reviving the economy, vaccination is also an effective insurance policy against a possible third wave. But given the lackluster and slow pace of vaccination drive in the month of July vehemently suggests that there are risks of delays in economic recovery. However, not everything is as glim and detestable, as an uptick in the pace of vaccination has been witnessed in the last few days.

The second pivot, other than the vaccine pivot, to be played attention to is that of policy. As a simple rule of economics, if inflation is under control, immense liquidity in market and accommodative monetary policy will help revive the economy on two fronts. An accommodative monetary policy will help ensure easy financial conditions coupled with easy credit in the economy and hence it will lead to robust investment in the economy which is the need of the hour. Secondly, it will help control borrowing costs for the government’s extensive growth borrowing programme.

However, it would be an understatement to state that this strategy is not costless. It is to be noted that such a euphoric scenario can only play out when the inflation in the economy is under control. Thus, this effectively makes controlling inflation bank’s “collateral”. So when inflation flares up, continuing an accommodative stance would be difficult.

But given the recent CPI numbers indicating inflation, 5-6 percent is on an already high base of 6.6 per cent in 2020. In addition to the elevated inflation expectations, supply constraints and slower demand too pose a risk to the economy and inflation monitoring. But according to various experts, the inflation that the economy is facing right now is transitory.

Given the inflation expectations might persist in the future due to supply-side problem, the economic recovery will require effective policy support.

Thus, given both the arguments, it is quite clear that the economy’s revival at the moment depends on a robust vaccination drive and accommodative monetary policy. This also effectively means that the inflation-targeting policy of RBI will come under greater scrutiny as policy pivot would become important in the near future.

The broader issue however here is the reliance that needs to be developed to live with “long Covid”. This is due to the fact that even with a robust, widespread vaccination campaign, future pandemic waves may still materialize. And as a matter of fact, the monetary, fiscal and administrative policies certainly cannot remain in a suspended emergency.

Edited by Aishwarya Ingle