Gold and Your Money: Keep allocation to gold within 15%

It’s role is that of a portfolio diversifier, not a wealth creator.

Gold and Your Money: Keep allocation to gold within 15%

Portfolio diversification is a strategy aimed at reducing risk by investing in a variety of assets with different characteristics. The staple investment categories typically include equities (stocks) and bonds. However, gold, although not considered a staple investment asset, can serve as a useful portfolio diversifier.

Gold has historically exhibited a unique behavior compared to traditional financial assets like stocks and bonds. When the equity market experiences a downturn or becomes volatile, gold often serves as a safe-haven investment. This means that during periods of market turmoil or economic uncertainty, investors tend to flock towards gold as a store of value and a hedge against inflation.

The factors that support gold during such times are often the same factors that negatively affect the equity market. For example, geopolitical tensions, economic crises, currency devaluations, or concerns about the stability of financial systems can all contribute to an increase in demand for gold. As a result, the price of gold may rise or remain relatively stable when other asset classes, like stocks, are declining.

By including gold in a diversified investment portfolio, investors can potentially reduce their overall portfolio risk. This is because gold’s behavior is often not strongly correlated with other financial assets. In other words, gold tends to move independently or in the opposite direction to stocks and bonds, providing a potential buffer against market volatility and potential losses.

It’s important to note that while gold can be a useful diversifier, it is not without its own risks. Gold prices can be influenced by various factors, including changes in global interest rates, central bank policies, and supply and demand dynamics in the gold market. Additionally, the price of gold can be subject to significant short-term fluctuations.

When considering adding gold to a portfolio, investors should carefully assess their investment objectives, risk tolerance, and time horizon. The proportion of gold in a portfolio will depend on individual circumstances and preferences. Some investors may choose to allocate a small percentage of their portfolio to gold, while others may have a more significant allocation based on their investment strategy and outlook.

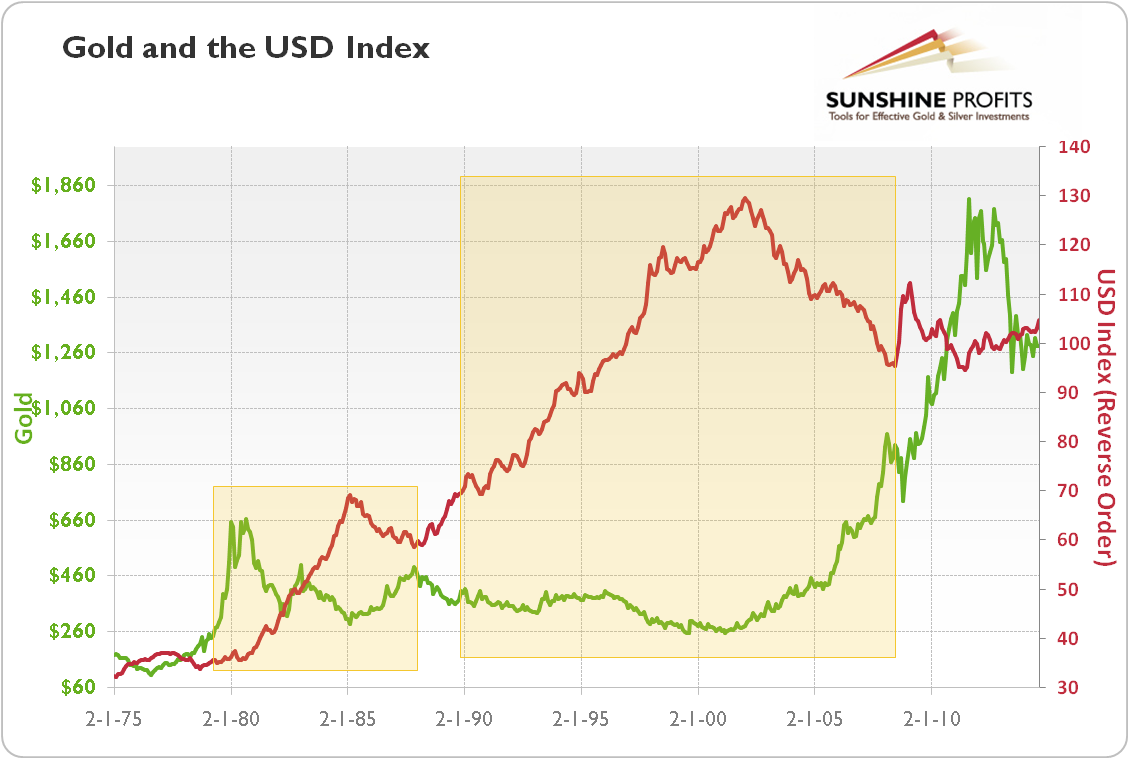

Inverse correlation of gold with USD

The relationship between gold prices and the US dollar is often characterized by an inverse correlation. When the US dollar strengthens, gold prices tend to weaken, and vice versa. This inverse correlation is driven by various factors, including market perceptions of the relative strength of the US economy, interest rate differentials, and investor sentiment.

In recent years, the US dollar has indeed been relatively strong, partly due to the US Federal Reserve’s efforts to combat inflation by raising interest rates. Higher interest rates attract foreign capital, leading to increased demand for the US dollar and potentially putting downward pressure on gold prices.

However, it’s important to note that the relationship between gold prices and the US dollar is not a perfect one. There are other factors that can influence gold prices, such as geopolitical events, economic uncertainties, and global demand for the precious metal. These factors can sometimes override the impact of the US dollar on gold prices.

Regarding the future outlook, if the US Federal Reserve reaches the end of its rate hike cycle or reduces interest rates in the future, it could potentially weaken the US dollar. A weaker US dollar, in turn, could provide support for gold prices. However, it’s important to remember that the relationship between gold and the US dollar is complex and can be influenced by a multitude of factors beyond just interest rate movements.

Allocating a portion of the portfolio to gold can be a prudent strategy for diversification, but it’s important to consider the appropriate allocation based on individual circumstances and investment goals. While there is no one-size-fits-all answer, a common recommendation is to allocate around 10% to 15% of the portfolio to gold.

The purpose of including gold in the portfolio is not primarily to predict specific price levels and attempt to time the market. Instead, it serves as a diversifier that can help reduce overall portfolio volatility and potentially enhance long-term risk-adjusted returns. Gold’s unique behavior and its tendency to behave differently from traditional financial assets like stocks and bonds make it an effective tool for diversification.

Equities (stocks) are often considered a staple asset class in a portfolio due to their potential for long-term growth. Historically, equities have provided higher returns compared to other asset classes over extended periods. However, they also come with higher volatility and risks. Bonds, on the other hand, are known for stability and liquidity. They can provide income, capital preservation, and act as a counterbalance to the potential volatility of equities.

In summary, while gold can serve as a valuable portfolio diversifier, it is typically recommended to allocate around 10% to 15% of the portfolio to gold. Equities and bonds remain staple assets, with equities offering growth potential and bonds providing stability and liquidity. By combining these assets and carefully considering individual circumstances, investors can aim for better risk-adjusted returns over the long term.