Kotak Mahindra Bank: A Banking Pioneer Since 1985

Kotak Mahindra Bank is one of the leading private sector banks in India, known for its comprehensive range of financial products and services. With a strong focus on innovation, customer-centricity, and technological advancements, the bank has emerged as a critical player in the Indian banking sector.

-

Founders and Founders

Image credits: SugerMint

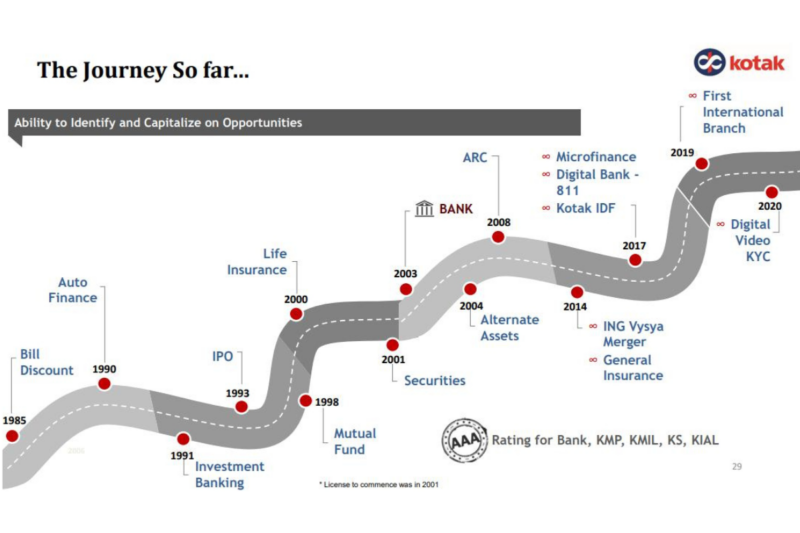

Kotak Mahindra Bank was founded in 1985 by Mr. Uday Kotak, an Indian entrepreneur and business leader. The bank’s journey began under the name of Kotak Capital Management Finance Limited, with a vision to provide tailored financial solutions to businesses and individuals in India.

Uday Kotak, armed with a strong entrepreneurial spirit, established the bank with a determination to build a reliable institution that would cater to the evolving financial needs of the Indian market. With a focus on innovation and customer-centricity, Kotak Mahindra Bank quickly gained recognition as a trustworthy and progressive financial institution.

Under Mr. Uday Kotak’s leadership, the bank embarked on a path of growth and expansion, offering a wide range of products and services to meet the diverse requirements of its customers. Over the years, the bank’s commitment to excellence and its customer-centric approach has helped it emerge as a leading player in the Indian banking sector. Today, Uday Kotak’s entrepreneurial vision and leadership continue to guide Kotak Mahindra Bank. His relentless pursuit of innovation, coupled with a strong emphasis on integrity and ethical business practices, has shaped the bank’s identity and contributed to its success.

As a testament to the founders’ vision and dedication, Kotak Mahindra Bank has become a trusted name in the Indian banking industry, known for its unwavering commitment to customer satisfaction and its ability to adapt to changing market dynamics.

2. Initial Name and Products/Services

Kotak Mahindra Bank, initially known as Kotak Capital Management Finance Limited, had humble beginnings focusing on specific financial services. Established in 1985 by Mr. Uday Kotak, the company primarily offered services in bill discounting, corporate finance, and stockbroking. These services cater to the financial needs of businesses and individuals, aiming to provide customized solutions to their diverse requirements.

The objective behind starting this business was to fill the gap in the market for personalized financial services. Kotak Capital Management Finance Limited recognized the need for specialized financial solutions that went beyond traditional banking offerings. By providing services such as bill discounting and corporate finance, the company aimed to support businesses in managing their working capital requirements and facilitating their growth.

Furthermore, the stockbroking division enabled individuals to invest in the stock market and capitalize on market opportunities. This offering allowed clients to make informed investment decisions and navigate the complexities of the financial markets with the guidance and expertise of Kotak Mahindra Bank.

With its initial products and services, Kotak Capital Management Finance Limited laid the foundation for what would eventually become one of India’s leading private sector banks, catering to a broader range of financial needs and expanding its offerings to encompass a comprehensive suite of banking, investment, and wealth management solutions.

3. Initial Hindrances and Problems

During its early years, Kotak Mahindra Bank faced several hindrances and problems as it sought to establish itself in the Indian banking sector. Some of the initial challenges encountered by the business include:

- Regulatory Hurdles: The banking sector in India was highly regulated, requiring extensive licensing and compliance procedures. Obtaining the necessary licenses and approvals from regulatory authorities posed a significant challenge for Kotak Mahindra Bank. The stringent regulations limited the bank’s operational flexibility and hindered its expansion plans.

- Established Competitors: Kotak Mahindra Bank faced tough competition from well-established players in the banking industry. Competing with long-standing public sector banks and established private sector banks with strong customer bases and brand recognition was a daunting task. Gaining market share and building a customer base amidst the fierce competition required strategic planning and differentiation.

- Building Trust: Being a relatively new entrant in the banking sector, Kotak Mahindra Bank had to establish trust and credibility among customers. Convincing individuals and businesses to trust a relatively unknown banking entity was a significant challenge. The bank had to work diligently to prove its reliability, security, and commitment to customer satisfaction.

- Limited Financial Resources: Starting a bank requires substantial financial resources, and initially, Kotak Mahindra Bank had limited capital. Raising funds and managing capital adequacy were critical hurdles to overcome. The bank had to devise effective strategies to attract investors and secure funding for its operations and growth.

- Technological Infrastructure: In the early years, technological advancements were not as prevalent as they are today. Establishing a robust technical infrastructure to support banking operations and provide efficient services was a significant challenge. Developing secure systems, implementing digital platforms, and ensuring data privacy were crucial tasks that required considerable investment and expertise.

Despite these initial hindrances and problems, Kotak Mahindra Bank persevered, leveraging its entrepreneurial spirit, strategic vision, and customer-centric approach to overcome challenges and carve a niche in the highly competitive banking industry.

4. Current Owners and Name

Uday Kotak, the Founder and Managing Director & CEO of Kotak Mahindra Bank, has played a pivotal role in the bank’s success and growth since its inception. With an illustrious career spanning over 35 years, Uday Kotak has established himself as a prominent figure in the Indian financial services sector.

As the driving force behind Kotak Mahindra Bank, Uday Kotak has led the group in providing a diverse range of financial services. Under his leadership, the bank has witnessed significant expansion and transformation, evolving into one of the leading private-sector banks in India.

Uday Kotak’s expertise and strategic vision have been instrumental in shaping the bank’s business strategies and customer-centric approach. He has been actively involved in diversifying the bank’s product offerings, embracing technological advancements, and fostering innovation within the organization. Recognized for his exceptional leadership skills and contributions to the banking industry, Uday Kotak has received numerous accolades and awards throughout his career. His deep understanding of the financial landscape, coupled with his unwavering commitment to excellence, has propelled Kotak Mahindra Bank to new heights.

As the current owner and CEO of Kotak Mahindra Bank, Uday Kotak continues to steer the organization towards sustained growth, profitability, and customer satisfaction. His relentless pursuit of excellence and his unwavering dedication to the banking industry make him a revered figure in the Indian financial services sector.

5. Current Products and Services

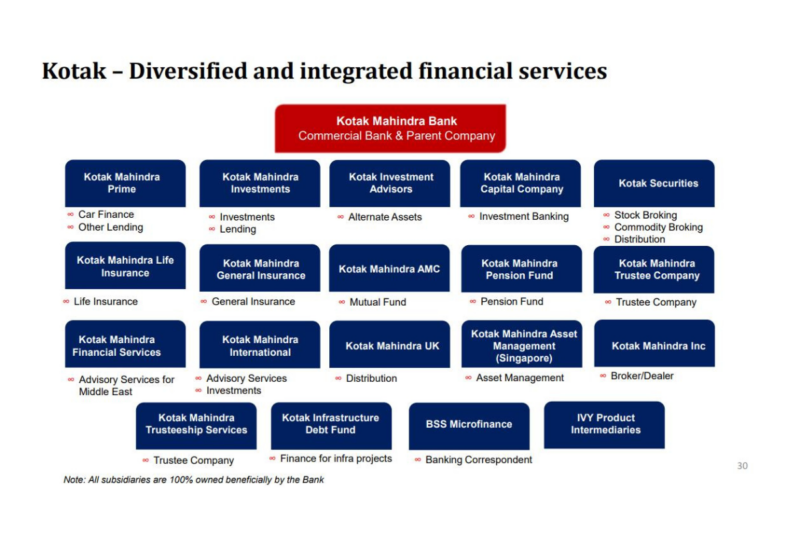

Kotak Mahindra Bank offers a wide range of products and services to cater to the diverse financial needs of its customers. With a focus on convenience and accessibility, the bank provides various digital platforms and traditional banking solutions. Here are some of the current products and services offered by Kotak Mahindra Bank:

- Mobile Banking: Kotak Mahindra Bank’s mobile banking app allows customers to access their accounts, make transactions, pay bills, and manage their finances on-the-go.

- Net Banking: Through the bank’s secure net banking portal, customers can perform various banking activities, including checking account balances, transferring funds, and managing their investments.

- Manage Your Account: Kotak Mahindra Bank provides robust account management services, allowing customers to monitor transactions, view statements, and set up alerts for personalized financial control.

- Transfer Money: The bank offers seamless fund transfer options, enabling customers to transfer money between their own accounts or to other bank accounts through NEFT, RTGS, and IMPS.

- Recharge/Make Payments: Customers can conveniently recharge their mobile phones and DTH connections and pay utility bills using Kotak Mahindra Bank’s platforms.

- Credit Cards: Kotak Mahindra Bank offers a range of credit cards tailored to suit various lifestyles and needs, providing benefits such as reward points, cashback, travel perks, and exclusive offers.

- Debit Cards: The bank’s debit cards offer secure and convenient access to funds, along with benefits like cashback, reward points, and discounts on shopping and dining.

- Loans: Kotak Mahindra Bank provides a wide array of loan products, including home loans, personal loans, business loans, loans against property, and vehicle loans, catering to the financial aspirations of individuals and businesses.

- National Pension Scheme (NPS): As an authorized point of presence for the NPS, Kotak Mahindra Bank facilitates the enrollment and management of the National Pension Scheme, helping customers plan for their retirement.

- Deposits: The bank offers various deposit products, including savings accounts, current accounts, fixed deposits, and recurring deposits, providing customers with flexible and secure investment options.

Additionally, Kotak Mahindra Bank extends its services to include mutual funds, life insurance products, and zero-balance savings accounts, aiming to provide comprehensive financial solutions to its customers.

6. Global Expansion

Kotak Mahindra Bank, a part of the Kotak Mahindra Group, has established a notable global presence across key financial hubs. With a vision to cater to the diverse financial needs of its global clientele, the bank has strategically expanded its operations to various international locations.

The bank has established branches and representative offices in prominent global cities, including New York, London, Dubai, Abu Dhabi, Mauritius, and Singapore. These locations serve as strategic bases to offer a wide range of financial products and services to both retail and corporate customers.

By having a presence in these global financial centers, Kotak Mahindra Bank aims to provide seamless banking services to its international clients. These branches and representative offices facilitate cross-border transactions, investment services, trade finance, and advisory services, among others. Moreover, they act as a gateway for global investors looking to access Indian markets and avail themselves of the bank’s expertise and offerings.

Kotak Mahindra Bank’s global presence not only enhances its reach but also strengthens its position as a trusted financial institution internationally. Through its expansion, the bank demonstrates its commitment to serving customers beyond borders, fostering economic growth, and contributing to the global financial landscape.

7. Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) play a crucial role in assessing the success and growth of Kotak Mahindra Bank. Here are five significant KPIs that provide insights into the bank’s performance:

- Total Assets: The total assets of Kotak Mahindra Bank serve as a fundamental indicator of its size and growth. A higher value signifies the bank’s ability to attract deposits, generate loans, and expand its financial operations.

- Net Interest Margin (NIM): NIM is a critical bank profitability indicator. It represents the difference between interest earned on loans and investments and the interest paid on deposits. A healthy NIM indicates the bank’s ability to manage its interest rate spread and generate profits from its core banking activities.

- Fee Income: Fee income represents the revenue generated by the bank through non-interest-based services such as commissions, fees, and charges. This KPI reflects the bank’s ability to diversify its income streams and offer value-added services to its customers.

- Return on Assets (ROA): ROA measures the bank’s profitability in relation to its total assets. It provides insights into how efficiently the bank utilizes its assets to generate profits. A higher ROA indicates effective management of assets and the bank’s ability to generate returns for its shareholders.

- Capital Adequacy Ratio (CAR): CAR measures the bank’s financial strength and its ability to absorb losses. It compares the bank’s capital to its risk-weighted assets and determines its ability to meet regulatory requirements. A higher CAR indicates a more substantial capital base, enhancing the bank’s stability and resilience.

By monitoring these key performance indicators, Kotak Mahindra Bank can assess its financial health, profitability, efficiency, and risk management, enabling it to make informed strategic decisions and maintain a competitive edge in the banking industry.

8. Lawsuits/Scams

According to the report in 2019, an FIR was lodged based on a complaint filed by a Delhi-based businessman. The complainant alleged that the bank and the accused individuals cheated him of a substantial amount of money by falsely promising to secure a loan for his business. It is claimed that the bank and the accused individuals collected significant sums of money as processing fees and other charges but failed to provide the promised loan.

The FIR includes charges of cheating, criminal conspiracy, and forgery, among others. The complainant has also alleged that the bank and the accused individuals manipulated documents and submitted false information during the loan processing.

After the incident, Kotak Mahindra Bank has focused on conducting its operations with transparency, integrity, and compliance with legal and regulatory frameworks. This commitment to maintaining a high standard of corporate governance has contributed to its positive standing in the industry till date.

By prioritizing customer satisfaction and ethical conduct, Kotak Mahindra Bank has built a solid reputation for trustworthiness and reliability. The bank’s emphasis on risk management and compliance has helped it avoid any significant legal entanglements, ensuring a stable and secure environment for its customers and stakeholders.

9. Financial Overview

Kotak Mahindra Bank has demonstrated commendable financial performance, showcasing its strength and resilience in the competitive banking industry. The bank’s market capitalization stands at an impressive INR 3.67 trillion, highlighting its robust market presence and investor confidence.

In terms of profitability, Kotak Mahindra Bank reported a consolidated profit after tax (PAT) of ₹14,925 crores for the fiscal year 2022-2023, representing a notable 23% year-on-year growth. This impressive increase in profits demonstrates the bank’s effective management of its operations, cost optimization, and revenue generation strategies.

Furthermore, Kotak Mahindra Bank has managed its borrowings prudently. The bank’s borrowings amounted to ₹23,416.27 crores, reflecting a cautious approach to maintaining an optimal debt position. By effectively managing its borrowings, the bank ensures financial stability and reduces any potential risks associated with excessive debt.

These financial indicators showcase Kotak Mahindra Bank’s strong performance and its ability to deliver value to its stakeholders. With a focus on sustainable growth and a customer-centric approach, the bank continues strengthening its position as a leading player in the Indian banking sector.

10. Banking Excellence

Kotak Mahindra Bank has been actively involved in various corporate social responsibility (CSR) initiatives, reflecting its commitment to societal well-being. The bank’s CSR programs focus on areas such as education, healthcare, environmental sustainability, and skill development. Through its initiatives, the bank has contributed to improving communities and supporting social causes.

Kotak Mahindra Bank has also been recognized and awarded for its excellence and performance in the banking industry. It has received accolades for its corporate governance practices, customer service, technological advancements, and financial performance. These achievements highlight the bank’s dedication to maintaining high standards and delivering value to its stakeholders.

Furthermore, Kotak Mahindra Bank has embraced digital transformation, leveraging technology to enhance customer experience and streamline operations. The bank offers innovative digital banking solutions, mobile apps, and online platforms, enabling customers to access banking services anytime, anywhere conveniently.

In recent years, Kotak Mahindra Bank has actively collaborated with fintech startups and launched initiatives to foster innovation in the financial services sector. Through partnerships and investments in technology-driven companies, the bank aims to stay at the forefront of digital disruption and leverage emerging technologies to provide cutting-edge solutions to its customers.

Overall, Kotak Mahindra Bank’s additional initiatives, awards, focus on digital transformation, and collaborations with fintech highlight its commitment to growth, innovation, and social responsibility.

Conclusion

Kotak Mahindra Bank has come a long way since its inception in 1985. With its commitment to innovation, customer-centric approach, and wide range of financial products and services, the bank has positioned itself as a significant player in the Indian banking sector. While expanding its footprint globally, Kotak Mahindra Bank focuses on delivering value to its customers and stakeholders while maintaining a strong financial standing.