FDI also known as foreign direct investment is a crucial form of investment in the economy. Such kinds of investments are considered all the more important if certain unprecedented contraction grips the country. This means when the economy is slumping and is in invariable need of investments as consumers’ and producers’ confidence are at an all-time low. in fact, increased inflows usually take place at times when domestic private investments remain aloof or elusive.

Given that India right now quite appropriately fills the bracket, the inflow for the country is the need of the hour. This is due to the very pertinent fact that investments are quite critical for the country’s economic growth and resurgence. It is also quite crucial as private consumption, at the moment, has been badly bruised by an invariable health crisis and subsequent income losses exacerbated by rising prices in the economy and increased medical expenditure.

FDI Equity inflows in India

According to the latest reports released, foreign direct investment in equity, for the June quarter jumped by a significant 168% year-on-year in India. This means that the gross FDI inflows strategically and emphatically surged by 90%. But here it is to be noted that this significant number was aided effectively by a conducive base of the previous financial year that had contracted immensely.

Though, as aforementioned, the record growth could have been due to the conductive base of the last financial year but it is to be noted that the inflows are still higher than the previous level that was witnessed in the quarter of June quarter FY20.

This comes despite the odious second Covid wave that had ravaged the healthcare sector and the economy in India. The effects of the second wave were so much crippling that it had consequently led to curbs in certain key industrialist and manufacturing sectors like Maharashtra and Delhi.

For clarification, the gross FDI inflows significantly include reinvested earnings, FDI in equity, the equity capital of the unincorporated bodies, and various other capital. It is to be noted that it rose to $53 billion in the first quarter, which is a significant rise from the earlier FDI inflow at $11.84 billion that was recorded in the previous financial year. Given that FDI inflows were the biggest gainers, they effectively surged from $6.56 billion to $17.57 billion.

Monthly breakdown

If the data has to be scrutinized on a monthly basis, it can be deciphered that the sharp growth was recorded in the first three months of the current fiscal year. This was followed by moderation that had crept in the March quarter. Though the moderation might have kicked in the fourth month of the fiscal year, it is worthy of mentioning here that the full-year inflows still had hit a record high for the financial year 2021. Thus, it can be rightfully stated that the robust inflows definitely had beaten the Covid blues. Breaking down the FDI equity inflows that had emphatically risen by 19% to a humungous $59.6 billion, gross inflows had effectively risen by 10%.

The Reason

It is to be noted that the FDI inflows for the financial year 2021, were greatly boosted by the digital sector. According to the reports, a sizable part of this was constituted by Reliance Jio alone. In addition to the digital sector, the automobiles sector too had robustly attracted the highest FDI, which was emphatically up by 27% in the June quarter. The automobile sector was significantly followed by the inflows into the computer software sector the services sector, which attracted inflows up to 11 percent.

Given that the economic condition of the country was quite battered, FDI inflows can be considered strategically important. Investments in the economy are crucial as they onset the cycle of demand and supply in the economy. The more the investment in the economy, the more is the demand for goods. This subsequently leads to the increased supply and hence employment in the economy invariably rises. Also, given the low confidence in consumers and producers in the economy, which is pestering demand and investment in the economy, increased FDI inflows can be considered economically viable and strategic.

In terms of states that attracted the highest FDIs in the economy, Karnataka topped the FDI recipient list for the June quarter. According to the reports, it had a humongous share of 48%. Karnataka was followed by Maharashtra, which emphatically attracted 23 percent of the FDI inflows. Delhi too was the runner in the race that attracted about 11 percent in the FDI inflows. Given that the automobile sector was the largest gainer after the digital sector, it is no surprise that Karnataka accounted for at least 88% of the auto sector FDI investments.

Strategic policies

The huge FDI inflows even at the back of slower economic growth and confidence in the Indian economy give rise to a pertinent question that what led to the rise of such robust inflows? The answer quite rightly is the strategic measures that were taken by the Government. The strategic measures that were taken by the government were on the effective fronts of FDI policy reforms that greatly facilitated investment in the economy. The FDI boost was also seen due to the government’s ease of doing business measures to attract more FDIs in the economy. Such a claim was also corroborated by the ministry of commerce and industry which maintained the same in its statement.

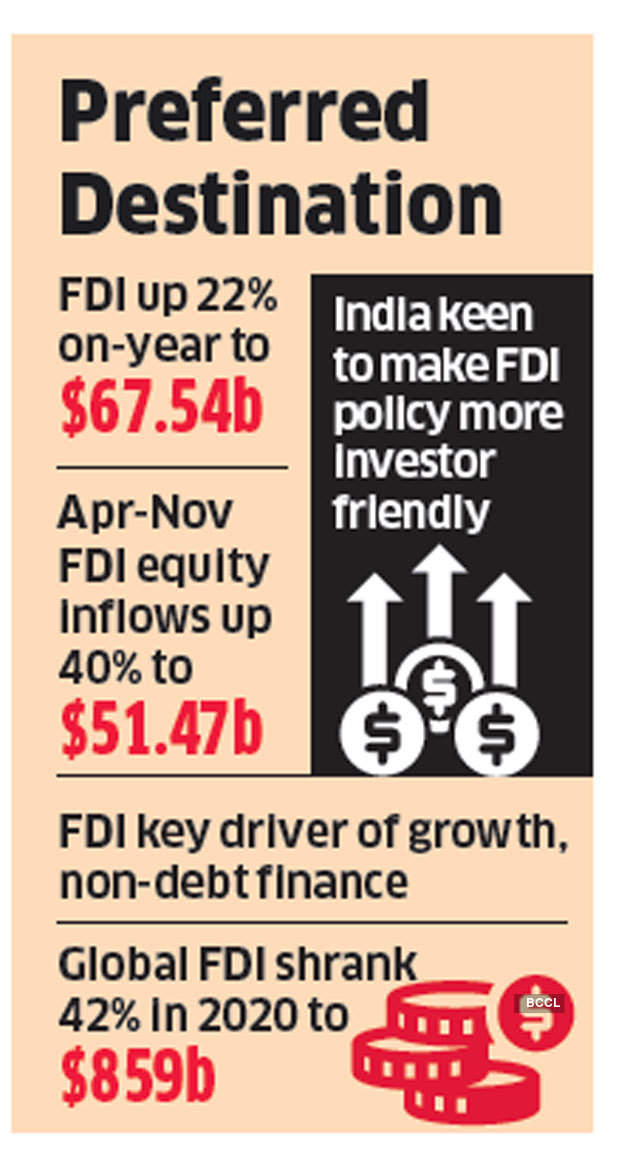

Unctad report in January maintained that two countries, namely China and India were the major “outliers” in a gloomy year for the FDI inflows. This came at the backdrop of the FDI inflows that had plummeted worldwide by 42% in the financial year 2020. It had plunged to $859 billion that was effectively the lowest level gained ever since the 1990s.

Even in comparison to China which only witnessed the rise of 4 percent, India witnessed a 13% year-on-year rise amongst the highest among key nations. Though, according to the report by Unctad, China remained ahead in the absolute term, with FDI inflows of as much as $163 billion in the financial year 2020. While in comparison India stood at $57 billion.

Edited by Sanjana Simlai.