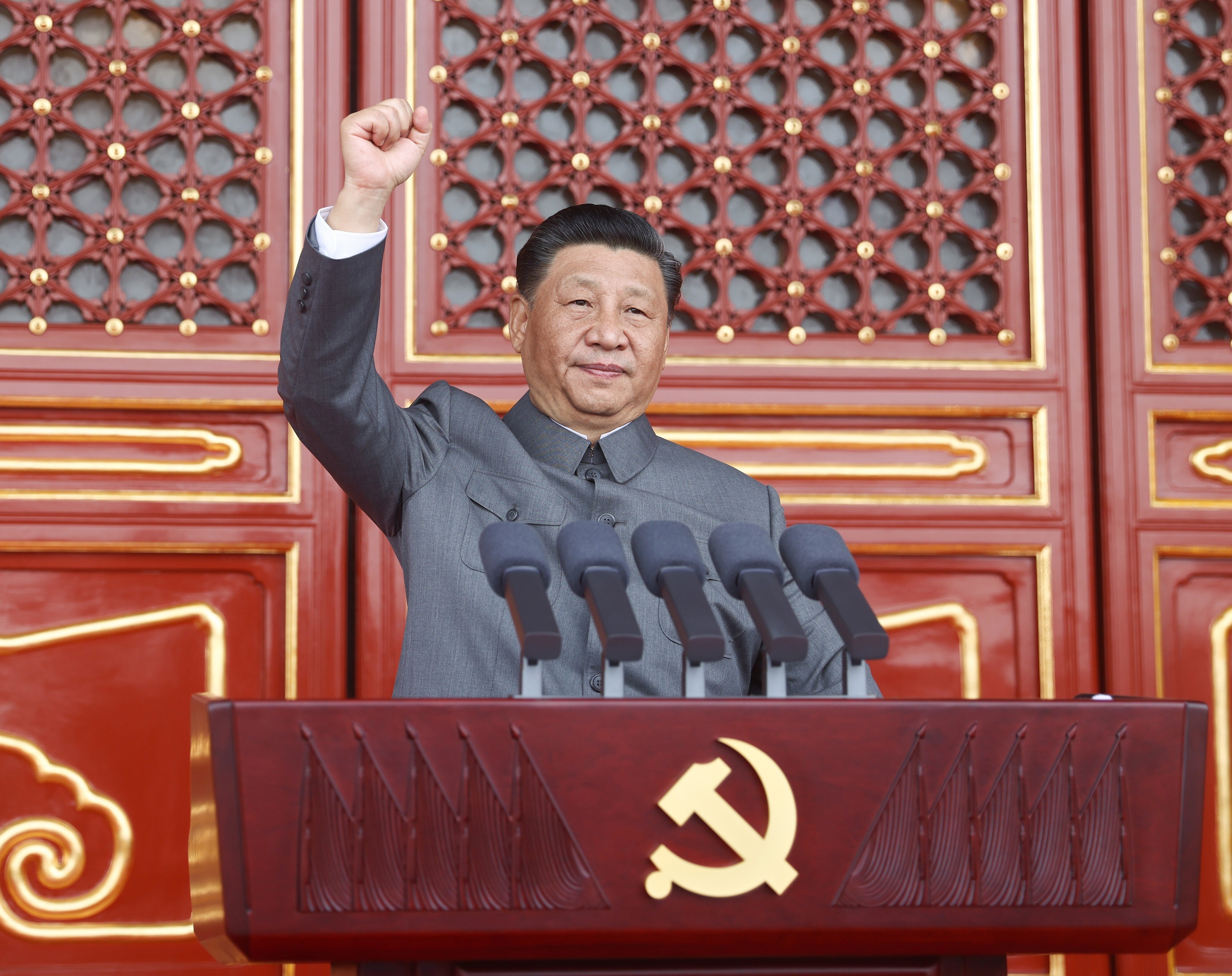

No matter what, China always remains in the headlines for its crackdown on either its’ citizen’s fundamental rights or the working of the corporates. Be it any, the repercussions of both are quite detestable. China’s recent campaign plans to strategically clamp down on various industries. These industries vividly range from education to steel to property.

Such regulatory crackdown by the government has infuriated the financial markets and has significantly curbed the outlook for growth. It is to be noted that China’s crackdown comes amidst supply chain disruptions and the burgeoning inflation in the economy. As a matter of fact, the regulations come after China’s recent warning that it will try and curb the excessive wealth of a few billionaires in order to restore equality in society.

Crippling regulations of China and their repercussions

The aforementioned regulations that have been placed in the economy by the Chinese make the business prospects in China quite nonaccommodative and uncanny. It is to be noted that given the resurgence of the virus, stimulus and government funding are required, but more importantly, private investment and demand in the economy are needed. Given, Chinese crippling economic stance, demand and private investment in the economy face the largest threat at the moment. Beijing, in fact, has signaled that there can definitely be more regulations for businesses in the coming years. This will significantly lead to dissatisfaction amongst various business owners and disincentivize them to invest in the economy, which is a crucial need of the hour.

According to various economists, Chinese authorities essentially need to manage the intensity and pace of such regulations. This is due to the fact that China doesn’t want its economy to weaken faster than expected this financial year.

It is to be noted here that all the regulations come after President Xi Jinping’s unconventional timing to complete his major economic and social development targets that were set for this year. On the other hand, this needs to be achieved while strictly maintaining virus controls. Asking for too much? We think so.

China’s untimely Decarbonization Push

China, in a series of regulations, has set quite an ambitious goal of effectively becoming a carbon neuttral nation by 2060. This target has been hard to achieve in recent years particularly due to the large scale of crypto mining in the economy. Thus, in order to rectify such discrepancies and to strategically achieve net-zero emissions, Beijing has untimely pledged to strategically increase the use of renewable energy. Additionally, it has pledged to include innovative ideas and strategically develop new technologies so as to capture carbon emissions in the economy.

The steel sector comes under increased scrutiny as it actually contributes to more than 15% of national emissions. Announcement of such goals and increasing covid cases in the economy, steel production, reportedly plunged to a 15 month low recorded in the month of July. It is to be noted that this came even after China’s central party had assured that no drastic measure to achieve such goals will be taken. According to the reports, the coal output too significantly fell to the lowest in four months.

Thus, given such a contraction trend, it can be stated that such a furious pace of carbon reduction could effectively and quite detestably, at the moment, curb economic growth. This problem will be exacerbated if the demand exceeds supply in the economy, of which there is a high possibility given that the global economy is slowly recuperating and thus global economic demand is on a rise.

Now it is worth mentioning here that economic growth is the actual short-term goal given the economic circumstances at the present. While, on the other hand, steel output reduction in order to curb carbon emission is strategically the long-term goal. Thus, if there is a conflict between the two, policymakers should definitely prioritize employment, growth, and short-term priority.

Not only is the steel sector bearing the brunt of Chinese untimely regulations but also the nation’s runway property market. It is to be noted that China has been strategically increasing restrictions on the property market. This, in turn, is leading to halting of land auctions, thus disruption of economic activities in the economy and higher mortgage rates leading to lower demand for the same. At the same time, China is effectively banning private equity funds from actually and emphatically raising money to invest in such residential developments. This will significantly lead to a fall in private investment in the economy, which can spell doom for the economy.

According to the reports, such detestable restrictions have already hit home purchases and can lead to a contraction in the retail sector. On the other hand, these sales have been declining for two straight months. According to Rosealea Yao, who is an analyst at the Gavekal, construction starts for this financial year will experience a substantial 4% decline. This comes in comparison to earlier predictions of an estimated growth of 3%.

According to Nomura Holdings Inc., property curbs can quite detestably account for more than half of the slowdown in GDP. To put this perspective into number, according to reports contraction of 4.7% can be witnessed in the second half of the year. It is worthy of mentioning here that the repercussions of the same will be wide and will go well beyond the just drop in sales of homes and lower investment. It will invariably also affect restrictions on the sale and production of construction materials, including financial services in the real estate sector and furniture and home appliances.

According to Lu Ting, who is a chief China economist at Nomura, the Chinese authorities have been shortsighted in understanding the downward pressure such measures will have on the real estate industry. The effect can be to such an extent that construction and investment growth in the economy in the next six months can considerably slow down or worse shrink. This consecutively will have an immense detestable and crippling effect on the income of related industries. This can also have repercussions for the employment sector of the country and thus can indirectly affect the household and personal finances of many.

Edited by Sanjana Simlai.