Some facts you didn’t know about Digital Yuan:

The digital currency Yuan will permit new forms of safe and convenient real-time international money transfers, stimulating China’s deepening reform in payment and settlement systems. develop advanced trading technologies and strategies to make your bitcoin trade profitable and worthy. In addition, it will help develop the national brand for “China’s renminbi”; and provide an essential tool for the government to regulate cross-border capital flows.

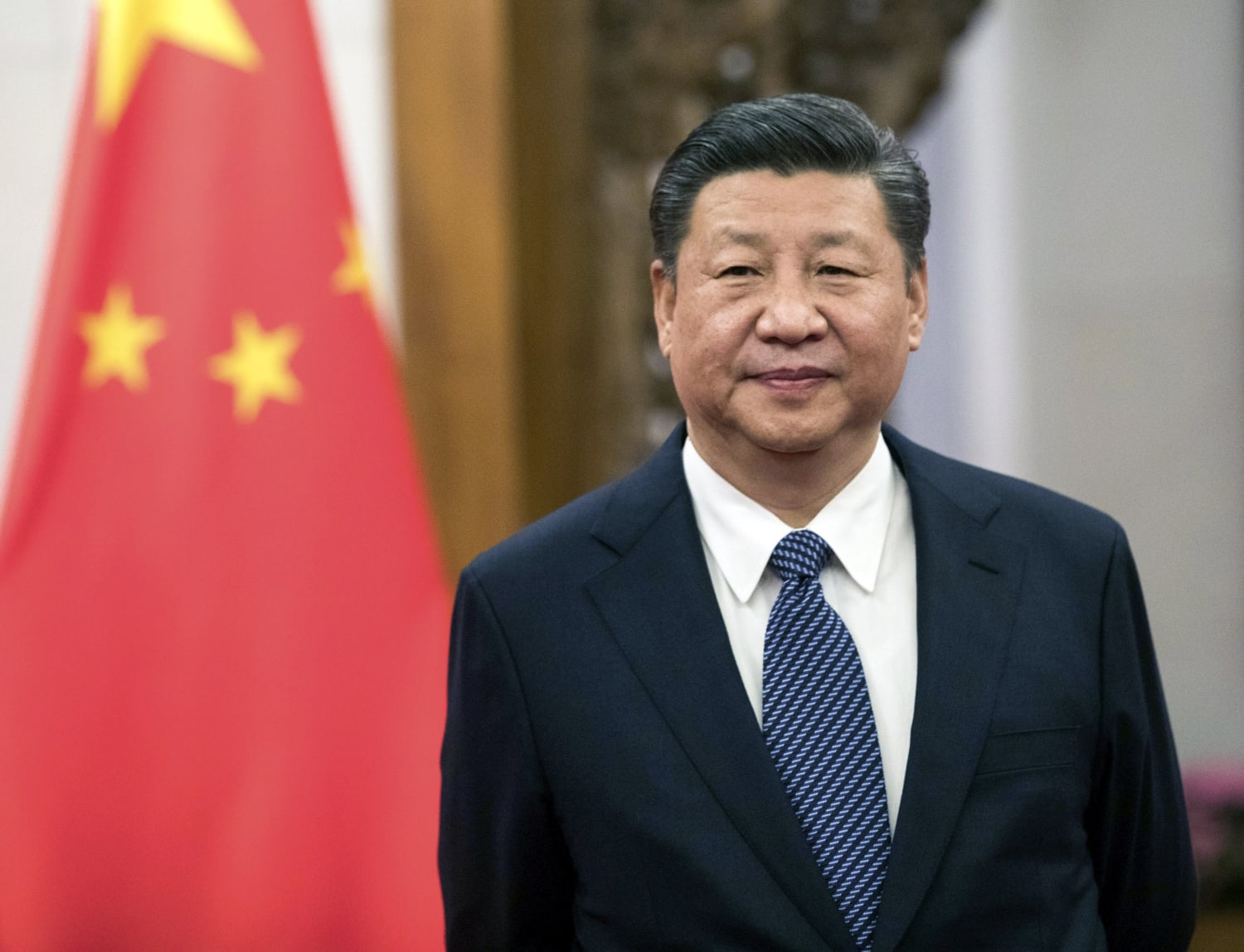

Chinese President Xi Jinping said in a speech at the first Boao Forum for Asia conference in the southern island province of Hainan that he thinks ‘digital currency will become an essential form of payment. Although central bank digital currencies like yuan incur many characteristics of fiat currency and cryptocurrency to some extent, let’s explore some interesting facts you didn’t know about digital yuan.

-

Digital Yuan can bring revolution to the financial sector of china:

Firstly, digital currency will permit new forms of safe and convenient real-time international money transfers. Internet-based e-commerce has brought about changes in the market structure for domestic and cross-border remittances. The use of digital currency will make cross-border remittances more convenient and safe. For example, a Chinese living in the US can use digital currency to transfer RMB directly to his childhood living in China without going through Western Union or other international money transfer services that charge high commissions and take several days to complete transactions.

Secondly, it will stimulate China’s deepening reform in payment and settlement systems. It is well known that the continuous growth of Internet financial transactions has raised significant challenges for China’s current payment and settlement systems. The crosstalk between digital currency and traditional payment and settlement systems will make the payment and settlement systems more transparent and efficient.

Thirdly, it will help develop the national brand for “China’s renminbi .”It is well known that “currency wars” have caused severe competition among countries over the past few years. Digital currency will promote the application of China’s renminbi in cross-border e-commerce transactions, thus raising the status of the Chinese currency in competition with other currencies.

Fourthly, it provides an essential tool for the government to regulate cross-border capital flows. As a result of globalization, there has been a significant increase in cross-border capital flows. Central bank digital currency can play a role in improving cross-border clearance efficiency, scaling out an inefficient settlement and cross-border interbank fund transfers, and eventually building a global China clearing center.

International transactions between different currencies are usually through US dollars as the key currency. Using renminbi for cross-border trade and investment will reduce dependence on the US dollar, thus reducing friction with the US on exchange rates and capital controls.

- Digital Yuan will not replace other currencies, and it is not like bitcoin:

Firstly, the digital currency will not replace other currencies. For example, Digital Yuan will complement and not replace cash and other payment instruments currently in circulation. Secondly, the digital currency will not become a “digital version of Bitcoin.” Two significant differences exist between digital currency issued by central banks and Bitcoin.

First, the former will be under the legal framework of the central bank, while the latter is outside the legal framework of any country. Secondly, it is centralized in terms of issuance; it is decentralized in terms of information sharing. Centralized issuance means that specific organizations issue electronic money based on authorization from a central bank; decentralized information sharing means that no one controls digital currencies issued by anyone through a distributed computing mechanism.

- No new money will be in circulation.

A central bank’s digital currency like the yuan will not directly impact its monetary policy, which means no new money will be in circulation. The central bank uses monetary policy to control the existing base money (cash and reserves), but it does not directly control a digital currency.

If the government sets up a mechanism for purchasing and selling digital currency, it can control the amount of outstanding digital currency; or if it chooses to add more cash into circulation by issuing paper currency, then this will increase the amount of existing cash in circulation without changing the total amount of outstanding digital currency. It is because digital currencies function as complete units separate from their underlying assets.

- Digital Yuan will have a clearing mechanism:

Further development of the digital currency industry requires a consensus on the clearing mechanism. Currently, banks and post offices are mainly responsible for performing banking and settlement functions, but they do not provide adequate facilities for performing settlement tasks; enterprises are mainly responsible for performing payment operations, but their settlement service is not reliable enough.

To build a safe and sound financial system that is also conducive to promoting cross-border e-commerce transactions, China will speed up the establishment of a clearing system through e-commerce financial institutions like banks and joint ventures that can work with domestic and cross-border services.