Professional Oil Trading Techniques: The Cryptocurrency Crude Analyst

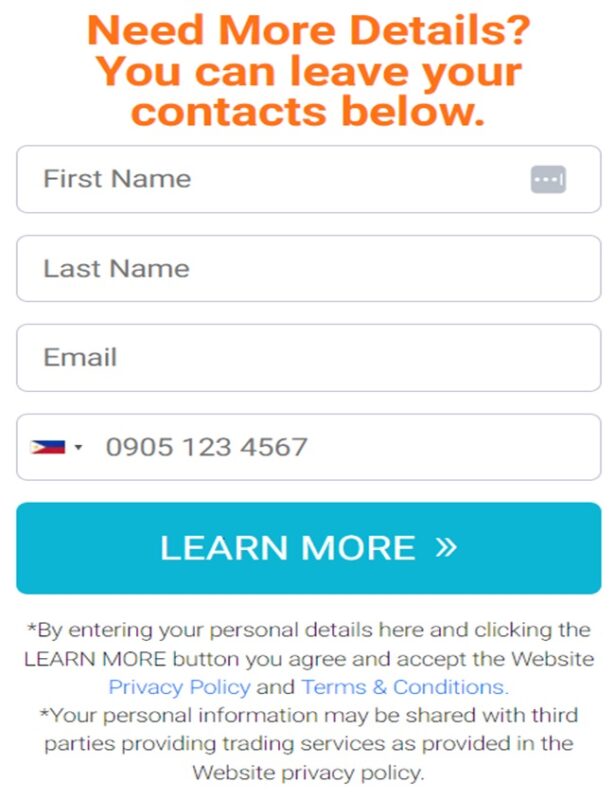

In the ever-evolving world of finance and commodities trading, the convergence of traditional oil trading and the digital realm of cryptocurrencies has given birth to a unique profession: the Cryptocurrency Crude Analyst. This fascinating blend of industries has created opportunities for professionals to leverage cryptocurrency technology to analyze and optimize oil trading strategies. In this article, we will delve deep into this emerging field, exploring the role of Cryptocurrency Crude Analysts, the integration of cryptocurrency data in oil trading, risk management techniques, challenges, and the promising future of this dynamic domain. Click this image below to start oil trading and learn how you can begin your trading journey.

Understanding Cryptocurrency in Oil Trading

What is Cryptocurrency and its Significance

Cryptocurrency, such as Bitcoin and Ethereum, is a digital or virtual form of currency that uses cryptography for security. Its decentralized nature and blockchain technology have made it a groundbreaking innovation in the world of finance. The significance of cryptocurrency in oil trading lies in its potential to revolutionize how transactions and data are handled, making the process more efficient and transparent.

The Evolution of Cryptocurrency in Commodity Markets

Over the past decade, cryptocurrencies have been gradually making their way into commodity markets, including oil. This shift is driven by the desire for faster, more secure transactions and increased liquidity. Cryptocurrency’s adaptability and ability to operate 24/7 have attracted traders and analysts looking to gain an edge in commodity trading.

Advantages and Disadvantages of Using Cryptocurrency in Oil Trading

Cryptocurrency offers several advantages in oil trading, including reduced transaction costs, faster settlement times, and global accessibility. However, it also comes with risks such as price volatility, regulatory uncertainty, and security concerns. Cryptocurrency Crude Analysts play a crucial role in navigating these advantages and disadvantages effectively.

The Role of the Cryptocurrency Crude Analyst

Defining the Cryptocurrency Crude Analyst

A Cryptocurrency Crude Analyst is a specialized professional who combines expertise in cryptocurrency technology and traditional oil trading strategies. They analyze market data, trends, and emerging opportunities while utilizing cryptocurrency tools and techniques to inform trading decisions.

Responsibilities and Skills Required

The role of a Cryptocurrency Crude Analyst involves monitoring cryptocurrency markets, conducting data analysis, and identifying correlations with oil price movements. These professionals must possess strong analytical skills, a deep understanding of blockchain technology, and the ability to interpret complex data sets.

How Cryptocurrency Analysts Impact Oil Trading Strategies

Cryptocurrency Crude Analysts provide valuable insights that inform oil trading strategies. By leveraging real-time data from cryptocurrency markets, they can identify market sentiment shifts, track supply and demand trends, and enhance risk management strategies. This data-driven approach allows traders to make more informed decisions and adapt to rapidly changing market conditions.

Analyzing Oil Prices with Cryptocurrency Data

The Importance of Real-time Data in Oil Trading

In the fast-paced world of oil trading, having access to real-time data is crucial. Cryptocurrency markets operate 24/7, providing a continuous stream of information that can be used to gain a competitive edge. Cryptocurrency Crude Analysts use this data to monitor oil prices, market sentiment, and trading volumes.

Utilizing Blockchain Technology for Price Analysis

Blockchain technology, the backbone of cryptocurrencies, offers a secure and transparent ledger of transactions. Analysts can use this technology to track the movement of oil shipments, verify authenticity, and reduce fraud. This enhances the accuracy of price analysis and strengthens the integrity of the oil trading process.

Case Studies: Successful Applications of Cryptocurrency Data in Oil Trading

Numerous case studies highlight the successful integration of cryptocurrency data in oil trading. From predicting oil price movements to optimizing supply chain logistics, Cryptocurrency Crude Analysts have demonstrated their ability to generate substantial value for trading firms.

Risk Management and Cryptocurrency Tools

Identifying Risks in Oil Trading

Oil trading inherently involves risks such as geopolitical events, price fluctuations, and supply chain disruptions. Cryptocurrency Crude Analysts identify and assess these risks using advanced data analysis and risk management techniques.

Implementing Cryptocurrency-Based Risk Assessment Techniques

Cryptocurrency Crude Analysts use cryptocurrency-based tools to assess and mitigate risks. These tools include smart contracts, which can automate transactions and enforce contractual agreements, reducing the potential for disputes and fraud.

Hedging Strategies with Cryptocurrency

Cryptocurrency can also be used as a hedging tool to offset risks in oil trading. By entering into cryptocurrency futures contracts or options, traders can protect their positions against adverse price movements in the oil market.

Challenges and Ethical Considerations

Data Privacy and Security Concerns

The use of cryptocurrency in oil trading raises concerns about data privacy and security. Cryptocurrency Crude Analysts must navigate these challenges by implementing robust security measures and complying with data protection regulations.

Regulatory Compliance in Cryptocurrency-Enabled Oil Trading

The regulatory landscape for cryptocurrency in commodity markets is evolving. Analysts and traders must stay informed about changing regulations and ensure compliance to avoid legal issues.

Ethical Dilemmas in the Intersection of Cryptocurrency and Oil

Ethical considerations arise when cryptocurrencies are used in oil trading. These include questions about the environmental impact of cryptocurrency mining and the ethical sourcing of oil. Striking a balance between profitability and ethical practices is a challenge faced by Cryptocurrency Crude Analysts.

The Future of Cryptocurrency in Oil Trading

Emerging Trends and Innovations

The future of cryptocurrency in oil trading promises exciting innovations, including the development of specialized trading platforms, increased integration of blockchain technology, and the emergence of new cryptocurrency-backed financial instruments.

Potential Disruption and Opportunities

Cryptocurrency has the potential to disrupt traditional oil trading practices, leading to more efficient and transparent markets. This disruption creates opportunities for Cryptocurrency Crude Analysts to pioneer new strategies and technologies.

Preparing for the Future: Education and Skill Development

As the role of Cryptocurrency Crude Analysts continues to evolve, professionals in this field must invest in education and skill development to stay at the forefront of the industry. Continued learning and adaptation are essential to navigate the changing landscape of cryptocurrency-enabled oil trading successfully.

Conclusion

In conclusion, the integration of cryptocurrency into oil trading has given rise to the specialized profession of Cryptocurrency Crude Analysts, who excel in utilizing cryptocurrency technology to analyze oil markets, manage risks, and optimize trading strategies. As both the cryptocurrency and oil industries continue to evolve, the pivotal contributions of Cryptocurrency Crude Analysts are set to shape the future of commodity trading in profound ways. Recognizing the significance of this convergence and staying informed about emerging trends and challenges is imperative for professionals in both fields.