Indian Rupee Is The Worst Performing Currency In Entire Asia, The currency declined by 2.2%

Indian Rupee Is The Worst Performing Currency In Entire Asia

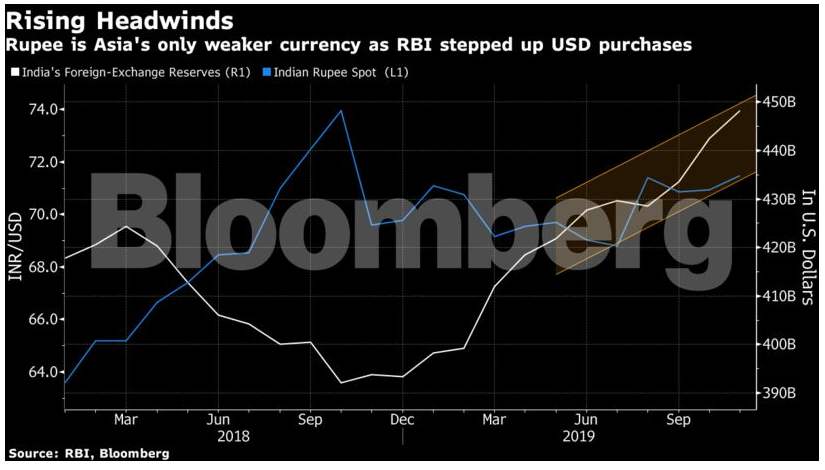

The Indian National Rupee (INR) has had one of the worst performing currency among Asian currencies. The INR is projected to be guided in the short to medium term by RBI intervention, inflation trajectory, oil price movement, and the speed of liquidity unwinding by global central banks, according to experts.

For the second year in a row, the Indian rupee will conclude the year with a lower value against the US dollar. The rupee has historically declined against the dollar by 1-3 percent year on year, and this year was no exception, with the INR depreciating by about 2% against the US dollar. The rupee traded in a range of 72.263 to 76.419, indicating that it had recovered significantly from its low point earlier in the month.

According to sources, Goldman Sachs Group Inc. and Nomura Holdings Inc. reduced their equities outlook due to high valuations, causing foreigners to sell Indian stocks. The trade deficit is at an all-time high, and the central bank’s policy divergence from the Federal Reserve has had an influence on the currency’s value.

“The monetary policy divergence and rising current account gap have caused depreciation in the currency in the near term,” according to B. Prasanna, head of global markets, sales, trading, and research at ICICI Bank Ltd in Mumbai.

What does this depreciation entail for the Reserve Bank of India (RBI)? On the one hand, a weaker currency can help exports, but on the other hand, there is a risk of inflation. This could make it difficult for the RBI to keep rates at their current low levels for much longer.

“The imminent liquidity withdrawal by the US Fed and other central banks was one of the primary drivers in the INR’s drop. The withdrawal of nearly Rs. 30,000 crore by foreign institutional investors (FIIs) from the Indian equities market has caused some concern in the key indexes, trading a few percentage points below their all-time high. “The scenario would compel liquidity tightening and rate hikes by the RBI somewhere in 2022, and its effect is already seen in the performance of the INR,” said Nish Bhatt, Founder and CEO of Millwood Kane International, an investment consultancy firm.

This quarter, global funds poured $4.6 billion into Indian stocks, the most in the region. A portion of those funds came from Reliance Industries Ltd rights offering and share sales in Kotak Mahindra Bank Ltd and Bharti Airtel Ltd. A flurry of acquisitions for Reliance’s digital unit, JIO Platforms Ltd, is expected to bring in another $15 billion in foreign direct investment.

Simultaneously, the country’s current account is expected to become positive in the June quarter, as imports have declined faster than exports. According to Barclays Plc, the surplus, which is the first since 2004, is estimated to be around 1% of GDP.

Due To Worst Performing Currency, Stocks On The Verge Of A Bear Market

The benchmark S&P BSE Sensex Index has fallen by roughly 10% from its all-time high reached in October, owing to a foreign flight from stocks. Despite this, Sensex’s one-year forward price-to-earnings ratio is at 21, compared to 12 for MSCI’s Emerging Markets Index, indicating that the shares have room to fall considerably further. This quarter, bond outflows were $587 million.

As India’s trade imbalance increased to an all-time high of roughly $23 billion in November due to more significant imports, bearish rupee calls are growing. According to Goldman Sachs, the plentiful liquidity in the banking sector, which was partly produced by the RBI’s dollar purchases, may make it harder for the central bank to act to the same amount in 2022 to prevent rupee depreciation.

Even so, the road ahead is unlikely to remain smooth until the end of the year.

The optimism fueling stock market inflows, like in other places, has yet to be backed up by significant improvements in economic indicators. And, while it builds reserves and tries to increase exports, the Reserve Bank of India is likely to keep buying dollars, reducing the currency’s rise.

“The rupee is expected to recover in the coming months,” said currency strategist Anindya Banerjee of Kotak Securities Ltd. “The rupee would have strengthened in this quarter as well if it hadn’t been for the central bank’s dollar purchases.”

Article Proof Read & Published by Gauri Malhotra