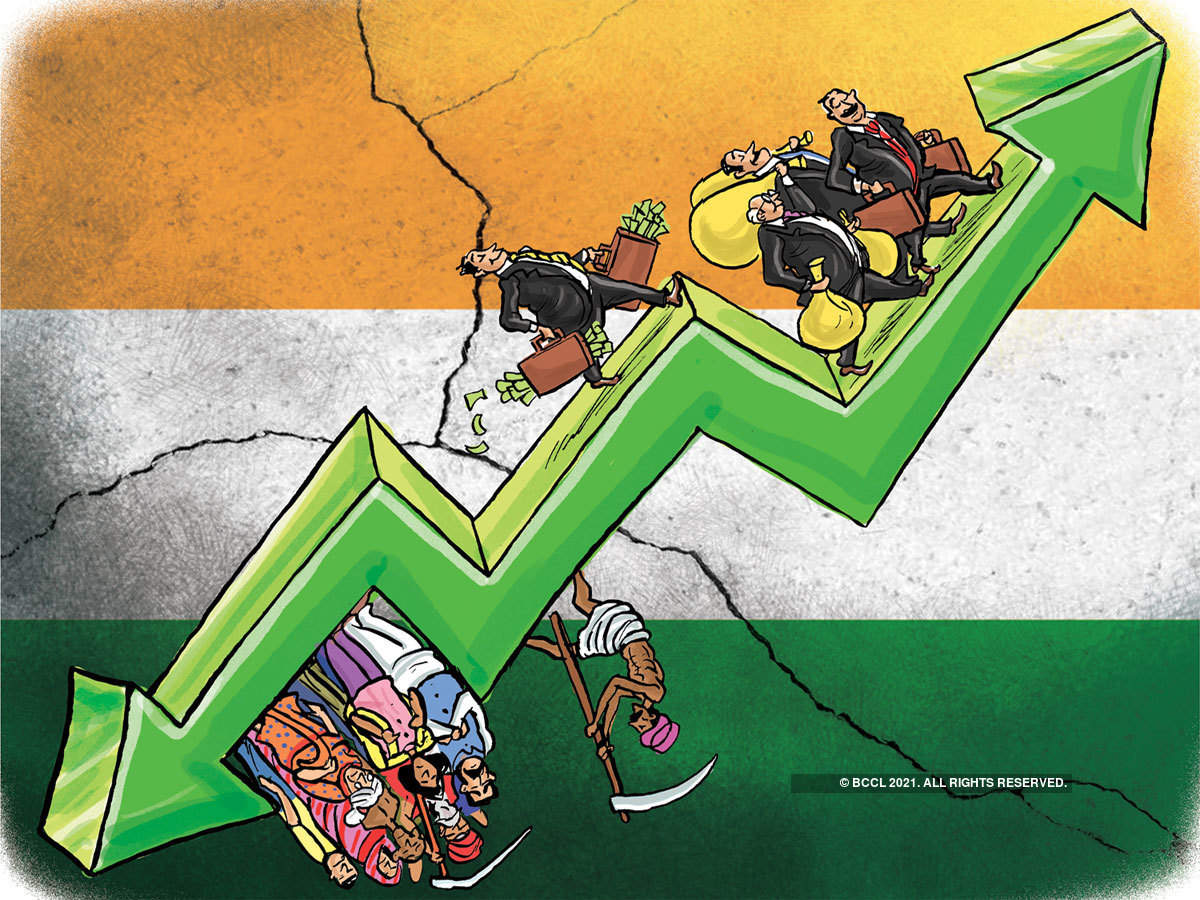

India’s economic growth: What does the change in investment grade from Baa3 to Baa2 mean for India? How far has the banking sector come?

India’s economic growth has been a conversation of concern for quite a while, and it has been a long since we heard anything good. Even though there are still a number of parameters that need working on, such as the private investment demand and domestic consumption, it cannot be denied that recovery has been underway, even if not the much-estimated V-shaped.

In a recent event, however, America’s rating agency Moody’s changed India’s economic outlook from negative to stable, bringing in sighs of relief from across the country. While analysts have been torn between the record-breaking highs of the Indian stock market as opposed to the dragging real economy, looks like there’s some assertion of balance that’s being brought after all.

It has been since affirmed by the rating agency that the country’s foreign currency and local currency to the moderate investment grade, at Baa2. This is a sign for a more stabilized economic pattern and could invite capital investments from the world if, however, other variables like the political environment stay in check.

This is especially important since the sovereign rating of the country was slashed by Moody’s from Baa2 to Baa3, the lowest investment grade in the agency’s list. This came in after Moody’s concluded that India would have a difficult time in the implementation of the policies that would be capable to reduce the low growth risk facing the economy, as well as the fiscal position that attained a deteriorating dynamic after the government’s pro-capital position.

So, what changed in the country’s position since last year? What led to an upgrade in the rating agency’s outlook?

It has been maintained by the rating agency that their anticipation of the risk that banking and non-banking financial solutions would have a faring risk hasn’t exactly played out, fortunately, for the capital cushion and greater continuum of liquidity has helped stabilize the position of these financial institutions.

Even though the RBI report of financial stability declared that the true value of transactions that turned bad would be revealed once this cushion of liquidity is taken aback, the situation seems to be fairly on track at the present moment, allowing the rating agency to undertake the declaration of the said action.

So, does this mean that the risk from the high debt burden and weak debt affordability, both at the union and domestic level, no longer remain?

Absolutely not. The risk is still very much there, the likelihood of it turning bad, however, has reduced. This means that the economy is now in a position that would allow for a gradual reduction in the high fiscal deficit over the years to come, and the financial position of the country would stabilize as to prevent the country’s sovereign profile to deteriorate any further.

Given the fact that banks have strengthened their capital position thus far post the pandemic, it can be said that the credit outlook of the country may be able to assist the country’s economy. Analysts, however, have spiked certain doubts in this matter.

It has been observed that despite low-interest rates for a long time now, credit demand remains at an all-time low, being an alarming phenomenon for the country on a larger scale. Nonetheless, we would tackle this problem as we move ahead. For now, it’s imperative to focus on the fact that bank provisioning has allowed for the gradual write-off of legacy problem assets over the past few years.

“The affirmation of Axis, ICICI, HDFC Bank and SBI’s deposit ratings and change in outlook to stable follows the change in outlook on the sovereign rating to stable,” Moody’s said in a statement. “The mail previous negative outlook on the sovereign rating drove the negative outlook on these banks, because of strong linkages to the sovereign credit profile,” mentioned the report released by Moody’s, expressing their reason for shifting the country’s sovereign position from Baa3 to Baa2.

How has India achieved this strength in the banking and financial systems?

Oh well, suffice it to say we have been at it for quite a while now. It has been observed by experts that over the last six financial years since the government became explicitly vocal about the country’s balance sheet crisis, a series of action steps have been taken to stabilize the condition of the country’s banking systems.

Since 2015, banks have been able to recover Rs 5.01 lakh crore of bad loans and write-offs. This number holds tangible significance owing to the fact that such incidents had been seen to taken place in the past few years, and recovery of a significant proportion is a sign that the banks have been able to stabilize their position from a probable financial crisis.

Note also that a few more provisions have been undertaken in and over the said period that has enabled the strengthening of the systems over the years.

These include, but are not limited to, government infusion of Rs 3.06 lakh crore in state-owned banks, reforms introduced in the system’s functioning and operational environment, debt resolution plans and schemes, and prima facie alterations in them, and recovery provisions. The five years between 2017-18 and 2021-22 have seen a lot of improvement in the financial metrics of the country’s banking system.

How about the economic growth of the country? What does Moody’s think about it?

As per the report released by Moody’s, it has been assessed that the country would record a growth rate of 9.3 per cent in the current fiscal year, following the 7.3 per cent contraction that was recorded in the last fiscal year. If that happens, the country would be able to surpass the 2019 levels and Moody’s estimates that it would be the case, basing this as their argument for the transition made for the country’s economic outlook from negative to stable.

As for the gross domestic product, the rating agency also has shown a little concern about the parameter, expecting a 6 per cent real GDP growth in the medium run. However, analysts believe that this estimate is undervalued and does not take into account the recovering parameters, which may lead to better growth in the real product numbers.

Are there enough levers for better growth in the real GDP? Maybe. But would that be experienced in the short run? Well, we believe not, because there’s a lot of parameters that would take time to pick pace at the moment.

How would this upgrade impact the economy?

Since overseas borrowing costs are tied to a country’s rating and the agencies’ outlook on the nation, an upgrade usually helps in lowering borrowing costs for the government as well as the corporate sector. With chances of default receding and improvement in overall debt serviceability, foreign investors take comfort in subscribing to government and corporate bonds at lower rates.

Edited by Sanjana Simlai.