RBI believes the economy is losing speed, and high frequency indicators imply a lack of momentum.

The RBI believes the economy is losing speed, and high-frequency indicators imply a lack of momentum.

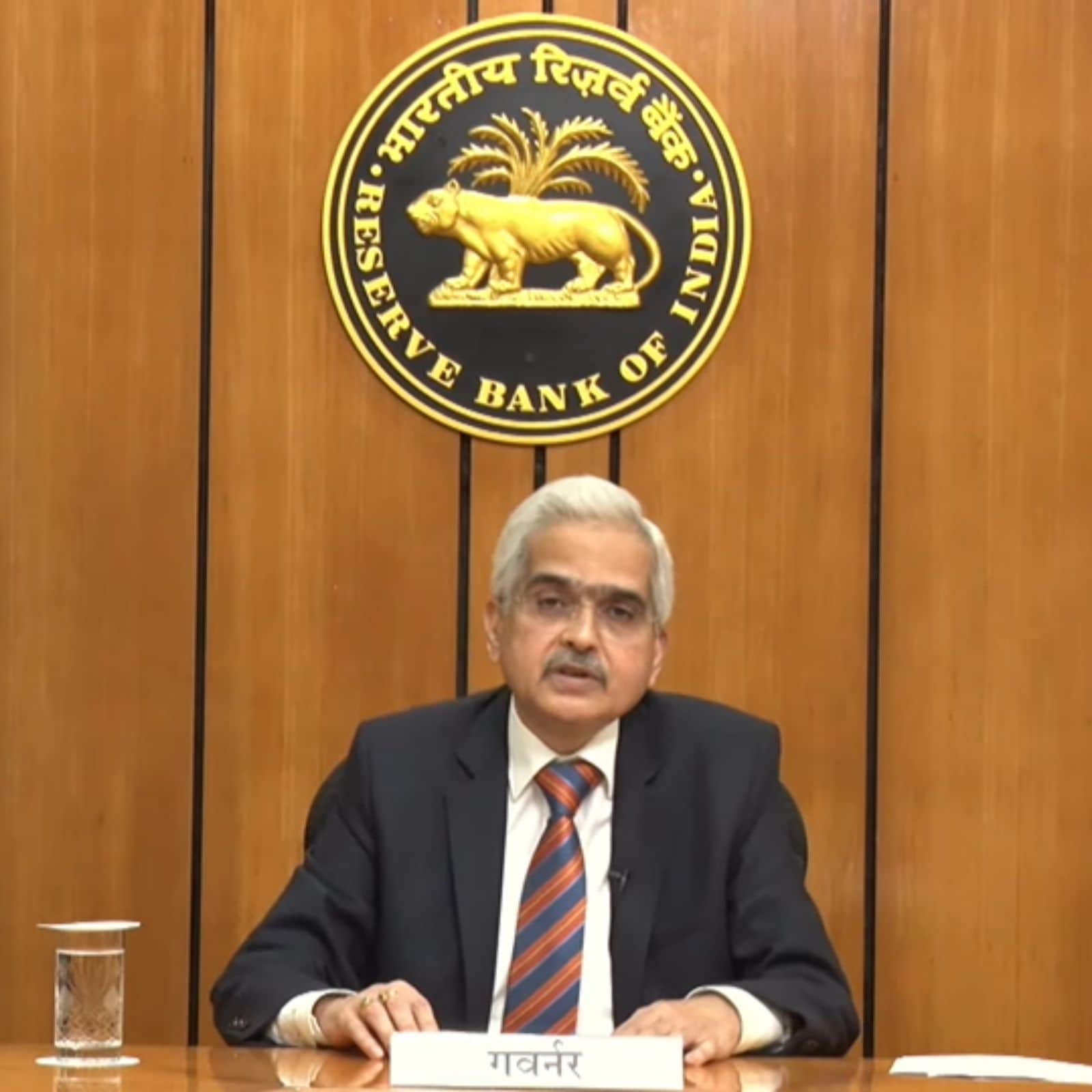

The Reserve Bank of India (RBI) voiced worry on Friday that the economy may be losing speed, pointing out that high-frequency indicators are beginning to show signs of a slowdown. Furthermore, the central bank said that elevated global prices for crude oil, metals, and fertilizers have already influenced trade terms, resulting in larger trade and current account deficits.

In a recent statement, the RBI stated that the immediate impact of geopolitical repercussions is on domestic inflation, with nearly three-fourths of the consumer price index at risk. The rise in international crude, metal, and fertilizer prices has resulted in a trade shock that has increased trade and current account imbalances.

High-frequency indications already hint at a slowing of the recovery that has been gaining steam since the second quarter of 2021-22, with 86.8 percent of the adult population completely vaccinated and 3.5% having received booster doses.

Furthermore, consistent governmental assistance provided a foundation for aggregate demand and economic activity. While fiscal policy focused on easing the sufferings and loss of livelihood caused by the epidemic, reprioritizing fiscal expenditure provided a boost to GDP.

In 2022, the global restoration is expected to stall significantly. The RBI specifically stated that the increase in foreign trade volumes is expected to slow by half from 10.1 percent in 2021, owing to a slowing in goods trade, while providers are expected to remain modest and slow even more in 2023.

The research stated that “coverage trade-offs have become increasingly sophisticated in the future, and tail risks, such as stagflation, loom large in several countries.”

The RBI stated that persistently high inflation was forcing central banks to resort to counter-cyclical monetary policy actions when the priority should have been given to assisting the financial recovery.

While the NSO forecasted 8.9 percent growth in 2021-22, the central bank stated that personal final consumption expenditure (PFCE) and gross fixed capital formation (GFCF) are still in the process, having barely exceeded pre-pandemic levels.

The risks to the global economy in 2022 are high, and there is a possibility of a recession, according to the central bank. The IMF reduced international progress for the year to 3.6% in its April 2022 WEO, down from 6.1 percent in 2021.

Recognizing the effects of geopolitical spillovers, the financial coverage committee lowered its projection for actual GDP growth in 2022–23 to 7.2 percent in April, a 60 basis point decrease from its pre-war projection, due to higher oil prices weighing on non-public consumption and higher imports lowering net exports. Inflation was anticipated to be 5.7 percent, according to 120 fundamental elements.

The advanced economies’ expansion may slow to 3.3% from 5.2 percent a year ago, while the EMDEs’ (rising markets and developing economies’) expansion may slow to 3.8% from 6.8 percent.

The central bank also highlighted upside risks to inflation in India if crude oil prices remain over $100 per barrel, as second-round effects on manufacturing and services costs re-ignite.

The RBI drew notice of the IMF’s downbeat estimate for the global economy in its annual report for 2021–22, which was issued on Friday.

According to the RBI, both groups of countries are expected to see inflation rise by 2.6 and 2.8 percentage points, respectively. As of now in 2022 (as of May 24), more than 40 central banks in AEs and emerging market economies have raised policy rates of interest and/or reduced liquidity.

In 2022, the global recovery is likely to lose substantial traction. The RBI specifically stated that global trade volume growth is likely to be half of what it was in 2021, owing mostly to a slowing in merchandise trade, while services are expected to remain modest and decline even more in 2023.

Policy trade-offs will become more complicated in the future, and tail risks, such as stagflation, will loom large in some nations.

The central bank also warned of the risks to Indian inflation if crude oil prices remain above $100 per barrel, as second-round effects on manufacturing and service prices re-ignite.

The RBI emphasized that persistently rising inflation was forcing central banks to use countervailing monetary policy when the priority should have been given to assisting the economic recovery.

While the NSO forecasted 8.9 percent growth in 2021-22, the central bank emphasized that private final consumption expenditure (PFCE) and gross fixed capital formation (GFCF) are still in the works, having only just surpassed pre-pandemic levels.

The risks to the world economy in 2022 are significant, and there is potential for a downturn, according to the central bank. In its April 2022 World Economic Outlook, the IMF reduced global growth for the year to 3.6 percent, down from 6.2 percent in 2021.

Growth in advanced economies is expected to fall to 3.3 percent from 5.2 percent last year, while growth in emerging markets and developing economies (EMDEs) is expected to fall to 3.8 percent from 6.8 percent.

According to the RBI, both categories of nations are likely to see increased inflation by 2.6 and 2.8 percentage points, respectively. More than 40 central banks from AEs and emerging market nations have raised policy interest rates and/or reduced liquidity so far in 2022 (as of May 24).

Recognizing the effects of geopolitical spillovers, the monetary policy committee lowered its projection for 2022–23 real GDP growth to 7.2 percent in April, a 60 basis point decrease from its pre-war projection, due to higher oil prices weighing on private consumption and higher imports reducing net exports. Inflation was expected to rise by 120 basis points to 5.7%.