After releasing *40,000 crores on October 7, another instalment was released three weeks later. July 15 was the date of the first instalment of 75,000 crores GST compensation released by the Finance Ministry.

On Thursday, the finance ministry announced *44,000 crores in back-to-back loans to states – the final instalment of the estimated shortfall of GST(Goods and Service Tax) revenue for 2021-22 of *1,59 lakh crore.

To boost growth and front-load public expenditure, the Union Finance Ministry on Thursday released *44,000 crores of back-to-back loans to states – the final instalment of the estimated shortfall of GST (Goods and Services Tax) revenue for 2021-22.

As of October 7, the Centre released 40,000 crores in the third instalment.

According to an official statement, the finance ministry released the first tranche of 75,000 crores on July 15.

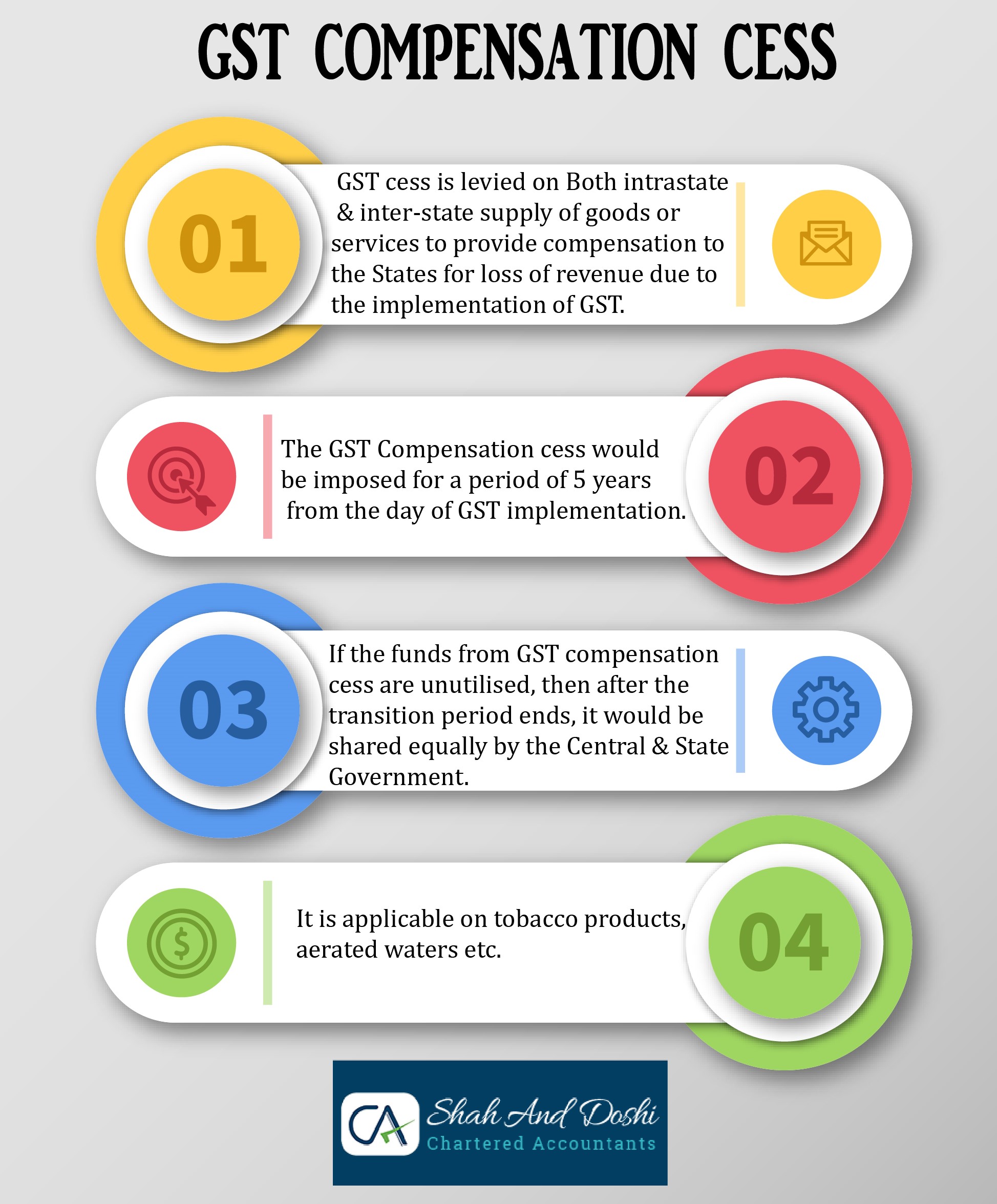

The GST collection figures fell sharply due to the impact of the Covid-19 pandemic and the 68-day nationwide lockdown that began March 25 last year. To compensate for the loss of revenue to the states, the union government devised back-to-back borrowing mechanisms.

Last year, all states agreed to a borrowing mechanism proposed by the Centre and facilitated by the Reserve Bank of India through a separate window. The principal and interest are repaid from the GST compensation cess fund, and the money is borrowed collectively on behalf of states.

On May 28, the 43rd meeting of the GST Council approved a borrowing plan of *1,59 lakh crore to cover states’ revenue shortfalls in 2020-21 and *1,10 lakh crore for 2020-21.

Moreover, the compensation [of 44,000 crores] will be paid at regular intervals out of actual cess collections, as per the statement.

In July 2017, when GST was introduced, it promised states an increase in revenue of 14% over five years (until 2022) if they collected compensation cess on luxury goods and sin products like liquor, cigarettes, distilled water, automobiles, coal, and tobacco.

This amount of *1.59 lakh crore is not included in compensation for the year 2021-2022, but it will be added to the over *1 lakh crore in compensation for states/UTs with this legislation fiscal year. According to the statement, GST compensation in FY 2021-22 is expected to be greater than 2.59 lakh crores.

GST shortfall

To cover the GST shortfall, the Centre approved a loan of Rs 44,000 crore to the states for the balance of Rs 1.59 lakh crore in this fiscal year. Additionally, they are released as back-to-back loans on top of the bi-monthly GST compensation paid out of cess collections.

In the 43rd GST Council meeting held on May 28, 2021, it was decided that the Centre would borrow Rs 1.59 lakh crore in 2021-22 and distribute it to states and UTs back-to-back to balance the resource gap where GST compensation has not been adequate.

The amount is similar to that released to states in the past fiscal year 2020-21, which was Rs 1.10 lakh crore. Today, the Ministry of Finance said that states and UTs could use the back-to-back loan facility instead of GST compensation, releasing Rs 44,000 crore.

Earlier this year, the ministry released Rs 75,000 crore to the states on July 15 and Rs 40,000 crore on October 7. The statement added that a total of Rs 1.59 lakh crore has now been released as back-to-back GST compensation loans across the board in the current fiscal year.

Additionally, the legislature is estimated to release over Rs 1 lakh crore to states and union territories as compensation this year (based on cess collections).

The ministry said that GST compensation is expected to exceed Rs 2.59 lakh crore in FY 2021-22.

All states and UTs have a vital role in addressing and managing the Covid-19 pandemic and stepping up capital expenditure. Ministry of Finance front-loaded the release of assistance under the back-to-back loan facility of *1,59,000 crore during FY 2021-22 to assist states and UTs,” the statement said.

The *44,000 crores being released is funded by borrowings of the union government secured by five-year securities issued in the current financial year, with an average yield of 5.69%. The central government will not be borrowing additional market funds due to this release, it said.

As part of this release, states are expected to plan public expenditures for improving health infrastructure and taking up infrastructure projects, among other things, according to the report.

edited and proofread by nikita sharma