On November 8, 2016, the government demonetized high-denomination currency notes, creating a nightmare for citizens. Many people lined up outside the banks and ATMs to get new currency notes to continue living. As a result of this situation, old notes could not be deposited after December 30, 2016. The economy suffered greatly. Despite thinking it was a brilliant move, the ruling party managed to mess it up.

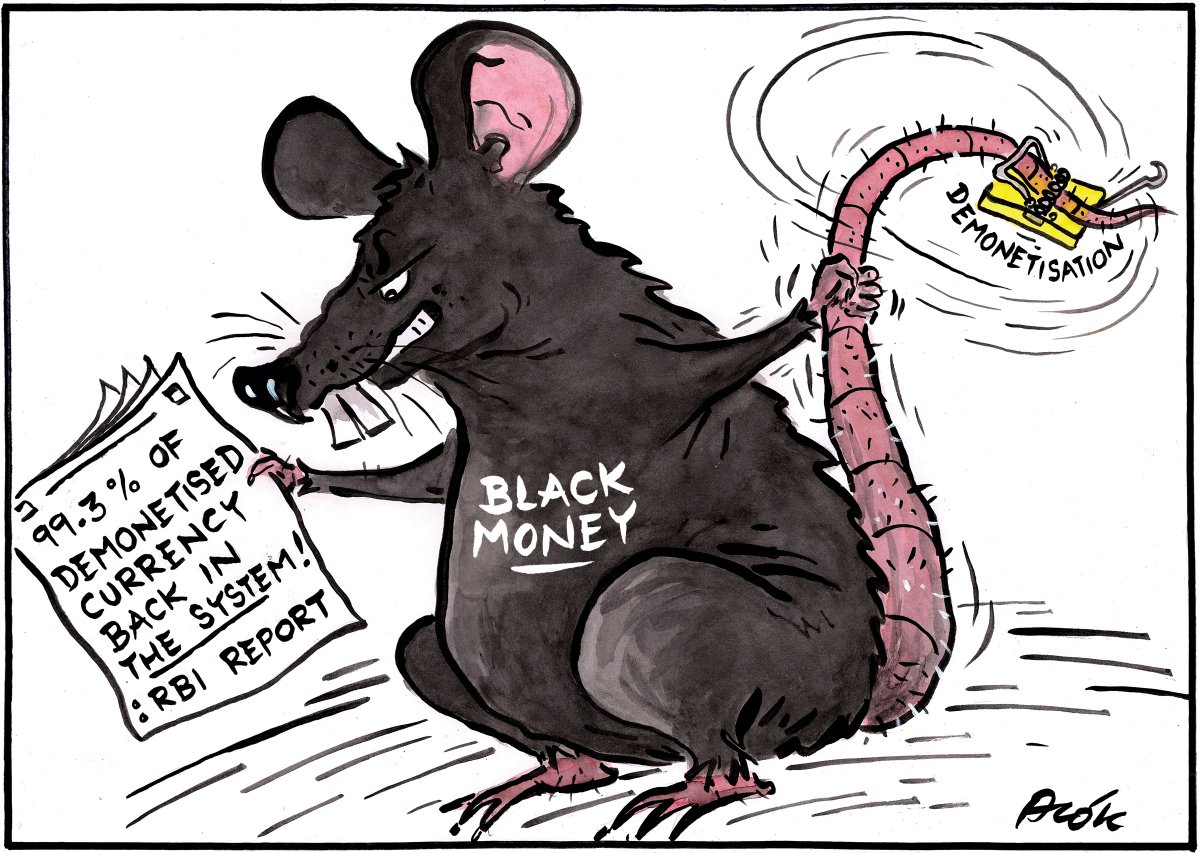

Black means cash, hence the sudden demonetization. The money that is held in black markets would most likely be in high-denomination currency notes. The rich’s black money would become meaningless if high-denomination notices were suddenly declared illegal.

Approximately Rs 18 lakh crore was in circulation just before demonetization was announced, and 85% of the money was in the form of extensive denomination currency notes of 1,000 and 500 rupees. Denotified letters only are used to buy petrol, fuel, food, and medicines after demonetization, and trade and manufacturing were not permitted.

Demonetization: was it a good idea but poorly executed?

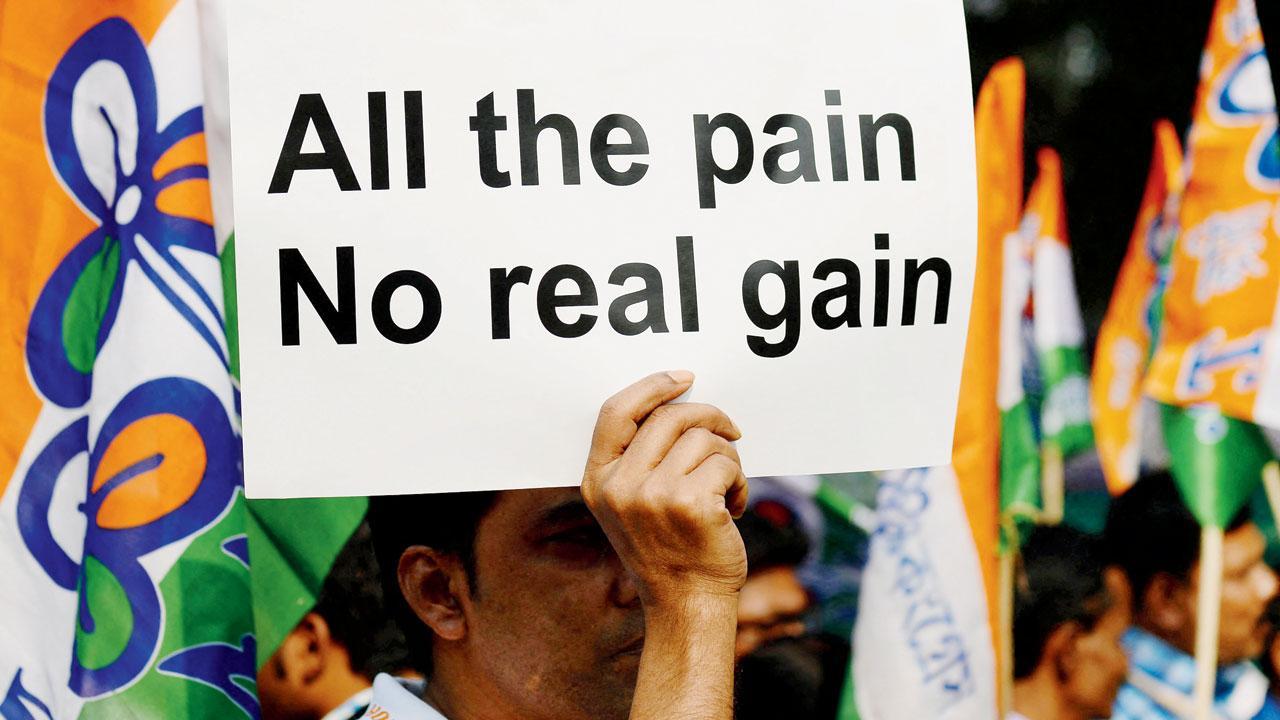

Demonetisation wasn’t a good idea, and it was poorly executed – it was a ridiculous idea from the beginning.

It’s a belief I’ve heard from both regime supporters and friends who otherwise have a negative view of the regime. On November 8, 2016, the government said it aimed to punish black money and corruption in India by denotifying high-value currency notes within a four-hour deadline. Narendra Modi, after all, had been elected on the very basis of this promise.

The fact that the people who suffered the worst effects of this move nevertheless re-elected the government in 2019 is somewhat perplexing, considering the well-documented economic consequences of this decision. I believe this occurred because most of the electorate thought that this decision had noble intentions. As a result of a very individual state of misery, the government created a compelling political narrative.

The demonetization announcement came as a surprise.

An announcement was made at 8 pm, and the decision became effective at midnight. Policymakers believed surprise and secrecy were necessary to stop black-money hoarders from getting rid of their illegal funds during the next four hours. Nevertheless, people snapped up jewellery and property. A certain amount of black money was converted into assets that were subsequently monetized.

A fatal flaw in the policy is the misconception that black money is merely cash. Income is not the same as wealth, and economic activity generates black income. An example would be a doctor seeing 50 patients and declaring their revenue by 30, and the remaining 30 is black income. Businesses routinely practice under-invoicing. Throughout one’s life, one’s wealth accumulates as a result of this black income.

Undervalued inventory or foreign tax haven balances are among the various ways wealth is held. There is an expectation of a return, and 1% of the black wealth would be in cash, for which no return is offered. Demonetisation would have removed 1% of black wealth if it had been able to demobilize black money. However, mis-invoicing would continue to generate black incomes.

Due to widespread corruption, it was relatively easy to convert old currency into new notes. Several bankers were caught helping wealthy clients convert old currency into new messages. The fee was 30%, and this resulted in a new black income. The poor were used as cash mules, leading to a sudden surge in deposits in Jan Dhan accounts. Business people showed cash in hand to exchange the old currency for the new currency. Various methods were used to convert the currencies. Black money became easier to hold after the introduction of new Rs 2,000 currency notes.

This author estimated in June 2017 that 99% of these notes had been returned to banks by January 10, 2017, and the RBI confirmed this estimate. In cooperative banks or abroad, was the balance 1% of the currency? Or did the old currency all get converted into new cash?

Demonetization’s shifting goals

As part of their campaign promises, the ruling party promised to a) eradicate black money and b) bring back the overseas hoards. Its election campaign said that bringing back black money from abroad could give each Indian family Rs 15 lakh. It turned out that the promise was a “jumla.” The government nor the government officials knew where and how much ill-gotten money was abroad.

Various arguments have been advanced to support demonetization. The following claims are by no means exhaustive, but they may be considered a broad summary of the concerns.

Claim 1. Black money is cash

It is incorrect to think of the black economy this way. Demonetisation is predicated on this assumption, but unfortunately, this is the main weakness in the policy. In a nutshell, the black economy refers to the transactions that take place in an economy without being taxed. It follows that a currency note per se cannot be considered black or white.

Fruit and vegetable sellers in the streets, labourers visiting a construction site or the kabadi wala (sanitation worker) dealing only in cash do not constitute illegal or black market transactions. Even if they sold in cheques or other non-cash alternatives, their income levels and the industries they work in would have kept them out of the income tax net. Black money is not cash.

Even if all that cash is legal, it doesn’t necessarily mean that it’s legitimate. It isn’t always ok to use cash. When, for instance, one buys commodities with cash and then doesn’t receive receipts, or when one pays proportionately for real estate in black and white, that is indeed black money. The reason is not just that the transaction happens in cash but also that it escapes taxation. Black money does not need to be provided in cash in order to be present.

As a result, a move that criminalizes all cash will invariably have a negative impact on those who legitimately depend on the cash economy, like those in the organized sector or daily wagerers. Our population is dominated by them by sheer numbers.

Claim 2. By properly implementing the idea, the black economy would have been eliminated.

The last line of defence, which is perhaps the most problematic, is questionable. Assume that the illegal cash was never reimbursed by the government. Could the black economy have been eradicated? In short, no. In economics, this is referred to as conflating stocks with flows.

A simple analogy is that if water is leaking from tank 1 (white economy) and flowing into tank 2 (black economy), destroying tank two will not stop water leaks, thereby eliminating the black economy. That’s why businesses are still conducted in cash without receipts, or properties are still sold in black and white despite demonetization.

Even when implemented without any loopholes, such experiments are at best a one-time interruption to the black money held in the system as cash, which will resume once the new currency has been introduced.

According to some, a step taken in surprise may discourage people from engaging in illicit transactions in the future. Even if we were to agree to this for argument’s sake, it would require periodic (and every time on a stealthy basis) demonetizations. Multiple bouts of demonetization may be unprofitable even for people who support demonetization.

In addition, the process of exchanging currencies involved black marketing since touts charged hefty commissions for exchanging old and new money. The very act it was supposed to discourage was encouraged by demonetization.

Tax perception needs to change to stop illegal cash transactions (and possibly other tax evasion methods). By encouraging the view that taxpayers’ money is being wasted – for example, by funding universities such as Jawaharlal Nehru University that are deemed anti-national – the government promotes evaders to now justify it as nationalist or even patriotic.

By concentrating on criminalizing opposition voices instead of justifying the need to pay taxes to ensure some degree of equality in a world of extreme inequality or to make sure taxpayers have access to public resources, the government could do the cause much good.

Lastly, I would like to raise the question of why the government did not hold the government accountable for demonetization if it was a terrible idea and it affected the lives of the poorest in our country? Possibly Indians have endorsed the move to curb corruption because it is intended to curb corruption.

Corruption exposes inequality in its most naked form, which is why it matters to the people. As the poor struggle to meet their basic needs, the ruling elite steal their resources to enrich themselves. The move was seen as an attack on unfairness in instances like these when it appears the system is unfair.

Claim 3. Most black money is in cash, even if not all cash is black

Black money, though illegal, constitutes only a tiny part of the black economy. At any time, a large volume of black money is hidden abroad (because, by definition, it isn’t reported). Examples include Swiss bank accounts or investments in fictitious shell companies abroad were low or nonexistent tax rates. They are not affected by the demonetization of the currency back home because they are held in non-cash forms.

Foreign direct investment often provides tax rebates on such black money, which escaped the tax net. Demonetisation will do very little to curb the black economy if a significant majority is in the form of such round-tripping or wealth held in Swiss accounts.

Impact of demonetization on the economy

The economy relies on cash for all its nutrients, like blood. Transactions enable incomes to be generated through cash circulation. 85% of the blood will be removed from the body in a week, and 5% will be replaced. The economy collapsed when 85% of the currency was taken out and replaced little by little over a year. The damage would have been reversed if the currency had been restored within a few days.

94% of India’s workforce is employed in the unorganized sector, and this sector is composed of micro and small businesses which do not use formal banking methods. Despite income losses in the organized sector, the unorganized industry couldn’t cope without cash.

Although official statistics showed that 2016-’17 was the best year for growth for the decade, the year of demonetization, there is no data on the unorganized sector; the GDP data uses the organized sector as a proxy. When the latter was declining, and the former was growing, that may have been accurate, but it was problematic when the latter refused. In the case of alternative data, the economy would have been in recession.

Demonetisation has long-term consequences that go beyond the short term. Unemployment is increasing, and inequalities are increasing, resulting in a decline in demand. Already before the Covid-19 pandemic hit in 2020, this had caused an economic slowdown.

Despite shifting goalposts, demonetization was an ill-advised step that failed to accomplish any of its goals. Specifically, it hurt the unorganized sector of the economy. In the subsequent elections, the ruling party did not highlight this achievement as an achievement.

With the monetization of government debt, the country experienced a policy-induced crisis that adversely affected the marginalized sectors of society, including farmers, labourers, and women.

Conclusion of demonetization

Narendra Modi deemed the high-denomination notes (Rs 500 and Rs 1,000) then in circulation as non-legal tender on November 8, 2018.

Let’s discuss the objectives of demonetization before we discuss its effects, whether they are positive or negative

- Demonetization aims at curtailing the shadow economy and terrorism funded by counterfeiting.

- Secondly, the Indian economy must be digitalized.

Did the objective get accomplished?

Demonetization has not achieved its stated purpose of “extinguishing” black money to the extent that almost 90 per cent of the total cash in circulation has been returned to the banks, but that is just one aspect of it.

Let’s examine the economic effects of demonetization in India:

Positives

- By eliminating black money from the economy, this money can be used to develop the economy to a reasonable extent

- The Indian economy becomes more trustworthy with increased transparency. The result is an influx of foreign investment.

- Economic growth was boosted by demonetization, which encouraged cashless transactions.

Negative

- Before demonetization, GDP growth was estimated at 7.8%. The estimate has been reduced to 7.1% following demonetization.

- Demonetization has the most devastating effect on agriculture, small and medium-sized businesses, and the informal sector.

As a result of demonetization, black money is not eliminated, nor is black income stopped.