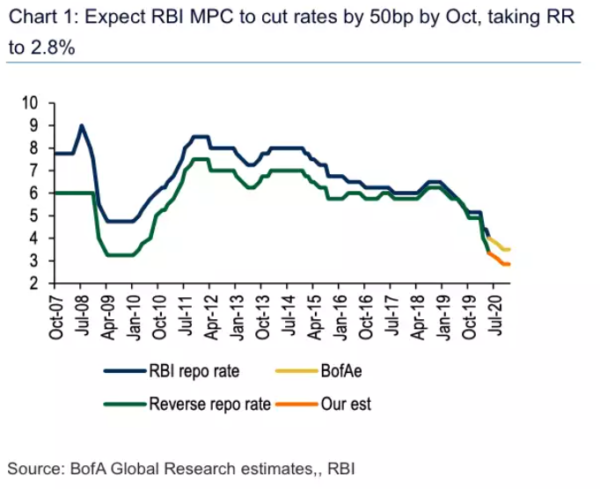

The RBI sustains the repo rate at 4% for the ninth day in a row.

What is a reverse repo rate, and how does it work?

Reserve Bank of India borrows money from banks at the Reverse Repo Rate for a short time. The RBI uses it as a key monetary policy instrument to keep the economy liquid and keep inflation under control. The Reverse Repo Rate assists the RBI in obtaining funds from banks when required. In exchange, the RBI provides them with lucrative interest rates.

Banks also voluntarily park extra funds with the central bank because it allows them to receive a greater interest rate on their excess funds. The Monetary Policy Committee (MPC), chaired by the RBI Governor, determines the Reverse Repo Rate. The decision is made at the Committee’s bi-monthly meeting.

Depending on macroeconomic circumstances, the central bank raises or lowers the reverse repo rate. An increase in the Reverse Repo Rate encourages banks to deposit their excess cash with the central bank for a short period, reducing liquidity in the banking system and the overall economy.

In other words, the RBI receives surplus money from banks overnight in exchange for government securities as security.

Banks earn less on excess money deposited with the Reserve Bank of India whenever the RBI lowers the reverse repo rate. As an outcome, banks are more likely to invest in more lucrative avenues, such as money markets, hence improving overall liquidity in the economy.

While this may result in reduced loan interest rates for bank clients, the choice will be based on several factors, including the bank’s internal liquidity status and the availability of other possibly less risky and similarly rewarding investment possibilities.

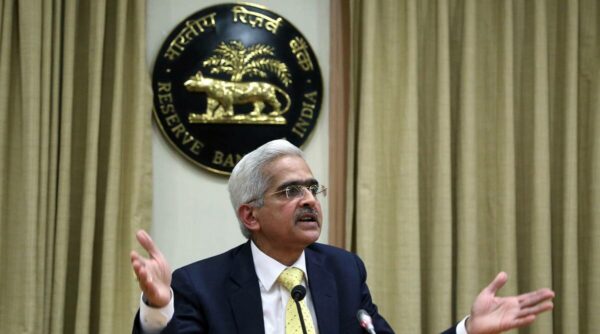

On Wednesday, Governor Shaktikanta Das of the Reserve Bank of India (RBI) announced that the six-member Monetary Benchmark Committee (MPC) had unanimously opted to hold the policy repo rate at 4%. The rate has remained stable for the ninth time in a row.

In India, the Monetary Policy Committee is in charge of setting the benchmark interest rate. The Monetary Policy Committee meets at least six times a year (notably, once BIMONTHLY), and its decisions are published following each meeting.

The committee consists of three Reserve Bank of India staff and three external members appointed by the Indian government. For “utmost confidentiality,” they must maintain a “quiet period” of seven days before and after the rate determination.

The committee is chaired ex officio by the Governor of the Reserve Bank of India, and a majority vote is required, with the Governor having the casting vote in the event of a tie. The committee’s current mandate is to keep annual inflation at 4% through March 31, 2021, with a maximum tolerance of 6% and a minimum tolerance of 2%.

The Reserve Bank of India Act, 1934 was revised by the Finance Act (India), 2016, to create the Monetary Policy Committee (MPC), which will bring more openness and accountability to determining India’s monetary policy.

After each meeting, the monetary policy is published, with each member explaining their position. If inflation exceeds the allowed range for three consecutive quarters, the committee must report to the Indian government.

After the MPC meeting, RBI Governor Shaktikanta Das announced the reverse repo rate would stand at 3.35 per cent. The committee decided 5:1 to retain an “accommodative” posture to restart and sustain long-term growth.

The MPC has kept the marginal standing facility (MSF) rate and the bank rate unchanged at 4.25 per cent.

Meanwhile, it was determined by a five-to-one margin to keep the accommodative policy stance “to revive and sustain growth on a long-term basis.”

The RBI Monetary Policy Committee kept key interest rates unchanged on Wednesday, despite the new coronavirus strain Omicron adding to economic uncertainty. Over two dozen Omicron cases have been documented in India thus far. As a result, numerous states have had to adopt new travel restrictions. The Omicron rise has sparked fears that the third wave of Covid-19 would hit the country.

RBI Governor Shaktikanta Das stated that the MPC unanimously agreed to keep rates unchanged and maintain an accommodative approach as long as it is essential to promote growth while keeping inflation under control.

“The MPC kept the policy rates and stance unchanged, as expected. The rhetoric has also remained focused on sustaining growth as long as inflation is kept under control.

We expect the RBI to fine-tune the surplus liquidity in order to manage rates and, as a result, provide guidance on the operating target rate moving closer to the Repo rate. In February, we maintain our base case of a reverse repo rate hike “Senior Economist at Kotak Mahindra Bank Upasna Bhardwaj commented.

On May 22, 2020, during an off-policy cycle, the policy rate was last modified to encourage demand by lowering interest rates to a historic low.

The government has given the RBI to ensure that retail inflation based on the Consumer Price Index (CPI) stays at 4% with a 2% buffer on each side.

The Real GDP growth is expected to be 9.5 per cent in 2021-22, with 6.6 per cent in Q3 and 6 per cent in Q4, according to RBI Governor Shaktikanta Das. He stated that real GDP growth for the first quarter of 2022-23 is 17.2%, with 7.8% for the second quarter.

REGARDING INFLATION

“The persistence of CPI inflation excluding food and fuel after June 2020 is an area of policy concern in light of input cost pressures that could quickly be communicated to retail inflation as demand improves,” RBI Governor Shaktikanta Das said.

He continued, “In the short run, price pressures may prevail. In light of the optimistic hopes for Rabi crops, vegetable prices are projected to witness a seasonal adjustment with winter arrivals.”

REGARDING FUEL PRICES

Shaktikanta Das commented on the recent drop in gasoline and diesel taxes, saying, “By raising purchasing power, this should help to support consumption demand. Government consumption has increased since August, helping to support aggregate demand.”

“A softening of crude oil prices in November would reduce the build-up of domestic cost pressures,” he continued.

EDITED AND PROOFREAD BY NIKITA SHARMA