Bajaj Finserv’s Success Story: Driving Financial Dreams Since 2007

In today’s fast-paced and dynamic world, access to reliable and comprehensive financial services is crucial for individuals and businesses alike. Recognizing this need, Bajaj Finserv has emerged as a prominent player in the financial services industry, providing a wide range of solutions to meet the diverse needs of its customers. With a strong foundation and a customer-centric approach, Bajaj Finserv has earned a reputation for empowering individuals and businesses with the tools and resources to achieve their financial goals.

Established in 2007, Bajaj Finserv has its roots in the Bajaj Group, a renowned Indian conglomerate. The company was founded by Shri Jamnalal Bajaj, an eminent industrialist and philanthropist, in the year 2007.

Initially known as Bajaj Auto Finance Limited, the company focused primarily on providing financial solutions related to automobile purchases. Understanding the aspirations of individuals to own vehicles and the economic challenges that often accompany such dreams, Bajaj Finserv aimed to make vehicle ownership accessible to a broader audience. By offering affordable financing options for two-wheelers, three-wheelers, and other automobile segments, Bajaj Finserv played a significant role in fulfilling the dreams of many.

The journey of Bajaj Finserv was not without its challenges. Like any new venture, the company encountered initial hindrances and problems. Establishing a robust distribution network to reach customers across India was one of the primary challenges. Additionally, navigating the complex regulatory landscape and building trust among customers who were wary of financial transactions were hurdles that the company had to overcome. However, with a strategic approach, dedication, and a focus on customer satisfaction, Bajaj Finserv successfully addressed these challenges and steadily gained a strong foothold in the market.

Today, Bajaj Finserv is recognized as one of the leading financial services companies in India. Under the leadership of Sanjiv Bajaj, the company has expanded its product portfolio and diversified its offerings to cater to a broader range of financial needs. The current suite of products and services includes personal loans, home loans, business loans, insurance products, investments, and EMI cards. By providing comprehensive financial solutions, Bajaj Finserv empowers individuals and businesses to achieve their aspirations and navigate the complex financial landscape with confidence.

Moreover, Bajaj Finserv’s commitment to innovation and technological advancements has played a crucial role in its success. The company has embraced digital transformation, introducing digital lending platforms and mobile applications that make financial transactions seamless and convenient for customers. Through these digital initiatives, Bajaj Finserv has not only enhanced accessibility but also improved customer experiences, simplifying processes and reducing turnaround times.

In line with its vision to empower individuals and businesses beyond borders, Bajaj Finserv has also expanded its footprint. While it has established a strong network of branches and touchpoints across India, the company has ventured into select international markets, extending its financial services to customers abroad.

As a leading player in the financial services sector, Bajaj Finserv operates based on key performance indicators (KPIs) that reflect its financial health, operational efficiency, and overall performance. These KPIs include metrics such as customer acquisition, loan disbursement, revenue growth, asset quality, and market share. By consistently monitoring and optimizing these indicators, Bajaj Finserv strives to stay ahead in a competitive industry and continue delivering value to its stakeholders.

-

Foundation and Founders

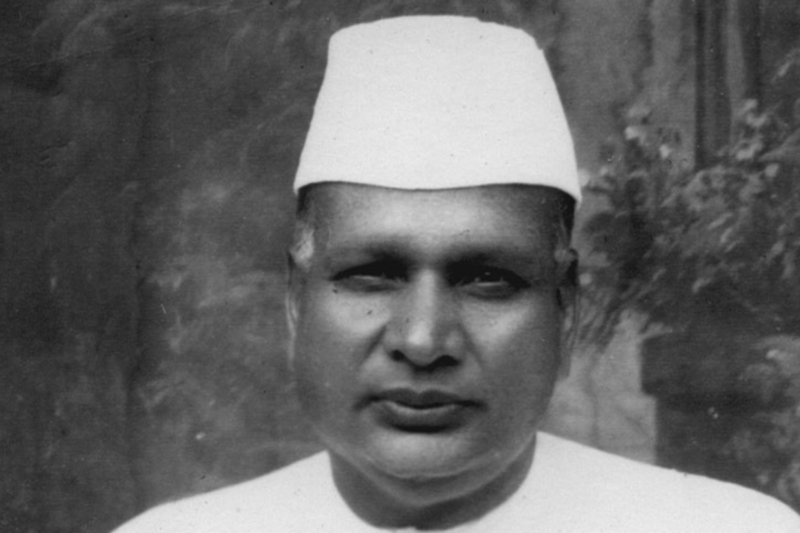

Bajaj Finserv was founded by Shri Jamnalal Bajaj, an eminent industrialist and philanthropist, in the year 2007. However, the legacy of the Bajaj family and its association with the business world dates back much earlier. Shri Jamnalal Bajaj, born in 1889, played a significant role in shaping the Bajaj Group and establishing its prominence in various industries.

Shri Jamnalal Bajaj was a visionary leader who believed in the principles of integrity, dedication, and social responsibility. He not only contributed to the growth of the Bajaj Group but also actively participated in the Indian independence movement, following the footsteps of Mahatma Gandhi. His dedication to social causes and commitment to nation-building earned him immense respect and admiration.

The journey of Bajaj Finserv can be traced back to its parent company, Bajaj Auto Limited, founded by Shri Jamnalal Bajaj’s grandson, Jamnalal Bajaj, in 1945. Bajaj Auto Limited became a leading player in the automobile industry, and its success paved the way for establishing Bajaj Finserv as a separate entity focused on providing financial services.

Shri Jamnalal Bajaj’s vision and values continue to guide the Bajaj Group and its subsidiaries, including Bajaj Finserv. His principles of ethical business practices, customer-centricity, and social welfare form the foundation of the company’s operations and its commitment to delivering financial solutions that empower individuals and businesses.

2. Initial Name and Products/Services

Bajaj Finserv, initially known as Bajaj Auto Finance Limited (after demerger), began its journey with a strong association with the Bajaj Group, a renowned Indian conglomerate. The company initially focused on providing financial services related to automobile purchases. It aimed to address customers’ financial needs looking to buy Bajaj vehicles, including two-wheelers, three-wheelers, and other automobile segments.

The objective behind starting this business was to bridge the gap between customers’ aspirations to own vehicles and the financial resources required for the same. Bajaj Finserv recognized the need to make vehicle ownership more accessible by offering affordable financing options to a wider audience. By providing financing solutions tailored to the automotive sector, Bajaj Finserv aimed to empower individuals to realize their dreams of owning a vehicle.

The company’s initial products and services revolved around financing options for Bajaj vehicles, allowing customers to purchase their preferred models through flexible payment plans. By leveraging its strong ties, Bajaj Finserv had with Bajaj Auto aimed to enhance the overall customer experience by offering competitive interest rates, simplified loan processing, and convenient repayment options.

3. Initial Hindrances and Problems

During its early stages, Bajaj Finserv encountered several hindrances and problems that required strategic planning and perseverance to overcome. One of the primary challenges was establishing a robust distribution network to reach customers across India. The vast geographical expanse and diverse customer base posed logistical difficulties in terms of earning potential borrowers and providing them with financial solutions.

Additionally, Bajaj Finserv had to navigate regulatory requirements and build trust among customers who were initially cautious about financial transactions. Convincing customers to avail of financial services and overcoming skepticism towards borrowing money were significant hurdles. The company invested substantial efforts in educating customers about the benefits and transparency of its offerings, earning their confidence over time.

Moreover, the company faced competition from established financial institutions, requiring Bajaj Finserv to differentiate itself and demonstrate its value proposition. Building brand recognition and establishing credibility in a competitive market were key challenges in the initial years.

Despite these hindrances, Bajaj Finserv’s commitment to innovation, customer-centric approach, and strategic expansion allowed the company to overcome these obstacles and emerge as a trusted and leading financial services provider in India.

4. Current Ownership and Name

Bajaj Finserv, a prominent financial services company, is currently owned and operated by the Bajaj Group, a renowned Indian conglomerate. Sanjiv Bajaj, a respected business leader, serves as the Chairman and Managing Director of Bajaj Finserv. Sanjiv Bajaj, a member of the Bajaj family, has played a crucial role in shaping the company’s growth and success.

Under Sanjiv Bajaj’s leadership, Bajaj Finserv has expanded its product portfolio, diversified its offerings, and strengthened its market presence. With his strategic vision and focus on innovation, Bajaj Finserv has continued to evolve and adapt to the changing financial landscape.

Sanjiv Bajaj’s leadership and management expertise have propelled Bajaj Finserv to new heights, solidifying its position as one of India’s leading financial services providers. His commitment to customer-centricity, operational excellence, and ethical business practices has been instrumental in the company’s sustained growth and success.

5. Current Products and Services

Bajaj Finserv offers a comprehensive range of financial products and services to cater to the diverse needs of its customers. Their current offerings include:

Loans: Bajaj Finserv provides a wide array of loan options to individuals and businesses. These include Personal Loans, Insta Personal Loans for quick financing, Business Loans, Home Loans, Gold Loans, MSME Loans for micro, small, and medium enterprises, Mortgage Loans, Loan against Property, Two and Three-Wheeler Loans, Education Loans on Property, Loan against Car, specialized loans for Doctors and Chartered Accountants, and many more. This extensive range of loan products ensures that customers can find suitable financing solutions tailored to their specific requirements.

Insurance: Bajaj Finserv offers various insurance products to provide financial protection and security. These include Health Insurance, Car Insurance, Two-Wheeler Insurance, Pocket Insurance for coverage against specific risks, Investment Insurance, Appliances Extended Warranty Insurance, and Pocket Subscription Insurance. By offering a diverse range of insurance options, Bajaj Finserv aims to safeguard customers against unforeseen events and provide peace of mind.

Investment: Bajaj Finserv enables customers to grow their wealth through different investment avenues. They offer Fixed Deposits with attractive interest rates, Systematic Deposit Plans for disciplined savings, the facility to open a Demat Account for seamless stock market investments, and Mutual Funds for diversified investment portfolios. These investment options cater to various risk profiles and investment goals, empowering customers to build a robust financial future.

Additional Services: Bajaj Finserv also provides value-added services such as Pocket Subscriptions, which offer access to premium digital content and services. They have Bajaj Mall, an online marketplace for a wide range of products and services. Bajaj Finserv wallets and cards facilitate convenient and secure transactions. Furthermore, customers can avail themselves of services like bills and recharge to meet their day-to-day financial needs efficiently.

In summary, Bajaj Finserv’s current product and service offerings encompass an extensive range of loans, insurance options, investment opportunities, and additional services.

6. Expansion

Bajaj Finserv has significantly expanded its distribution network, enabling widespread accessibility of its financial services across India. With a remarkable presence in the country, the company has established a vast network of locations, including both urban and rural areas.

To cater to the diverse needs of customers, Bajaj Finserv has set up a remarkable of over 3000 locations across India. This extensive network ensures that individuals and businesses in various cities, towns, and rural areas can conveniently access the company’s products and services. Notably, out of these locations, a substantial 1,690 branches are strategically placed in rural areas, emphasizing Bajaj Finserv’s commitment to serving customers in remote regions.

By expanding its footprint to encompass rural areas, Bajaj Finserv plays a vital role in fostering financial inclusion. It enables individuals in underserved communities to access loans, insurance, and other financial solutions that may have otherwise been out of reach. This expansion showcases the company’s dedication to reaching out to diverse segments of the population and supporting the growth and development of the entire nation.

7. Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) play a crucial role in evaluating the success and progress of any business, including Bajaj Finserv. Here are five key KPIs that provide insights into the company’s performance:

- Customer Acquisition: Bajaj Finserv’s ability to attract new customers is a vital KPI. It measures the effectiveness of marketing and sales strategies in expanding the customer base and increasing market share.

- Loan Disbursement: This KPI reflects the company’s lending activity and its ability to meet the financial needs of customers. High loan disbursement indicates healthy demand for Bajaj Finserv’s loan products and demonstrates its role in facilitating access to credit.

- Revenue Growth: Revenue growth is a fundamental KPI that showcases Bajaj Finserv’s ability to generate income from its various products and services. It highlights the company’s market position, customer satisfaction, and overall financial performance.

- Asset Quality: The quality of assets is a critical KPI for any financial institution. For Bajaj Finserv, monitoring the level of non-performing assets (NPAs) and the asset quality ratio provides insights into credit risk management and the effectiveness of loan recovery measures.

- Market Share: Market share is a crucial KPI that measures Bajaj Finserv’s position relative to its competitors. It reflects the company’s ability to capture a significant portion of the market, highlighting its brand strength, customer trust, and competitive advantage.

8. Legal Matters

Bajaj Finserv, a prominent financial services company, has maintained a commendable track record when it comes to scams, scandals, and lawsuits. As of the latest available information, Bajaj Finserv has never been embroiled in any fraud, scandal, or significant legal dispute.

With a strong commitment to ethical business practices and a customer-centric approach, Bajaj Finserv has prioritized transparency and integrity in all its operations. This dedication to maintaining high standards of corporate governance has contributed to its reputation as a trustworthy and reliable financial institution.

By adhering to strict compliance regulations and industry best practices, Bajaj Finserv has successfully avoided any involvement in fraudulent activities or controversial incidents. The company’s focus on building long-term relationships with customers, partners, and stakeholders has further reinforced its commitment to operating with utmost professionalism and credibility.

It is worth noting that maintaining a clean record in the financial industry is an accomplishment that reflects the company’s commitment to its core values. Bajaj Finserv’s reputation for trustworthiness and reliability has played a significant role in its growth and success, establishing it as a preferred choice for individuals and businesses seeking financial solutions.

9. Financial Performance

Bajaj Finserv has demonstrated robust financial performance, indicating its strength and stability in the market. As of the latest available data, the company boasts a market capitalization of approximately 2.42 trillion INR, highlighting its significant market presence and investor confidence.

Regarding net sales, Bajaj Finserv recorded a notable increase in consolidated net sales for the fiscal year ending March 2023. The company reported net sales of Rs 23,624.61 crore, marking a substantial growth of 25.25% compared to the previous year. This growth signifies the company’s ability to attract and serve a more extensive customer base, resulting in increased revenue generation.

Furthermore, Bajaj Finserv reported a consolidated net profit of Rs 1,768.95 crore for the quarter ended 31 March 2023, indicating a significant rise of 31.41% compared to the same period in the previous year. This growth in net profit showcases the company’s efficient operational performance and effective management of its financial resources.

10. Financial Empowerment

In addition to its core financial services, Bajaj Finserv has actively pursued partnerships and collaborations to enhance its offerings. The company has joined forces with various leading brands and institutions, enabling customers to access a more comprehensive array of products and services. Bajaj Finserv has also focused on embracing digital transformation to provide seamless and convenient experiences to its customers. Through technological advancements, the company has introduced digital lending platforms and mobile applications, making it easier for individuals to avail loans and manage their finances. This commitment to innovation and strategic alliances has further strengthened Bajaj Finserv’s position in the financial services sector.

Conclusion

Bajaj Finserv has emerged as a leading financial services company, offering a diverse range of solutions to meet the evolving needs of individuals and businesses. With a strong foundation, strategic expansion, and a customer-centric approach, Bajaj Finserv continues to play a pivotal role in shaping the financial services landscape in India. As a trusted brand, it strives to provide innovative and accessible financial solutions to empower its customers and contribute to their economic well-being.