Is Quantum Computing A Mirage? Nvidia CEO’s Shocking 20-Year Prediction Triggers Market Meltdown

Quantum computing faces a reality check as stocks plunge and experts forecast decades before practical applications.

Quantum computing has often been termed the next big leap in technology, but December 8, 2025, marked a severe jolt for this budding technology. Today, the stocks of the major players in quantum computing – Rigetti Computing, D-Wave Quantum, Quantum Computing Inc., and IonQ – crashed almost 40%. Sharp pause to a year-long rally? A sobering prediction by Nvidia CEO Jensen Huang stated that the practical application of quantum computing technology might still be two decades away.

The Catalysts Behind the Market Downturn

Huang’s Realistic Timeline

During a public address, Huang remarked, “If you said 15 years for beneficial quantum computers, that’d probably be early. If you said 30, it’s probably on the late side. But if you picked 20, many of us would believe it.” The words from one of the industry’s most influential figures sent shockwaves into the market. Those high investors riding on the wave created by QC breakthroughs were forced to reassess the return timeline on their investments.

Hence, Huang’s remarks also point toward the technical and financial hurdles before the technology will permeate. As highly promising and having no equals within its niche-type calculations, solutions to challenging chemistry problems or problems of logistics and cryptography lie ahead.

Market Overvaluation and Revenue Realities

Breakthroughs such as Google’s high-profile demonstration of quantum supremacy in December 2024 have buoyed the quantum computing sector. With investors increasingly showing interest, stocks of companies such as IonQ and Rigetti Computing are at least three times higher than last year, far outpacing the twofold growth enjoyed by Nvidia.

Revenue, however, shows a very bleak scenario. Despite over $10 billion in market valuation before the crash, IonQ is only anticipated to make around $41.6 million in fiscal 2024. For the same period and time interval, Rigetti Computing should generate only $11 million, having a reasonable valuation of $4.4 billion for the market. Again, this illustrates how far these market assessments are from reality and what is financially viable for modern quantum computing companies.

The Fallout: $8 Billion in Market Value Wiped Out

Following Huang’s comments, the combined market value of Rigetti Computing, D-Wave Quantum, Quantum Computing Inc., and IonQ plummeted by over $8 billion. This represents a sharp correction to the speculative nature of investment in emerging technologies such as quantum computing. Such companies hold massive potential, though their dependence on limited, government-related revenues and the high cost of research and development pose significant risks.

Investor Sentiment and Expert Opinions

Realistic Expectations

Ivana Delevska, Chief Investment Officer at Spear Invest, which owns shares in Rigetti and IonQ through an actively managed ETF, endorsed Huang’s timeline. “The 15- to 20-year timeline seems very realistic,” she said, referring to Nvidia’s period to develop accelerated computing technology. Transformational technologies often require sustained investment and innovation over several decades before maturity.

Government Support and Strategic Importance

Despite the market downturn, analysts remain optimistic about the long-term prospects of quant computing. Richard Shannon of Craig-Hallum points out that government funding is a momentum factor for the sector: “There will be considerable government-related revenues in the next few years. Governments worldwide are investing significantly in it because quantum computing could enable advanced encryption/decryption technologies that can protect national security.”.

Shannon also highlighted the disruptive potential of quantum computing, stating, “Quant computing will be disruptive to parts of the classical compute business, of which Nvidia is a chief beneficiary.” This suggests that while the path to commercialization may be extended, the eventual impact of quantum computing could reshape entire industries.

Challenges in QC Development

Technical Hurdles

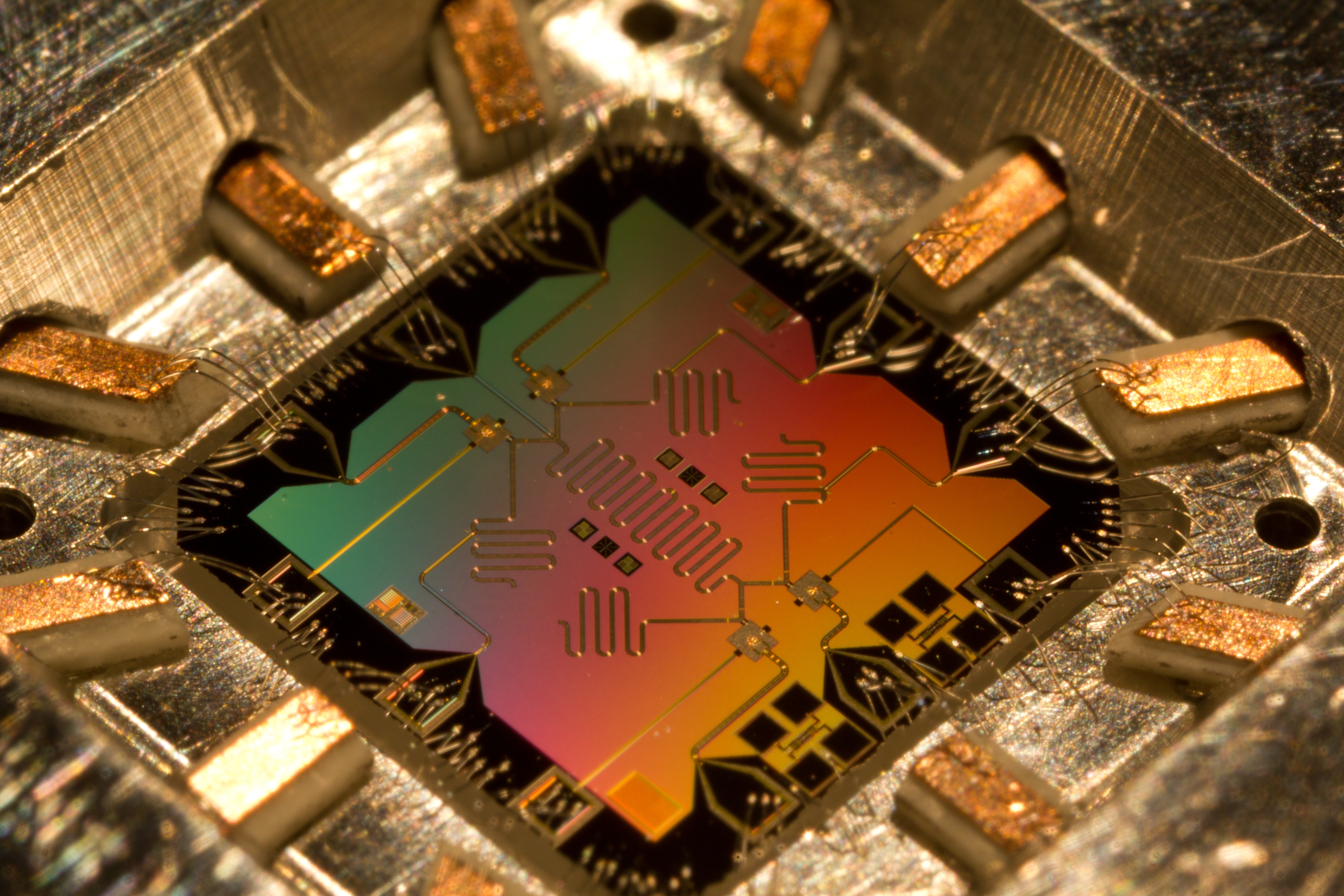

Quantum computers are built on entirely different lines of thinking than classic computers, using quantum bits or qubits. Qubits allow the quantum computer to solve specific problems exponentially faster than the corresponding problem solved by a classic computer. The major challenge remains to sustain the relative stability of qubits, which is called coherence. Existing quantum computers are noisy, and scaling qubits up while maintaining coherence is a massive task.

High Costs and Limited Applications

The high-cost development of QC technology costs in both hardware and software. Furthermore, the limited applications of quantum computers can only be utilized in niche areas such as quantum chemistry simulations and optimization problems. This would mean researchers have to contend with the high technical and monetary cost of quantum computing for broader commercial viability.

Competition and Geopolitical Factors

This means that a race in quantum computing technology is also a commercial and strategic game. For instance, citizens of countries such as the United States, China, and the European Union see quantum computing as a national security treasure. Government spending on quantum research has skyrocketed over the past years, as have collaborations to advance the field. Conversely, geopolitical tensions and competition for talent and resources may pose a risk to the quantum computing ecosystem at the global level.

Lessons for Investors

A more recent lesson can be gleaned from the QC sector: recent quantum computing stock crashes as a lesson to investors: new technologies can provide spectacular promises of returns but pose a greater risk. So, the most crucial take is balancing enthusiasm with a realistic perspective about challenges and timelines.

Indeed, quantum computing is still promising for long-term investors. As Ivana Delevska noted, the quantum computing journey may mirror what Nvidia did with accelerated computing—a process that took decades but revolutionized the entire tech landscape. The lesson from this is patience; transformational technologies require such a period, and the road to full commercialization comes with host problems.

Looking Ahead: The Future of Quantum Computing

While QC stocks look highly dim in the short term, the future still seems bright. Further research, development and enhanced governmental support might lead quantum computing past its current hindrances. At its eventual end, practical “beneficial” quantum computers can be used for novel applications such as cryptography, material science, artificial intelligence, and climate modelling.

In the interim, stakeholders will navigate the tightrope of expectations in the light of momentum. Long-term investors and investors, for example, would choose companies whose fundamentals are rock-solid and see a clear future picture. Researchers and policymakers would face technical and structural challenges to quantum computing at its full potential.

But for now, this is an especially welcome dose of realism coming from Nvidia CEO Jensen Huang‘s 20-year timeline for practical quantum computing: no doubt dampening the enthusiasm in the markets, but one that lets the industry refocus on the steady progress needed to bring quantum computing out of niche and into cornerstone-of-the-digital-age territory.