Incorporate A Company In British Virgin Islands In 2025

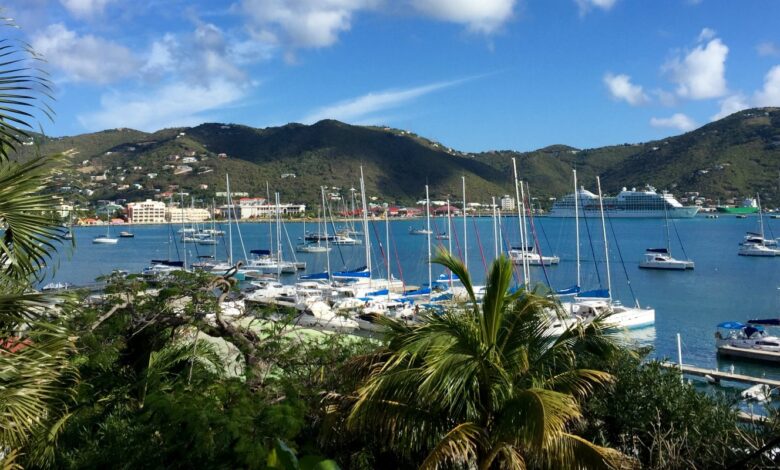

The British Virgin Islands (BVI) is a British Overseas Territory located in the Caribbean, comprising around 60 islands and cays, with Tortola as its largest and most populated island. Known for its crystal-clear waters, stunning beaches, and vibrant marine life, the BVI is a popular destination for tourists, especially for sailing and water sports. Beyond tourism, the BVI is also recognised as a significant international financial centre, attracting businesses and investors worldwide due to its tax-friendly environment, confidentiality, and strong legal framework. The territory is self-governed with a stable political system, though it maintains close ties to the United Kingdom. The BVI’s dual focus on tourism and finance contributes to its thriving economy and international reputation.

Standard of Living in the British Virgin Islands

The British Virgin Islands offers a high standard of living, especially for expatriates and locals employed in the finance and tourism sectors. Life in the BVI is characterised by a relaxed, tropical lifestyle paired with access to modern amenities. The islands have high-quality healthcare facilities, numerous private and public schools, and recreational options, particularly for those who enjoy outdoor activities and water sports.

However, the cost of living is relatively high, largely due to the islands’ reliance on imported goods and limited local resources. Housing, groceries, and utilities are expensive, though the tax-free income environment helps offset some of these costs. The BVI is generally safe, with low crime rates and a close-knit community, making it an appealing place to live for families and professionals.

Personal Taxes in the British Virgin Islands

One of the main attractions of the BVI for both residents and expatriates is its lack of personal income tax. Individuals do not pay any tax on income, capital gains, or inheritance, making the BVI a desirable location for high-net-worth individuals and retirees. This tax-friendly policy extends to the absence of wealth or estate taxes, allowing residents to retain and grow their wealth without significant deductions. While there is no income tax, residents do contribute to social security, which funds healthcare and other essential services. This tax-free personal income environment makes the BVI particularly attractive to those seeking financial efficiency and wealth preservation in a Caribbean paradise.

Corporate Taxes in the British Virgin Islands

The BVI is renowned for its corporate-friendly tax policies, making it a popular jurisdiction for international business and offshore companies. Corporations incorporated in the BVI do not pay any corporate income tax, capital gains tax, or withholding tax, which has led to a booming financial services sector. Businesses established in the BVI enjoy confidentiality, minimal reporting requirements, and a straightforward incorporation process, all of which are major draws for multinational corporations and holding companies.

Major Industries in the British Virgin Islands

The British Virgin Islands (BVI) has a diverse economy anchored by two major industries: tourism and financial services. The islands’ tropical climate, beautiful beaches, and clear waters attract thousands of visitors each year, making tourism a vital part of the economy. The BVI is particularly known for its yacht charters, diving, and water sports, drawing tourists and enthusiasts from around the world. The hospitality sector, including hotels, restaurants, and tour operators, thrives due to this influx of visitors, providing ample job opportunities for residents and expatriates alike.

The second pillar of the BVI’s economy is its financial services sector, which has transformed the islands into a global offshore financial hub. The BVI’s favorable tax policies, regulatory environment, and confidentiality laws make it an attractive location for offshore companies, trusts, and asset management.

Inflation & Cost of Living in the British Virgin Islands

The cost of living in the BVI is relatively high, particularly for expatriates, due to the islands’ reliance on imported goods. Most food items, household supplies, and fuel need to be imported, which inflates prices. Housing is also expensive, with rents on Tortola and Virgin Gorda – the most popular islands – comparable to rates in major cities. Utilities, especially electricity and internet, are costly as well, and dining out is more expensive than in other Caribbean destinations.

Inflation in the BVI is generally stable but can be influenced by fluctuations in global shipping costs, fuel prices, and currency exchange rates. The government monitors inflation closely, but residents and expatriates need to budget carefully to maintain their lifestyle. Despite the high cost of living, the absence of personal income tax helps offset expenses for residents, making the BVI financially attractive for high-net-worth individuals.

Property Tax, or Services, and Sales Tax in the British Virgin Islands

The government does levy a property tax on real estate, based on the annual rental value (ARV) of the property. The property tax rate varies depending on the property type and location, with higher rates for commercial properties and lower rates for residential homes.

Additionally, import duties are applied to goods brought into the islands, ranging from 5% to 20%, depending on the item. These duties contribute significantly to the cost of living but are a primary revenue source for the government. Certain services, such as hospitality and tourism, may incur service fees, often added directly to bills in restaurants and hotels. Utilities, telecommunications, and other essential services are generally not taxed directly but come with relatively high costs due to infrastructure and import-related expenses.

Types of Business Entities in the British Virgin Islands

BVI offers several types of business entities suited for various purposes, particularly in the offshore and international business sectors:

Business Company (BC) – The most popular business structure in the BVI, a Business Company (BC) is typically used by foreign investors to manage international transactions and assets. BCs are not permitted to conduct local business, making them ideal for global trade, investment, and asset protection.

Limited Liability Company (LLC) – The BVI LLC is similar to the American LLC, providing a flexible structure with limited liability. It is commonly used for investment holding, joint ventures, and asset protection.

Partnerships – Partnerships in the BVI include General Partnerships and Limited Partnerships. Limited Partnerships are common for investment funds and private equity arrangements, allowing limited partners to contribute capital while having limited liability.

Trusts – The BVI is a leading jurisdiction for establishing trusts, which are used for estate planning, wealth management, and asset protection. BVI trusts provide flexibility and confidentiality, making them popular for high-net-worth individuals.

Branch of a Foreign Company – Foreign companies can establish a branch in the BVI to conduct international business. However, branches are subject to certain regulatory requirements and restrictions.

Licenses to Start a Business in the British Virgin Islands

Starting a business in the BVI requires obtaining the appropriate licenses and adhering to regulatory standards. The BVI Financial Services Commission (FSC) oversees business licensing, particularly for companies in financial services, such as insurance, banking, and investment management. The type of license required depends on the business structure and the nature of the business.

Trade License – Local businesses operating within the BVI, such as retail shops or restaurants, require a trade license from the Department of Trade, Investment Promotion, and Consumer Affairs.

Financial Services License – For businesses in banking, insurance, and asset management, a financial services license from the BVI Financial Services Commission is mandatory. This licensing process includes background checks, business plan reviews, and compliance with international standards.

Tourism and Hospitality Licenses – Tourism-related businesses, such as hotels, tour operators, and yacht charters, may require specific tourism licenses to operate legally. These licenses are regulated by the BVI Tourist Board.

The application process involves submitting documentation, undergoing regulatory checks, and paying the required fees. The BVI government provides a streamlined process, especially for international businesses, to make setting up operations efficient and straightforward.

Opportunities for Expats for Business Growth in the British Virgin Islands

The BVI offers several business growth opportunities for expatriates, particularly in the tourism, financial services, and real estate sectors. The tourism sector, with its focus on high-end hospitality and water-based activities, presents openings for innovative services that cater to luxury travellers. Expatriates with experience in hospitality, wellness, and Eco-tourism can find promising business prospects in developing unique travel experiences for BVI’s discerning visitors.

In financial services, expatriates with expertise in legal, accounting, or asset management services have substantial opportunities to establish consulting firms, law practices, or asset management companies, supporting the needs of the BVI’s offshore business clients. Real estate development is also a lucrative field, particularly in luxury accommodations and vacation rentals, catering to tourists and affluent expatriates.

Citizenship for Expats in the British Virgin Islands

Obtaining citizenship in the BVI is challenging for expatriates, as the territory does not have an automatic path to citizenship for long-term residents. Expatriates may, however, apply for residency or work permits, which allow them to live and work in the BVI. Permanent residency can be pursued after residing in the BVI for 20 years, but this does not guarantee citizenship. For those interested in making the BVI a long-term home, obtaining a Certificate of Residence may provide more stability and the right to work without annual renewals.

In rare cases, British citizenship may be an option for those who meet specific criteria and have maintained residency in the BVI for a significant period. However, this process is complex and not automatically available to all expatriates. While citizenship may be limited, the BVI government offers long-term visas and permits for expatriates who wish to invest in or work on the islands, creating a viable alternative for those seeking a stable base in the Caribbean.

Why Register a Company in the British Virgin Islands

The British Virgin Islands has become one of the world’s leading jurisdictions for offshore company registration, particularly favored by investors and multinational corporations. BVI companies benefit from a tax-neutral environment making the BVI an ideal base for holding companies, investment firms, and multinational corporations.

Another reason to register a company in the BVI is the straightforward regulatory environment. The BVI’s legal framework, based on English common law, provides businesses with a stable and predictable setting. The BVI Business Companies Act, established in 2004, created a flexible structure that simplifies company incorporation and reduces bureaucratic processes. Furthermore, the BVI is highly regarded for its confidentiality laws, offering investors privacy with limited public disclosure requirements. These advantages have solidified the BVI’s position as a reputable, secure, and tax-efficient jurisdiction for global businesses.

How to Register a Company in the British Virgin Islands

Registering a company in the BVI is a streamlined process facilitated by the Financial Services Commission (FSC), which oversees company incorporation and regulation. To register a business, follow these key steps:

Choose the Business Structure – The most popular structure is the Business Company (BC), which offers flexibility for international business activities and can be fully foreign-owned. Other options include Limited Liability Companies (LLCs) and trusts, depending on business goals.

Engage a Registered Agent – All companies in the BVI must appoint a licensed registered agent, typically a corporate service provider, who will handle the incorporation process. The agent acts as the company’s representative within the BVI and ensures compliance with local laws.

Reserve a Company Name – A unique company name must be selected and checked for availability. The name must include a suffix like “Ltd.” or “Inc.” based on the company’s structure.

Prepare Incorporation Documents – Key documents, including the Memorandum of Association and Articles of Association, outline the company’s purpose, structure, and rules. These must be submitted to the FSC through the registered agent.

Submit Application and Pay Fees – The registered agent submits the incorporation documents, along with applicable fees, to the FSC. Once approved, the FSC issues a Certificate of Incorporation, officially establishing the company.

Open a Bank Account (if needed) – To manage financial operations, companies often open a bank account, though this step may be conducted outside the BVI.

The entire registration process generally takes a few days, making the BVI an efficient option for businesses seeking swift incorporation.

Cost to Register a Business in the British Virgin Islands

The cost to register a business in the BVI varies based on the company type, share capital, and services provided by the registered agent. Initial incorporation fees for a standard Business Company (BC) typically range from $1,000 to $2,000, covering registration, government fees, and the agent’s services. Companies with authorised share capital exceeding a certain threshold may incur additional costs.

Annual fees also apply, with standard maintenance fees for BCs typically costing around $450. Companies engaging in financial services or other regulated activities may face additional licensing fees. While registration costs in the BVI are not the lowest among offshore jurisdictions, they are competitive, given the regulatory stability and business advantages offered by the BVI’s environment.

Relation with Other Countries of the British Virgin Islands

The British Virgin Islands maintains strong relations with many countries, particularly the United Kingdom, as it is a British Overseas Territory. This connection provides the BVI with a stable political framework, access to international support, and alignment with British legal principles. The BVI is also recognized by the United States and many European nations as a reputable offshore jurisdiction, allowing it to foster economic partnerships and trade.

The BVI actively engages in international cooperation to comply with global tax transparency and anti-money laundering standards. It has signed numerous Tax Information Exchange Agreements (TIEAs) with countries around the world, allowing for the exchange of tax information and compliance with international norms. This commitment to transparency has improved the BVI’s reputation, making it a trusted partner in global finance and appealing to businesses that value compliance and reputation. Through these international relations and standards, the BVI balances its tax neutrality with robust regulatory oversight, attracting reputable companies and investors.

Other Taxes in the British Virgin Islands

Payroll Tax – BVI does have a payroll tax, levied on employers based on the wages paid to employees. The tax rate varies by the size and type of business, typically ranging between 10% and 14%. Part of this tax may be passed on to employees, though employers bear the primary responsibility.

Stamp Duty – Stamp duty is applied to real estate transactions, particularly for non-BVI citizens purchasing property. The stamp duty rate for non-residents can reach up to 12% of the property’s purchase price, while local buyers face lower rates. This tax regulates foreign property investment while contributing to government revenue.

License Fees – Certain businesses, especially those in financial services, require licenses to operate in the BVI. These licenses come with associated fees, particularly for businesses in regulated sectors like insurance, banking, and asset management. License fees are structured to generate revenue while regulating the business environment.

Social Security, Weather, Climate & Regional Safety in the British Virgin Islands

The British Virgin Islands offers a moderate social security framework primarily aimed at citizens and residents who contribute through employment. Social security benefits include retirement pensions, disability benefits, and healthcare provisions. Employers and employees contribute to social security, which supports basic healthcare and retirement needs. While healthcare facilities are available, more specialized treatments often require travel to nearby regions like Puerto Rico or the United States, so many residents supplement public healthcare with private insurance.

The British Virgin Islands enjoys a tropical climate with warm weather year-round. The islands experience a rainy season from May to November, coinciding with the Atlantic hurricane season, when there is an increased risk of storms. The BVI government has invested in hurricane preparedness and infrastructure to minimize storm damage and ensure community safety. Regional safety in the BVI is generally high, with low crime rates, a close-knit community, and a strong focus on public safety, making it an attractive place to live for both locals and expatriates.

Passport Power of the British Virgin Islands

As a British Overseas Territory, the British Virgin Islands issues British Overseas Territories passports (BOTC) to its citizens. This passport provides visa-free or visa-on-arrival access to over 100 countries, allowing residents of the BVI significant travel freedom, especially within the Caribbean and to the United Kingdom. However, a BOTC passport does not automatically grant the right to live or work in the UK. Citizens of the BVI who wish to obtain full British citizenship can apply for it, which, if granted, provides expanded rights, including freedom of movement within the United Kingdom and European Union countries for short stays.

Scope of Education, Growth, and Quality of Life in the British Virgin Islands

The British Virgin Islands offers a range of educational options, primarily through public and private schools on the larger islands like Tortola and Virgin Golda. The public school system in the BVI is available to residents, with education up to the secondary level provided by the government. For expatriate families, private and international schools are available, offering alternative curricula, including the British and American systems. Many BVI students choose to pursue higher education abroad, particularly in the United States, United Kingdom, or nearby Caribbean universities, due to the limited number of higher education institutions within the BVI.

Life in the British Virgin Islands offers a high quality of life marked by beautiful surroundings, a relaxed lifestyle, and a close-knit community. The BVI’s economy, supported by tourism and financial services, provides ample job opportunities, especially for professionals in finance, hospitality, and education. The cost of living is high, but the absence of personal income tax helps residents offset expenses.

Overall, the British Virgin Islands offers a well-rounded environment for living, with a focus on community safety, education, and high standards of living, making it an appealing destination for those looking to enjoy both work and leisure in a scenic, stable setting.