The High Octane Family Feuds That Dot India’s Corporate Sector, From Oberoi’s To The Kalyani Family Feud And Many More, Blood May Not Be Thicker After All!

No matter how vast the fortune, several stories of family feuds dot India's corporate history. From the more famous case of the Ambani brothers to the rivalry between father and son, Birla (and more), the latest to join this chain is the emerging tussle within the Oberoi Group and the Kalyani family feud. All these stories tell us one thing-wealth can often be accompanied by deep divisions and strife within families, showing that life for the rich and powerful is far from perfect.

India’s Corporate Billionaires And Family Feuds

The issue of the lack of ability of the siblings, and within the families, to share wealth and power also lies worldwide.

However, internationally it has been kept in check by the speed at which family or individually run firms have been taken over by professional managers and by the threat of litigation which especially from activist shareholders has often been a very real one.

On the contrary in the Indian context, unresolved bitter fights among the family members with regard to the distribution of wealth are all too frequent.

One of the most famous and outstanding examples of this is the Mukesh and Anil Ambani business conflict that was solved in 2010 when the brothers signed just two- line private agreement and dismissed all the cases and accusations against each other.

Money, power, and family: the unholy trinity is the formula which the family businesses use; however, as everybody knows even the coin has two faces, the unity factor does not always go well with money and power, and what follows is a clash much more entertaining than your daily soap opera.

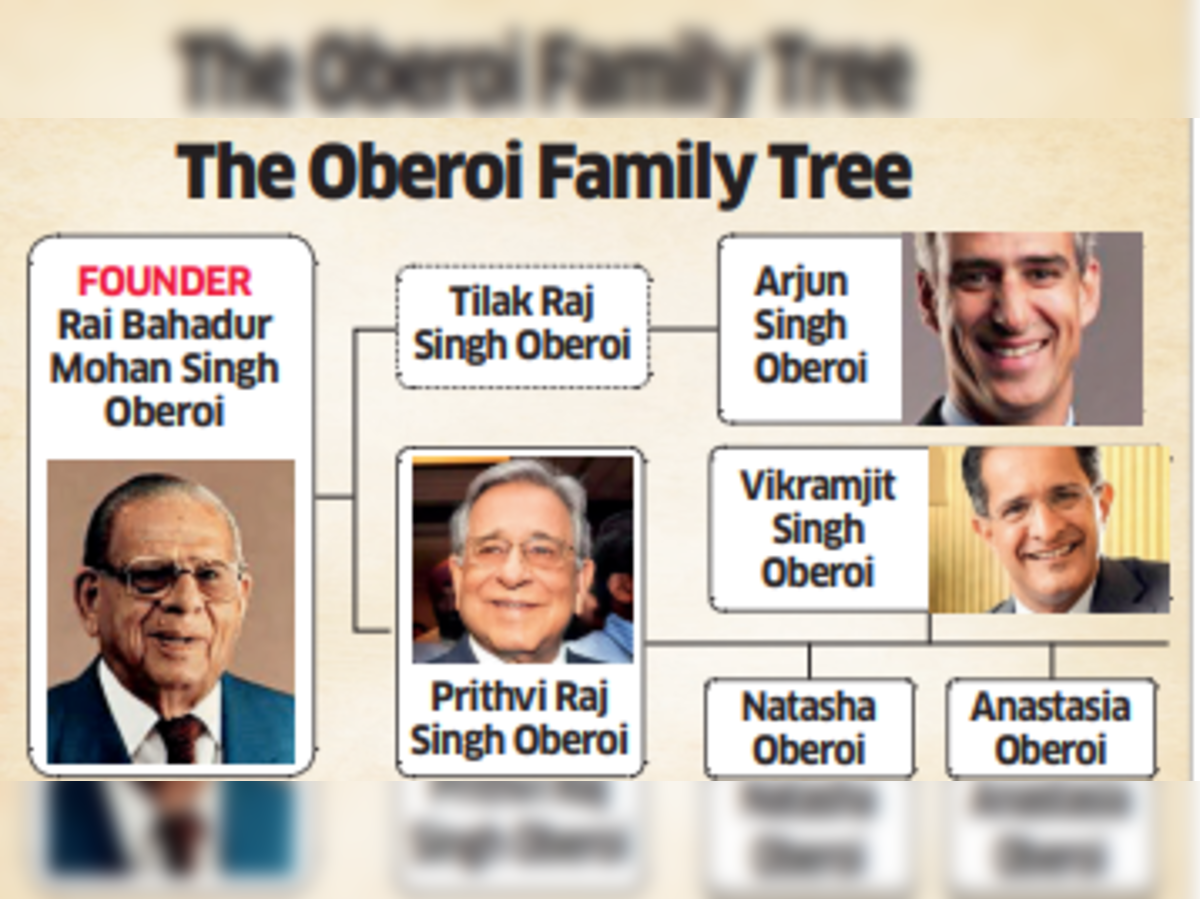

The Oberoi Group

There seems to be a bitter family struggle brewing to lay claim to the country’s largest hotel empire: Oberoi Group.

The internal conflict within the Oberoi family over the property succession comes during a time when the company is interested in expansion.

On Vikramjit Oberoi’s side are Natasha Oberoi and Arjun Oberoi while the oppressing party is Anastasia Oberoi, PRS Oberoi’s daughter by Mirjana Jojic Oberoi and between the two parties’ contestations, there are two wills purported to have been signed by PRS Oberoi.

Anastasia Oberoi has sought an interim relief in the Delhi High Court stating that her stepbrother Vikramjit Oberoi, stepsister Natasha Oberoi and cousin brother Arjun Oberoi are bent upon hindering the operation of the “Will of her father”.

‘Discrepancies’ in Will

PRS Oberoi passed away 10 months back. Vikramjit Oberoi is the current managing director and chief executive officer managing the EIH Ltd which is the largest company of the Oberoi group.

Arjun Oberoi is the EIH’s executive chairman.

Anastasia has produced a will dated October 25, 2021, and a codicil executed on August 27, 2022, which is the last will of PRS Oberoi the former executive chairman of EIH Ltd and speaks of his final wishes bequeathing his property and assets listed in the will and codicil to Magnum and certain trusts, she said.

However, Vikramjit refused to accept that will and codicil.

Vikramjit Oberoi had filed a will executed on 20.03.1992 by PRS Oberoi and he said that the PRS Oberoi had neither right, title or interest in the shares owned by Vikramjit Oberoi in Oberoi Hotels.

The shares of Oberoi Hotels and Oberoi Properties were held by the testator (PRS Oberoi) in trust for Vikramjit and Arjun, and were to devolve upon his death of the testator and according to the contention of Vikramjit, therefore, the provisions of the Succession Act have to be applied.

Thursday saw the the Delhi High Court delivering an interim order that two hundred and fifty-three shares in EIH Ltd, Oberoi Hotels and Oberoi Properties that belong to the late PRS Oberoi cannot be transferred.

Thus, Anastasia is suing her siblings and a cousin for a share of the family’s wealth.

In its 19-page order, the court has stated that the interest of Anastasia and his mother can be protected by restraining the three executors of the will which include Rajaraman Shankar, Daniel Lee Farrugia and Natasha Oberoi and others from transferring or transmitting any shares in EIH Ltd, Oberoi Hotels and Oberoi Properties held by the testator PRS Oberoi except a single Class-A share in Oberoi Hotels and Oberoi Properties each to Shankar.

Preserving the stay of Anastasia and her mother in their family house situated in Kapashera, Delhi, Chawla again prevented Vikramjit and his companions including Arjun, Natasha, Shankar and Farrugia from tampering with the possessory and Enjoyment of the House by the mother and daughter.

However, as analysts have pointed out, the matter may distract the chain’s leadership at a time when it is involved in expansion strategies.

“The developments can cause a lot of problems at the family level even as they look forward to implementing their development plans since they are eager to sign more properties given the high level of competition in this sector.”

An insider for Oberoi said that a dispute in the family had been on for the last three-four years and could not be settled due to PRS Oberoi’s serious health complications.

EIH (in which Reliance Industries Limited owns more than 18% of the stake) for the financial year 2014 – 15 recorded revenues from operation at Rs. 526. Rs 5 crore in the quarter ending June, this year which rose from Rs 498 crore in the same period last year.

The chain which had recorded a net profit of Rs 106 crore for the previous corresponding quarter reported Rs 97 crore for the quarter ended June, 2013.

They have reported the COGS of Rs 1511 crore for the same year and the firm’s revenue from operation was Rs 2511 crore and profit was Rs 678 crore.

As a standalone entity, EIH posted a rise in its June quarter revenue to Rs 498 crore from Rs 455 crore in the previous year, CFO Kallol Kundu said during the earnings call last month.

The Kalyani Family Fued Enters A New Dimension

The third-generation procreation of ‘new will’ adds a new dimension of suspense to the Kalyani family drama.

In a fresh twist to the Kalyani family property tussle: Gaurishankar Kalyani, brother of Baba Kalyani filed an affidavit in the Pune Civil Court opposing the execution of the will of his mother Sulochana Kalyani who passed away in 2012.

Gaurishankar came out with a new will dated December 9, 2022, in which he levelled a few grave allegations against Baba Kalyani.

According to the affidavit, the late Sulochana reportedly wrote Baba had taken control of most of the family’s wealth, leaving her and her husband, Neelkanth Kalyani, with a small portion.

“Between 1992 and 1994, Baba seized control of several companies, including Bharat Forge and Kalyani Steels, from my husband. After 1994, we were left with only a small share of the wealth my husband had built,” affidavit states.

Gaurishankar’s affidavit responds to affidavits filed by Madan Takale and Shrikrishna Adivarekar seeking probate of Sulochana’s 2012 will. The case is set to be heard in Pune on October 9, 2024.

In August, Sulochana’s son Viraj applied for probate of Sulochana’s 2022 will made by Gaurishankar. This new document which was signed by her, months before her death contains rather serious charges against her eldest son, Baba Kalyani who is the chairman and Managing director at Bharat Forge.

Sulochana & Neelkanth were blessed with three children namely Baba, Gaurishanka, and Sugandha. As per her wishes, the couple agreed to make Gaurishankar and his family financially secure by gifting the remaining wealth to them in the year 2007.

“We decided to give Hikal to Sugandha. By this time, Baba had already taken away many of the assets including HUF assets. Only Gaurishankar had not received any of the family assets until then. So, to safeguard Gaurishankar and his family, my husband wished to give his remaining assets to Gaurishankar,” said the affidavi. She alleged this did not sit well with Baba.

“As my husband aged, Baba and his family pressured me to reverse these decisions,” Baba and his family pressured me to reverse these decisions,” Sulochana stated, adding that, under Baba’s influence, she filed legal proceedings against Gaurishankar and his family.

She also claimed Baba had used her power of attorney to file court documents in her name without her knowledge and had initiated several legal actions using relatives.

Sulochana withdrew proceedings, claiming they were instigated by Baba. New affidavit surfaces weeks after Baba Kalyani testified in court, asserting his grandfather, Annappa Kalyani, was not wealthy and that his wealth was self-acquired.

In an email response, a spokesperson for Baba Kalyani group said that the allegations and contentions in late Sulochana Kalyani’s affidavit are incorrect and denied as produced by Gaurishankar Kalyani. “Kalyani will appropriately represent his case before the hon’ble Pune District Court.”

The family has faced multiple legal disputes in recent years.

Gaurishankar’s daughter, Sheetal Kalyani, has sued Baba for her share of the family wealth. Additionally, Sugandha’s children, Sameer and Palallavi, have filed a partition suit seeking their portion of the family assets. Baba contests both suits, claiming all his wealth is self-made, not inherited.

In May, Gaurishankar filed an application in Pune court stating his sister’s children, Sameer and Pallavi-have no rights over Kalyani family wealth. He said they can only claim rights through their mother, Sugandha whose claims are barred by limitation.

Blood Feuds and Billionaires, Inheritance Battles of India’s Wealthy Families

“Blood is thicker than water.” “Family comes above all else.” Whether it’s Bollywood or Hollywood, the theme of family unity has been glorified in films for decades.

But while family ties are held sacred on the silver screen, in the real world—particularly in the business world—money and power often shake the foundations of even the closest-knit families.

The result? Feuds far more dramatic than any scripted soap opera.

In the high-stakes world of family businesses, the mix of power, wealth, and relationships often leads to fierce disputes. Family businesses, though often built on unity, can unravel when faced with the pressures of inheritance, control, and legacy.

These dynasties, where the family name is synonymous with power and influence, are no strangers to courtroom battles, where the prize is not just wealth, but the control of entire empires.

Here are some of the most headline-grabbing family business feuds of all time, where fortunes were contested, reputations were tarnished, and the very definition of “family” was called into question.

Top Family Business Fights for Inheritance

1) The Birla Family Feud

One of India’s most iconic business families, the Birlas, has roots that go back over a century. Founded by Seth Shiv Narayan Birla in 1857, the Birla empire spans multiple industries, from textiles to cement, and is an integral part of India’s industrial story.

However, the family’s legacy was rocked by the death of Priyamvada Birla, widow of M.P. Birla, one of the key figures in building the family’s fortune.

In 1999, Priyamvada allegedly left her entire estate, including the prized Lodhi Estate in Delhi, to R.S. Lodha, bypassing her own family members.

Lodha, who was married to Priyamvada’s niece, not only became the unexpected heir but was also named executor of the will, making the situation even more contentious.

The Birla family was shocked and contested the will, leading to a complex legal battle that made headlines across India. The family argued that the will was not valid and that Priyamvada’s assets should rightfully stay within the Birla family.

The battle dragged on for years and involved multiple courts, including the Supreme Court of India.

Despite the fierce opposition, R.S. Lodha became chairman of the Birla Corporation, and his involvement in several other business ventures, including a key role on the board of the State Bank of India, gave him significant influence.

However, his sudden death in 2008 did little to resolve the feud, as his son, Harsh Vardhan Lodha, stepped in to continue the battle against the Birla family.

2) Singhania vs. Singhania

The feud within the Singhania family began in 2015 when Vijaypat Singhania, the patriarch of the Raymond empire, found himself in a bitter battle over the company’s control.

With his two sons, Gautam and Madhupati, on opposing sides, the conflict took center stage.

Going back to 1998, Vijaypat’s eldest son, Madhupati, made the decision to relocate to Singapore with his wife Anuradha and their four children—Ananya, Rasaalika, Tarini, and Raivathari.

Before the move, he chose to relinquish his and his children’s rights to the family’s assets.

What did this mean?

In the event of Vijaypat’s passing, Madhupati would not be entitled to inherit any part of the family wealth. Gautam, the youngest son, went on to take over as the managing director of Raymond.

Later, in his old age, Vijaypat decided to hand over control of the empire, including his 37.17% stake, to Gautam. However, this decision prompted Madhupati’s children to re-enter the picture, demanding what they believed was rightfully theirs.

Claiming their rights under the 1998 Family Agreement, Madhupati’s four children petitioned the Bombay High Court, seeking a share in the Raymond brand, ancestral properties, and other assets.

But the story doesn’t end there.

Gautam, initially portrayed as a dutiful son, soon found himself in a bitter dispute with his father over a property deal involving JK House. This disagreement drove a wedge between the father and son, adding another layer to the family conflict.

The feud, which continues to this day, has made numerous headlines over the years, affecting Raymond Ltd.’s share price and casting a shadow over the company.

3) Ambani Brothers’ Clash for the Throne

It all started as it usually does in these cases, with the death of a business magnate, Dhirubhai Ambani.

After their father died in 2002, disputes arose between Mukesh and Anil Ambani regarding the division of the Reliance empire, aka Reliance Industries.

Dhirubhai Ambani breathed his last breath without signing his will, and the empire he had painstakingly built stood at a crossroads. His eldest son, Mukesh, and youngest son, Anil, were to inherit everything. But what ensued was far from a harmonious transition of power.

Being the eldest, Mukesh Ambani was made the chairman of Reliance Industries, and Anil was appointed as managing director. Anil was not satisfied with the option to answer to his brother and wanted a much bigger share of the meal.

The feud between the two became public in 2004, with disagreements over leadership and business strategies. Things went sour, and at last, they reached the court, where both brothers began to drag each other down to maintain a firm group in the empire.

Surprisingly, there wasn’t much fluctuation during this period on RIL’s stock price.

But soon, realising that the media was devouring the fight hungrily and businesses were being affected, both decided to solve the matter amicably.

In 2005, a formal split divided Reliance Industries, with Mukesh controlling the core petrochemicals and oil & gas business and Anil venturing into telecom and other sectors.

They also signed a non-compete pact till 2010. Throughout the years one big fight or other kept on brewing between the brothers at which point then Finance Minister Pranab Mukherjee advised the two to solve it privately.

4) Hinduja Family Discord

Sibling rivalry is often not uncommon when it comes to family businesses, but rarely does it reach the level seen within the Hinduja family.

The once-close-knit brothers—Srichand, Gopichand, Prakash, and Ashok Hinduja—were united for years. However, as the family patriarch Srichand grew older, a feud began to unfold, with a staggering $112 billion (₹9.2 lakh crore) at stake.

Interestingly, the conflict stemmed from a single document, not a will, but a letter signed by all four brothers in 2014. The letter declared that any asset owned by one brother belonged to all, with the requirement that one brother would act as executor for another.

Seizing upon this document, the three younger brothers—Gopichand, Prakash, and Ashok—attempted to claim control over Hinduja Bank, which was under the management of Srichand and his daughter, Vinoo. In response, Srichand and Vinoo challenged the letter, asserting that it should be rendered invalid.

A London court eventually ruled in Srichand’s favor, appointing Vinoo as his “litigation friend,” allowing her to safeguard his interests and manage his assets as he battled dementia.

This ruling has, for now, tipped the scales in favor of Srichand and Vinoo.

5) Godrej Group Division

Unlike the other contentious battles on this list, the division of the Godrej Group has been relatively peaceful.

In 2002, the Godrej brothers chose to split their business empire based on their respective interests.

Adi and Nadir Godrej oversee Godrej Industries, which focuses on FMCG and consumer goods, while Jamshyd and Smita Godrej manage Godrej Appliances and Godrej Security.

Both sides have undergone a comprehensive restructuring, with each brother transferring shares of the other’s businesses, ensuring no cross-control.

The division is seen as a strategic move to allow for focused growth, and the brothers have maintained a positive relationship throughout. To preserve this harmony, both sides signed a six-year non-compete agreement and have remained in discussions about maintaining peace even beyond the agreement’s end.

The Last Bit, These cases clearly show the importance of transparent and well-planned estate arrangements to prevent family conflicts, especially in wealthy and prominent business families.

No matter how vast the fortune is, these stories show that wealth can often be accompanied by deep divisions and strife within families, showing that life for the rich and powerful is far from perfect.