Can Higher FD Rates Offered By Banks Lure In Customers? The Mega Challenge For Banks To Up Deposit Growth In A Shifting Interest Rate Scenario

With interest rates poised to ease, the opportunity for banks to raise FD rates to attract customers—especially when returns from other asset classes are higher—is narrowing. New-age small financial banks have already taken the lead in this space.

Finance Minister Nirmala Sitharaman and Reserve Bank of India (RBI) Governor Shaktikanta Das have assigned banks a difficult task: to significantly increase their deposit base or FD’s.

While the financial health of banks seems stable, with a surge in both secured and unsecured lending driven by corporate and individual demand for capital, credit growth has consistently outpaced deposit growth in recent quarters.

Thus, this imbalance is a growing concern for RBI Governor Das.

In a recent address, Das emphasized the need for banks to “focus more on mobilizing household financial savings through innovative products and service offerings, and by fully leveraging their extensive branch networks.”

As individuals continue to see better returns from equities, real estate, gold, and alternative investments, banks are finding it increasingly difficult to attract deposits, even as loan growth lags behind.

Moreover, the RBI has recently reiterated its zero-tolerance stance on compliance and regulatory lapses to bank heads, stressing the importance of clear income recognition, managing bad loans, and provisioning, especially given the aggressive lending trends of recent years.

“The divergence between bank deposit growth and credit growth could pose liquidity management challenges for banks,” Das noted in a recent meeting after announcing the decision to keep interest rates steady at 6.5 percent, following the last rate hike in February 2023.

Hence, why is the Governor so concerned, let us take a closer look at the boiling points.

While experts acknowledge that banks could theoretically face liquidity challenges if the credit-to-deposit gap widens, this scenario doesn’t seem to be unfolding for most Indian banks.

“The real issue arises when a bank raises short-term deposits to support a long-term asset, and those deposits aren’t renewed. In such cases, the bank needs funds to cover those deposits,” explains a banking analyst from a private research firm, who requested anonymity.

However, this isn’t a significant concern for India’s large and mid-sized banks.

Jefferies India says, “Household deposits make up 61 percent of total deposits, and growth has picked up to 12 percent after two sluggish years. This may indicate a shift in savings towards capital markets and increased consumption. Within household deposits, the share of savings deposits has dropped to a seven-year low of 41 percent, with funds moving into term deposits, which could be nearing a peak.”

This trend showcases a shift in household savings away from bank deposits toward assets offering better returns.

“Term deposits have grown the fastest at 19 percent, gaining share from savings deposits, which increased by just six percent. The growth in savings deposits for both PSU and private sector banks has converged, posing a potential risk for private banks in mobilizing low-cost deposits,” the Jefferies analysts added.

In recent years, passive and exchange-traded funds (ETFs) have become popular among latecomers to the Indian equities market. Investors with higher risk tolerance have also ventured into Futures and Options (F&O) trading, an area where the Securities and Exchange Board of India (Sebi) has tightened regulations due to significant intraday losses suffered by traders over the past two years.

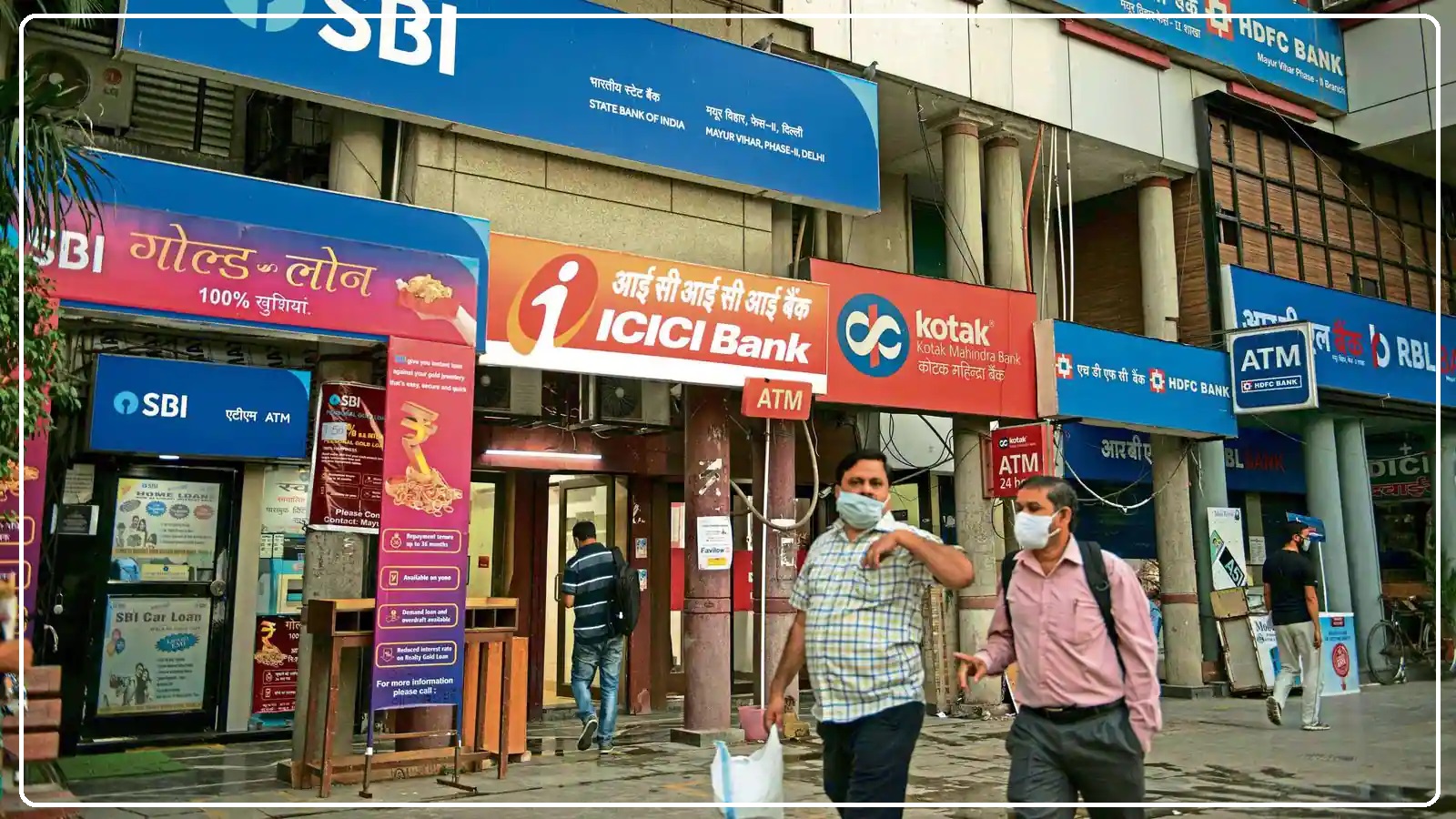

An analysis of the same reveals that while India’s top four banks by asset size—SBI, HDFC Bank, ICICI Bank, and Axis Bank—have experienced growth in both deposits and advances, the rate of growth has been more pronounced for advances over the past year.

For SBI, credit growth surged by approximately 15.9 percent, while total deposits for the standalone bank increased by around 8 percent from the June-ended 2023 quarter to the June-ended 2024 quarter.

Similarly, Axis Bank saw credit growth (14 percent) outpace deposit growth (12 percent) during the same period, and ICICI Bank also observed loans outpacing deposits.

New, Innovative Products

Investors typically turn to bank deposits when they offer attractive interest rates or serve as a secure savings option.

“To attract additional deposits, banks may need to offer higher interest rates to make deposits more appealing, with longer lock-in periods and the ability to pass on interest rates on disbursements,” explains Bhavik Hathi, Managing Director of Alvarez & Marsal’s global transaction advisory group.

Another strategy that banks have been using for some time is issuing loans against fixed deposits. They might even consider offering a higher loan limit, in some cases exceeding the underlying deposit, to meet credit requirements.

Nitin Aggarwal, Head of BFSI (Institutional Equities) at Motilal Oswal Financial Services, adds that banks will need to focus on deposit rates and their mobilization efforts.

Public sector banks have not been aggressively mobilizing deposits due to ample liquidity. “Banks need to work harder by offering attractive deposit rates,” Aggarwal notes, although he doesn’t foresee a fierce competition to raise deposit rates at this point.

)

He predicts that the pressure to raise deposits will persist for at least two more quarters.

India’s banking system had a credit-deposit ratio of 78.1 percent for FY24, and analysts suggest it ideally should decrease by another one percent to around 77 percent.

In 2023, Standard & Poor’s (S&P) warned that the credit-deposit ratio of Indian banks might come under pressure due to the continued lag in deposit growth compared to the pace of credit expansion.

Unity Small Finance Bank is currently offering one of the highest fixed deposit rates in the market, at 9 percent for deposits under Rs 3 crore with a specific tenure of 1,001 days.

Founded from the merger of PMC Bank with Centrum Financial Services and BharatPe in 2021-22, Unity SFB is India’s youngest bank.

According to its Managing Director and CEO, Inderjit Camotra, the bank is deliberately offering high deposit rates to attract a strong base of senior citizens, working women, and small businesses as their initial customers.

Camotra explains that the bank is “happy to share the interest spread (of high single digits) with the depositors.” As a retail bank, Unity SFB lends primarily to micro, small, and medium enterprises (MSMEs), SMEs, and micro-finance groups, where interest rates range between 12 to 21 percent.

As of July 2024, Unity SFB, which serves 1.7 million customers, has a net NPA of 0.6 percent on total advances of Rs 8,500 crore and deposits of Rs 8,100 crore. The bank’s deposits have grown by 17.7 percent, while advances have grown slightly slower during the July-September 2024 quarter.

One of the bank’s savings products, popular with working women, is the Pearl account. This account offers wellness and health-related benefits, lower average monthly balance requirements, a dedicated relationship manager, doorstep banking, and various discounts and offers, making it a unique product.

In 2024, Bajaj Finance introduced an innovative digital FD product, offering interest rates up to 8.4 percent per annum for general customers and 8.65 percent per annum for senior citizens.

The digital FD offers 8.4 percent interest on deposits ranging from Rs 15,000 to Rs 5 crore, with a tenure of 42 months. Bajaj Finance also offers systematic deposit plans, allowing customers to invest either in a lump sum or on a monthly basis.

The company reports having over five lakh customers in its digital FD scheme, with Rs 50,000 crore in deposits.

Nitin Aggarwal from Motilal Oswal Financial Services notes that small finance banks have little choice but to offer attractive deposit rates to attract more customers. “They cater to high-yield segments, like microfinance institutions (MFIs),” he says.

)

Deposit Rates May Soften

The Reserve Bank of India (RBI) and the Monetary Policy Committee have signaled that their primary focus remains on combating persistently high food inflation. While the central bank is unlikely to rush into cutting interest rates, the process toward a rate reduction has begun.

Indications from the US Federal Reserve suggest that a rate cut may be on the horizon, potentially occurring after nearly four and a half years.

As interest rates begin to decline—possibly by the end of the year in India—banks are unlikely to continue raising deposit rates.

Analysts predict that any increases will be minimal, perhaps between 5 to 15 basis points, especially for banks facing liquidity pressures.

Long-term fixed deposits may experience only modest rate cuts, while short- to medium-term fixed deposits could see sharper reductions.

HDFC Bank, India’s largest private sector bank, currently has the highest credit-deposit ratio among banks at 104 percent. This elevated ratio, resulting from its merger with HDFC, was due to lower deposits and might lead to a slight slowdown in credit growth for a short period.

Both public and private sector banks face a significant challenge in maintaining customer loyalty to fixed deposits. There are no easy solutions to this issue.

However, newer banks may have a bit more flexibility to keep deposit rates elevated for a few more quarters before an inevitable decline occurs.

The Last Bit, So what can be done?

As the banking scene shifts with potential interest rate cuts on the horizon, both public and private sector banks will need to manage the delicate balance between attracting deposits and managing liquidity.

While newer banks may have some flexibility to maintain higher deposit rates in the short term, the overall trend is likely to see a softening of rates which poses a challenge for banks to retain customer loyalty to fixed deposits amidst a competitive environment.

As the countdown to rate cuts continues, strategic innovation and customer engagement will be key to sustaining deposit growth.