Why OLA Electric IPO Will Be The Biggest Crash, Bigger Than Paytm & Zomato?

An impressive R&D expenditure is not enough; investors want to see what comes out of it. Without strong quality standards, a seasoned supply chain, a well-oiled governance structure, depth of distribution, and a turnover rate that is more than four times industry averages, Ola could fall over while trying to grow, hence making OLA Electric IPO the biggest crash, bigger than Paytm & Zomato.

Ola Electric Mobility’s journey from a much-hyped debut to news of its scooters catching fire to becoming India’s best-selling electric scooter firm has been a rollercoaster since its initial funding injection in 2019. Being the first of a new batch of unicorns waiting in the wings to cruise into the capital markets, Ola would also give investors an early chance to buy into the EV adoption story, which is expected to follow a similar growth trajectory as China but range issues and a lack of charging infrastructure remain genuine handicaps, putting a brake on Ola’s electrifying IPO this year.

About the founder, Bhavish Aggarwal’s electric scooters are as colourful as his tweets, which often mock colleagues, publications, and even pronouns. ‘They (Ola) need to put their heads down and grow for another ten years before launching an IPO. If they go public now, they will put the company under unnecessary stress. The product is half baked, the organisation is half baked, and the CEO tweets as if he had fully baked,’ says one user in a Reddit chat on X, depicting the public sentiments about the company.

So, will the hard-working entrepreneur capture the imagination of the Indian stock markets as he brings Ola Electric Mobility public in the largest IPO of the year thus far?

There are several reasons why some experts or investors believe OLA Electric’s IPO will encounter considerable problems, maybe larger than Paytm or Zomato’s first public offerings.

Reason 1: Only growth; lack of path-to-profitability.

In FY24, the firm had sales of INR5,000 crore, a 90% increase over the previous year. However, it recorded losses of INR1,584 crore. Ola has reported losses for three years in a row despite staggering sales growth. Its operating revenue has grown, but so have its expenses, which include charges for technology, raw materials, and advertising.

Revenue from operations climbed by more than seven times in FY23 to ₹ 2,630.93 crore, up from ₹ 373.42 crore the previous year. For the three months ending June 2023, revenue from operations was ₹ 1,242.75 crore. However, the losses continue to pile up. In FY21, their loss was ₹ 199.23 crore, which increased to Rs784.15 crore in FY22 and a huge ₹ 1,472.07 crore in FY23. Net cash spent for operational operations increased to ₹ 1,507.27 crore in FY23 from ₹ 252.02 crore in FY21. The company has provided little guidance on what it intends to do to become profitable.

Meanwhile, advertising, marketing, and sales promotion consume a great amount of money. In FY23, ad and marketing costs were for 2.34 % (₹ 61.47 crore) of revenue from operations, a decrease from ₹ 49.24 crore or 13.23 % in FY22. Even while its spending on technology is growing, its share of the total revenue is decreasing as the pie grows larger. In FY21, technology expenses were ₹ 9.43 crore, accounting for 1091.55 % of revenue from operations. This increased to ₹ 98.3 crore in FY23, although it still only accounts for 3.76 % of revenue from operations.

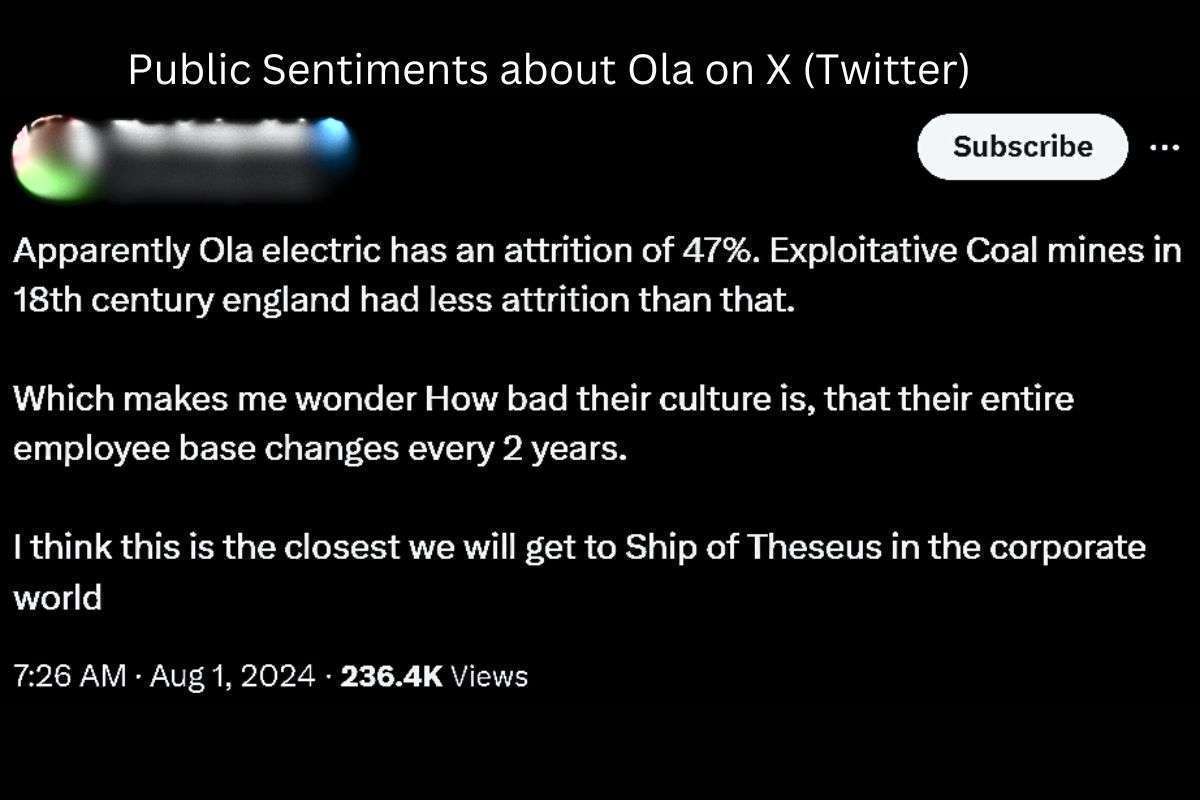

Another key parameter contributing to its financial losses is a high attrition rate. Its staff attrition rate was 42.06 % and 47.48 % for the seven-month period ended October 2023 (on an annualised basis) and fiscal 2023, respectively. In other words, Ola merely checks the proper boxes in terms of growth, not profitability.

Despite rising losses, Ola Electric maintained the market leader by volume in December and increased its market share to 40% in the EV two-wheeler sector. Ola increased its market share the highest, followed by Bajaj Auto, while TVS Motor had the greatest loss. Ola’s market share increased greatly as a result of the company’s strong marketing campaign, ‘December to Remember’, which gave aggressive discounts to customers and lowered product pricing.

Delhi saw the greatest increase in penetration, rising from 6.9 % in November to 19.8 %. So, this game of discounting is not going to work in the long run. While Ola was able to raise gross margins, other expenditures remained relatively stable at 29% of sales, resulting in Ebidta losses of 25% of sales, leaving Ola with little room for improvement in profitability.

Reason 2: Founder selling maximum shares.

What strikes out is that promoter Bhavish Aggarwal is offloading most shares in the OFS (Offer for sale). He plans to sell 4.73 crore equity shares through the IPO. As the only promoter with the greatest shareholding, selling almost 50 % of the total OFS shares, it raises concerns about Aggarwal’s confidence in Ola Electric’s company. Pre-IPO, Aggarwal owned 36.94 % of Ola Electric, with ANI Technologies and Indus Trust owning 4.35 and 3.85 %, respectively. Typically, promotors do participate in OFS during an IPO; however, in this case of Ola Electric, the promoter selling the most shares in the overall OFS is odd. It raises concerns about the promoter’s confidence and commitment.

Reason 3: Conflict of Interest and Reputation of Founder.

The firm is heavily reliant on the skills and reputation of Bhavish Aggarwal, the founder, chairman, and managing director of Ola Electric. He has a big impact on Ola Electric and ANI Technologies Private Limited, where he serves as chairman and managing director. Krutrim SI Designs Private Limited is his most recent venture. Ola Electric states in the DRHP that his engagement with ANI Technologies Private Limited and Krutrim SI Designs Private Limited may detract from the time that he may devote to the core firm.

Second, Aggarwal is a shareholder in Tork Motors Private Limited, which is in the same company as Ola Electric. “Any potential conflict of interest may have a negative impact on Ola’s business, prospects, operational performance, and financial condition,” the firm notes. The business claims it cannot guarantee that Aggarwal would not prioritise the interests of such other companies over those of Ola Electric.

To be honest, Ola Electric is a company with a difference. It represents Bhavish Agarwal’s penchant for taking big risks. He takes a unique approach to EVs and battery cells. In an industry known for its measured, slow-and-steady approach, he prefers sprinting all the time. But with speed come bumps. Ola Cabs has been diversifying. However, several of its operations (food delivery, foreign expansion, etc.) have closed or struggled due to significant losses, signalling the haphazard reputation of the founder that may trigger risks for the company.

Agarwal has failed to deliver on numerous of his tall claims, including a svelte car, sleek motorbikes or a global rollout. He’s missed production, sales, and other crucial deadlines while transitioning from one experiment to the next – ride-hailing, financial services, food, and now AI – with varied results. Such leaps of faith and irresponsible leadership will result in serious consequences for any public corporation. Finally, the method of price cuts for scaling carries its own set of hazards.

Reason 4: Competition from peers seems thrashing Ola’s dominance.

Ola has now captured a third of the E2W market in the year to March, representing a sixfold increase in only two years. With income rising 88% over FY23-24, Agarwal’s story is based on sales numbers driving margin gains. When the overall running costs are already two-thirds cheaper, according to Bloomberg NEF calculations, the appeal of e-scooters to the huge, price-sensitive middle class is also obvious. But this is when the energy source begins to fail.

Legacy peers like Bajaj and TVS, now second and third in the pecking order, have turned up the heat at the cost of market leader Ola, whose sales have halved in Q1FY25 (April-June 2024), according to Vahan statistics. Rajiv Bajaj, whom Agarwal challenged in a public debate, derived 14% of his revenue from E-variants with two and three Ws in the same June quarter. TVS IQube E-scooter sales have octupled in just 12 months, ending March 23. Second, even after six years of Sarkari subsidies, India’s E2Ws control just 5% of the entire scooter market, according to HSBC estimates. Ola’s disruption and dominance must be viewed through that lens.

EV technology is rapidly changing, and Ola Electric faces significant risk as it attempts to stay ahead of the technology race. The company also relies on investor funding because its operation does not generate cash flows. On the other hand, legacy players like TVS Motor, Hero MotoCorp, and Bajaj Auto, with their successful ICE (internal combustion engine) operations, are making a lot of money and using some of it to support their efforts to exploit new possibilities in electric vehicles. Therefore, Investors must recognise that investing in pure EV firms entails a greater risk.

Furthermore, as a new player in the EV business, Ola Electric has minimal experience producing, testing, delivering, and servicing EVs. While every EV it supplies must fulfil the applicable EV standards set by the Automotive Research Association of India and the Automotive Industry Standards as revised, these testing and approval methods may fail to detect and correct all latent, possible, and other problems.

Reason 5: The after-sales and service of Ola are not seen as good from the customer’s lens.

Ola’s warranty provision is 5.9% of sales, showing issues with product quality and after-sales. Ola’s after-sales service has sparked public criticism. While same-day service is common in the two-wheeler market, the firm has been chastised for lengthy repair periods and overcrowded service centres. Ola has since expanded its service centres from 431 to 600 between March and July 2024.

Reason 6: The swing of new-age startups between overvaluations and reductions in valuations.

Ola’s valuation has fallen by a quarter at the upper end of the price range and over 35% at the lower end in less than a year after marquee private investors like Temasek jumped in at a tantalising $5.4 billion. It’s crucial to investigate what has happened in the firm or the business strategy that has caused Aggarwal to lower his expectations. More so, when some of his late-stage backers are themselves taking some money off the table, some within couple of years after joining the cap table, even at a loss. Are they observing something in the organisation, like a major financial shortage, that we are not aware of?

Reason 7: Gigafactory- the biggest secret.

The largest undertaking at Ola Electric is undoubtedly battery cell manufacture. This is also founder’s passion project. The initial 6.4 GWH capacity planned for April 2025 is anticipated to cost roughly INR 3500 crore. Ola aims to increase the capacity to 20 GWH. The firm has had free cash outflows of roughly INR2,000 crore in the previous pair of years, and given that the enormous gigafactory will be ramped up and likely begin commercial production in the near future, we anticipate the company consuming a great amount of cash in the next two years. This signifies that the company will require a large amount of money. Aside from that, this endeavour poses a number of great hazards.

Ola aims to mass-manufacture a new technology format (4680 cells) but without the help of a technological partnership like Exide or Amara Rajas for lithium-ion batteries. Given this, there may be occasions when many problems arise, making resolution difficult and costly. Ola argues that its R&D prowess and vertically integrated technology and manufacturing skills, which include indigenous battery cell manufacture at its Giga plant, enable it to stand apart and decrease costs by a third. However, worldwide, battery technology is continually advancing. Lithium-ion is the finest chemistry available today, but it is pricey, import-dependent, and unstable (think scooter fires and regulatory penalties). Even Chinese engineers, who now dominate the EV industry, have yet to produce an alternative.

The 4680 cells can handle both LFP (lithium iron phosphate) and NMC (nickel manganese cobalt) chemistry. However, given Ola’s large capacity plans, persuading other manufacturers to buy cells from its manufacturing would be vital. This will only be achievable if Ola’s cells exhibit superior performance, dependability, and economic benefits in real-world applications.

The final brake.

With some of the tech startups selling below their IPO pricing, it’s understandable that investors believe unit economics is the most important indicator of efficiency. To be sure, they agree that fledgling firms may burn cash and generate losses, but only if these losses are due to fresh investments and each vehicle sold contributes positively to the bottom line.

Investors have been wary of the exorbitant valuations required by recent IPOs, particularly those of new-age businesses, despite losses or unimpressive profits.

Large new-age digital businesses, like Nykaa (FSN E-Commerce Ventures), Zomato, and Paytm (One97 Communications), that went public in 2021, fared poorly in the secondary markets, resulting in significant value loss for stockholders. For example, investors in One97 Communications’ IPO lost about 70% of their investment within 1.5 years after the offering. This made investors aware of the values of IPO-bound firms and raised concerns about their commercial prospects.

In the end, an impressive R&D expenditure is not enough; investors want to see what comes out of it. Without strong quality standards, a seasoned supply chain, a well-oiled governance structure, depth of distribution, and a churn rate that is more than four times industry averages, Ola could fall over while trying to grow, hence making OLA Electric IPO the biggest crash, bigger than Paytm & Zomato.