Modi 3.0’s First Union Budget Bears The Unmistakable Stamp Of Coalition Politics And Little Signs Of Learning!

In the Union Budget, in a balancing act, Nirmala Sitharaman prioritizes political alliances over comprehensive reforms, sidelining long-term growth and equity concerns. FM signals shift from earlier trickle-down strategy to a slew of schemes for unemployed youth, MSMEs, tax cuts for the middle class; tightens fiscal deficit target to 4.9% of GDP; promises next-gen reforms to be spelt out later.

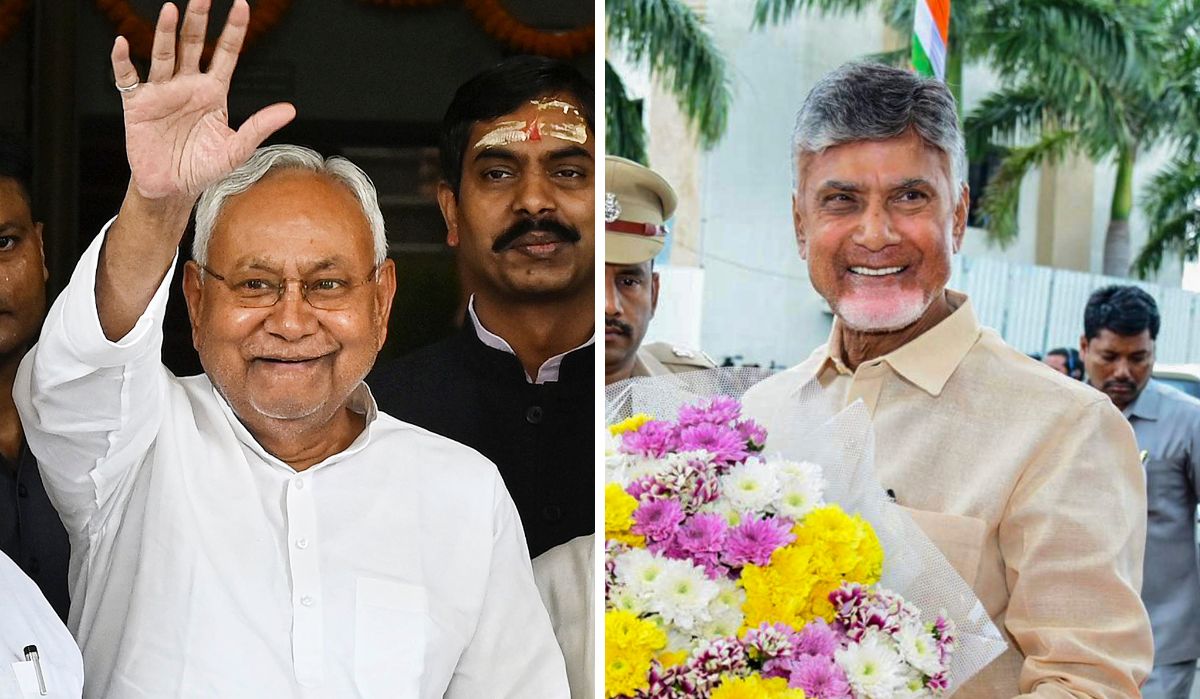

Modi 3.0 First Union Budget, An Appeasement Treaty With Bihar And Andhra?

Union Finance Minister Nirmala Sitharaman on July 23 announced significant income tax relief for the middle class, a Rs. 2 lakh crore allocation for job creation schemes over the next five years, and increased spending for states governed by her party’s new coalition partners, the Telugu Desam Party (TDP) in Andhra Pradesh and the Janata Dal (United) in Bihar.

This announcement came as part of the Narendra Modi 3.0 government’s first Budget following the 2024 general election.

With rural distress and unemployment contributing to the BJP’s loss of its majority, Sitharaman, in her seventh consecutive budget, allocated Rs. 2.66 lakh crore for rural development and maintained infrastructure spending at Rs. 11.11 lakh crore to spur economic growth.

Key measures in the Budget included the abolition of the “angel tax” for all startup investors, reductions in customs duties on mobile phones and gold, and simplifications in capital gains tax. However, an increase in the securities transaction tax (STT) on futures and options of securities led to a decline in stock markets.

India’s economy, the fifth largest in the world, is projected to grow at an annual rate of 6.5-7% in the fiscal year ending in March 2025. Despite this rapid growth, experts underline that the benefits are unevenly distributed, with wealth concentrated among the affluent while many Indians in the large informal sector face poor job quality and insecurity.

Subsidies to manufacturing have not sufficiently generated jobs, and inequality has surged over the last decade. According to the World Inequality Lab, the wealth concentration among the richest 1% of India’s population is at its highest in six decades.

“India’s economic growth continues to be the shining exception in a world gripped by policy uncertainties and will remain so in the years ahead,” Sitharaman stated. “In this Budget, we particularly focus on employment, skilling, MSMEs, and the middle class.”

She emphasized that Rs. 2 lakh crore had been allocated over five years for employment and skilling initiatives for 4.1 crore youth and that Rs. 1.48 lakh crore would be allocated for education, employment, and skilling.

Financial Aid for Andhra Pradesh and Bihar

For Bihar, where the Assembly election is approaching next year, Finance Minister Nirmala Sitharaman announced a Rs. 60,000 crore allocation for infrastructure projects, including expressways, a power plant, heritage corridors, and new airports.

The support comes in the form of capital projects rather than subsidies or cash grants. The ruling JD(U), a BJP ally, has long demanded an economic package and Special Category Status for Bihar.

Similarly, Andhra Pradesh, whose ruling TDP recently joined the BJP-led National Democratic Alliance, will receive Rs. 15,000 crore in financial aid through multilateral agencies. Sitharaman assured that a similar request for Bihar would be expedited.

Middle-Class Relief

For the middle class, Sitharaman increased the standard deduction by 50% to Rs. 75,000 and adjusted tax slabs for those opting for the new income tax regime.

The adjustment will result in annual tax savings of up to Rs. 17,500 for taxpayers under the new regime, which offers lower tax rates but limited deductions and exemptions.

Employment Generation

The primary theme of Budget 2024-25 is ‘EMPLOYMENT,’ addressing the concerns of various voter groups, including the young, the salaried class, farmers, and small entrepreneurs.

The acronym stands for Employment and Education; Micro, Small, and Medium Enterprises (MSMEs); Productivity; Land; Opportunities; Youth; Middle Class; Energy Security; New Generation Reforms; and Technology.

To stimulate employment, the Budget includes incentives for companies, such as paying one month’s salary for first-time employees, providing incentives for retirement fund contributions in the first four years of employment, and reimbursing employers up to Rs. 3,000 per month for two years towards the Employees’ Provident Fund Organisation contributions for each additional employee.

Additionally, the Budget includes programs to improve skills, internships for students, and subsidized loans for higher education.

Economic Context

After more than a decade in office, Prime Minister Narendra Modi faces pressure to generate more jobs to sustain economic growth.

Despite an official urban unemployment rate of 6.7%, private estimates, such as those from the Centre for Monitoring Indian Economy, place youth unemployment at 9.2% as of early July, accentuating the challenge of job creation in the world’s most populous country.

Thanks to solid tax collections and a higher-than-expected dividend from the Reserve Bank of India, Sitharaman announced that the government’s fiscal deficit will be reduced to 4.9% of GDP in 2024-25, down from the 5.1% estimated in the interim Budget presented in February.

She also marginally reduced gross market borrowing to Rs. 14.01 lakh crore.

Budget 2024-25 Allocations

For the fiscal year 2024-25 (April 2024 to March 2025), the Budget has allocated Rs. 1.52 lakh crore for agriculture and allied sectors.

It includes aid for building 3 crore affordable housing units in both urban and rural areas, credit support for small and medium businesses, and an increase in small loans to Rs. 20 lakh for small enterprises.

Additionally, it proposes the establishment of 12 industrial parks and a Rs. 1,000 crore venture capital fund for the space sector.

Defence Spending

The government has allocated Rs. 6.21 lakh crore for defence in 2024-25, an increase from last year’s outlay of Rs. 5.94 lakh crore. The capital outlay is set at Rs. 1.72 lakh crore.

The total allocation to the defence sector constitutes 12.9% of the overall Budget.

Defence Minister Rajnath Singh noted that the Rs. 1.05 lakh crore allocation for domestic capital procurement will boost self-reliance in the defence sector.

Energy and Environment

Despite being a significant emitter of greenhouse gases, the government plans to establish a new 800-megawatt coal-fired thermal power plant.

Additionally, Sitharaman announced support for developing small and modular nuclear reactors to meet future energy demands.

Flood Relief

The Budget has allocated Rs. 11,500 crore to address flood damage. India, highly vulnerable to climate impacts, has seen increased flooding due to extreme rains and glacier melt in recent years.

Census and NPR Update

The Budget has allocated Rs. 1,309.46 crore for the Census, a significant reduction from the Rs. 3,768 crore allocated in 2021-22, indicating that the decadal exercise might not be conducted in the upcoming fiscal year.

The Union Cabinet approved the Census of India 2021 at a cost of Rs. 8,754.23 crore and the update of the National Population Register (NPR) at Rs. 3,941.35 crore in December 2019. Initially scheduled for April 1 to September 30, 2020, the Census and NPR update were postponed due to the COVID-19 pandemic.

The Census remains on hold, and no new schedule has been announced. Officials noted that the recent general election would prevent the Census from being conducted in 2024. The entire Census and NPR exercise is estimated to cost over Rs. 12,000 crore.

Reactions to the Budget

Prime Minister Narendra Modi praised the Union Budget 2024-25, stating that it would drive economic development and empower all sections of society.

“This Budget will lead the country’s villages, poor, and farmers toward prosperity. It is a Budget for the continued empowerment of the newly emerged neo middle class,” Modi remarked.

BJP allies from Bihar applauded Finance Minister Nirmala Sitharaman’s announcements, with the JD(U) asserting that these measures will foster development and help the state become “aatmanirbhar” (self-reliant).

Bihar Chief Minister Nitish Kumar expressed that the “special help” announced in the Budget addressed the State’s concerns, which had previously prompted demands for Special Category Status.

The TDP also praised the Budget’s provisions for Andhra Pradesh.

Chief Minister N. Chandrababu Naidu said it would significantly contribute to the State’s development.

On X, Naidu thanked Prime Minister Modi and Finance Minister Sitharaman “for recognizing the needs of our State and focusing on a Capital, Polavaram, industrial nodes, and the development of backward areas.”

Leader of Opposition in the Lok Sabha Rahul Gandhi criticized the Budget on X, calling it a “kursi bachao [save government] Budget” and accusing it of making “hollow promises” to BJP allies at the expense of other States.

He also claimed that the Budget was a “copy and paste” of the Congress manifesto for the 2024 election and previous Budgets.

Congress party president Mallikarjun Kharge termed the Budget “copycat” and alleged it was designed not for the country’s progress but to “save the Modi government.”

In a post in Hindi on X, Kharge said,

“The Modi government’s ‘copycat budget’ could not even properly copy the Congress’ Nyay Patra! The Modi government’s budget is distributing half-hearted ‘rewadis (freebies)’ to deceive its coalition partners so that the NDA survives.”

He added that after 10 years, the Budget made limited announcements for the youth suffering from the unfulfilled “slogan of two crore jobs per year.”

Samajwadi Party president Akhilesh Yadav criticized the Budget for neglecting the interests of the youth and farmers.

Speaking to reporters, Yadav linked Sitharaman’s development measures for Bihar and Andhra Pradesh to the BJP’s political need to “save” its government and questioned the lack of provisions for Uttar Pradesh, India’s most populous state.

The Trinamool Congress attacked the BJP-led NDA government, stating that the Union Budget reflected the regime’s fiscal and political bankruptcy. In a social media post, the party referred to the Budget as the “Andhra-Bihar Budget.”

Trinamool national general secretary Abhishek Banerjee criticized the Budget, claiming that Bengal had been “consistently deprived” by the BJP government.

“Has there been a positive outcome of 12 BJP MPs elected from Bengal?” Banerjee asked outside the Parliament complex.

The Viewpoint

Evaluating the Union Budget 2024-25

The Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman, aims to address a broad spectrum of economic and social needs, balancing development initiatives with fiscal prudence.

Here’s an assessment of its strengths and potential shortcomings

Strengths of the Budget

1. Focus on Economic Growth

The Budget’s allocation of Rs. 1.52 lakh crore for agriculture and allied sectors, alongside aid for building 3 crore affordable housing units, indicates boosting rural and urban development.

These measures are likely to create jobs and stimulate economic activity.

The proposal to establish 12 industrial parks and a Rs. 1,000 crore venture capital fund for the space sector emphasizes industrial growth and innovation.

2. Support for Small and Medium Enterprises (SMEs)

Similarly, increased credit support and raising small loans to Rs. 20 lakh for small businesses will provide much-needed liquidity and help SMEs grow, which are crucial for employment generation and economic resilience.

3. Defence and Infrastructure Investment

The Rs. 6.21 lakh crore allocation for defence, including Rs. 1.72 lakh crore for capital outlay, stresses strengthening national security and promoting domestic defence manufacturing, aligning with the ‘Atmanirbhar Bharat’ initiative.

Likewise, continued investment in long-term infrastructure projects, such as expressways and new airports, will enhance connectivity and boost economic growth.

4. Middle-Class Relief

Raising the standard deduction to Rs. 75,000 and adjusting tax slabs for the new income tax regime will provide financial relief to the middle class, increasing disposable income and potentially boosting consumption.

5. Employment and Skilling Initiatives

The Budget’s emphasis on employment, with incentives for companies hiring first-time employees and initiatives to improve skills and provide internships, aims to tackle unemployment and enhance the employability of the youth.

Potential Shortcomings

1. Limited Addressal of Inequality

While the Budget includes measures for various sectors, it may not sufficiently address the deepening economic inequality.

Critics argue that wealth concentration among the richest 1% remains unchallenged, and more robust redistributive policies may be necessary.

2. Environmental Concerns

The plan to set up a new 800-megawatt coal-fired thermal power plant appears counterproductive to global climate goals. More aggressive investment in renewable energy sources and sustainability initiatives would be beneficial for long-term environmental health.

3. Insufficient Focus on Health and Education

Although there are provisions for education, the overall allocation might fall short of the transformative investment needed in both health and education sectors. These areas are critical for human capital development and long-term economic growth.

4. Uncertain Execution of Census and NPR

The significant reduction in allocation for the Census and the uncertainty surrounding its execution could delay essential data collection needed for effective policy planning and implementation.

5. Sector-Specific Gaps

Some regions and sectors, such as Uttar Pradesh, have raised concerns about being overlooked. Ensuring balanced regional development is vital for national cohesion and uniform economic progress.

The Last Bit, The Union Budget 2024-25 sets a comprehensive plan aimed at driving economic growth, supporting SMEs, and enhancing national security.

It provides significant relief to the middle class and focuses on employment and skilling. However, it could benefit from more targeted measures to reduce inequality, address environmental concerns, and ensure robust investment in health and education.

Additionally, regional and sector-specific gaps need to be addressed to ensure balanced and inclusive development.