Budget 2024 Hits Middle Class Hard, Favors Rich. Why Modi Government’s Budget 2024 Ignores Middle Class People’s Struggle!

Modi Government’s Budget 2024 Betrays the Middle Class. High Taxes, Empty Promises, and Job Crisis Highlight Aggressive Policies Favouring the Rich While Ignoring the Real Struggles of Ordinary Citizens.

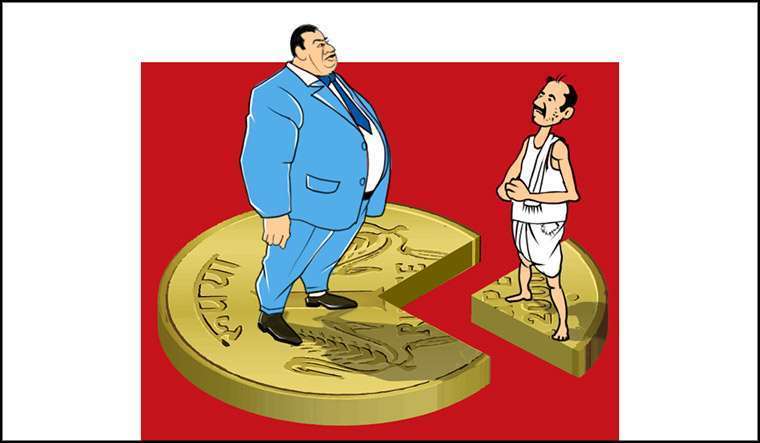

India’s income inequality is at an all time high. After seeing Budget 2024, a twitter user wrote on Twitter – Poor got subsidy, rich got rebate Middle class, you just watch TV, You got a debate!

Usually, the opposition criticises the budget. The ruling party supports the budget giving it 10/10 But this budget was not a common budget. There were many people who were hurt. But they had no option but to cry.

What has Nirmala done that left, right, centre, everyone is sad?

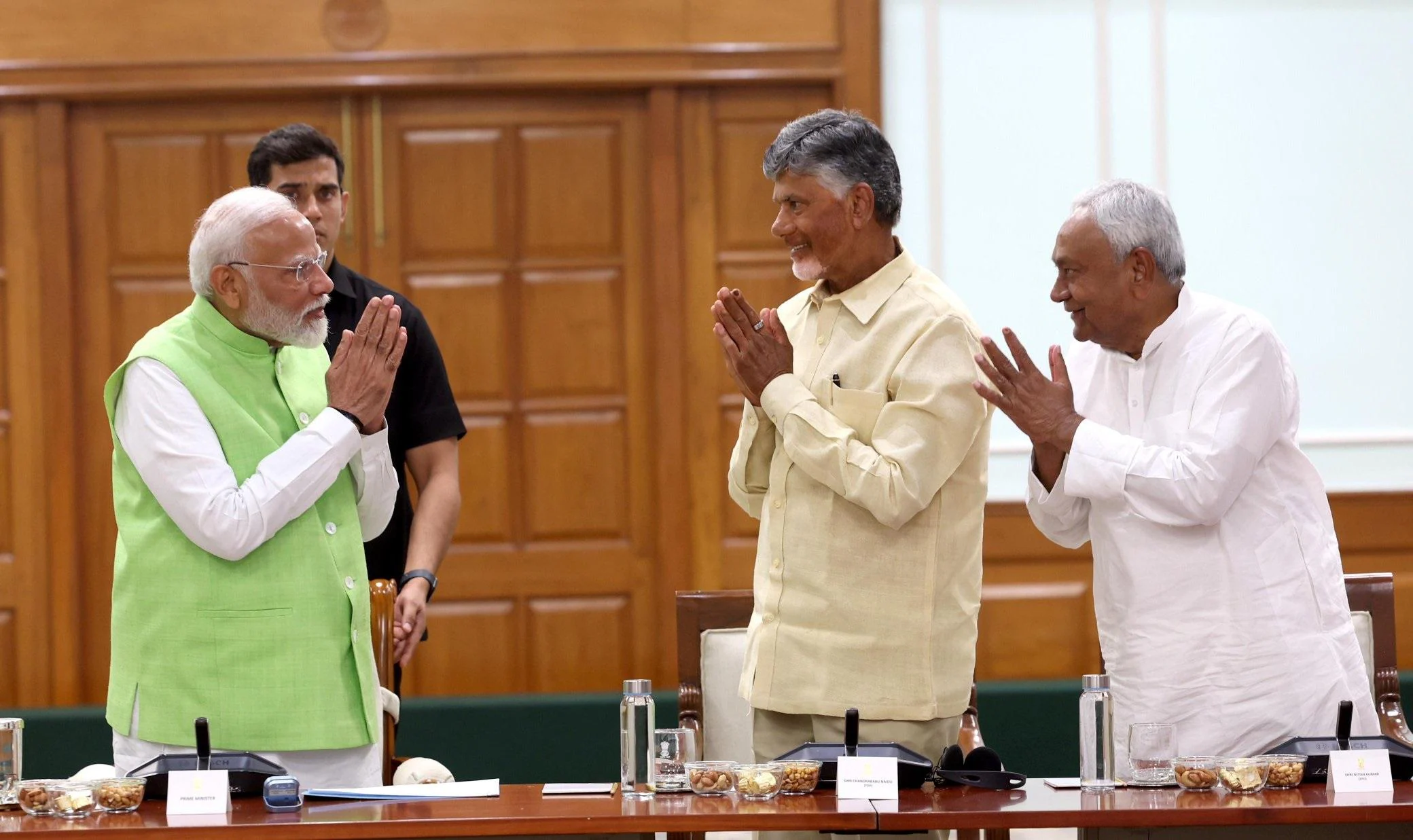

Why is this budget being called the Nitish Naidu budget?

How did the finance minister give 2 rupees in one hand and took 4 rupees from the other?

And good policy moves like angel tax, corporate tax, reopening of tax assessment cases.

Good things were seen but have lost the focus on capital gains, tax and indexation policy.

And how did the super rich of the country get saved again?

In Budget 2024, what is this for a common person? And why is this budget so bitter for the middle class?

After 10 years, for the first time, the government has at least admitted that there is an issue of FDI inflow and job creation.

It happened so that before the budget, the economic survey report was tabled and it was proposed that, take more money from China, take FDI from China, China’s units, their factories should be built in India. So that the Western nations, who do not want to do direct import, direct business with China, they take goods from India. Although the company will be in China.

This strategy is being used in desperation because FDI inflow has been the lowest in 16 years. Economic survey has also stated that India’s dream of a developed country is not going to be easy. The survey clearly states that companies are making a profit but the private sector is not creating jobs. Job creation should be their bottom line. Government is monitoring them. This jobless growth must be stopped.

For that, the economic policy states that the government is not alone responsible. Center, state, and private companies will have to come together to make a tripartite compact, an understanding which will increase the number of jobs in the country. And perhaps for the first time, social media was mentioned in an economic document.

Economic survey found that social media, screen time, sedentary habits, and unhealthy food is destroying the productivity of our country. Before the budget, one thing was clear to everyone as far as job creation is concerned, the government is also struggling. This has become such a big problem that no party has a simple solution to it.

The common man will have to pay taxes, at the same time, the common man will have to be self-reliant in the matter of jobs. After Make in India, Startup in India, the government has understood in 2024 that if jobs are not created, if jobs are not given, they will be out of the election. So, three initiatives have been announced in the budget.

- Scheme A is for first-time job holders in the formal sector. They will get a monthly salary of Rs 15,000. This will benefit 10 lakh youth, bringing them to the job market.

- Scheme B is an incentive for the manufacturing sector to give jobs to more people. This scheme will benefit 30 lakh people through EPFO contribution, people will get money in their accounts.

- Scheme C is for those who provide employment. Government will give Rs 3,000 per month to every new employee for 2 years. Employer’s EPF contribution will be reimbursed by the government. This will reduce the load on the employer and encourage them to hire more people.

Will this scheme will increase job opportunities? Or will 10,000 people come with CVs for 10 vacancies in the coming years?

They could have focused more on jobs, made bigger plans, invested more money. But it seems like they have to save their seats. That’s why Budget 2024 became Nitish Naidu Budget. Although elections are coming up in Haryana and Maharashtra, the government didn’t have that much money. So, focus on saving the NDA government.

Andhra Pradesh got 15,000 crore rupees in budget. grant for backward regions of Andhra Pradesh and Polavaram Dam project. Nirmala Sitharaman has announced new airports, medical college, sports infrastructure for Bihar. 26,000 crore rupees for Bihar highways like Patna Purnia, Baxar Bhagalpur and Bodhgaya Darbhanga Express.

Now, how will the government get money for all this?

Because the government hand is tight and the state of GST is such that the government says that there is no need to publish GST collection data. So, the solution is the same that has been going on for years. Take the middle class and squeeze them more.

The tax rates have now increased even more than the first world and the quality of life is worse than the third world. Every year, a middle class person thinks that this year they will get something in their pocket. Some benefits, some relief. Media says, masterstroke. The middle class becomes happy. This year, the biggest pocket cutter is standard deduction. That too, only for the new tax regime, where standard deduction has been made from Rs. 50,000 to Rs. 75,000.

A deduction on family pension for pensioners, that has been enhanced from Rs. 15,000 to Rs 25,000. New tax slabs have been announced, with slight changes. Nirmala Sitharaman says that this can save up to Rs 17,500. That’s the maximum. But there is one plus point that the government has finally put a 3-year time limit to reopen the reassessment cases.

Also, a big announcement has been made that Angel Tax has been abolished. This is the tax that startup companies used to get from investors. There was a heavy tax on this but it was imposed to stop money laundering. What happened is that the government strangled the small startups.

It’s a good thing that the government has understood that if they just step aside and don’t interfere in people’s work, then Indian businessmen will rule the world. Today, the businessmen who are successful are despite the government, not because of the government.

All this is fine, but what did the middle class get in the midst of all this?

Bad days of investors as Nirmala Sitharaman announced 12.5% long term capital gains on all financial assets including equity. This used to be 10% and now it is expected that this rate will continue to increase and short-term capital gains tax, which means, the profit you earn in less than a year, increased by 15% to 20%. Along with that, security transaction tax on futures and options transactions increased by 0.02% from 0.01%.

Nirmala Sitharaman has removed indexation on gold and real estate. The government has implemented a type of inheritance tax. The tax which was used to threaten people if Congress won the elections. The Modi government did the same.

Suppose your father bought a small house worth 15 lakhs. The value of the property is 1.5 crore after 30 years, say. If you had sold it till yesterday, you would have got 30 years of indexation benefit. But now, the entire tax on 1.5 crore will be imposed without indexation benefit. The government thinks that this will reduce real estate speculation.

But what will happen, as always, is that the cash component will increase again and the transparency will be eliminated. The sad part is that the Modi government talks big but can’t even touch the big people or show red eyes to big countries.

It is evident that India is the country with the highest wealth inequality. If small countries are ignored, the 1% population controls 40% of the wealth. And about the super-rich, they work in their own universe. But no one can even touch them to impose a super-rich tax, impose a super-rich cess.

China is the biggest economic and military threat to India. First India is importing things worth 100 billion dollars. Then it is calling China and asking for FDI. India is giving them easy visas. The Chinese companies that were banned, are now entering with Ambani. Why?

Does India don’t even have the ability to manufacture garments? Does India need a Chinese company for that?

The same China that kills Indian soldiers, enters Indian borders, ask votes for the army, but while the budget is coming in the name of increasing defence expenditure, what is received is not much.

So how will India defeat China, when the government is inviting them, not increasing their defence expenditure. Instead of ending dependency on China, the government is increasing it. And in the coming days, more such fake promises will be made from the budget.

Like, 1 crore youth will be made to do an internship in Fortune 500 companies with 5000 rupees allowance. Let’s do the maths, Fortune 500 companies do not employ 3 crore people in the world. And in one country, these Fortune 500 companies will give 1 crore people internships.

Who will ask these questions after 2 months? By then, a new trick will be prepared. But people should protect their careers and their pockets.