From “I Am A Fan Of Modi” To Elon Musk’s Cooling Intrest In India Vs China; Why Is Musk’s Tesla No Longer “Enamoured” With India And How India Has A Lot Of Catching Up To Do Compared To China

From making the big statement, “I am a fan of Modi,” to complete silence, Elon Musk has done a complete 180 when it comes to mega plans in India concerning the world’s most renowned EV Brand—Tesla.

Elon Musk in his visit to India had spoken extensively about Tesla’s plan to enter the Indian market has unexpectedly stalled after Elon Musk cancelled his trip to India in April and went to China instead.

Since then, according to most media reports, Tesla’s executives have stopped communicating with Indian officials, leading to the belief that Musk has no immediate plans to invest in India.

Tesla had been eyeing India, the world’s third-largest automobile market, for expansion; however, the plan was put on hold after the Indian government insisted that Tesla manufacture cars locally, similar to its operations in China.

However, Tesla wanted to test the Indian market and, hence, preferred to import vehicles initially; Musk had previously stated that Tesla would enter the Indian market “as soon as humanly possible” following a meeting with Indian Prime Minister Narendra Modi during Modi’s state visit to the US last year.

Musk then praised Modi for encouraging significant investments in India and expressed much enthusiasm for the country, which has since dissipated.

In April, it was reported that Tesla planned to invest $2 to $3 billion and build a new factory in India, with an announcement expected after Musk’s meeting with Modi; however, Musk cancelled the visit, citing pressing obligations at Tesla, and expressed his hope to visit India later in the year.

Much to everyone’s surprise, the unpredictable billionaire made an unexpected trip to China just a week later.

Going To China Instead

Going To China Instead

Musk’s visit to China, rather than India, was necessary for Tesla. The visit reportedly helped Tesla overcome regulatory challenges related to launching its self-driving software in the country, a key market for the company.

Musk met with Chinese Premier Li Qiang, and shortly afterwards, Tesla’s Model 3 and Model Y vehicles passed the country’s data security requirements.

India, Moving On

Now that Tesla has cooled its interest in India, officials stated they are looking to domestic car makers to boost electric vehicle production.

However, they added that Tesla would still be welcome to take advantage of a new import tax policy if Musk decides to re-engage.

Tesla’s apparent withdrawal from India coincides with the Model Y being made available for government purchase in China, according to state news outlet Paper.cn.

The Model Y, a fully electric compact crossover SUV, has been included in a list of electric and hybrid vehicles that local governments can purchase for service cars.

However, India still likely remains on Musk’s radar as he congratulated Modi after his swearing-in as prime minister for the third time last month.

“Congratulations Narendra Modi on your victory in the world’s largest democratic elections! Looking forward to my companies doing exciting work in India,” he wrote on X.

Modi responded, saying,

“Indian youth, our demography, predictable policies, and stable democratic polity will continue to provide the business environment for all our partners.”

India EV Market

India EV Market

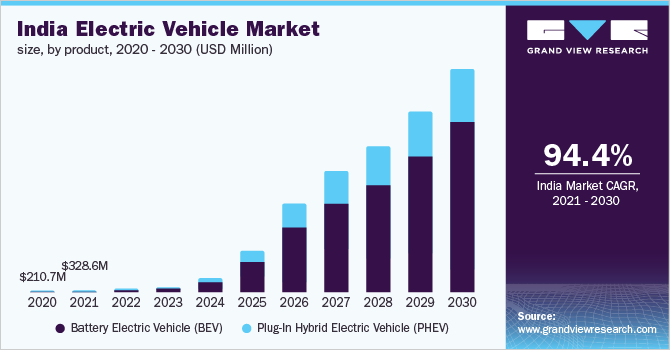

India’s electric vehicle market is small but growing, currently dominated by local carmaker Tata while the Modi’s government is targeting 30 percent of new cars to be electric by 2030, up from about 2 percent currently.

It should be noted that in recent years, Musk has opposed India’s high import taxes on electric vehicles and lobbied for change.

However, in March, the Indian government introduced a new policy that proposed cutting import taxes from as high as 100 per cent to 15 per cent on specific models, provided Tesla invests at least $500 million and establishes a factory in the country.

According to recent reports, India is likely to change its new electric vehicle (EV) policy to incentivize automakers that have already invested in the country (this is in the backdrop of Tesla’s not having made any firm commitment to building a factory in India).

The policy, which aims to accelerate the local manufacturing of high-end electric cars, currently supports only fresh investments even as consultations are ongoing with stakeholders on other vital issues troubling carmakers.

Govt Likely To Look At SOPs

Govt Likely To Look At SOPs

The government is currently considering making investments in plants that produce both internal combustion engine (ICE) and electric vehicles (EVs), which are eligible for incentives.

The latest move aims to scale up production and make large investments more viable for automakers companies like Volkswagen-Skoda, Hyundai-Kia, and VinFast, which have already shown interest in the new Scheme for Manufacturing of Electric Cars (SMEC).

However, the automakers have raised two major concerns – the scheme should consider current investments and include plants producing petrol and diesel cars along with EVs, since EVs currently have a small share of India’s passenger vehicle market.

Despite the new scheme, no automaker has officially commented on participating in the EV scheme since its announcement on March 15.

Under SMEC, the government will allow imports of completely built-up EVs with a minimum cost, insurance, and freight value of $35,000 at a 15% import duty for up to five years if companies invest at least $500 million in building new plants.

The govt is also consulting with industry stakeholders to make the scheme more attractive to legacy automakers, even as in April, Tesla CEO Elon Musk postponed a trip to India, during which he was expected to announce Tesla’s plan to set up an EV factory- this could include allowing investments in facilities manufacturing both ICE and EVs.

Initially, SMEC guidelines stated that only companies investing in greenfield plants for EV manufacturing within three years of government approval would be eligible for incentives.

There is currently no provision for considering past investments for local EV production. The government is now considering changes to make the scheme appealing to traditional companies as well, including specifying a backdate for investments in high-end EV manufacturing.

This adjustment could make firms like VinFast eligible for incentives under SMEC; notably, the Vietnamese carmaker has already started building a new plant in Tamil Nadu and announced plans to invest $500 million over five years in India.

The government is currently preparing standard operating procedures (SOPs) for implementing the Scheme for Manufacturing of Electric Cars (SMEC).

An official familiar with the matter stated,

“Some legacy companies interested in the scheme have raised concerns about the required investment levels for EV-only facilities. The market for high-end electric vehicles, priced above Rs 25 lakh, is very small in India. To commit investments of Rs 4,000 crore, one needs scale, and scale is limited at the Rs 25 lakh price point in the Indian market.”

The initial focus on greenfield EV plants under SMEC was primarily to ensure accurate assessment of local content by companies.

According to the scheme, companies are required to produce electric cars with 25% local content initially, increasing to 50% by the fifth year.

Auto companies and component manufacturers will need to calculate the domestic value addition (DVA) across their supply chain and present these details to vehicle testing agencies for evaluation.

China’s Advanced EV Manufacturing and Manufacturing Sector

China’s Advanced EV Manufacturing and Manufacturing Sector

Compared to India, China has long established itself as a global leader in electric vehicle (EV) manufacturing and the broader manufacturing sector.

What has worked for China is the significant government support, a well-developed supply chain, and substantial investments in technology and infrastructure.

China is currently the largest market for electric vehicles, accounting for over half of the world’s EV sales, and the country’s emphasis on green technology has led to the widespread adoption of EVs, which are equally supported by strong government policies and incentives.

Companies like BYD, NIO, and Xpeng are at the forefront of EV innovation, producing a wide range of high-quality electric cars that compete globally.

These companies have also invested heavily in research and development, resulting in cutting-edge technology and significant market share.

Likewise, China has developed a comprehensive ecosystem for EVs, including extensive charging infrastructure and battery recycling facilities. The government’s support in building a vigorous network of charging stations has eased consumer concerns about range anxiety, further boosting EV adoption.

Moreover, China’s well-integrated supply chain ensures the efficient production of EV components, including batteries; the country is home to some of the world’s largest battery manufacturers, such as CATL, which supply both domestic and international markets.

Therefore, as one can see, India lags significantly behind in all these parameters.

Advanced Manufacturing Sector

China is known as the “world’s factory” due to its vast manufacturing capabilities. The country’s manufacturing sector is highly advanced, with state-of-the-art facilities and cutting-edge technology.

Chinese manufacturers benefit from economies of scale, allowing them to produce goods at lower costs. This efficiency is driven by large-scale production, skilled labor, and advanced automation.

The Chinese government has played a crucial role in the advancement of its manufacturing sector, providing subsidies, tax incentives, and investment in infrastructure. This support has enabled rapid industrial growth and technological advancement.

India’s Challenges and the Road Ahead

While India has made significant strides in manufacturing and is working towards becoming a major player in the EV market, it still needs to overcome several challenges compared to China.

The Indian market for EVs is still in its nascent stages. High costs, limited infrastructure, and consumer skepticism about electric vehicles have slowed adoption, and the market for high-end EVs, in particular, remains very small.

Additionally, compared to China, India’s supply chain for EV components is not as developed and relies heavily on imports for key components like batteries, which increases costs and hampers local manufacturing capabilities.

The lack of a comprehensive charging infrastructure is a significant barrier to EV adoption in India. While efforts are being made to build charging stations, the network is still insufficient to support widespread use.

Although the Indian government has introduced policies and incentives to promote EV manufacturing, they are not yet as extensive or effective as those in China. More research, development, and infrastructure investment are needed to boost the sector.

While growing, India’s manufacturing sector still lags behind China in terms of technology and skilled workforce. If India wants to be reckoned with on the global stage, it needs to make significant investments in education, training, and technological upgrades to compete globally.

The Bottom Line, while India has the potential to become a significant player in the EV and manufacturing sectors, it has a long way to go to match China’s level of advancement.

The Bottom Line, while India has the potential to become a significant player in the EV and manufacturing sectors, it has a long way to go to match China’s level of advancement.

To put it straightforwardly, we are still struggling to build infrastructure at basic levels: roads, bridges, highway infrastructure, etc., are in a grim state.

Thus, we have a long way to go in the context of EVs.

However, India can still accept the challenge with continued government support, infrastructure investment, and strong supply chain development, these parameters will be critical for India’s growth in these areas.