HFCL Sript Will Be The Next Multi-Bagger For The Investors

HFCL is a dynamic and technology-driven enterprise, providing next-generation communication products and integrated network solutions to the telecom, defence, and railway sectors. It focuses on innovation, seamless execution, and strong industry collaborations. The company has established a distinguished position in its core domains. It has five manufacturing facilities and serves over 45 countries.

It is the leading manufacturer of optical fibre, with a market share of more than 50% in India. It has delivered over 5 lakh units of proprietary backhaul radios to various TSPs since its inception. It had forged a technology partnership with Qualcomm to develop 5G Radio Access Network products. Collaborated with Microsoft to establish enterprise 5G networks using HFCL-manufactured equipment.

It had secured governmental approval for a production-linked incentive of 653 INR crores for telecom equipment. It deployed Wi-Fi 7 access points with 10 Gbps throughput (the commercial launch is likely to happen in Q4 FY24). It achieved unparalleled cost competitiveness through high levels of backward and horizontal integration.

It had clocked an export revenue CAGR of 88% over the last three years and expanded into the UK, France, Germany, and Australia. It had established a strong sales network across Europe and North America. It developed specialised cables tailored for the UK and US markets. It was engaged in implementing a high-bandwidth fibre optic communication network for the Indian Army and the Indian Air Force. It was engaged in executing an FTTH network rollout across 200+ cities in North India.

It began a 1,770 crore INR water pipeline project in Uttar Pradesh, including provisions for laying optical fibre cables. The engineers designed cost-effective yet cutting-edge border surveillance radar technology. It designed a 12-micron core-based thermal weapon sight for defence forces, a feat achieved by a few global companies.

It had completed the telecom network deployment for Mauritius Metro Phase 1. It had executed a telecom network for Dhaka Metro Phase 1 and began Phase 2. It secured contracts for telecom network implementation in the Agra-Kanpur Metro, Delhi Metro, and Surat Metro.

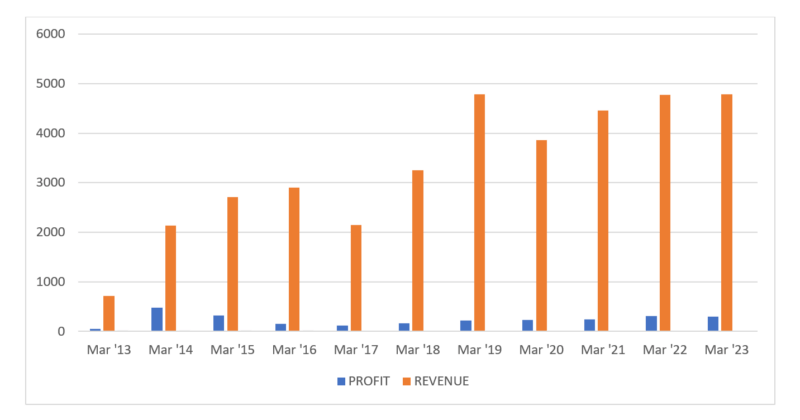

Financials

The HFCL financials are very good, and their revenue increased from 714 INR crores in FY13 to 4790.50 INR crores during FY23 and showed a rapid growth of 570X times, and their profit zoomed from 56.4 INR crores in FY13 to 301 INR crores in FY23 with a growth of 433.68X times. The financials are very strong and show good resilience.

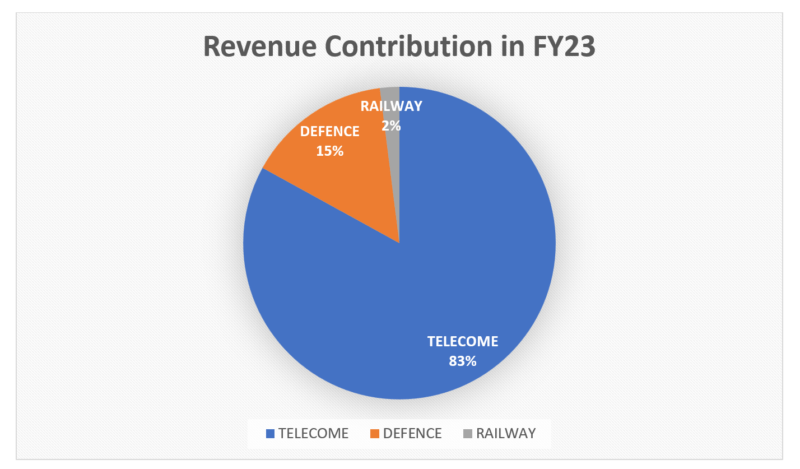

Revenue segment contribution

Telecom

The telecom segment is the highest revenue generator for HFCL, which contributes 83% of revenue, and this segment would have sharp growth. More than half of the Indian population are active Internet users. India has the second-largest 5G network in the world. The penetration of private players for giving new connections to fixed broadband is high, and this all needs the key infrastructure of optical fibre, which is important.

HFCL is the market leader, having more than 50% of the share and having a strategic partnership to supply all the telecom players in India. In-house development of new products with strategic tie-ups with Qualcomm, AMD, and Microsoft will add more revenue and growth by diversifying itself into new products and technology. By the push from the government to transform India into more digital.

HFCL is the key player in the transformation, and we will see more revenue generation in this segment. The world is still transforming into 5G, and at HFCL, 88% of revenue comes from exports. So, we can see more revenue in the upcoming quarters. It produces routers, Wi-Fi access points, switches, modular boxes, and tools for optical fibre. In the future, revenue from telecommunications and optical fibre will increase.

Defence

Defence contributes 15% of its revenue. It produces electronic fuses, electronic optics, high-capacity radio relays, and ground surveillance radars. HFCL is listed on the NATO database. India is pushing more on ATMANIRBHAR to produce more in-house technology and products. It was a great advantage for HFCL in the defence segment.

India is now becoming a net exporter of defence rather than only a net importer in the previous era. This could allow HFCL to market defence technology and products to the more friendly diplomatic nations in India. This would be the segment that could see sharp growth.

Railways

Railways contribute 2% of their revenue. It is the key player in telecommunication in railways and has given telecommunication to a few metro projects. 90% of Indian railway tracks have been electrified, and railways are using more technology for the safety of trains and the uninterrupted speed of trains on tracks. This would be a great advantage for HFCL to get more telecommunications orders from Indian Railways.

Order Book

Their order book has received orders worth more than 7,000 INR crores. It shows the strength of a company and its strong bonding and trust with clients.

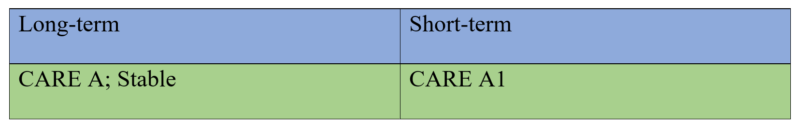

Credit Rating by CARE

The credit rating by CARE tells us the company is in a good position, and its products and technology have a good future and market. They are very strong in financials, and the company is in a good position to move on the right track. These positive ratings help them to raise more capex in the future.

Debt

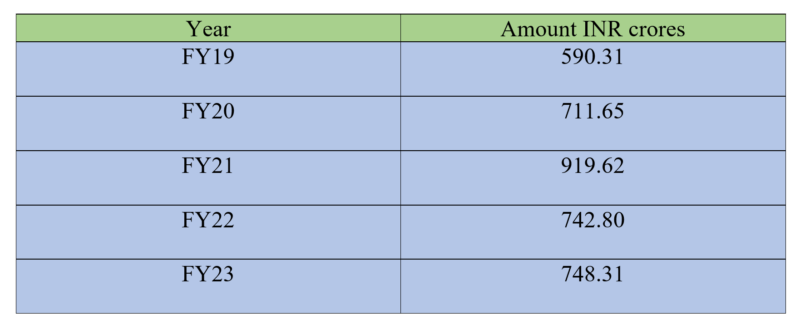

HFCL reduced their debt from 919.62 INR crores in FY21 to 748.31 INR crores at present. It shows the strong growth of the company and the commitment of their management towards the company, and even though the company needs much more capital to invest in R&D and manufacturing to cater for the growth and needs of clients and the market at present, it will boost the confidence of investors.

Management

Mahendra Nahata had transformed HFCL from small SMEs to global MNCs. Reducing a debt burden on the capex burner is always a difficult task. Winning strategic partnerships with Qualcomm, Microsoft, and AMD to develop in-house, more advanced technologies wins the hearts of every stakeholder and industry player. It was spreading the marketing team of a network throughout the world. Through the visionary future of the management, HFCL became the market leader and has more than 50% of the market share for optical fibre in India..

Industry

The industry is good and developing rapidly, and there are no big players from India in technology development. The world is transforming from 4G to 5G right now. India’s smartphone and data consumption are very high. FTH players are spreading their network coverage to more places day by day. The government has permitted the launch of satellite direct-home internet for players like Jio and Airtel. Amazon and Starlink are waiting for approval. The players are already developing 6G technology. The industry is the very best and has a high scope for growth and expansion. Technology plays an important role in the development of the world economy.

Economy

India’s economy is very strong and growing at an average of 6.8%, according to the report of the IMF. China and India together contribute more than half of global economic growth. There is strong propaganda that the world would be hit by an economic recession, but there is no impact on India because it is a consumption-based, market-driven economy and everyone in the world wants to market their products in India. India is shifting its position towards transforming poor people into middle-class people and middle-class people into rich people.

There is no doubt that the geo-political strategic foreign policy for building diplomatic relations wing big trade deals. Hosting the G20 successfully, India, by winning the hearts of world leaders, would strengthen our trade deals and economy. Even though some parts of the world are already in a recession, they are coming out of it.

This modern digital economy is different because the good is produced and finally finds its path to the end consumer, but sometimes the good faces challenges in the process of production to reach the ultimate consumer, but it finds a way to reach the whole economy surrounded by that ecosystem, and it is fine, but we can see distractions sometimes in the middle. Once the dark clouds of fear and struggles in the circular process of product development are clear, then the world economy will be booming.

Why the HFCL script will be the next multi-bagger for the investors

- In a decade, it clocked growth of 570x times in revenue and 433.68x times in profit.

- The debt of the company is shrinking rapidly, even though the industry is a big capex burner.

- The market leader in optical fibre has a commanding market share of more than 50% in India, and India is transforming rapidly into a digital economy.

- An increase in 5G implementation and the growth of FTH users will increase sales.

- Optical fibre is like a precious commodity that connects everything and everyone in the future, and this segment alone will make miracles for the company.

- Indian railways are modernising their network and communications to fix bugs for the safety and uninterrupted movement of trains, so there is huge scope to expand.

- HFCL has been exempted by the European Commission from the provision of anti-dumping duties imposed on imports of Indian optical fibre.

- strong in-house R&D team and collaboration with Qualcomm, AMD, and Microsoft to develop indigenous new products.

- The defence sector contributes 2% of the company’s revenue, but electronic fuses, electronic optics, high-capacity radio relays, and ground surveillance radars are the best products. We see the allocation of money increase every year from the government. It had a great scope to sell the Indian defence and their strategic diplomatic countries to the world.

- If we compare revenue, profit, and nature of business with the share price of HFCL, the share of HFCL is undervalued at present.