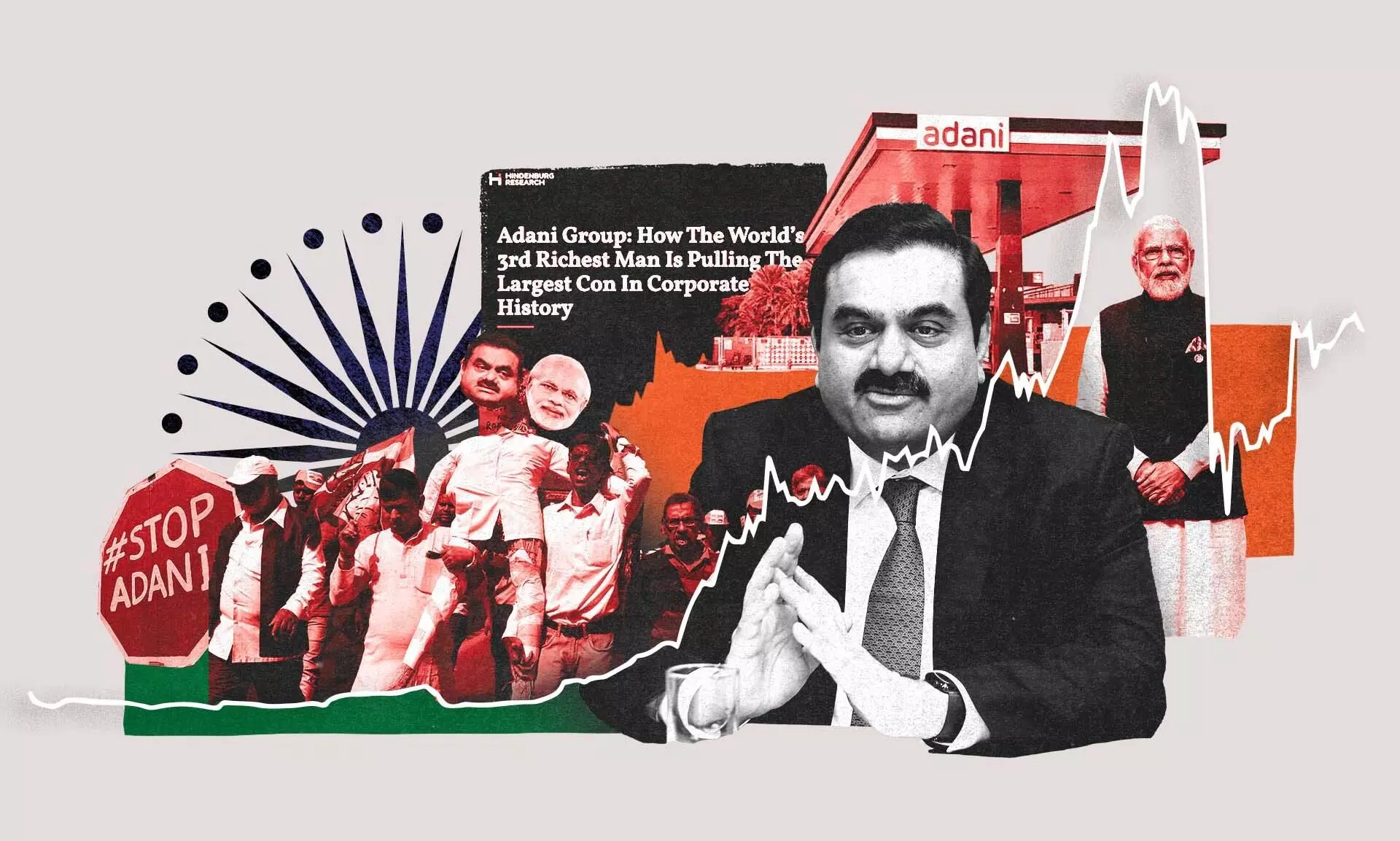

Adani Under The Scanner Once Again This Time OCCRP Report Alleges Huge Scam In The Supply Of Coal By Adani; Case Of Smoke Without Fire? And Why Are Indian Investors Still Upbeat On Adani Group Stocks?

Burning coal produces carbon and harms the environment; we know that, but passing lesser grade coal as premium and charging triple the price of the same seems to be Adani’s game!

In yet another exposé on Adani, it claims that at least 24 shipments that landed on the Tamil Nadu coast between January and October 2014 were originally priced as low-quality coal but ultimately sold by the Adani group to the State’s power utility at triple the cost.

The third such report on Adani by the Organized Crime and Corruption Reporting Project, OCCRP (the previous one provided fresh insights into stock market allegations) regarding the low quality of coal being supplied by the Adani group has once again ruffled the feathers in political and bureaucratic circles.

The issue of low-quality coal and the resulting environmental degradation has been a recurring concern in Tamil Nadu.

This investigation reveals that at least 24 coal shipments which arrived on the Tamil Nadu coast between January and October 2014 were initially priced as low-quality coal.

Report Details from OCCRP

Report Details from OCCRP

On January 9, 2014, the bulk carrier MV Kalliopi L arrived at Ennore port after a two-week journey from Indonesia, carrying 69,925 tonnes of coal intended for the state’s power company, according to OCCRP.

The paperwork for this shipment took a more complicated path, passing through the British Virgin Islands and Singapore.

During this process, the price of the coal surged to $91.91 per tonne, and its quality inexplicably upgraded from low-grade steam coal to the high-quality type preferred by power companies.

Before the shipment reached Tangedco, the paperwork passed through a middleman, Supreme Union Investors Ltd, a company registered in the tax haven of the British Virgin Islands.

Supreme Union Investors issued an invoice for the shipment to Adani Global PTE Singapore, the group’s regional headquarters, listing the unit price as $33.75 per tonne and the quality as “below 3,500” kilocalories per kilogram (kcal/kg), classified as low-grade.

However, when Adani Global invoiced Tangedco for the same shipment a month later, the unit price had dramatically increased to $91.91 per tonne, and the coal was now listed with a calorific value of 6,000 kcal/kg, indicating a high-quality form relatively free of impurities.

The Proof

The Proof

The evidence supporting these claims comes from various sources, including invoices and banking documents from multiple jurisdictions, details from investigations by India’s Directorate of Revenue Intelligence (DRI), leaked documents from a key Indonesian coal supplier for Adani, and a collection of documents obtained from Tangedco.

The DRI, operating under the Union Ministry of Finance, began investigating nearly a decade ago to determine if the Adani group and other companies had used offshore intermediaries to inflate coal prices supplied to utilities.

However, Adani won a case in the Bombay High Court that prevented the DRI from obtaining details about shipments, including types of invoices like those obtained by OCCRP from abroad.

The DRI has since filed an appeal in the Supreme Court.

Arappor Iyakkam stated that the OCCRP report had supported its request for an investigation into the coal import scam involving Tangedco, in which the Adani group sold low-quality coal imported from Indonesia at an exorbitant price.

Jayaraman Venkatesan of Arappor Iyakkam stated that between 2012 and 2016, Tangedco imported substantial quantities of coal for power plants—totalling 2.44 crore tonnes from companies such as Adani Global Private Limited, Knowledge International Strategy Systems, Chettinad Logistics, MMTC, and MSTC. Of this, 49% was supplied by Adani Global.

Jayaraman emphasized that the quality of coal is crucial as it affects the physical weight.

According to tender norms, imported coal should have 6,000 kilocalories per kilogram (kcal/kg), but in reality, only 4,500 kcal/kg of poor quality coal was supplied, leading to significant losses for the Electricity Department.

Jayaraman also stated that their allegations of Adani supplying poor-quality coal to Tangedco (confirmed by the OCCRP report). Despite this, no action has been taken to even file a First Information Report (FIR).

However, a complaint filed with the Directorate of Vigilance and Anti-Corruption (DVAC) regarding the coal transport scam resulted in an FIR and raids on retired officials of the Electricity Department.

Tangedco initiated an investigation, but the findings have not been disclosed.

In July 2021, the then Electricity Minister, V. Senthilbalaji, reported that 2.38 lakh tonnes of coal worth Rs. 85 crore had gone missing from the North Chennai thermal power plant.

Tangedco officials confirmed that low calorific coal was often passed off as high calorific coal by the supplier, leading to the ‘loss’ of coal.

G. Sundararajan of Poovulagin Nanbargal noted the severe environmental pollution caused by burning low-quality coal.

In environmentally sensitive areas like Ennore, the Electricity Department has not only suffered financial losses but also caused significant environmental damage.

He urged the State government to initiate a probe and penalize Adani for the financial and environmental harm caused.

When questioned by OCCRP about the findings, an Adani spokesperson denied the allegations, calling them “false and baseless.”

The Same Pattern

The Same Pattern

However, the data uncovered by journalists mirrors the patterns outlined in a 2016 notice by the Directorate of Revenue Intelligence (DRI), detailing an industry-wide investigation into multiple Adani Group companies and other entities for suspected manipulation of coal prices and calorific values.

The DRI suspected that coal was directly transported from Indonesian ports to India, while import invoices followed intricate routes.

These invoices traversed through one or more intermediaries in global financial centers like Singapore, Hong Kong, Dubai, and the British Virgin Islands before reaching the buyer via Adani Global.

In its 2016 notice, the DRI highlighted the discovery of dual sets of test reports for shipments, with one indicating lower gross calorific value (GVC) and the other showing higher GVC, a significant finding indicating potential irregularities.

However, Adani obstructed the DRI’s attempts to gather more information about shipments in other jurisdictions through legal action.

At the DRI’s behest, a Mumbai court issued formal requests in 2017 to courts in Hong Kong, Switzerland, UAE, and Singapore, seeking assistance in accessing information held by Adani subsidiaries, including shipment details, associated invoices, and payment proofs.

Yet, Adani Group contested the DRI’s requests for its business records the following year. The Bombay High Court ruled in Adani’s favor, compelling the DRI to withdraw its requests.

Subsequently, the DRI appealed the court’s decision to India’s Supreme Court, initiating a protracted legal process. Adani reportedly took three years to file a counter affidavit to the DRI’s appeal, contributing to the sluggish pace of the case. The next hearing is scheduled for August 6.

No Effect On Indian Investors

No Effect On Indian Investors

Despite repeated attacks on the Adani Group by foreign media organizations such as The Financial Times and the George Soros-backed OCCRP, Indian investors are showing little concern as the group’s stocks continue to soar.

The market appears to have become immune to these allegations, with Adani Group’s market capitalization surging by over Rs 11,000 crore on Wednesday alone, reaching a total of $200 billion (more than Rs 16.9 lakh crore).

Adani Group’s stock, Adani Power (NS:ADAN), closed at a record high, experiencing a 2.1% increase from the previous day’s closing price.

Market experts suggest that these reports have had minimal impact on Adani Group stocks, as investors tend to assess the situation thoroughly before forming their judgments.

This marks the third occasion where The Financial Times and OCCRP have collaborated to publish negative reports about the Adani Group, leading investors to suspect a deliberate effort to influence stock prices.

However, many are questioning the timing of the latest report, which coincides with ongoing general elections and raises questions about its motives.

Moreover, the transactions mentioned in the reports, dating back a decade, are perceived as posing minimal risk to the stocks.

The recent reports from these Western media outlets accuse the Adani Group of selling low-grade imported coal in India at high-value coal prices, some of which allegedly occurred during the UPA government’s tenure.

Despite these allegations, investors continue to see strong value in Adani Group stocks, with the group’s market capitalization witnessing a remarkable 57% increase over the past year, now reaching $200 billion.

Repeated Targeting of Adani by OCCRP and Others

Repeated Targeting of Adani by OCCRP and Others

1) How and why is it that Adani is repeatedly targeted by OCCRP and others?

Is it a case of smoke without fire, or are there irregularities in Adani Group’s dealings?

The repeated targeting of Adani Group by organizations like OCCRP raises questions along two lines –

1) About the motivations behind these investigations.

2) Is Adani really guilty

While it’s possible that these reports could be fueled by genuine concerns about potential irregularities or unethical practices within the Adani Group, it’s also important to consider the possibility of bias or ulterior motives behind such targeting.

Adani Group’s rapid expansion and dominance across various sectors may have attracted scrutiny from investigative bodies, especially if there have been past instances of regulatory violations or controversies.

However, it should be noted that the Adani group has been repeatedly spoken about regarding the ‘favouritism’ card and ‘crony capitalism’.

2) Is the timing of the report aimed at swaying the elections away from BJP?

2) Is the timing of the report aimed at swaying the elections away from BJP?

The timing of negative reports targeting Adani Group, especially during sensitive periods like elections, raises suspicions about potential political motivations.

While it’s conceivable that certain entities may seek to influence public opinion or sway electoral outcomes through negative media coverage, it’s crucial to assess the credibility and substance of these reports independently.

Political considerations aside, the timing of the report should not detract from its merit or validity.

Instead, it spears the need for transparency and accountability in corporate and political spheres alike.

Moreover, the impact of such reports on electoral outcomes is contingent on various factors, including public perception, media coverage, and the overall political climate, making it difficult to attribute causality solely to the timing of the report.

3) Why do Indian investors pay no heed to these reports and continue to show support for Adani stocks?

3) Why do Indian investors pay no heed to these reports and continue to show support for Adani stocks?

The resilience of Indian investors in supporting Adani stocks amidst negative media coverage suggests a level of confidence in the fundamental strength and growth prospects of the Adani Group.

Despite the allegations and controversies surrounding the group, it seems that investors are prioritizing factors such as financial performance, market dominance, and growth potential when making investment decisions.

Additionally, Indian investors may be viewing foreign media reports with skepticism, considering potential biases or agendas behind such coverage.

Furthermore, the lack of concrete regulatory action or legal repercussions (no action on the part of the government and regulatory authorities) stemming from these reports may contribute to investor confidence in Adani Group’s resilience.

However, still it is essential for investors to remain vigilant and critically evaluate information from multiple sources to make informed investment decisions and mitigate risks.

The Last Bit, Whether one remains steadfast in their confidence in Adani Group or chooses to doubt their dealings, one thing can be said- nothing has managed to deter Adani Group.

From one controversy to another, in India and Internationally, Adani stocks continue to rise. The group is expanding exponentially across all sectors, and Adani remains one of the wealthiest in the world!