Hikes In Commercial LPG & ATF Prices; New Sanctions On Russia And Red Sea Conflict Leading To Price Escalation In India?

As state-owned retailers announce revisions in the prices of commercial LPG gas cylinders and jet fuel effective from March 1, concerns arise regarding potential hikes in oil and LPG costs and the broader impact on inflation. These adjustments, coupled with the regular fluctuations in fuel prices, have far-reaching implications for households, extending beyond direct fuel expenses. The surge in jet fuel prices could translate into higher flight ticket prices, making air travel more expensive, while the increased cost of commercial LPG cylinders could lead to elevated expenses for households reliant on food delivery. Moreover, recent developments concerning Russia's redirection of LNG supplies and the imposition of fresh U.S. sanctions on Moscow have led to significant implications for global oil markets, particularly impacting Russian oil sales to India. Further, the escalating tensions in the Red Sea, particularly around the Bab-el-Mandeb Strait, are also set to impact India significantly.

As state-owned retailers announce revisions in the prices of commercial LPG gas cylinders and jet fuel effective from March 1, concerns arise regarding potential hikes in oil and LPG costs and the broader impact on inflation.

State-owned retailers have recently adjusted the prices of commercial LPG gas cylinders and jet fuel; effective from March 1 – the prices of 19 Kg commercial LPG gas cylinders have been raised by Rs 25 across various metropolitan areas.

In Delhi, the retail price of a 19 Kg commercial LPG cylinder has surged to Rs 1795 per cylinder, while in Mumbai, it now stands at Rs 1,749.

Similarly, in Kolkata and Chennai, the prices for the 19 kg cylinder have increased to Rs 1,911 and Rs 1,960.50 respectively, as of March 1.

Previously, on February 1, the OMCs had increased the prices of the 19 kg IndaneGas cylinders to Rs 1,769.50 and Rs 1,887 in Delhi and Kolkata respectively. In Mumbai and Chennai, the cylinders were priced at Rs 1,723.50 and Rs 1,937 each.

Regarding ATF prices, they have been raised across metros starting from March 1, 2024.

In Delhi and Kolkata, the prices for domestic airlines have been hiked to Rs 1,01,397/Kl and Rs 1,10,297/Kl respectively. Meanwhile, in Mumbai and Chennai, ATF prices for domestic airlines have been increased to Rs 94,809/Kl and Rs 1,05,399/Kl respectively.

It’s worth noting that ahead of Budget 2024, the OMCs had reduced ATF prices by Rs 1,221/Kl on February 1.

State-owned Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL), and Hindustan Petroleum Corporation Ltd (HPCL) undertake revisions of cooking gas and ATF prices on the 1st of every month; these adjustments are based on the average international price observed in the previous month.

Bracing For Impact

As state-owned retailers announce revisions in the prices of commercial LPG gas cylinders and jet fuel effective from March 1, concerns arise regarding potential hikes in oil and LPG costs and the broader impact on inflation.

These adjustments, coupled with the regular fluctuations in fuel prices, have far-reaching implications for households, extending beyond direct fuel expenses.

The surge in jet fuel prices could translate into higher flight ticket prices, making air travel more expensive, while the increased cost of commercial LPG cylinders could lead to elevated expenses for households reliant on food prepared or ordered from outside.

New Sanctions On Russia

What could further compound problems for India, according to LSEG data, is that Russia has redirected LNG supplies bound for Asia around Africa, presumably to avoid the Red Sea, which could have contributed to the rise in prices.

The latest development complicates the efforts of Indian state refiners to secure annual supply deals, as per three industry sources familiar with the matter.

The sanctions, introduced to mark the second anniversary of Moscow’s invasion of Ukraine and in retaliation for the death of opposition leader Alexei Navalny, specifically target Russia’s leading tanker group, Sovcomflot, which Washington accuses of violating the G7’s price cap on Russian oil, along with 14 crude oil tankers associated with Sovcomflot.

Concerns among Indian refiners regarding the latest sanctions revolve around potential challenges in acquiring vessels for transporting Russian oil and the subsequent increase in freight rates; this could narrow the discount for the oil, which is procured from traders and Russian companies on a delivered basis.

Moreover, Moscow might need to channel even more volumes through traders to mitigate further sanctions risk, further aggravating uncertainties, as mentioned by industry sources who declined to be named due to the sensitivity of the issue.

India’s shift towards being a major buyer of Russian oil began recently, benefiting from lower prices after Europe banned Russian oil imports.

Russia emerged as India’s top oil supplier in 2023, with state refiners like Indian Oil Corp (IOC), Bharat Petroleum Corp, and Hindustan Petroleum Corp engaging in discussions with Russian major Rosneft for an annual deal to secure a combined volume of up to 400,000 bpd of Russian oil, predominantly Urals, for the fiscal year beginning April 1, according to sources.

However, final volumes under these proposed term deals depend on payment terms and discounts offered by Russia.

Despite Rosneft’s offer of a discount of $3-$3.50 per barrel to Dubai prices, considered thin by refiners amidst the uncertainties brought by sanctions, Indian state refiners are not pursuing supplies of Sokol grade crude under the planned term deal due to payment issues.

India’s commitment to buying Russian oil is contingent on it being sold below the price cap in non-sanctioned vessels; the country is exploring alternative oil sources as U.S. sanctions constrain trade with Russia.

Thus, the tightening enforcement of U.S. sanctions impacts India’s oil trade with Russia, prompting refiners to consider diversifying their supplies.

Although Russia remains India’s primary supplier, there is evidence of increased purchases from elsewhere. For instance, imports from Saudi Arabia have risen by 22% compared to January, with Reliance Industries Ltd. procuring its highest volume since May 2020.

According to refinery executives, despite the interest from Indian refiners to acquire more Russian oil, a resurgence in buying would necessitate U.S. approval.

Additionally, Moscow’s preference for payment in yuan, due to heightened scrutiny by some banks over using dirhams for settling trades in recent months, adds another layer of complicatedness to the situation.

Red Sea Crises

The escalating Red Sea crisis has posed significant challenges to global trade, with anticipated impacts on shipping costs.

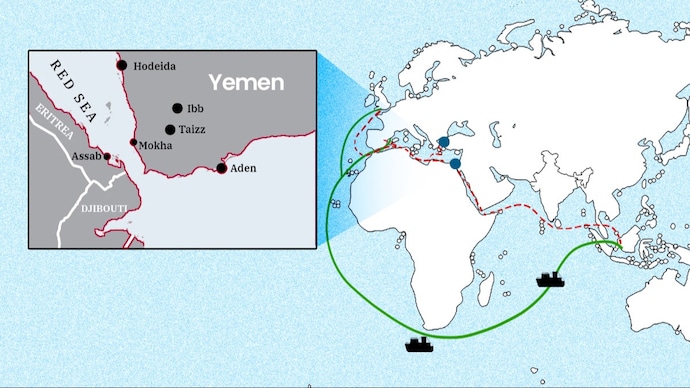

Recent attacks by Yemen-based Houthi militants in the Bab-el-Mandeb Strait, a vital shipping route connecting the Red Sea and the Mediterranean Sea to the Indian Ocean, have heightened tensions in the region.

The disruption of Red Sea shipping lanes, as a result of the Houthi conflict, has particularly significant implications for Indian trade, affecting routes crucial for imports of crude oil and LNG, as well as trade with key regions such as the Middle East, Africa, and Europe, as noted by the Global Trade Research Initiative.

India, heavily reliant on the Bab-el-Mandeb Strait for its energy imports and trade, faces substantial economic and security risks from any disruptions in this strategic area with the conflict necessitating India to consider alternative routes, such as the longer Cape of Good Hope, there’s a potential for increased energy costs and logistical complexities.

Hence, to mitigate dependency on the conflict-prone Red Sea passage, India may seek to diversify its sources of crude oil and LNG and explore alternative trade routes.

Still, the conflict could lead to significant increases in shipping costs, delays due to rerouting, higher insurance premiums, and potential cargo losses from piracy and attacks – despite India’s efforts to ensure the safety of its ships in the Red Sea; the effectiveness may be limited, given that global shipping firms transport most Indian cargo.

However, there are some measures that India could adopt – including diversifying crude oil imports from regions like West Africa, the Americas, and the Mediterranean, utilizing ports outside conflict zones for transhipment and regional trade, and offering financial support and insurance schemes to Indian companies affected by trade disruptions.