Byju Raveendran assures investors on FEMA compliance after ED notice

Byju Raveendran assures investors on FEMA compliance after ED notice

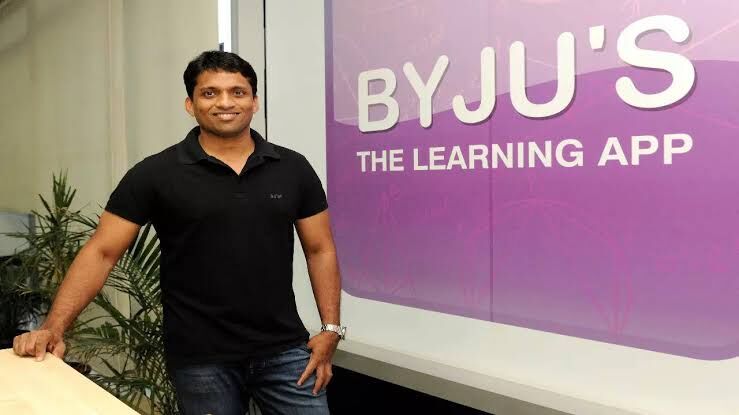

Byju Raveendran, the founder and CEO of edtech firm Byju’s, has reassured shareholders that the company is in complete compliance with the Foreign Exchange Management Act (FEMA). This statement follows reports of India’s Enforcement Directorate issuing a show-cause notice to Byju’s for alleged violations of the act.

In a note addressed to shareholders, Raveendran stated, “We want to assure you that BYJU’S has always been fully compliant with FEMA regulations.” The assertion of compliance comes in the wake of a recent due diligence effort, indicating that Byju’s leadership is confident in the company’s adherence to FEMA regulations.

Byju’s, a prominent player in the Indian edtech sector, has faced scrutiny over its operations, with regulatory concerns adding to the challenges the company is navigating. Raveendran’s communication to shareholders aims to allay any apprehensions arising from the Enforcement Directorate’s show-cause notice and reinforce confidence in Byju’s commitment to regulatory compliance.

As the edtech industry in India continues to evolve, the regulatory landscape becomes increasingly crucial, and companies like Byju’s are under close observation. Raveendran’s assurance to shareholders reflects a proactive approach to addressing regulatory matters and maintaining transparency in the face of challenges. The resolution of regulatory issues will likely play a key role in shaping Byju’s trajectory in the competitive edtech market.

The situation surrounding Byju’s and the alleged show-cause notice from India’s Enforcement Directorate is marked by conflicting reports. Moneycontrol claims to have obtained a copy of a letter sent by Byju Raveendran, the CEO and founder of Byju’s, to shareholders. The letter addresses recent reports suggesting that the Enforcement Directorate issued a show-cause notice to Byju’s parent company, Think and Learn Pvt Ltd (TLPL), and Raveendran, regarding a Rs 9,000 crore violation of the Foreign Exchange Management Act (FEMA).

In response to these reports, Byju’s swiftly denied having received any notice from the Enforcement Directorate. The contradiction between the reports and Byju’s official statement adds a layer of complexity to the situation, leaving stakeholders and the public in a state of uncertainty regarding the regulatory matters surrounding the edtech giant.

The availability of the letter from Raveendran to shareholders, acknowledging the reports and asserting compliance with FEMA regulations, indicates a proactive approach by Byju’s leadership to address concerns and maintain transparency amidst regulatory scrutiny. As the situation unfolds, clarification from regulatory authorities and further statements from Byju’s will likely provide more clarity on the veracity of the alleged show-cause notice and the company’s stance on the matter.

Byju Raveendran, the CEO of Byju’s, addressed the allegations in a letter sourced by Moneycontrol, stating that the report is based on “hearsay and lacks any factual basis.” He categorically denied that Byju’s has received any notice as mentioned in the article. Raveendran emphasized that as of the current date, the company has not been served with any such notice.

Furthermore, Raveendran highlighted that a trusted law firm conducted a thorough due diligence exercise, and according to their findings, there are no violations of the Foreign Exchange Management Act (FEMA). This assertion reinforces Byju’s commitment to compliance and adherence to regulatory standards.

The situation gained attention earlier in April when the Enforcement Directorate (ED) conducted searches at three premises in Bengaluru as part of a case involving Raveendran and Byju’s under the provisions of FEMA. During that operation, the ED claimed to have seized various incriminating documents and digital data.

The conflicting narratives, with Byju’s denying the receipt of any notice and asserting compliance, and the ED’s previous actions, underscore the complexity of the regulatory scrutiny faced by the edtech giant. As the matter develops, stakeholders will likely be keenly awaiting further clarifications and official statements to ascertain the true nature of the allegations and Byju’s position in this regulatory context.

The Enforcement Directorate (ED) has not commented on the recent development as of the time of publishing the story. This lack of official response adds to the ongoing uncertainty surrounding the regulatory scrutiny faced by Byju’s.

In the context of the searches conducted by the ED in April, it was revealed that Byju’s had received foreign direct investment (FDI) amounting to approximately Rs 28,000 crore from 2011 to 2023. Additionally, the company allegedly remitted about Rs 9,754 crore to various foreign jurisdictions during the same period in the name of overseas direct investment. These details were disclosed by the ED during its investigations.

Byju Raveendran, in the letter to shareholders, mentioned that the company has maintained a “cooperative stance” with the ED throughout their inquiries. He stated, “We have satisfactorily answered all their queries, both verbally and on record.” This assertion reflects Byju’s commitment to cooperation and transparency in addressing regulatory inquiries.

The unfolding situation underscores the intricacies of regulatory investigations and the impact on companies, especially in sectors like edtech that attract substantial foreign investments. As the ED’s stance and any potential developments become clearer, stakeholders will be closely monitoring for official statements and responses from regulatory authorities and Byju’s leadership to gain insights into the resolution of this matter.