Challenges in Flexible Packaging Industry: CRISIL Asserts Decadal Low Profitability of 8%

Challenges in Flexible Packaging Industry: CRISIL Asserts Decadal Low Profitability of 8%

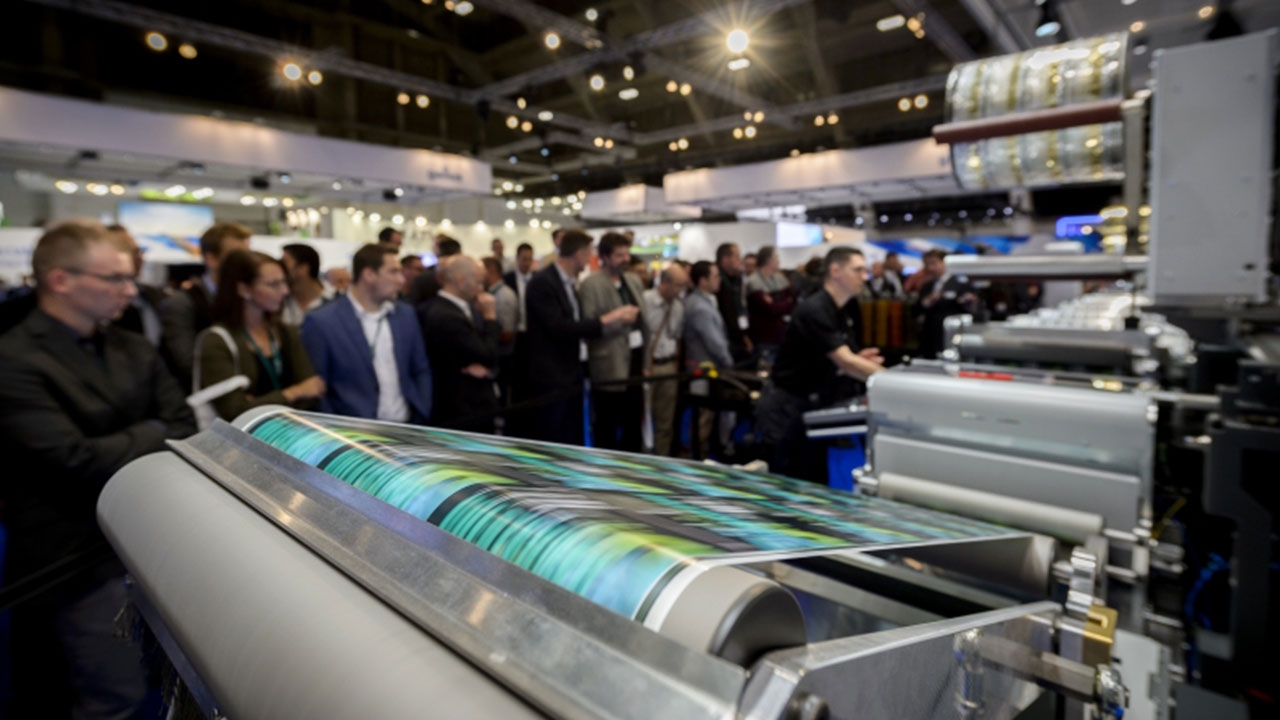

The flexible packaging industry, a critical cog in the packaging sector, is witnessing an unprecedented slump in profitability. A recent report from CRISIL, the global analytical company, indicates that the industry is set to post a decadal low profitability of around 8%.

This contraction has largely been attributed to two main factors: an oversupply in the domestic market and a weakened export demand. A noticeable trend in the past few years has been the rapid capacity expansion by many flexible packaging firms.

These expansions were undertaken in anticipation of a surging demand, both domestically and internationally. However, the actual demand has been subdued, leading to a situation of oversupply.

According to a research by CRISIL Ratings, significant capacity expansions over the previous two fiscal years and the resulting oversupply will reduce the profitability of the Indian flexible packaging sector to a decadal low of 8% this fiscal.

Additionally, it added, the drop in profitability will be a result of the sluggish export market. Revenue will also decrease by 3-5% as a result of the supply glut’s continued impact on realisations.

Eight major flexible packaging companies, which together make up more than 75% of the domestic capacity, were the subject of a CRISIL Ratings investigation. “The credit risk profiles of manufacturers will remain under pressure till an expected recovery in operating performance kicks in towards the end of the fiscal,” the company said.

It claimed that the sector has previously seen periods of oversupply and significant capacity increase.

For instance, capacity expansion caused the industry’s operating margin to collapse last fiscal, down from the 18–20% witnessed during the epidemic to only 10.5%.Bi-axially orientated polypropylene (BOPP) and bi-axially oriented polyethylene (BOPET) films are used in this sector.

Due to its superior print quality, longer shelf life, stronger tensile strength, and higher oxygen-retention power compared to BOPP films, BOPET films have a variety of end-use applications. BOPP films, on the other hand, are more affordable and have superior moisture resistance qualities, making them perfect for packaging food items.

The report’s findings indicate that while the areas of food packaging, medicines, and personal care are anticipated to maintain domestic demand steady, exports may only gradually begin to increase towards the end of this fiscal year.

Demand-supply balance is anticipated to progressively improve over the next 6 to 12 months as no significant capacity is scheduled to come online this fiscal year or the one after. Given these factors, volume growth is predicted to be low this fiscal year, at 5–6%.

On the supply side, this fiscal’s average raw material prices will be lower than last year’s, which will also have an effect on realisations. Due to a flat sales performance over the previous fiscal year, the industry’s revenue would thus decline by 3–5%.

To survive this cyclical slump, manufacturers will need to rely on balance sheet liquidity and financial flexibility. According to CRISIL, macroeconomic changes that affect commodity prices as well as any significant investment that might exacerbate the demand-supply mismatch would be the most important monitorables in the short future.

Initial projections estimated a robust growth in sectors like FMCG (Fast Moving Consumer Goods), pharmaceuticals, and e-commerce. These sectors heavily rely on flexible packaging solutions. However, the actual growth in these sectors has been modest at best.

The market has seen an influx of new entrants, lured by the initially promising outlook. This has led to a fragmented market with increased competition, resulting in underutilized capacities.

Key markets, especially in the West and the Middle East, have seen sluggish growth or even contraction in certain sectors. This has directly impacted the demand for packaged goods, and consequently, flexible packaging.

Geopolitical tensions, especially between major economies, have resulted in trade restrictions and tariffs. Such protectionist measures have dented the competitiveness of exports, further exacerbating the weak demand situation.

The global push towards sustainability has seen a shift in preference towards eco-friendly packaging solutions. As a result, traditional flexible packaging, especially plastic-based, has faced resistance in many markets.

Given the oversupply and heightened competition, the industry might witness mergers and acquisitions. Smaller players with underutilized capacities might find it challenging to stay afloat and could become acquisition targets for larger players.

To mitigate risks associated with a single market, companies are looking to diversify into related sectors. For instance, moving into rigid packaging or offering specialized solutions such as sustainable or smart packaging.

Embracing technological advances and sustainability can rejuvenate the industry. Biodegradable films, smart packaging solutions that enhance user experience, and recyclable materials can make flexible packaging more appealing to a wider market.

While export markets are crucial, firms should also look at deepening their penetration in the domestic market. This might involve catering to regional demands, offering tailor-made solutions, and enhancing supply chain efficiencies.

The flexible packaging industry is undoubtedly going through challenging times. However, adversity often breeds innovation. By realigning their strategies, focusing on sustainability, and deepening domestic penetration, firms can navigate these choppy waters and emerge stronger. As always, the industry’s ability to adapt and evolve will determine its trajectory in the coming decade.