China’s Investments In Africa Grew At An Unprecedented Rate From FY20 , But Now Fear Emerges As Chinese Economy Falters; Is The Chinese Tap Set To Turn Off?

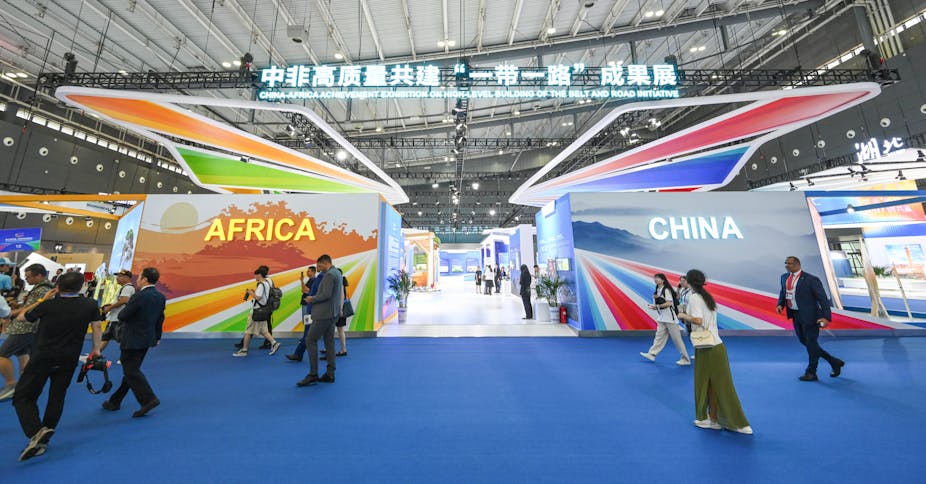

China's investments in Africa have grown at a rapid pace; while the same garnered much scepticism from around the world as some viewed China's economic presence in Africa as resource-driven neo-colonialism, others argued that these investments have a more nuanced purpose. Nevertheless, with strategic partnerships, extensive investments, and growing influence, China has become a prominent player in the African continent. Under President Xi Jinping's Belt and Road Initiative (BRI) many projects have been funded; however, as the BRI enters its second decade, questions arise about China's future direction and the sustainability of its lending practices as China's own economy finds itself shaky.

China’s strategic plan for Africa is evident through the Forum on China-Africa Cooperation (FOCAC), initiated in 2000.

In recent FOCAC meetings, China pledged substantial economic assistance, including $60 billion in 2018 and $40 billion in 2021; during the pandemic, China pledged to provide 1.2 billion doses of COVID-19 vaccines to African nations, addressing their urgent need for vaccinations.

However, that is not all; China’s economic engagement extends to trade, with Sino-African trade exceeding $200 billion annually and over 10,000 Chinese firms operate across Africa, with investments totalling over $2 trillion, including $300 billion in current investments.

Moreover, Chinese loans to African governments have reached $160 billion, primarily in sectors such as transportation, power generation, mining, and telecommunications.

China’s Growing Influence In Africa

China’s influence in Africa extends to infrastructure development, with numerous projects financed and constructed by Chinese companies; examples include the African Union headquarters in Addis Ababa, Ethiopia, and the Economic Community of West African States (ECOWAS) headquarters in Abuja, Nigeria.

China has also increased its security assistance in Africa, offering $100 million in military aid to the African Union between 2017 and 2022. Chinese arms transfers to sub-Saharan Africa have also surged, surpassing those of the United States in quantity and quality.

Several African nations, including Zimbabwe, Mozambique, Namibia, the Seychelles, Tanzania, and Zambia, have received substantial arms from China.

At the same time, China’s first overseas military base in Djibouti has raised concerns about its strategic intentions in the region, and reports of incidents involving lasers from the Chinese base affecting U.S. military aircraft have added to the tensions.

China’s Control On Education

China has pursued soft power initiatives in Africa through education and cultural exchange programs. The Confucius Institutes, with 61 in Africa, promote the Chinese language and culture, and scholarships and vocational training opportunities have significantly increased the number of African students studying in China.

Surveillance and Media Influence

China’s presence in Africa extends to surveillance and media influence. Chinese firms like Huawei and ZTE have played a significant role in building telecom networks in over 30 African countries, and Safe city systems provided by Chinese firms are in use in nine African countries.

Chinese state media expansion in Africa, estimated at around $10 billion, has raised concerns about manipulating information and surveillance activities. Reports of Chinese involvement in digital communications penetration and censorship in some African nations have also sparked controversies.

Resource Exploitation

With over $43.39 billion in Chinese FDIs in Africa in 2020, it is tempting to conclude that China’s primary objective is resource exploitation; after all, China imports a wide range of vital natural resources from sub-Saharan Africa, including oil, gas, timber, gold, copper, uranium, cobalt, and lithium.

However, this view oversimplifies China’s engagement with the continent.

Equity investments, which grant China control over production, supply priorities, and transport infrastructure, are often overlooked.

Moreover, analyzing the distribution of Chinese FDIs in Africa, we find a correlation between the presence of natural resources and investment levels.

Resource-rich nations like South Africa, DR Congo, Zambia, and Angola received a significant share of China’s investments; larger African economies, such as Nigeria, South Africa, Ethiopia, Kenya, Ghana, and Tanzania, tend to receive higher levels of Chinese FDIs.

Thus, it is safe to assume that the trend can be attributed to their resources’ attractiveness and more advanced industrial infrastructure.

Despite the economic advantages of larger countries, Chinese FDIs exhibit that smaller African economies receive a favourable share of Chinese investment relative to their GDP, suggesting that China’s motivations in Africa go beyond mere economic incentives.

China’s Investment End Game

China’s investment strategy in Africa serves as geopolitical risk hedging. By diversifying investments across the continent, China mitigates the risks associated with fiscal defaults, regime changes, and other unforeseeable events.

China also seeks political alliances with African nations to legitimize its global aspirations through international institutions like the UN, and Africa has become crucial to China’s strategic security as it decouples from Western resources.

However, things now remain in limbo as China’s own economy is under strain, and many African countries are now wondering if these substantial and important investments and funding will continue.

Economic Headwinds and Debt Repayment

The BRI, launched in 2013, has transformed global infrastructure development, with billions of dollars flowing into railways, highways, airports, and power plants worldwide.

China’s loans provided an economic outlet and boosted its global influence, yet new economic realities have emerged, impacting both borrowing countries and China itself.

The era of low-interest rates and cheap financing has ended, with countries grappling with the economic fallout of the COVID-19 pandemic, with rising interest rates and commodity prices due to the war in Ukraine adding to their woes.

Debt Distress and Bailout Loans

Several countries have requested debt deferment or relief, with China offering bailout loans and participating in debt relief negotiations.

Debt distress issues suggest that many low and middle-income countries cannot afford additional debt at the moment, at the same time; however, the need for critical infrastructure projects to stimulate economic growth remains.

China’s Domestic Economic Challenges

China is navigating its Belt and Road Initiative amid domestic economic challenges, including a property crisis and mounting local government debt. It remains to be seen how these issues will affect China’s overseas lending in the long term. However, early signs suggest a shift in China’s focus towards domestic financing needs.

Despite these challenges, China’s interest in creating new investment opportunities and expanding its global influence remains. The initiative could continue, albeit with a focus on fewer, more impactful projects.

The Future of the Belt and Road Initiative in Africa

The future of the Belt and Road Initiative in Africa may involve a shift towards smaller-scale projects with greater social and environmental benefits. Researchers suggest that future lending may comprise fewer large-scale loans and more loans with smaller values under $50 million.

However, China is likely to continue directing funding based on its geopolitical aims, particularly in regions where it competes with the United States.

The Viewpoint

Once a symbol of China’s global infrastructure ambition, the Belt and Road Initiative is entering a new phase characterized by economic challenges, environmental concerns, and evolving priorities.

The future of the African initiative may involve a recalibration towards smaller, more sustainable projects; however, given the strategic importance of certain regions and the competition with the US, it suggests that the BRI will continue to shape global infrastructure.

The Last Bit, China’s investments in Africa, defy simple categorization. While resource exploitation plays a role, the egalitarian aspect of Chinese FDIs reveals a more complex strategy.

China’s end game in Africa extends beyond resources, encompassing resource security, mutual economic dependence, and political solidarity, but Africa’s increasing reliance on China may become a thorn in its side.