Financial Desperation in China Gives Rise To Unconventional Fines And Starving Zoo Animals

A peculiar plea recently grabbed headlines in China when a wildlife conservation group urged volunteers to provide food for starving animals in a government-run zoo. This appeal has shed light on a broader financial crisis afflicting numerous Chinese cities and provinces. As these regions grapple with mounting debts, heightened by the pandemic and a real estate market downturn, they have resorted to extraordinary measures to shore up their finances. From fining restaurants for serving cucumbers without a license to penalizing truck drivers for carrying heavy loads, these desperate tactics reflect local governments' dire straits as the alarming situation grips Chinese cities and their residents.

What could be worse than starving and dying animals in zoos? And this is precisely what is happening in local zoos in China.

In a recent plea that gained widespread attention, a Chinese wildlife conservation organization, the Endangered Species Fund, urgently called for volunteers to provide sustenance to underfed animals residing in a zoo located within Dongshan Park in the northern province of Liaoning.

This particular zoo, overseen by the local government, has found itself in dire financial straits, unable to adequately feed its animal inhabitants due to a severe shortage of funds.

The plea is indicative of the pressing predicament of the zoo, which houses a variety of animals, including three sika deer, six black bears, ten alpacas, and numerous monkeys and birds.

“There are still bear cubs in the park that need to be fed, the [horse] mare is about to give birth, and her food has been reduced by half, and the zoo’s staff have not been paid for six months,” the fund wrote in a post on its official Weibo account. “We hope relevant departments can pay attention to this issue!”

Notably, this facility doesn’t charge visitors for admission and relies heavily on state funding; unfortunately, this funding had been absent for six consecutive months, according to reports from the Endangered Species Fund.

The state-owned Paper cited a government employee in the city where the zoo is located, saying funding had been delayed due to the city’s “fiscal stress.”

A video posted online by the respected outlet China Newsweek showed a handwritten notice inside the park: “We haven’t paid our staff for six months. The animals have no food and will soon starve to death.”

No Funds

This alarming situation at the zoo is symbolic of a broader financial crisis gripping several Chinese city and provincial governments.

These entities have been compelled to curtail expenditures as they grapple with a monumental debt burden that burgeoned during the COVID-19 pandemic and an unprecedented slump in the country’s real estate sector.

Local governments were compelled to allocate billions of dollars toward mass testing and lockdown measures to enforce President Xi Jinping’s zero-Covid initiative.

The property market’s crisis has further fuelled financial concerns, leading to a significant drop in land sales depriving these local governments of a crucial revenue stream.

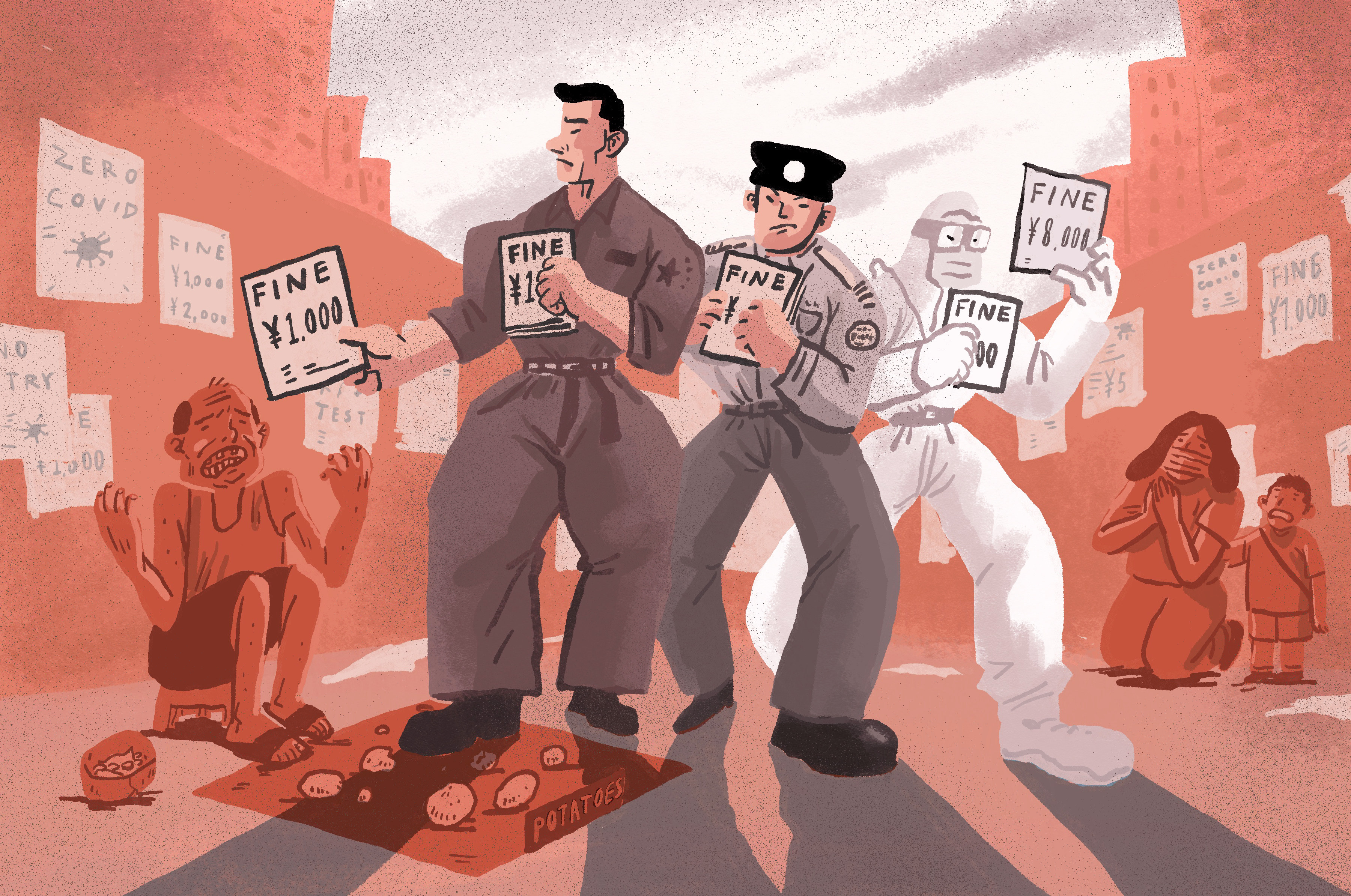

The Rise Of Extraordinary Fines

With few options, some of the local governments have resorted to unconventional methods to generate much-needed funds, such as imposing fines on restaurants without the requisite licenses to serve cucumbers and penalizing truck drivers for carrying excessively heavy loads.

China’s regional governments continue to pose a mounting risk for the world’s second-largest economy.

Willy Lam, a senior fellow at the Washington-based think tank The Jamestown Foundation, estimates that this debt could range from $9 trillion to $12 trillion, encompassing “hidden debt” issued by local government financial entities established to circumvent central government borrowing restrictions.

These entities are often used to funnel finances into infrastructure projects.

The situation, as Lam observes, appears to be spiralling “out of control,” with a significant portion of local government income dedicated to servicing debt interest.

No Way Out

As a result, these governments are compelled to employ stringent measures, such as heavy fines on restaurants and businesses, to generate revenue.

For instance, in June, three restaurants in Shanghai were each fined 5,000 yuan ($685) for serving cucumber on cold noodles without the requisite license, triggering public outrage.

Truck drivers in the central province of Henan also faced numerous fines for exceeding weight limits, with one driver amassing 58 tickets within two years, totalling 275,000 yuan ($37,687).

At least 15 Chinese cities reported a dramatic increase in revenue generated from fines and confiscations in 2021, according to Yuekai Securities. The city of Nanchang saw the most significant surge of 151%, while Qingdao topped the list by raising 4.38 billion yuan ($600 million).

While seemingly random, these fines represent desperate measures adopted by financially stressed local governments; the pandemic has deepened this financial strain, with overall tax income at all government levels declining by 3.5% in 2022, the most significant drop since China reformed its tax system in 1993.

The Public Ire

While, the central government has expressed concern over the surge in penalties imposed by local authorities, and therefore in response, directives were issued in 2022 forbidding local governments from imposing “arbitrary fines” to generate income.

However, this problem persists, and a crackdown was placed on such practices, still imposing arbitrary fines on individuals and small businesses is having adverse economic repercussions, and is potentially eroding business confidence while fostering discontent with Beijing.

The fines have also negatively impact the less fortunate and sparking further public dissent against the authorities.

The Last Bit, The financial woes faced by Chinese local governments have led to a troubling trend of imposing arbitrary fines on businesses and individuals, as illustrated by the cucumber fines and other unconventional measures.

While these fines may provide a short-term financial boost, they are risking harming small businesses, eroding confidence in the economy, and has incited public dissatisfaction with the authorities.

These financial challenges pose a significant risk to the broader Chinese economy, with staggering levels of debt and hidden liabilities.

As China grapples with this complex issue, it becomes evident that creative income sources (random fines) can only alleviate a fraction of the financial stress faced by local governments, and instead, it is putting undue pressure on the already fatigued citizens that has facing tough times due to record unemployment, the rising cost of living, real estate woes and extraordinary fines.