JSW Infra’s Bid for 3 Ports Worth Rs 2,000 Crore

JSW Infra’s Bid for 3 Ports Worth Rs 2,000 Crore

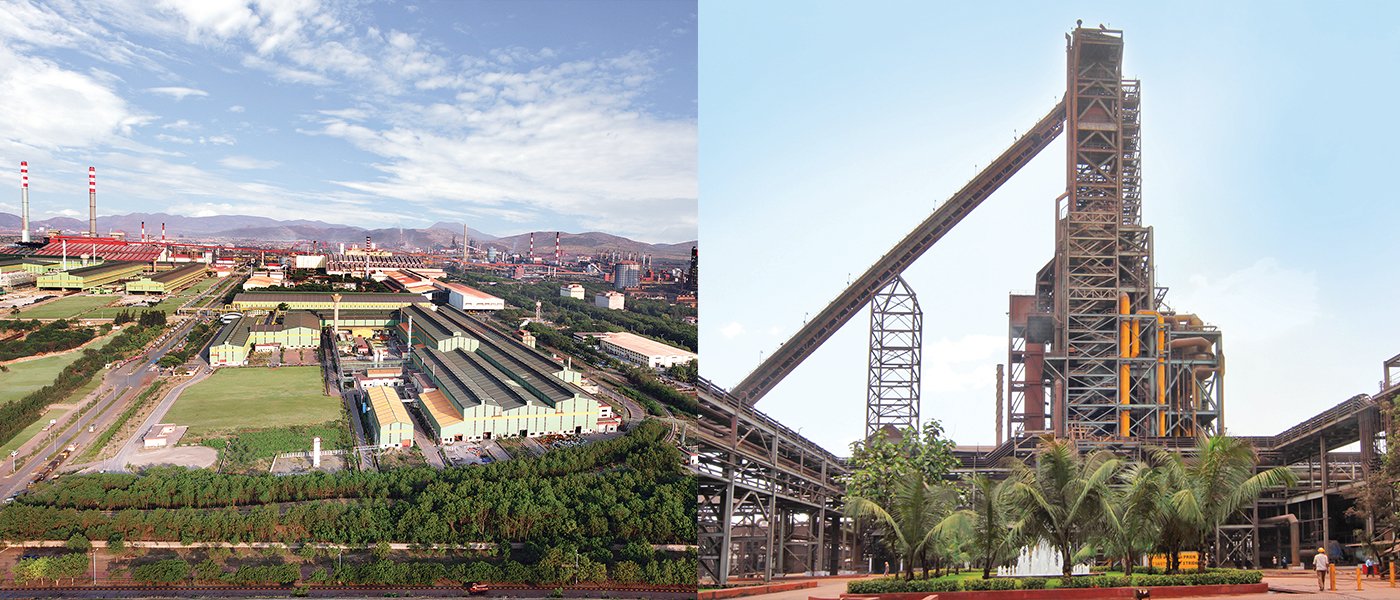

JSW Infrastructure Limited, a subsidiary of the JSW Group, has emerged as a significant player in the Indian infrastructure sector.

The company is currently making headlines for its ambitious move to acquire three ports in India for a staggering sum of Rs 2,000 crore.

JSW Infrastructure, the ports division of Sajjan Jindal’s JSW Group, has submitted bids for the purchase of three ports as part of the government’s privatisation initiative totaling Rs 2,000 crore. The company’s capacity would increase by another 10–12% thanks to these ports.

In a separate development, the second-largest commercial port operator in the nation based on cargo handling capacity has set a price range of Rs. 113-119 per share for its Rs. 2,800 crore initial public offering (IPO), which will begin on Monday (September 25) and end on Wednesday.

JSW Infrastructure has 158.4 million tonne of total cargo handling capacity as of the end of FY23, spread among nine ports and terminals on the eastern and western coastlines. The business has been running since 1999.

India decided to progressively phase down state ownership of port operations and offer the port industry to private enterprises as early as 1990. The 12 main ports operated by the Union government have seen 32 such agreements since July 3, 1997, when the first public private partnership concession was inked at Jawaharlal Nehru Port Authority.

The business plans to utilise the revenues from its IPO to pay off debt of Rs 880 crore, spend Rs 865.75 crore in a project to build an LPG terminal, and invest Rs 59.4 crore in the construction of an electric sub-station. Additionally, Rs 151.04 crore and Rs 103.88 crore will be utilised for the expansion at Mangalore Container Terminal, for its greenfield growth plans, and for general corporate reasons.

On September 22, JSW Infrastructure anticipates receiving Rs 1,260 crore from anchor investors. JSW Infrastructure would become the third port business to list after Gujarat Pipavav Port and Adani Ports and Special Economic Zone.

This strategic move by JSW Infra is set to reshape the landscape of the Indian ports and logistics industry and deserves a closer look.

The three ports that JSW Infra is eyeing for acquisition are:

- Krishnapatnam Port: Located in Nellore district of Andhra Pradesh, Krishnapatnam Port is one of the largest and busiest ports on the eastern coast of India. It is known for its deep draft and state-of-the-art infrastructure, making it an attractive asset for any logistics and infrastructure company.

- Gangavaram Port: Another key player on the eastern coast, Gangavaram Port is situated in Visakhapatnam, Andhra Pradesh. It is a versatile port handling a variety of cargo, including dry bulk, liquid bulk, and containers. Gangavaram Port’s strategic location and connectivity make it a valuable asset.

- Paradip Port: Located in Odisha, Paradip Port is one of the major ports on the eastern seaboard of India. It is well-equipped to handle various types of cargo, including iron ore, coal, and petroleum products. Paradip Port’s proximity to key industrial areas and upcoming infrastructure projects adds to its significance.

JSW Infra’s interest in acquiring these ports aligns with its broader expansion strategy in the infrastructure sector. The company has been actively investing in and developing infrastructure assets, including ports, terminals, and inland waterways. This acquisition would be a significant step forward in achieving its long-term goals.

- Strategic Location: The three ports under consideration are strategically located on the eastern coast of India, providing access to the Bay of Bengal. This geographical advantage opens up trade routes to Southeast Asia and offers connectivity to various parts of the country.

- Complementary Infrastructure: JSW Infra already operates ports in the western region of India, including Jaigarh Port in Maharashtra. Acquiring ports on the eastern coast complements their existing infrastructure, creating a nationwide network of ports and terminals.

- Increased Cargo Handling Capacity: The addition of Krishnapatnam, Gangavaram, and Paradip Ports will significantly increase JSW Infra’s cargo handling capacity. This is crucial as India’s trade volumes continue to grow, and efficient ports are essential for handling the increasing demand.

- Diversification: Diversifying its portfolio with these acquisitions allows JSW Infra to tap into different cargo segments and industries. This diversification can help mitigate risks associated with fluctuations in specific commodity markets.

JSW Infra’s move to acquire these ports has the potential to bring about several notable changes in the Indian ports and logistics industry:

1.Increased Competition: The acquisition will intensify competition among major players in the industry. This competition could lead to improved services, greater efficiency, and better infrastructure development.

2.Infrastructure Development: JSW Infra is known for its commitment to modernizing and upgrading infrastructure. This acquisition could lead to substantial investments in port facilities, enhancing their overall efficiency and capacity.

3.Economic Growth: Efficient and well-connected ports are crucial for economic growth. These acquisitions may stimulate trade and commerce in the regions surrounding the ports, leading to job creation and economic development.

4.Logistics Advancements: A more integrated network of ports will likely result in advancements in logistics and supply chain management, reducing transportation costs and transit times for businesses.

JSW Infra’s bid to acquire Krishnapatnam, Gangavaram, and Paradip Ports for Rs 2,000 crore represents a significant milestone in its expansion strategy within the Indian infrastructure sector.

If successful, this move could lead to substantial improvements in the ports and logistics industry, benefiting both the company and the Indian economy at large.

As the race to acquire these ports unfolds, it will be interesting to see how this strategic move impacts the future of the Indian infrastructure landscape.