Demand from Infrastructure and Real Estate Drives Expansion at Finolex Cables; Bright Prospects in Telecom Sector Also Contribute to Firm’s Growth 2023

Demand from Infrastructure and Real Estate Drives Expansion at Finolex Cables; Bright Prospects in Telecom Sector Also Contribute to Firm’s Growth 2023

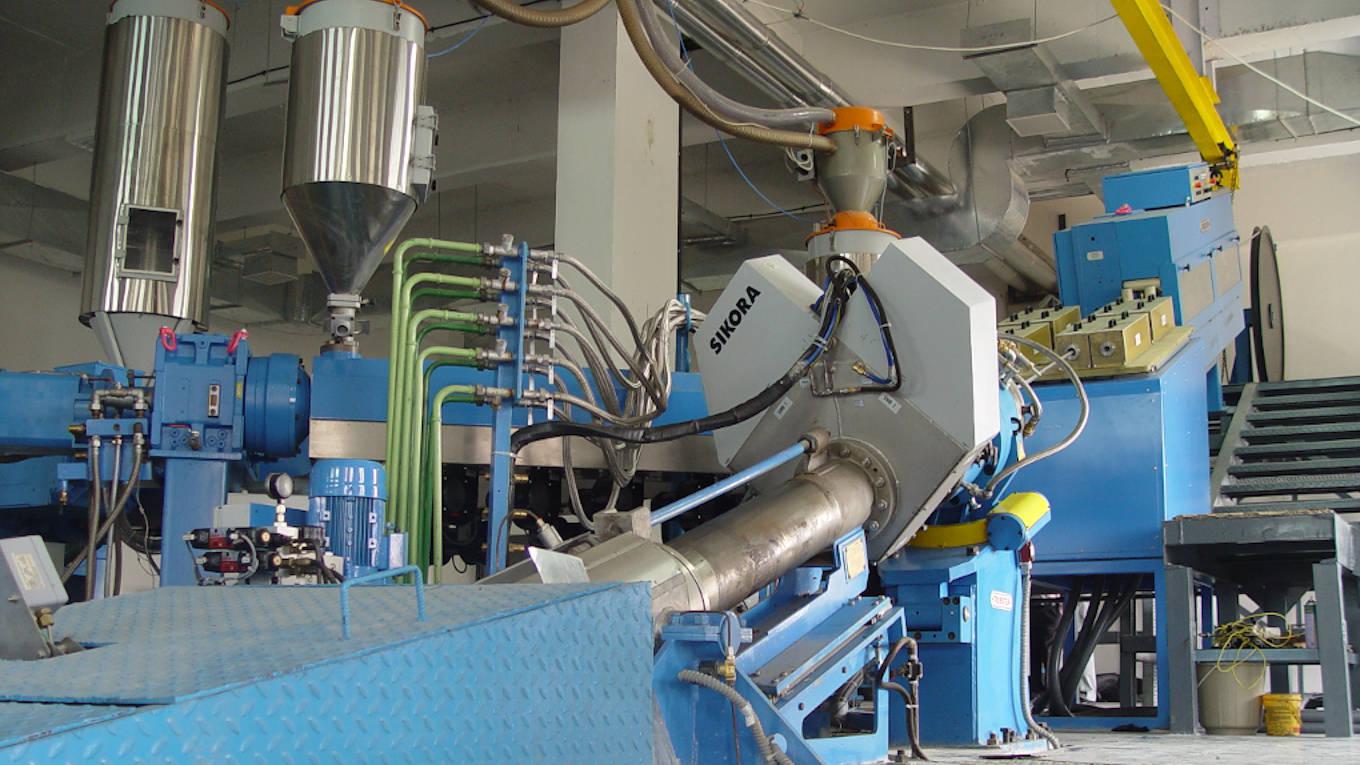

Finolex Cables is increasing capacity in its electrical and communication cables business due to strong demand from the infrastructure and real estate sectors and development possibilities in the telecom industry.

The goal of Finolex Cables, according to Deepak K. Chhabria, executive chairman, is to “get to the Rs 10,000 – Rs 11,000 crore revenue mark, and they would get there by using various means, including expansion of existing product lines.”

Chhabria said the company had ambitious aspirations for the optical fibre market. It expanded cabling, draw towers, and pre-form capacity as part of the Rs 300 crore investment plan.

“The car industry’s capability was exhausted. We are double our capacity. Delivery of the ordered machinery will take place in 12 months, according to Chhabria.

“The business twice increased capacity to produce 25 lakh pieces at the PVC electric conduit factory in Goa. He added that Finolex was considering establishing a new facility in the North and the East in the upcoming 12 months since there was nowhere to continue expanding in Goa.

The corporation has increased its fibre optic cabling capacity from 8 million fibre kilometres to 10 million km.

The firm has also been gradually constructing a pre-form facility and optical fibre draw towers to ensure that it doesn’t need to acquire fibre from outside sources and that all value addition will be done within the company, enhancing its profits.

The pre-form plant construction will begin shortly, and the optic fibre building is ready and will be erected here.

Finolex has initiated action to enter the engineering, procurement, and construction (EPC) industry of laying fibre optic cables in the telecom sector. According to Chhabria, these initiatives will start in Gujarat and subsequently expand to other states.

One of the machines for the electron e-beam initiative, which employs specialized radiation apparatus to manufacture cables, is scheduled to be finished by the end of the year. These electrical cables have specific uses in EVs, data centres, high-speed trains, and solar electricity.

“The CAPEX guidance for the next 18 to 20 months would be around Rs 300 crore and another Rs 100 crore on replenishment programmes for existing capacities,” said Mahesh Vishwanathan, CFO of Finolex Cables. The company’s topline is anticipated to increase by around Rs 2,000 crore, to Rs 6,000–6,500 crore, as a result of the investment in capacity growth. Since Finolex has no debt, its $2,200 crore in cash reserves will support expansion.

The electrical cables segment generated 82% of the company’s revenues, and robust growth is anticipated to continue in FY24. During the first quarter of FY24, the electric cables segment expanded by 29%, with increases in construction wire by 30%, industrial wire by 20%, and auto by 30%. 70% of the electric wires plant’s capacity was being used.

During the first quarter of FY24, value growth in the communication industry was flat, mainly due to the fibre price being dropped due to widespread dumping. However, with anti-dumping charges of between 5 and 15% in China and Indonesia, the business anticipates a return to normalcy and improved price realization. Long-term demand was anticipated from the government’s last-mile telecom connection initiative. Reliance and Bharati’s 5G rollouts were also expected to generate a significant market.

During Q1FY24, Finolex reported a revenue increase of 19% year over year to Rs 1,204 crore and net profit growth of 39% y-o to Rs 132 crore. EBIT for the business was 13%. Electrical wire volumes increased by 29%, while communication cable volumes increased by 17%.

Finolex Cables Ltd., established in 1958, is India’s leading manufacturer of electrical and telecommunication cables. The company has enjoyed a steady growth trajectory thanks to rising demand from key sectors, notably infrastructure, real estate, and telecommunications. This article will explore how these sectors have fuelled Finolex’s expansion and the bright prospects.

As the Indian government continues to invest heavily in infrastructure projects under schemes like ‘Smart Cities Mission’ and ‘Bharatmala’, the demand for high-quality electrical cables and wires has surged. Finolex, with its wide product range and established reputation, is a significant beneficiary of this trend.

With the uptick in India’s real estate sector, particularly in residential and commercial projects, the requirement for safe and reliable electrical wiring has escalated. Finolex, with its commitment to quality, is strategically positioned to meet this growing demand.

The ongoing digital transformation in India, driven by initiatives like ‘Digital India,’ has led to a massive expansion of the telecommunications network across the nation. Finolex Cables, which also manufactures optical fibre cables, is at the forefront of this growth.

The impending rollout of 5G technology in India opens another significant avenue for Finolex. The company’s optical fibre cables, essential for 5G infrastructure, are set to witness heightened demand as 5G becomes a reality in India.

To meet this increasing demand, Finolex has undertaken significant capital expenditure plans. These include expanding its manufacturing capabilities, enhancing production capacities, and adopting the latest technologies to improve efficiency and output.

Recognizing the potential of markets beyond its traditional strongholds, Finolex also focuses on geographic expansion, penetrating deeper into Tier 2 and Tier 3 cities where infrastructure and real estate developments are burgeoning.

Despite economic uncertainties, Finolex’s recent financials demonstrate resilience and growth. The company’s revenues and profits have consistently increased, backed by robust sales in all its segments.

Despite promising prospects, Finolex faces challenges, including fluctuating raw material prices, intense competition, and regulatory changes. Finolex engages in strategic sourcing to mitigate these risks, maintains a diverse product portfolio, and adheres to stringent compliance standards.

Finolex is keenly focusing on sustainability, given the rising global emphasis on green and clean technologies. It invests in Research & Development to produce more energy-efficient products and is actively adopting cleaner and greener processes in its manufacturing units.

In conclusion, the robust demand from India’s infrastructure, real estate, and telecommunications sectors is driving significant expansion at Finolex Cables Ltd. With its strong brand, extensive product portfolio, and strategic initiatives, the company is well-positioned to capitalize on these opportunities. While challenges are inherent in such a dynamic environment, Finolex’s steadfast focus on quality, innovation, and sustainability makes it a formidable player in India’s burgeoning cable industry.