What Went Wrong With Meesho After 2018?

Not just Meesho, but also a number of other Indian businesses that were formerly well-known representatives of iconic business concepts are now coming under fire from the general public and government authorities. The reputation of Indian startups is deteriorating every day, whether it's due to financial irregularities, consumer and staff abuse, failures in the legal system, or unethical problems. All of these businesses have one thing in common: they raised millions of funds under the guise of firm investment, and now either they are unable to manage the money in a legally compliant way, or they are starting to have financial burns. It's merely the loss of capital resources, whatever it may be. God knows what unfolds now in the zombie unicorn Meesho.

Meesho had a difficult last year. “I may not know the “V” of venture capital, but not sure, what makes Meesho a so called amazing startup story. If you can sell Rs.1000 worth of item in Rs.700 and can garner a million customers, where as the investor pays for this loss/gap; and if that makes you a successful startup, then I think there is something really wrong with this definition”; reads a LinkedIn post.

In 2015, the business launched a social commerce platform, and by 2021, it had become the industry’s poster child, with a $4.9 billion valuation. Meesho claimed to be the most downloaded app in the world in October 2021, with 57 million app downloads between August and October. However, things began to turn sour in 2022.

Meesho is trying to address challenging concerns from both its owners (investors) and stakeholders (resellers and consumers) due to a change in strategy, excessive cash burn, no profit in sight, and increased competition from large players—Flipkart and Amazon. Let’s move down the lane to understand what went wrong with Meesho!

High cash burns!

2018-Expenses more than revenue- Unfortunately a reverse game!

Meesho secured a $50 million Series C financing in 2018 and has reported its financial results for the fiscal year ending 31.03.2018. The firm, run by Vivek Aatrey, generated ₹6.01 crores in sales in FY18, a 5X increase from ₹1.21 crores in FY17. Wow, that’s an incredible increase in revenue; congrats, Meesho. But let’s take a look from the opposite side of the table. The company spent ₹10.98 crores to earn this income, representing a 6.6X expense increase from ₹1.66 crores in FY17. In FY17, the firm spent ₹1.38 to earn ₹1, but that figure grew to ₹1.83 in FY18. Wait, that means, approximately, Social commerce app Meesho spent ₹11 Cr to earn ₹6 Cr revenue in FY18!

2019- The uncontrolled drive to promote sales landed in high cash burn.

Fast growth is generally accompanied by a high burn, and Meesho is no exception. The company’s losses increased 20 times in fiscal 2019 compared to fiscal 2018. Meesho paid ₹76.9 crores on logistics services but lost up to ₹40 crores in shipping services to partnered retailers. The firm has been burning cash at an alarming rate in quest of scale, spending ₹185.3 crores in FY19, a 17X increase from ₹10.97 crores the previous year. The net losses were ₹100.42 crores in FY19, up more than 20X from the previous year. Meesho lost money at a rate of 125.47% over the previous fiscal year to promote sales.

Reseller bonuses accounted for ₹30 crores in costs in FY19, up from ₹68 lakhs in FY18. Furthermore, Meesho spent a massive ₹21.1 crores on marketing and advertising, a 20.5X increase over the previous fiscal year. As the firm has grown in size, its overall employee benefit costs have increased 8.76x from ₹3.6 crores in FY18 to ₹31.54 crores in FY19. Another ₹1.07 crores in miscellaneous spending was noted but not explained in the annual report submitted to the Registrar of Companies.

2020- The losses account for 92% of revenue.

The company got caught in a court case for allegedly violating e-commerce rules related to packaging information and a separate case for allegedly selling fake goods on its platform. Social commerce company Meesho has reported a staggering 3X increase in losses for FY20, as its expenses shot up in the year. Meesho’s revenue in FY20, which ended March 31, 2020, was INR 341.6 Cr, a 4X increase from INR 84.8 Cr in 2019.

During the same period, the business’s expenses increased 3.5X to INR 657 Cr, resulting in a year-end loss of INR 315.4 Cr, up from INR 100.42 Cr. Since its beginning in 2015, Meesho has been embroiled in losses. The scenario stays the same in 2020, with losses accounting for 92% of revenue.

Meesho also spent roughly INR 5.9 Cr on ‘information technology expenditures’ or ‘software and technology expenses,’ a 2.8x increase from INR 2.1 Cr in FY2019.

2021- The start of the new decade contributed to the series of recurring losses!

From FY20 to FY21, the startup’s waste almost doubled. The Bengaluru-based business, which was planning an IPO in 2023, spent INR 1,337.3 Cr in FY21, a 2X increase from INR 655.3 Cr in FY20. In other words, Meesho has spent ₹1 to make ₹0.59.

Meesho’s additional expenses increased from INR 540 Cr to INR 1,179.1 Cr between April 1, 2020 and March 31, 2021. In FY21, the firm spent a massive INR 424.1 Cr on marketing and promotion efforts, up from INR 217.4 Cr in FY20. It had a total loss after tax of INR 498.6 Cr in FY21, a 62.5% increase from INR 306.6 Cr in FY20.

2022- The bursts of the financing bubble and the onset of funding winter.

Meesho is losing Rs. 9 crores per day in fiscal year 22! Due to increased logistics and advertising costs, top e-commerce platform Meesho recorded a loss of Rs. 3,248 crores in the fiscal year 2022, a 550 % rise from the Rs. 499 crores reported in the previous fiscal year.

The advertising and promotion budget of the Bengaluru-based Meta-backed start-up increased by 508 % to Rs. 2,579 crores, up from Rs. 424 crores in FY ’21. Its total expenses for the year grew to Rs. 6,607 crores, a 394 % rise from Rs. 1,337 crores in FY ’21. Meesho also reported INR 3,232.3 Cr from operations in the fiscal year ending 31.03.2022, a 4X increase from INR 792.8 Cr in FY21.

In FY22, Meesho’s logistics and fulfilment expenditures totalled INR 2,829.4 Cr, accounting for 43% of the startup’s total make expenditures. In FY21, the SoftBank-backed company spent INR 632.3 Cr on logistics and delivery costs.

The EBITDA margin at Meesho fell from -58.39% in FY21 to -96.41% in FY22. In FY22, the firm invested INR 2 to generate INR 1 from its activities. Aside from that, the startup’s employee benefit expenses were INR 509 Cr in FY22, a 241% increase from INR 149.3 Cr the previous year. Employee benefit expenditures include salary, PF contributions, gratuities, and other employee welfare perks. At the very least, the corporation is investing in its people. But wait, the impending layoffs will shatter this illusion as well.

According to insiders, the layoffs are an attempt to limit the company’s cash burn. After a year of eye-popping investment and ballooning valuations scooped by Indian new-age entrepreneurs, Meesho aims to reduce capital burn like many other well-funded startups.

The firm has experimented with a variety of products. The firm entered the B2C sector in late 2021 after its social commerce operation was challenged by high marketing costs, reliance on influencers, and a lack of training for resellers to sell items. In addition, in 2021, it experimented with its community-buying grocery vertical Farmiso in Karnataka before spreading it to other states.

The onset of layoff in Meesho.

Farmiso was eventually renamed Meesho Superstore after the merger resulted in the combined firm laying off 150 people in April 2022. However, the business could not maintain itself, and Meesho shut down operations of Meesho Superstore in all cities save Mysore and Nagpur in September 2022, which resulted in the laying off of another 300 Meeshoites.

However, it was allegedly reported citing sources at the time the total number of employees impacted was around 400 then. Whether dead Covid people or terminated corporate individuals, the fudging of bits is very common in every aspect of the Indian diaspora.

Well, the series of layoffs doesn’t end here. Again, in May 2023, Meesho reported a third round of layoffs, terminating 251 employees in the pursuit to turn sustainability amid a larger reset in the technology in the industry. It’s strange how the people who helped to build the business in initial terms are laid off when the company achieves tremendous growth! That’s an iconic unfortunate of the Indian startup ecosystem.

The notion of zombie startups.

Do you know the meaning of zombie? Something present or live but incapable of growth. A similar ideology goes with the definition of zombie startups. These companies have become unicorns but have no business plans; they are not dying but will become useless.

Meesho is one of the famous zombie startups today in India. Now you may ask, why? Six years ago, Meesho pioneered social commerce in India, offering a source of income for millions of homemakers. But this strategy of Meesho tempered when it converted from social commerce to E-commerce and started direct selling to customers at a lower cost.

One of the resellers claims she has lost almost all of her customer base after Meesho changed its plan to sell straight to customers in 2021. Consumers may now purchase the same things via the Meesho app at a lower price than she quoted, which included her income. She is now being attacked by enraged friends and family members who feel betrayed. Yes, Meesho misled both the shareholders and the stakeholders.

CEO Vidit Aatrey repeated Meesho’s lofty promise of empowering Indian females and making them financially independent by providing possibilities to be entrepreneurs with no investment. “These are first-generation women entrepreneurs who are leading the social commerce revolution in India,” Aatrey remarked in 2020.

Everyone believed this story: investors, the media, and, most importantly, resellers. However, in mid-2021, the corporation abruptly changed course and opted to become an e-commerce platform by going straight to customers, cannibalising the businesses of 15 million, largely female resellers. Contrary to claims of females’ financial independence, women resellers believe

Meesho has stolen them of their livelihood after providing consistent revenue for years. Direct selling now accounts for 75% of Meesho’s income. Yes, the company failed to fulfil its vision.

Also, competition from other startups and e-commerce behemoths is increasing. As a result, the pioneering startup has just been labelled a zombie unicorn. According to one investor who assessed Meesho from an investment viewpoint, Meesho is back at the beginning line with its move from social commerce to an e-commerce enterprise.

Is Meesho’s vision lacking?

“Meesho has no idea what it is creating. It is transitioning from one approach to another: from social commerce to B2C, from international expansion to small-town grocery during a pandemic, and from zero-commission to ad-monetization.It just cannot spend its way out of this mess.

Not now, when it is surrounded by deep-pocketed, laser-focused rivals capable of outspending Meesho at every turn. There is concern that Meesho has returned to the starting line after spending more than $500 million in two years. But why the abrupt fall from grace? The solution is in Meesho’s probable illogical decisions.

A hard pivot and too many pies.

Why the idea of reselling lacked vision?

Meesho has positioned itself as a reseller destination for over five years. Then, in mid-2021, Meesho abruptly shifted from a reseller model to a B2C platform. The reasons for this were valid as a business because Meesho’s bunch of resellers had no control over either the products or the supplier. They had no actual experience or training in selling, resulting in poor order servicing and mounting user complaints, leading to Meesho now competing with deep-pocketed players: Walmart-backed Flipkart and Jeff Bezos’ Amazon.

The problematic business model of entering into the groceries segment.

Another disastrous step into this shift was the company’s entrance into the grocery market. Meesho announced intentions to provide food delivery services in over 200 cities in April 2021. However, it has been about a year before Farmiso has expanded outside a handful of locations.

Amazon, Flipkart, Tata Digital-controlled Big Basket, BlinkIt, DealShare, Swiggy, and JioMart dominate the hyper-competitive food business, having established critical sourcing and logistical skills. With significant funds, they have all demonstrated a willingness to support large-scale losses. Meesho had difficulty breaking into this market, contributing to the company’s downward momentum.

Competing against the bigwigs.

With lesser competitors like Glowroad and Shop101, Meesho may have developed the Indian social commerce business at its speed. That is not the case when competing with more giant corporations. Instead of waiting for the war to come to them, Flipkart brought the battle to Meesho’s domain in July 2021 with the launch of its social commerce app Shopsy. Shopsy has not only upset Meesho but also many of its resellers. Furthermore, Shopsy’s zero-commission strategy and 700-city supermarket aspirations have taken the lustre off Meesho.

Another setback for Meesho came in 2021, when Southeast Asia’s prominent e-commerce site Shopee opened in India, choking Meesho’s future development chances. Shopee, which has established a $150 billion business in 13 countries throughout Asia, South America, and Europe, is noted for its aggressive pricing, huge choice, and appealing promos.

Meesho is now stuck between Flipkart and Amazon on one side and Shopee pinching its company on the other as Shopee expands in India. Alas, Meesho forgot the adage saying ‘पैर उतनी फैलाओ जितनी चादर है ‘.

Other parameters raise concern over the zombie unicorn.

Legal notices to Meesho.

The pain of sellers-Compromising refund policies (Case study from 2023).

Sellers on Meesho are sending legal notices to the startup alleging unfair trade practices. Most sellers’ order deliveries have been met with a return request, claiming grounds such as damaged or incorrect merchandise. However, the items aren’t damaged when returned to the seller. The seller claims that courier partners are failing to perform their duty between deliveries and that sellers are liable for the loss and inconvenience due to this practice. Furthermore, the seller cannot follow up with the customer who made the return request because that specific information is not given.

Wait, but how’s that possible? A bit above, we read that Meesho had spent heavily on Information Technology and Software Services. Then, why such a nuisance in their tracking system? The notice further stated that this practise has resulted in “immense mental harassment to the seller” and requested that the company come up with an appropriate resolution, such as a refund of the damaged merchandise and harsh action against courier partners.

In January, Meesho implemented a series of new regulations that allow sellers to select their preferred courier partner for order returns depending on their individual needs, among other things. To make this option, sellers are offered different factors and indicators such as ‘Average Return Time,’ ‘Costing,’ and ‘Claims Raised’ of the courier partners.

Following this modification in late January, Meesho sellers disputed the increasing number of incorrect deliveries and low claim acceptance rate on Meesho over the earlier 30 days. While buyers obtain their refund when they return the wrong order package, sellers allege they do not receive the proper goods back and cannot seek compensation for the lost items. In such a case, Mohammad Salman, a seller in Meesho, registered a complaint in Consumer Complaints Court on June 2022.

To compensate for operating losses, Meesho modified its return policy. Their return policy included some rigorous requirements. According to a company spokesman, Meesho’s return policies are “fair and competitive,” and third-party logistics suppliers have no bearing on the new policy. However, the project has had severe technological challenges, with some merchants stating that they were not refunded despite receiving updated products from consumers. Again, these technical difficulties raise questions about the money spent on software technology services!

The mental harassment of consumers- Is Meesho involved in generating Ghost Orders? (Case study from 2021)

Previously, Meesho and Shadowfax were blamed of defrauding, cheating and scamming, and exploiting consumers on a large scale as well as “resorting to unfair trade and fraudulent practises, which give rise to both civil and criminal liability,” according to a legal notice dated 2021. According to the notice, Meesho has been accused of placing orders on its platform or intentionally aiding and promoting the same for financial advantage.

The plaintiff stated that if Meesho does not guarantee that it would comply with the Consumer Protection, IT, Privacy, and other applicable laws that prevent such consumer abuse, its customers may take the matter to court and cyber police. Moving on, the plaintiff has also requested that Google remove the Meesho app. They brought to the attention through this notice that the Impugned App (Meesho) is being used for impersonating and defrauding consumers and is not operating under consumer protection, IT, and other laws, necessitating its removal to protect consumers’ interests.

The legal notice claims that even after the owners were made aware of the fraudulent transactions, no action was taken to correct them and that the app’s continued availability on Google Play implies it is vulnerable to fraudulent transactions that can harm users.

FIR to Meesho.

Complaint of a customer. (Case reported in January 2021)

Police in Uttar Pradesh have filed a FIR against the zombie unicorn in response to a complaint submitted by a client who claimed he was sold a fake Rolex watch and a GUCCI t-shirt on the social commerce platform. The two goods were sent to the customer on January 21, 2021, and due to their low quality, the complainant became sceptical of their authenticity.

The complainant took the items to several stores in the city, and based on feedback, he concluded that fraudulent products had been supplied to him under the pretence of genuine ones. An FIR has been filed under Section 406 of the IPC against the firm and its directors, Vidit Aatrey and Sanjeev Kumar, for criminal breach of trust.

Complaint by a regulatory body. (Case reported in May 2022)

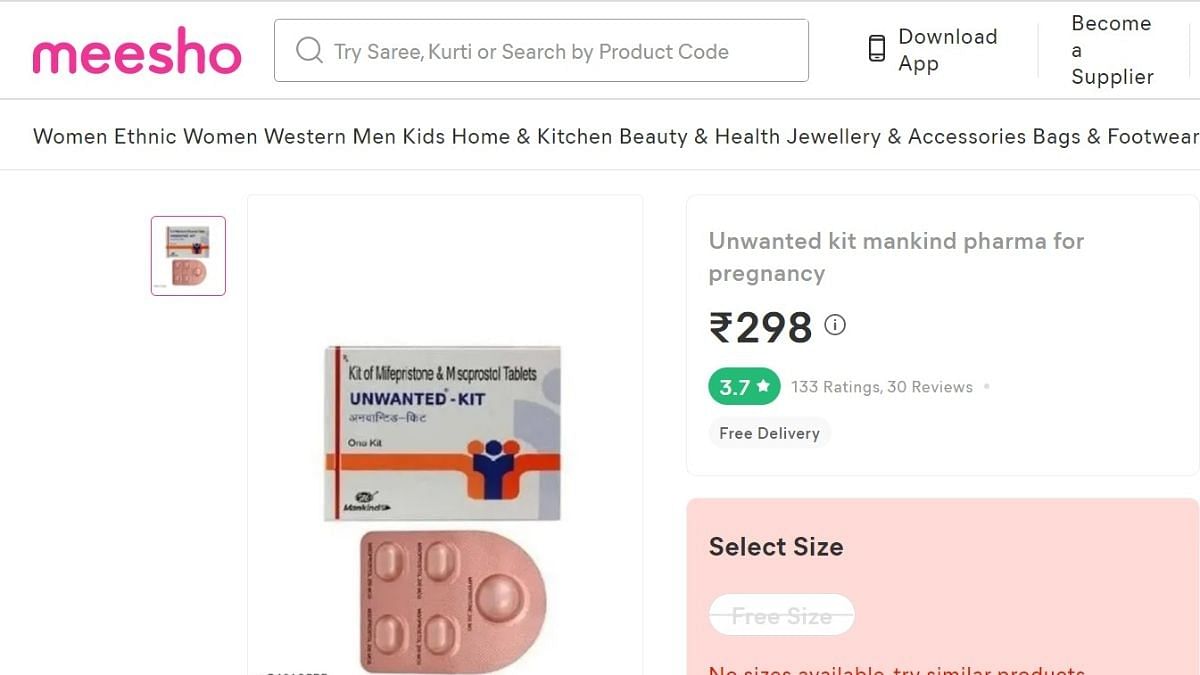

The FDA, Food and Drug Administration has filed 13 FIRs against Meesho.com and the sellers it boards for the online selling of abortion drugs (MTP Kit). Assistant Commissioner of FDA Ganesh Rokade stated that after receiving information that abortion drugs were being sold illegally on the Meesho.com online marketing portal, the officers of this administration registered demands for MTP Kit without prescription from various parts of the state as fake customers.

When the term MTP is entered into the search box, alternatives such as MTP abortion kits, MTP kit tablets, MTP pills, MTP tabs, and so on become accessible. After selecting one of these alternatives, photographs of abortion medications such as Unwanted Kit and Dr Morepen MTP Kit in their final saleable pack showed for adding to the basket. Without a doctor’s prescription, all of the orders were accepted.

The MTP Kit is a ‘Schedule H drug under the Drugs and Cosmetics Act of 1940; therefore, it may only be sold with a prescription from a registered medical practitioner. Furthermore, the Medical Termination of Pregnancy Act, 2002 and Rules, 2003 require this drug to be used in a health facility and under the supervision of a service provider. Meesho.com, on the other hand, encouraged the unlawful selling of MTP medications.

Last but not least, the zombie unicorn is famous for scams and compromised products. Just click here and explore the disgusting episodes of Meesho scams.

Conclusion.

Regarding shareholders’ interest, Meesho made a strategic mistake and is now competing with practically every major e-commerce company in India. To create the company it promised its investors, it has shifted from a dominant position in social commerce to a rival in numerous sectors. It seems that there is another Paytm on the way.

From the viewpoint of stakeholder concern, the startup failed to manage its reputation, and the so-called pioneering Indian social platform, which was once known for cheap and affordable products, is now famous for fake and low-quality merchandise.

Not only Meesho but there are also several Indian startups which were once famed symbols of iconic entrepreneurship ideas that are now facing harsh actions from society and regulatory bodies. Be it because of financial irregularities to customers and employee harassment, legal failures, to unethical issues, the picture of Indian startups is jeopardising every passing day.

One common thing in all these startups is they raised millions of funds under the pretext of company funding, and now either they cannot handle the funds in an uncorrupted way, or they are entering into the segments of cash burns. Whatever it may be, it’s just the loss of capital resources. God knows what unfolds now in the zombie unicorn Meesho.