Analyzing Settl’s FY23 Financial Performance: Unpacking the Numbers

Analyzing Settl’s FY23 Financial Performance: Unpacking the Numbers

Settl, a coliving operator, has set its sights on achieving a topline of Rs 41 crore in the current fiscal year (FY24) following its impressive growth over the past few years. From FY21 to FY23, the company’s scale expanded by over 15 times, reaching around Rs 16 crore in revenue.

Taking a closer look at its operations, Settl experienced substantial growth in revenue from operations. In FY23, its revenue reached Rs 16.33 crore, marking a significant increase of over 2.5 times compared to the previous fiscal year when it recorded Rs 6.36 crore in revenue (FY22).

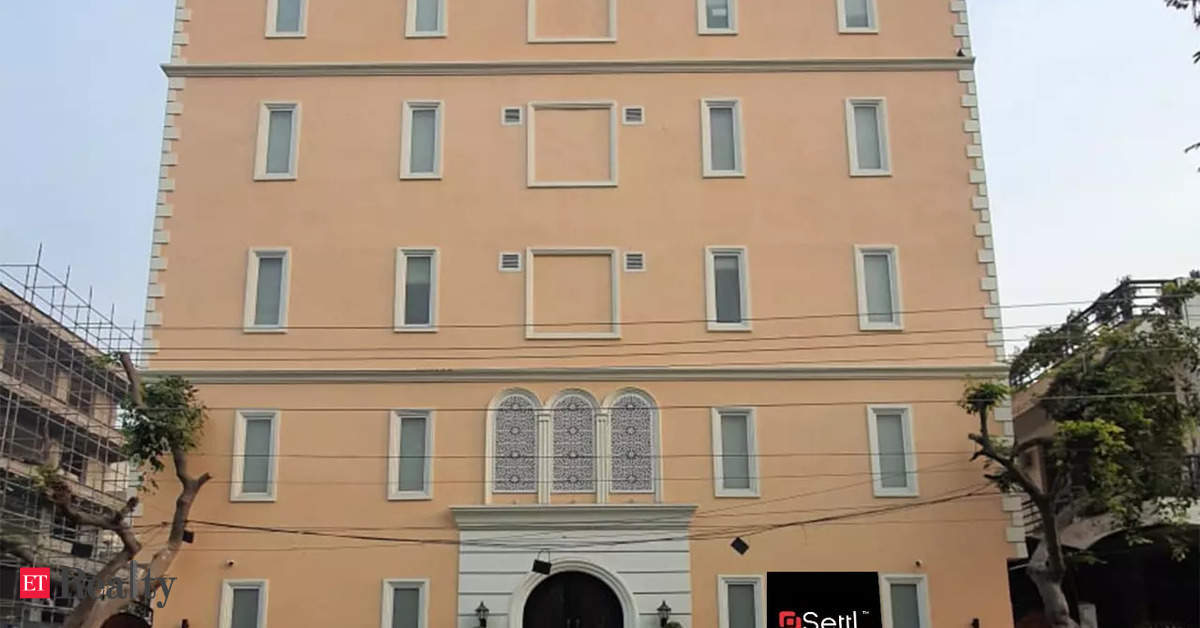

Settl, founded in 2020, has achieved remarkable growth in its revenue from operations during FY22, experiencing a six-fold increase. The company operates as a full-stack real estate operator, offering co-working, co-living, and community-living solutions to working professionals. It follows an asset-light model by leasing assets from builders or asset owners to establish its centers.

Currently, Settl operates 2,000 beds across 40 centers in Bangalore, Hyderabad, and Gurugram. As part of its expansion plans, the company aims to significantly increase its capacity to 5,000 beds, which is 2.5 times its current capacity. Additionally, Settl intends to expand its presence to other cities such as Noida, Pune, and Chennai.

With its ambitious revenue target of Rs 41 crore for FY24 and plans for expansion, Settl aims to capitalize on the growing demand for co-living spaces and strengthen its position in the market.

In terms of expenses, Settl allocated a significant portion of its total expenditure to the cost of services, which includes lease and equipment rentals, property maintenance, housekeeping, information technology, subscriptions, and other utility costs. This category accounted for more than 52% of the company’s total expenses. In FY23, the cost of services increased by 36% to Rs 9.68 crore compared to Rs 7.11 crore in FY22.

Spending on employee benefits also experienced a significant surge, nearly quadrupling to Rs 3.25 crore in FY23 from Rs 82 lakh in FY22. Additionally, the finance cost of the company doubled to Rs 33 lakh during the same period.

These expenditure trends indicate that Sethe company has been scaling up its operations and investing in its workforce, resulting in increased costs. As the company expands its presence and aims for higher revenue targets, it is important for Settl to carefully manage its expenses to maintain a sustainable financial performance.

Settl demonstrated effective expense management strategies in FY23, resulting in a reduction in losses compared to the previous fiscal year. The company’s losses before tax and exceptional items decreased by 30.4% to Rs 2.2 crore in FY23, down from Rs 3.16 crore in the preceding fiscal year.

In contrast, Settl experienced a significant increase in total expenses and net losses of approximately 317% and 153%, respectively, during FY22.

Looking at the unit level, Settl spent Rs 1.14 to earn one rupee of operating revenue in FY23. This metric reflects the company’s efficiency in utilizing its resources to generate revenue.

By controlling expenses and reducing losses, Settl has shown progress in its financial performance. The focus on cost management and improving operational efficiency will be crucial for the company’s continued growth and path toward profitability.

Settl has set its sights on achieving growth and establishing itself as a leading player in the premium coliving segment. The company states that it is operationally profitable, with losses primarily attributed to corporate expenses. It has expressed its goal of achieving profitability by November 2023.

To support its growth and expansion, Settl has raised approximately Rs 4.9 crore from investors, including ah! Ventures, We Founder Circle, and other angel investors. According to Fintrackr’s analysis, the company was valued at around Rs 30 crore following its latest fundraising round in September 2021. Settl plans to initiate its Series A funding round in March of next year.

The funding secured and the planned Series A round will provide it with the necessary capital to fuel its growth trajectory and further strengthen its position in the coliving market. With a focus on operational profitability and continued investment, Settl aims to capture a significant market share and achieve long-term success in the premium coliving space.