Over 4,900 Fraudulent GST Registrations Revoked Since May 16

Over 4,900 Fraudulent GST Registrations Revoked Since May 16

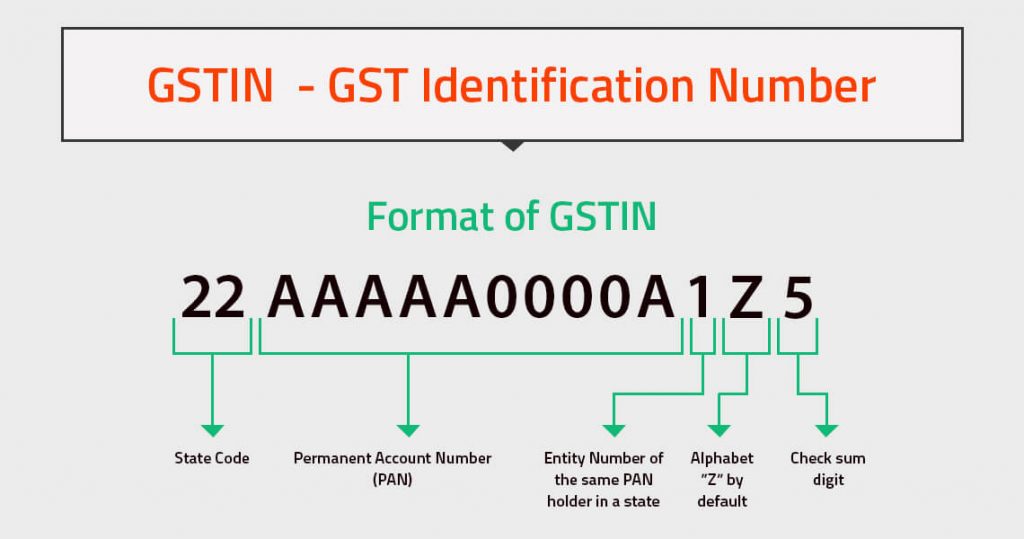

The identification and cancellation of non-existent GSTINs (Goods and Services Tax Identification Numbers) is part of a pan-India drive by the GST authorities to crack down on fake registrations. According to a senior tax official, approximately 17,000 non-existent GSTINs have been identified, and over 4,900 registrations have been canceled as a result.

The Goods and Services Tax (GST) regime, which was implemented in India, replaced the previous indirect tax system. The number of businesses registered under GST currently stands at 1.40 crore, which is nearly double the number of businesses registered under the previous indirect tax regime.

The identification and cancellation of fake registrations are important steps taken by the authorities to ensure the integrity of the GST system. By eliminating non-existent registrations, the aim is to prevent fraudulent activities such as tax evasion, fake invoices, and misuse of input tax credits.

This drive against fake registration highlights the government’s commitment to maintaining a transparent and compliant tax system. It sends a strong message that actions will be taken to weed out non-compliant businesses and ensure that genuine businesses operate within the framework of the GST laws.

Businesses need to ensure that their GST registrations are accurate and up to date. Maintaining compliance with the GST regulations helps businesses contribute to the overall tax revenue and fosters a fair and transparent business environment.

According to CBIC member Shashank Priya, in the ongoing drive against fake registration, a significant number of GSTINs have been selected for physical verification by field tax officers. As of July 4, over 69,600 GSTINs have been chosen for verification. Out of these, more than 59,000 GSTINs have been verified, and it has been found that 16,989 of them are non-existent.

This verification process plays a crucial role in identifying fraudulent registrations and ensuring the integrity of the GST system. By conducting physical verification, tax officers can validate the existence and legitimacy of the registered businesses.

The identification of non-existent GSTINs through this drive emphasizes the government’s commitment to tackling fake registrations and maintaining a transparent tax ecosystem. Such measures help in preventing tax evasion, fraudulent practices, and misuse of input tax credits.

The CBIC’s efforts in verifying GSTINs and taking action against non-existent registrations contribute to the overall effectiveness and credibility of the GST system. It reinforces the importance of compliance and ensures that businesses operating within the GST framework are genuine and legitimate.

By targeting fake registrations, the authorities aim to create a level playing field for honest taxpayers and promote a fair business environment. It also underscores the significance of ongoing vigilance and measures to combat tax-related malpractices.

According to CBIC member Shashank Priya, out of the 69,600 GSTINs selected for physical verification, a significant number of registrations have been suspended or canceled. Specifically, more than 11,000 GSTINs have been suspended, and 4,972 registrations have been canceled.

These actions were taken due to identified instances of tax evasion amounting to over Rs 15,000 crore. Additionally, the input tax credit (ITC) worth Rs 1,506 crore has been blocked to prevent its misuse. As part of the drive against fake registration, authorities have also managed to recover taxes worth Rs 87 crore.

These figures highlight the magnitude of the problem of fake registrations and tax evasion, which can have significant implications for government revenue and the fairness of the tax system. The actions taken by the authorities, including the suspension and cancellation of registrations, aim to curb such practices and ensure compliance with GST regulations.

Priya shared these updates during the Assocham’s National Conclave on GST, indicating the government’s commitment to addressing tax evasion and strengthening the GST framework. These measures not only deter fraudulent activities but also contribute to creating a transparent and accountable tax ecosystem.

By blocking ITC and recovering taxes, the authorities seek to prevent the misuse of credits and ensure that the tax system operates efficiently and fairly. These enforcement actions serve as a deterrent for those engaging in tax evasion practices and send a clear message about the consequences of non-compliance.

Overall, the government’s efforts to identify and tackle fake registrations, along with the recovery of evaded taxes, demonstrate its determination to maintain the integrity of the GST system and promote a culture of compliance among businesses.

The ongoing special drive to combat fake registration under the Goods and Services Tax (GST) is set to conclude on July 15. This two-month initiative, which began on May 16, aims to tackle the issue of fraudulent registrations, where individuals or businesses wrongfully avail input tax credit (ITC) by issuing fake invoices and thereby defrauding the tax authorities.

Shashank Priya, a member of the Central Board of Indirect Taxes and Customs (CBIC), also mentioned that the tax department is considering introducing more detailed reporting of data in the monthly tax returns filed through GSTR-3B. This proposed change would facilitate better matching between GSTR-3B, which is the summary return filed by taxpayers, and GSTR-2B, an auto-drafted statement that captures the input tax credit.

By implementing more granular reporting and improving the reconciliation process between GSTR-3B and GSTR-2B, the tax department aims to enhance the accuracy of ITC claims and reduce instances of mismatches or discrepancies. This move is expected to strengthen the compliance framework, ensuring that taxpayers are appropriately reporting their transactions and availing legitimate input tax credits.

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

Such measures not only help in curbing tax evasion but also promote transparency and accountability in the GST system. By identifying and addressing the loopholes that allow for fake registration and fraudulent practices, the government aims to protect the exchequer’s revenue and foster a fair and efficient tax ecosystem.

The ongoing drive against fake registration, coupled with the proposed improvements in reporting and reconciliation, demonstrates the government’s commitment to curbing tax fraud, improving compliance, and strengthening the GST framework. These efforts contribute to the integrity of the tax system and pave the way for a more effective and transparent taxation regime.