Modern Problems Require Modern Solutions: Zomato Faces Influx Of Rs. 2000 Bank Notes After RBI Order

Following the RBI's order on withdrawal of the highest denomination of the Indian currency, customers ordering food through the Zomato App opted for the COD mode so as to get rid of their Rs. 2000 bank notes.

The leading food delivery app in India, Zomato gets flooded with Rs. 2000 notes as customers opt for cash-on-delivery following the new announcement made by RBI.

A whooping 72 per cent of buyers handed out their 2000 rupee paper note to pay their food delivery bills in a bid to dispose off the bank note at the earliest.

RBI Announcement To Withdraw Rs. 2000

The Reserve Bank of India (RBI) came out with a communique to withdraw the circulation of the high paying note on 19 May 2023.

The Central Bank further urged all the citizens to exchange or deposit the Rs. 2000 bank notes by 30 September.

As soon as the announcement was made public, Indians are in a frenzy to do away with the highest denomination currency, and have thronged the jewelry stores and fuel stations to find a way out.

Banks will open the exchange facility on 23 May that is today. State Bank of India (SBI) proclaimed that no ID proof or requisition slip would be needed for the transaction.

In addition, RBI has set a limit of exchanges that can be made at any bank up to 10 currency notes that totals to Rs. 20,000 at one time.

However, there is no daily cap set for the deposit of Rs. 2000 bank notes. The bank customers are eligible to deposit any number of notes into their account and can later withdraw them.

Rs. 2000 denomination note will still be considered as a legal tender, yet RBI has advised Banks to stop the issue of the high paying note with immediate effect.

Shaktikanta Das, RBI Governor, manifested that citizens do not have to rush to exchange their bank notes as their is ample time of 4 months in hand, and the Central Bank will look after any issues that pops up during the whole process.

In fine tune with the clean note policy, the currency management operations of RBI decided to withdraw the highest denomination note from circulation.

The purpose of the Rs. 2000 currency notes have been fulfilled as they were initially introduced as an alternative measure post demonetization of Rs. 500 and Rs. 1000 bank notes in 2016.

Moreover, the printing of Rs. 2000 currency notes were ceased in the year 2018-19. The cumulative value of 2000 rupee notes have also degraded to 3.62 trillion in 2023 compared to 6.73 trillion in 2018.

Zomato Flooded

Following the RBI message, Zomato tweeted with a playful dig remarking that while kids exchanged Rs. 2000 notes at the bank, adults chose the COD mode of payment and gave away their Rs. 2000 bank notes, whereas legends never possessed the Rs. 2000 notes.

On Monday, Zomato took to Twitter again exclaiming that since the revelation of the withdrawal of the notes on Friday, the Gurugram-based restaurant aggregator witnessed a hysterical influx of the Rs. 2000 notes so much to as 72 per cent of its total users.

Along with the stream of memes that followed in Twitter, the food tech giant posted with a Breaking Bad reference wearing a Zomato T-shirt lying on a pile of Rs. 2000 notes.

Reacting to this tweet by Zomato, some users took a dig by stating that modern problems require modern solutions.

Zomato UPI

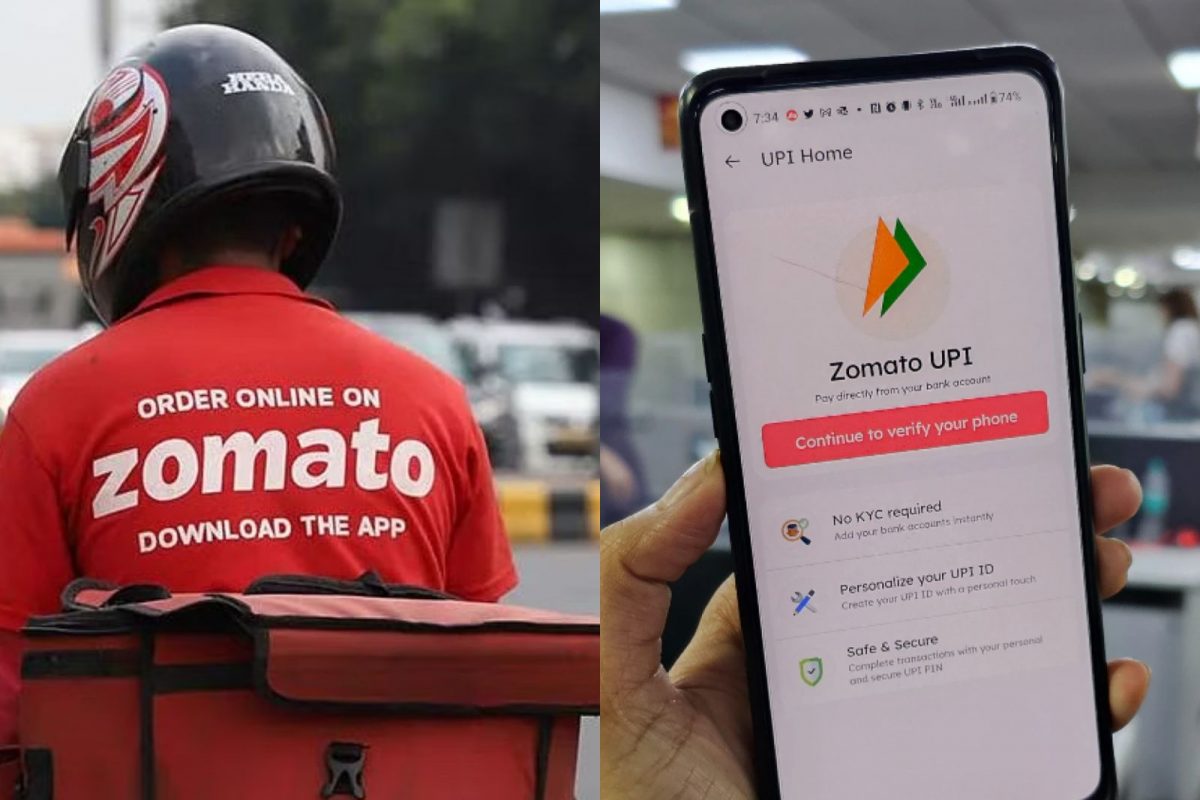

Hoping on to the bandwagon, Zomato in partnership with ICICI Bank has recently launched its newest service of Zomato UPI, and is currently rolling out the feature to its customer base.

The Zomato UPI will assist the buyer in completing their payment within the Zomato App itself, without the need of switching to other UPI apps such as Google Pay, Phone Pay, Paytm, Amazon Pay among others.

Zomato serves a large number of clientele who prefer using the UPI mode of payment, and therefore released their seamless solution into the market.

No wonder, the recent hullabaloo of the Rs. 2000 notes has almost masked this development by the food tech giant.

Proofread & Published By Naveenika Chauhan