What Is Virtual CFO, Its Roles & Responsibilities And Why Startups Must Have Virtual CFO. List Of 10 Companies Providing Best Virtual CFO Services

What Is Virtual CFO, Its Roles & Responsibilities And Why Startups Must Have Virtual CFO

What Is Virtual CFO

A Virtual CFO (Chief Financial Officer) is an outsourced service provider that offers high-level financial expertise and strategic guidance to businesses on a part-time, as-needed, or project basis. Virtual CFOs are particularly beneficial for small and medium-sized businesses that may not have the resources to hire a full-time CFO but still require expert financial management and advice.

Virtual CFOs work remotely and leverage technology to communicate and collaborate with clients. They provide a range of financial services, such as financial planning and analysis, budgeting, cash flow management, risk management, tax planning and compliance, investor relations, and strategic decision-making support.

By offering their services virtually, Virtual CFOs can provide businesses with the financial expertise they need in a more cost-effective and flexible manner compared to hiring a full-time CFO. This enables businesses to access high-quality financial management and guidance without incurring the significant overhead costs associated with a full-time executive position.

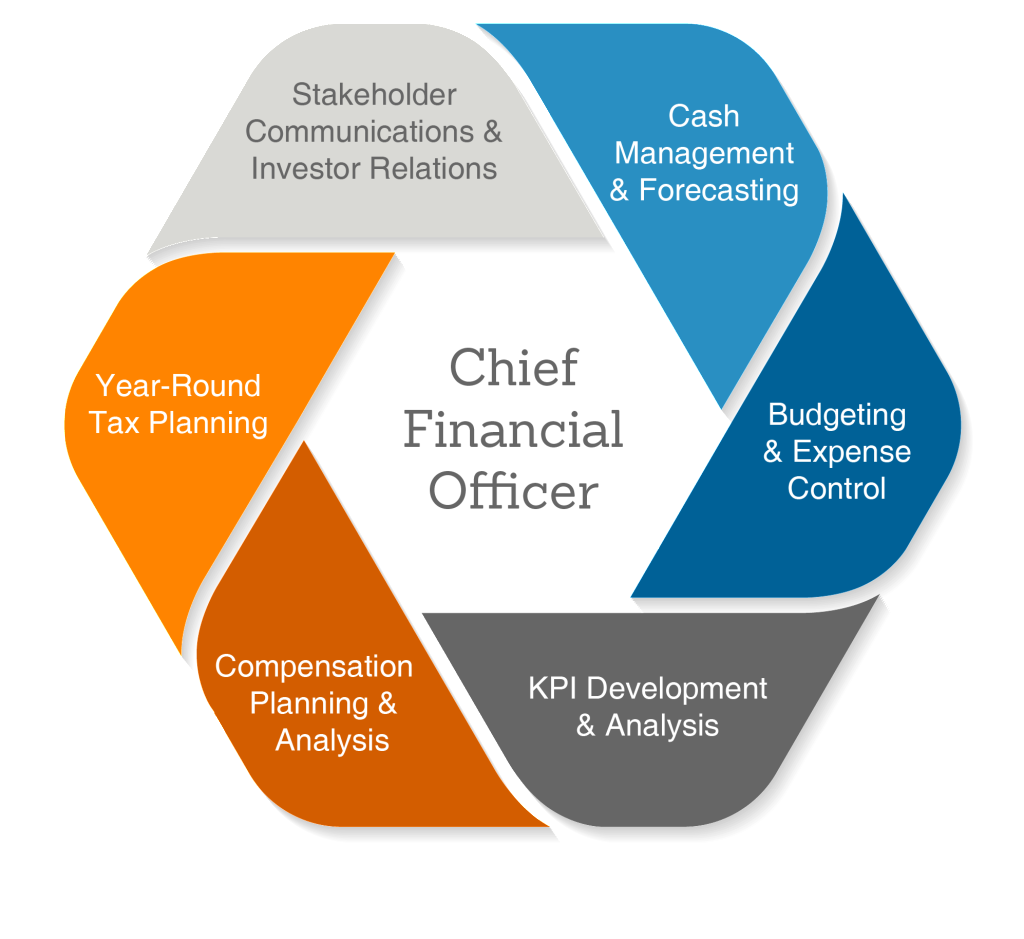

Roles & Responsibilities Of Virtual CFO

A Virtual CFO (Chief Financial Officer) is an outsourced service provider offering high-level financial expertise and strategic guidance to businesses. Virtual CFOs can work on a part-time, as-needed, or project basis, making them a more cost-effective solution for small and medium-sized businesses that may not have the resources to hire a full-time CFO.

The roles and responsibilities of a Virtual CFO can be varied and tailored to the specific needs of the client, but generally, they include the following:

Financial strategy and planning:

- Assessing the overall financial health of the company

- Developing short-term and long-term financial goals and strategies

- Identifying opportunities for growth and expansion

- Evaluating potential mergers and acquisitions

- Developing financial contingency plans

Financial analysis and reporting:

- Preparing and presenting financial statements and reports

- Analyzing financial data to identify trends, risks, and opportunities

- Developing and maintaining key financial performance indicators (KPIs)

- Creating and managing financial forecasting models

- Ensuring compliance with financial regulations and reporting standards

Cash flow management:

- Monitoring and managing cash flow to ensure adequate liquidity

- Identifying potential cash flow issues and developing solutions

- Implementing cash flow optimization strategies, such as cost reduction or revenue enhancement

- Evaluating and managing credit risk

Budgeting and cost control:

- Developing and implementing annual budgets and financial plans

- Monitoring budget performance and conducting variance analyses

- Identifying cost-saving opportunities and implementing cost control measures

- Ensuring effective allocation of resources

Risk management:

- Identifying and evaluating financial risks

- Developing and implementing risk mitigation strategies

- Ensuring compliance with relevant laws, regulations, and industry best practices

- Overseeing internal and external audits

Financial systems and processes:

- Implementing and maintaining financial systems and software

- Streamlining and optimizing financial processes and procedures

- Ensuring data accuracy and integrity

- Developing and maintaining internal financial controls

Tax planning and compliance:

- Developing tax strategies to minimize tax liability

- Ensuring timely and accurate filing of tax returns

- Managing tax audits and disputes

- Keeping up-to-date with changes in tax laws and regulations

Investor relations and fundraising:

- Developing and managing relationships with investors, lenders, and other stakeholders

- Creating and presenting financial information for investor meetings and pitches

- Assisting in fundraising efforts, such as debt or equity financing

- Evaluating financing options and negotiating terms

Strategic decision-making support:

- Providing financial expertise and insights to support key business decisions

- Collaborating with other executives and department heads to align financial goals with overall company objectives

- Participating in board meetings and presenting financial information as needed

Talent management and team development:

- Overseeing the finance department and ensuring adequate staffing levels

- Mentoring and developing finance team members

- Implementing training and development programs to improve financial expertise within the company

A Virtual CFO can provide significant value to a company by offering strategic financial guidance, improving financial processes, and ensuring compliance with regulations. By taking on these responsibilities, a Virtual CFO can help businesses optimize their financial performance and achieve their goals.

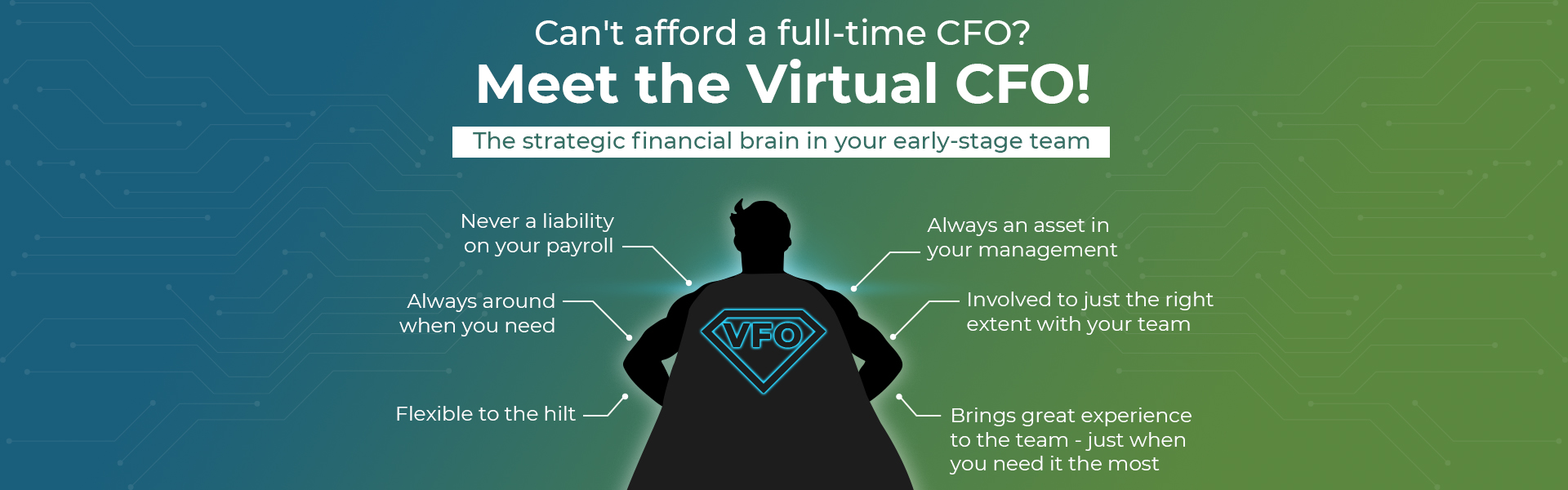

Why Startups Must Have Virtual CFO

Startups often require Virtual CFO (Chief Financial Officer) services for several reasons. While hiring a full-time, in-house CFO can be expensive, Virtual CFOs provide a more cost-effective solution that still offers valuable financial expertise. Here are some reasons why startups may need Virtual CFO services:

- Financial expertise: Virtual CFOs bring a wealth of financial knowledge and experience, helping startups navigate complex financial situations, including budgeting, cash flow management, and financial planning.

- Cost-effective: Hiring a full-time CFO can be costly, especially for early-stage startups with limited resources. Virtual CFOs offer a more affordable alternative, providing financial expertise on an as-needed basis and reducing overhead costs.

- Scalability: As startups grow, their financial needs may change. Virtual CFOs can scale their services up or down as required, providing flexibility and adaptability for the startup.

- Financial reporting and analysis: Virtual CFOs can help startups develop accurate and timely financial reports, ensuring they have the information needed to make informed business decisions. They can also provide valuable analysis and insights to help guide the company’s strategy.

- Compliance: Startups must adhere to various financial regulations and tax laws. Virtual CFOs can ensure that the startup remains compliant, reducing the risk of fines or legal issues.

- Fundraising support: Raising capital is crucial for many startups, and Virtual CFOs can help prepare financial projections, pitch decks, and other materials needed to secure funding from investors.

- Strategic planning: Virtual CFOs can contribute to the overall business strategy by providing financial insights, enabling startups to make better decisions regarding growth, pricing, and market positioning.

- Time-saving: Startups often have limited personnel resources, and outsourcing financial management to a Virtual CFO can save time, allowing founders and employees to focus on core business activities.

- Risk management: Virtual CFOs can identify potential financial risks and help startups develop mitigation strategies to minimize potential negative impacts on the business.

- Networking: Virtual CFOs often have extensive professional networks, which can be valuable for startups in need of financial or business advice, or connections to potential investors and partners.

List Of Companies Providing Best Virtual CFO Services

CFO Bridge (www.cfo-bridge.com)

SuperCFO (www.supercfo.com)

MyCFO (www.mycfo.in)

Virtual CFO Group (www.virtualcfogroup.com)

White Collar Services (www.whitecollar.in)

Act21 Softek (www.act21softwares.com)

FinAcc Global (www.finaccglobal.com)

DAS CFO (www.dascfo.com)

EzyCFO (www.ezycfo.com)

Boston Financial Advisory Group (www.bostonfagroup.com)

CFO Services (www.cfoservices.in)

Especia Associates (www.especia.co.in)