Top 10 Best P2P Lending Companies Services in Europe 2023

Top 10 Best P2P Lending Companies Services in Europe 2023

INTRODUCTION

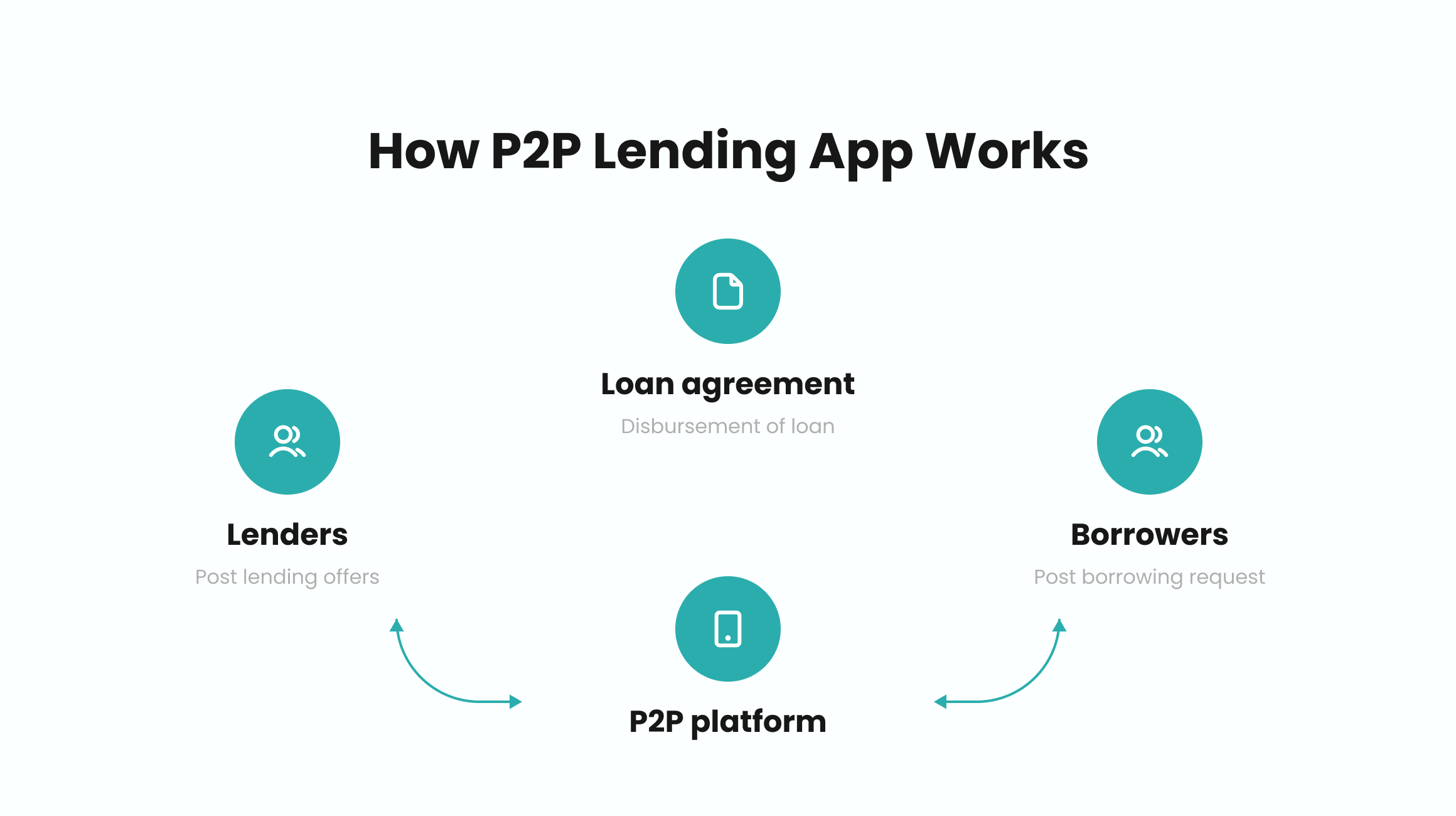

P2P lending, also known as peer-to-peer lending or social lending, is a method of borrowing and lending money that connects individual investors with borrowers through an online platform. The significance of P2P lending lies in the fact that it offers an alternative to traditional banking channels for borrowers who may not qualify for loans from banks or other financial institutions.

P2P lending provides a simple, transparent, and efficient way for borrowers to access funding, while at the same time offering investors the opportunity to earn attractive returns on their investments. By bypassing traditional intermediaries such as banks, P2P lending can offer borrowers lower interest rates and fees, while providing investors with higher returns than traditional savings accounts or government bonds.

IMPORTANCE

P2P lending has become an increasingly popular way of financing in Europe, as it offers a more convenient and accessible way for borrowers to access credit and investors to diversify their portfolios. With the growth of digital technologies and the increasing demand for more flexible and efficient financial services, P2P lending is poised to continue growing in popularity.

Moreover, P2P lending platforms are generally more transparent and accountable than traditional banks, which can be opaque in their lending practices. P2P lending platforms typically offer detailed information about their loans, including the creditworthiness of borrowers, the interest rates and fees charged, and the expected returns for investors. This level of transparency helps to build trust and confidence among borrowers and investors alike.

Finally, P2P lending has the potential to promote financial inclusion by extending credit to borrowers who may not have access to traditional banking services, such as those with a limited credit history or who are self-employed. By providing an alternative source of funding for these borrowers, P2P lending can help to bridge the gap between those who need credit and those who are willing to provide it.

Overall, P2P lending has the potential to revolutionize the way that we borrow and invest money, offering a more efficient, transparent, and accessible way of accessing credit and generating returns on investments. As such, it is likely to continue to play an increasingly important role in the European financial landscape in the years to come.

Here are the Top 10 Best P2P Lending Companies Services in Europe 2023

Mintos:

Mintos is a P2P lending marketplace that offers investors the opportunity to invest in loans issued by various lending companies across Europe. With more than 370,000 investors and over €8 billion in loans funded since its inception in 2015, Mintos has become one of the most popular P2P lending platforms in Europe.

Mintos is a Latvian P2P lending platform that was founded in 2015. It has become one of the most popular and largest P2P lending platforms in Europe. Mintos provides a marketplace where investors can lend money to borrowers and earn interest on their investments.

The platform allows investors to invest in loans issued by non-banking financial institutions (NBFI), which are registered and regulated in various countries across Europe. Mintos has partnered with more than 70 loan originators who offer loans in different categories, such as personal loans, car loans, business loans, and mortgages.

Mintos offers a user-friendly and easy-to-use platform, which allows investors to set their investment criteria and choose the loans they want to invest in. Investors can diversify their investments across different loan originators and loan types, which helps to mitigate the risk of default.

Mintos also provides an auto-invest feature that automatically invests funds in loans that meet the investor’s criteria. This feature helps investors to save time and ensure that their funds are invested efficiently.

Mintos charges a small fee for its services, which is deducted from the interest earned by the investor. The platform also offers a secondary market where investors can sell their investments before they mature.

Overall, Mintos provides a reliable and transparent platform that offers a high degree of flexibility and control for investors. The platform has received positive reviews from investors and has become one of the leading P2P lending platforms in Europe.

Bondora:

Bondora is a P2P lending platform that has been operating since 2009. It offers investors the opportunity to invest in loans issued to borrowers across Europe, with a focus on Estonia, Finland, and Spain. Bondora has funded over €400 million in loans and has more than 130,000 investors.

Bondora is a P2P lending company headquartered in Tallinn, Estonia. Founded in 2008, the company has since grown to become one of the largest and most popular P2P lending platforms in Europe, offering investors the opportunity to invest in loans originated in Estonia, Finland, Spain, and Slovakia.

Bondora allows investors to invest in consumer loans, providing a way for individuals to access credit outside the traditional banking system. The platform uses a proprietary scoring system to evaluate loan applicants, ensuring that only those with a high likelihood of repaying their loans are approved.

Investors can choose from a variety of investment options, including investing in individual loans, portfolios of loans, or through the Bondora Go & Grow product, which offers a fixed interest rate of 6.75% per year. The platform also provides a secondary market where investors can buy and sell their loan investments.

Bondora has attracted more than 152,000 investors from around the world and has facilitated more than €1.7 billion in loans since its inception. The company has won numerous awards for its innovative approach to P2P lending, including being named the Best European Peer-to-Peer Lending Platform by the European Fintech Awards in 2017.

Overall, Bondora is a well-regarded and established player in the P2P lending market, offering investors the opportunity to earn attractive returns while supporting individuals in need of credit.

Twino:

Twino is a P2P lending platform that offers investors the opportunity to invest in loans issued to borrowers across Europe. With over €1.3 billion in loans funded since its inception in 2009, Twino has become one of the largest P2P lending platforms in Europe.

Twino is a European-based peer-to-peer lending platform that was founded in 2009. In this response, I will provide an overview of Twino, its business model, and its impact on the lending industry.

Twino connects investors with borrowers, primarily in the consumer lending space, allowing investors to earn returns on their investments and borrowers to obtain loans at competitive rates. The platform offers unsecured loans ranging from €50 to €10,000, with loan terms ranging from 1 month to 5 years. The loans are primarily offered to borrowers in Latvia, Poland, and Russia, although Twino has expanded its reach to other countries in recent years.

Twino uses a proprietary credit assessment model to evaluate the creditworthiness of borrowers and to set interest rates for the loans. The platform offers a buyback guarantee, which means that Twino will repurchase the loan from the investor if the borrower is more than 60 days late on their payments.

Investors can choose from different loan terms and risk categories, with higher-risk loans offering higher potential returns. Twino charges a fee for its services, which includes a loan origination fee and a percentage of the interest earned by investors.

Twino has had a significant impact on the lending industry, particularly in Europe. The platform has provided an alternative source of financing for consumers who may not have access to traditional loans, and has allowed investors to earn competitive returns on their investments. Twino’s focus on technology and data-driven lending has also contributed to the development of innovative lending models in the industry. However, the platform has faced some challenges in recent years, including regulatory changes and economic

Estateguru:

Estate guru is a P2P lending platform that offers investors the opportunity to invest in secured property loans issued to borrowers across Europe. Since its inception in 2014, Estateguru has funded over €300 million in loans.

EstateGuru is a leading European peer-to-peer lending platform that focuses on short-term, property-backed loans. The company was founded in Estonia in 2013 and has since expanded to offer its services in several other European countries, including Latvia, Lithuania, Finland, Spain, and Portugal.

EstateGuru connects borrowers who need financing for their real estate projects with investors who are looking to earn returns by investing in these projects. The platform offers a range of loan types, including development loans, bridge loans, and business loans, all of which are secured by real estate collateral.

One of the key advantages of EstateGuru is its rigorous due diligence process, which ensures that all loans on the platform are of high quality and have a low risk of default. The company also offers a buyback guarantee on all loans, which means that if a borrower defaults on their loan, EstateGuru will buy back the loan from the investor at its face value.

EstateGuru has been recognized for its innovative approach to P2P lending, having won several awards in recent years. In 2020, the company was named Best European P2P Real Estate Lending Platform at the European Fintech Awards.

Overall, EstateGuru offers a reliable and secure platform for investors who are interested in earning returns by investing in real estate projects. The company’s focus on high-quality loans and rigorous due diligence process makes it a strong choice for investors who are looking for low-risk investment opportunities.

Funding Circle:

Funding Circle is a P2P lending platform that offers investors the opportunity to invest in loans issued to small businesses across Europe. With over €11 billion in loans funded since its inception in 2010, Funding Circle is one of the largest P2P lending platforms in Europe.

Funding Circle is a UK-based peer-to-peer lending platform that was founded in 2010. In this response, I will provide an overview of Funding Circle, its business model, and its impact on the lending industry.

Funding Circle connects small businesses with individual and institutional investors, allowing businesses to obtain loans and investors to earn returns on their investments. The platform provides unsecured loans of up to £500,000 to small businesses, with loan terms ranging from 6 months to 5 years. Funding Circle uses a proprietary credit assessment model to determine the creditworthiness of borrowers and to set interest rates for the loans.

Investors can lend money to businesses on the platform, and Funding Circle pools these funds to create a diversified portfolio of loans. Investors can choose from different risk categories, with higher-risk loans offering higher potential returns. Funding Circle charges a fee for its services, which includes loan origination fees and a percentage of the interest earned by investors

Zopa:

Zopa is a P2P lending platform that offers investors the opportunity to invest in loans issued to borrowers in the UK. Since its inception in 2005, Zopa has funded over £6 billion in loans and has more than 60,000 investors.

Zopa is a UK-based online peer-to-peer lending platform that was founded in 2005. In this response, I will provide an overview of Zopa, its business model, and its impact on the lending industry.

Zopa operates as a lending platform that connects borrowers and investors, allowing borrowers to obtain loans and investors to earn returns on their investments. Zopa facilitates loans for a range of purposes, including debt consolidation, home improvements, and car purchases. Borrowers can apply for loans online, and Zopa uses a proprietary algorithm to assess their creditworthiness and determine their interest rate.

Investors can lend money to borrowers on the platform, and Zopa pools these funds to create a diversified portfolio of loans. Investors can choose from different risk categories, with higher-risk loans offering higher potential returns. Zopa charges a fee for its services, which includes loan origination fees and a percentage of the interest earned by investors.

LendInvest:

LendInvest is a P2P lending platform that offers investors the opportunity to invest in loans issued to property developers in the UK. Since its inception in 2008, LendInvest has funded over £3.5 billion in loans.

CrowdProperty:

CrowdProperty is a P2P lending platform that offers investors the opportunity to invest in loans issued to property developers in the UK. Since its inception in 2014, CrowdProperty has funded over £125 million in loans.

CrowdProperty is a UK-based peer-to-peer lending platform that specializes in property development finance. In this response, I will provide an overview of CrowdProperty, its business model, and its impact on the lending and property development industries.

CrowdProperty connects property developers with individual investors, allowing developers to obtain financing for their projects and investors to earn returns on their investments. The platform provides short-term loans for property development projects, with loan terms typically ranging from 6 to 18 months. CrowdProperty also provides funding for bridging loans, refurbishment projects, and development finance for small-scale property developers.

CrowdProperty’s loan application process is straightforward and streamlined. Developers can submit their applications online, and the platform uses a rigorous assessment process to determine the viability of the project and the developer’s ability to repay the loan. Investors can then choose which projects to invest in, with a minimum investment of £500.

CrowdProperty’s focus on property development finance has been instrumental in filling a gap in the market for small- and medium-sized property developers, who may struggle to obtain financing from traditional lenders. The platform has also provided an opportunity for individual investors to participate in the property development industry, with the potential for high returns on their investments.

CrowdProperty’s success has been attributed to its focus on customer experience and the quality of its loan book. The platform has a strict due diligence process, with a team of experienced property professionals who assess the projects and developers to ensure they meet CrowdProperty’s strict lending criteria. This has resulted in a high rate of successful loan repayments and a low default rate, providing investors with added security.

Landbay:

Landbay is a P2P lending platform that offers investors the opportunity to invest in loans issued to property investors in the UK. Since its inception in 2013, Landbay has funded over £450 million in loans.

Landbay is a peer-to-peer lending platform that connects buy-to-let mortgage borrowers with individual and institutional investors. Founded in 2013 and headquartered in London, Landbay is regulated by the Financial Conduct Authority (FCA) and is a member of the Peer-to-Peer Finance Association (P2PFA).

Landbay provides investors with the opportunity to invest in a diversified portfolio of buy-to-let mortgages, with a minimum investment of £100. The platform claims to offer competitive interest rates, with projected returns ranging from 3.54% to 3.75% per annum, depending on the chosen product and investment term.

Landbay’s lending criteria focus on borrowers with a good credit history and properties in areas with strong rental demand and good prospects for capital growth. The platform also offers a range of lending products to suit different investor needs, including fixed-rate and tracker mortgages with terms of up to 10 years.

In addition to its lending services, Landbay also offers a secondary market where investors can buy and sell loan parts, providing greater flexibility for those looking to manage their investments.

Overall, Landbay is well-regarded in the P2P lending industry, with a strong reputation for responsible lending practices and transparent communication with investors.

Assetz Capital:

Assetz Capital is a P2P lending platform that offers investors the opportunity to invest in loans issued to businesses and property developers in the UK. Since its inception in 2013, Assetz Capital has funded over £1.2 billion in loans.

CONCLUSION

P2P lending platforms have become increasingly popular in Europe, as they offer investors the opportunity to earn attractive returns on their investments while providing borrowers with an alternative source of funding. These platforms have also been instrumental in promoting financial inclusion, as they provide borrowers who may not have access to traditional banking services with the opportunity to obtain loans at reasonable rates.