Adani row: UP discom rejects Adani Group’s request for Rs. 5,400 billion in smart meters

Following the damning Hindenburg report, a state utility in the BJP-ruled state of Uttar Pradesh cancelled a deal worth 5,400 crores for the sale of smart metres, which might be a big shock to the Adani Group.

The state-owned Madhyanchal Vidyut Vitran Nigam Limited surprisingly declined the Adani Group’s proposal to provide the energy distribution company, or discom, with around 7.5 million smart metres (MVVNL). The discom allegedly cancelled the offer despite Adani Transmission Limited, a part of the Adani Group, submitting the lowest price, due to “unavoidable issues,” according to insiders.

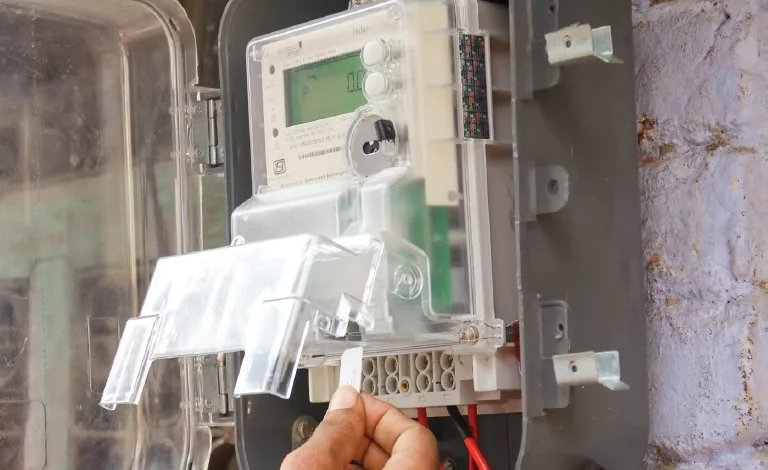

For the appointment of an Advanced Metering Infrastructure (AMI) service provider for smart prepayment metering in the territories under its authority, the MVVNL has issued an e-tender invitation. Adani Transmission Ltd. submitted a bid with the lowest pricing per smart metre, $10,000, when compared to L&T and GMR. The lowest bidder’s price is nonetheless seen as high since, in accordance with the Rural Electrification Corporation’s standing billing criteria, a fee of 6,000 per metre has been set.

According to an MVVNL announcement dated February 4, the tender has been cancelled due to unexpected circumstances. Regarding the procurement’s cancellation, the State authorities have not released any more remarks. It’s unclear if administrative officials decided to cancel the contract or Lucknow’s political leaders took the initiative.

Who made the call and what caused it are riddles, the source said, adding that the decision was made only a few days before a major investment summit that the Yogi Adityanath administration is hosting from February 10 to 12 in Lucknow to draw capital to Uttar Pradesh.

The ambitious event, which comes as opposition parties are pressing for the creation of a Joint Parliamentary Committee (JPC) to look into serious allegations made against Adani Group in the Hindenburg report, is modelled after the Vibrant Gujarat Summits, which were started when Prime Minister Narendra Modi was the Chief Minister of Gujarat. It’s unclear whether the decision was made at the bureaucratic level on a political or purely technical basis.

A.K. Sharma, the Uttar Pradesh Minister of Energy and Urban Development and a dependable aide to Prime Minister Narendra Modi, met one-on-one with the heads of corporate houses from Gujarat, including the industrialist at the centre of the controversy, Gautam Adani, in Ahmedabad on January 19, as part of a roadshow and conference held by the U.P. government in advance of the investment summit.

Along with Mr. Adani, the team also met Parimal Nathwani of the Reliance Group and Sudhir Mehta of the Torrent Group. Navneet Sehgal and Awanish Awasthy, two of Mr. Yogi’s trusted officials, were also included in the U.P. delegation. After reaching retirement age in 2022, the latter continues to act as a consultant.

Other discoms, including MVVNL, Dakshinanchal Vidyut Vitran Nigam Limited, Purvanchal Vidyut Vitran Nigam Limited, and Paschimanchal Vidyut Vitran Nigam Limited, had also released bids for the delivery of more than 25 million smart metres, with a total bid value estimated at 25,000 crore. According to insiders, it is probable that the other discoms would also cancel their tenders.

Adani Group loses $118 billion in ten days as a result of the bombshell report, the Hindenburg effect

The US-based short-seller company Hindenburg Research is in the news after its research on billionaire Gautam Adani’s conglomerate sent shares of the Adani Group plunging. According to business website Fortune, the market value of the Adani Group firms is currently $99 billion, down from $217 billion before to the publication of the Hindenburg Research research.

Since Hindenburg accused the Adani Group of stock manipulation, inappropriate use of tax havens, money laundering, and growing indebtedness, the group has lost $118 billion in 10 days, a 50% loss.

This week, Gautam Adani, who was dethroned from his title as Asia’s wealthiest man, cancelled a Rs 20,000 crore share sale in his main business, Adani Enterprises, citing the importance of investors’ interests. India Today managed to track down the short-seller firm’s New York office. However, Nathan Anderson, the creator of the Hindenburg, was not nearby.

A company in the US called Hindenburg says it specializes in “forensic financial research.” It makes the claim that it searches for business-related corruption or fraud. In 2017, Nathan Anderson, a Connecticut native and former employee of a data business, founded Hindenburg.

The Hindenburg airship caught fire as it soared into New Jersey in 1937, resulting in a well-publicised accident. It publishes research papers on anomalies and poor management at various startups and established businesses, which have, in the past, caused a sharp decrease in stock value. Then, in an effort to win money, it wagers against the target business.

HINDENBURG VS ADANI GROUP

Adani Group criticised the research in a number of ways after issuing its report in January, calling it “baseless” and “malicious.” However, in response, Hindenburg stated that “Fraud cannot be camouflaged by nationalism or a bloated answer that overlooks every significant claim we brought.” In the last six days, the aggregate depreciation suffered by the ten listed Adani Group companies has exceeded Rs 8.76 lakh crore, according to PTI. But after suffering a severe beating over the previous six days, shares of several of these companies recovered.

In response to worries over banks’ exposure to Adani Group firms later in the day, the Reserve Bank of India stated that the nation’s financial system is still robust and strong. “Numerous indicators of adequate capital, high-quality assets, liquidity, provision coverage, and profitability are positive. Additionally, banks abide with the RBI’s Large Exposure Framework requirements “The announcement from the central bank was made.

Edited by Prakriti Arora