Chipmakers, which were previously in high demand, are now facing unexpected hurdles.

Customers couldn’t get enough of the minuscule silicon bits that function as computer brains and are necessary for almost every gadget with an on/off switch. Demand was so robust, and the US’s reliance on a foreign source was so alarming, that Democrats and Republicans reached an agreement in July on a $52 billion subsidy plan that included incentives to create new chip operations in the US. Chipmakers in the United States, including Intel, Micron Technology, Texas Instruments, and Global Foundries, have committed to significant increases in domestic production, banking on increased demand for their products and the possibility of federal subsidies.

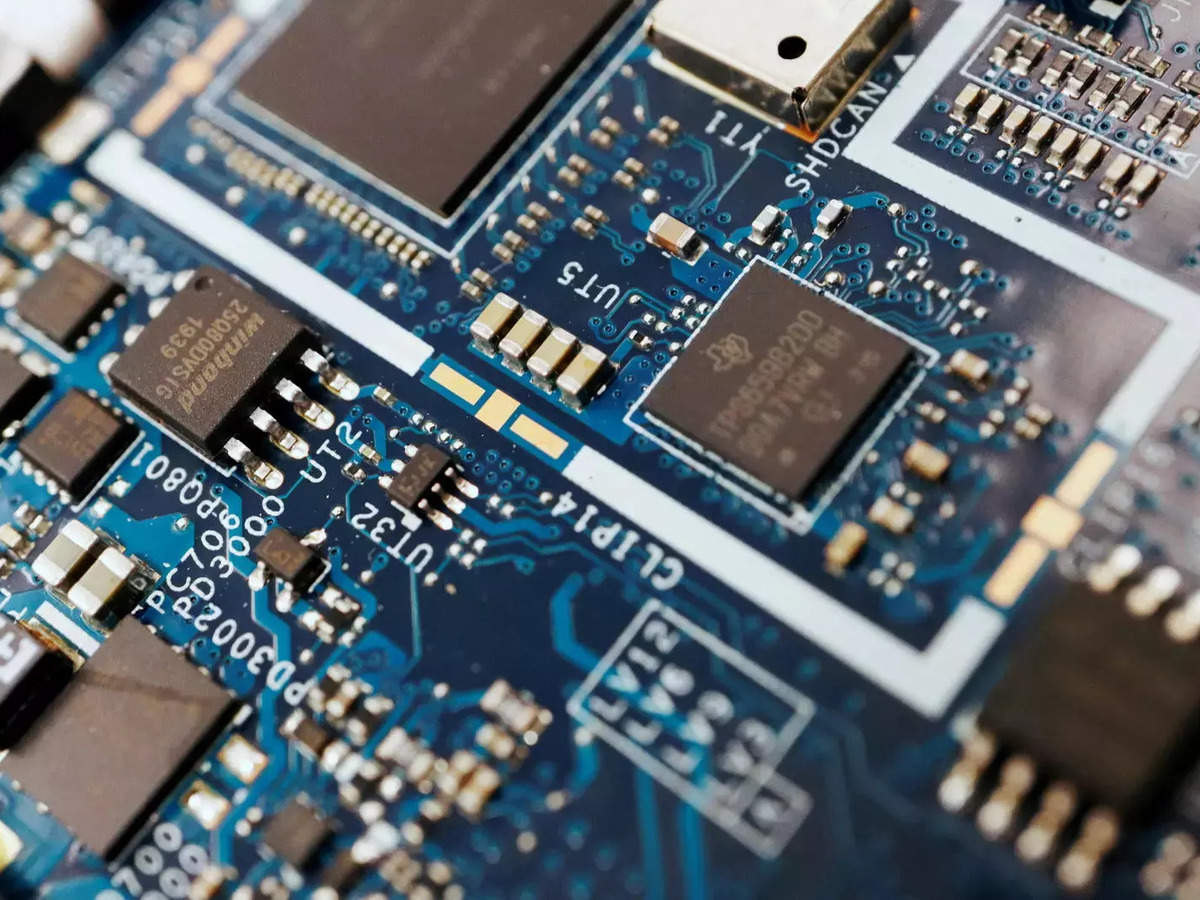

However, supplies of some semiconductors have recently piled up, which may be good news for consumers but bad news for industry executives.

Their audacious financial ambitions coincide with a sudden and unexpected dip in shopper demand for digital gadgets, new US limitations on gross sales to prospects in China, increasing inflation, and the strange potential of a scarcity of some chips while an oversupply of others.

As a result, chipmakers, who had anticipated massive demand and alternatives, are now confronted with massive hurdles. Many firms are now faced with difficult decisions about whether or not and when to ramp up production amid uncertainty about how long the current sales downturn would last.

“I would have predicted six months ago that we were in this hypergrowth era,” said Rene Haas, CEO of Arm, the British business whose chip expertise powers billions of cell phones. “We’re at a halt,” he said now. For many customers, items that have been scarce owing to a chip shortage may begin to become more available, albeit slowly.

Automakers, who have struggled to produce enough automobiles due to a scarcity of chips and other parts, have stated that they are receiving more but are still experiencing some challenges. Prices of cellphones and computers may also decline as chip supplies develop and costs for the two types of memory chips they utilize fall.

But, for the time being, not everyone is ready to receive all of the chips they desire, and prices for many types of semiconductors remain high. “We’re still much above pre-pandemic prices,” said Frank Cavallaro, CEO of chip distributor A2 Global Electronics and Solutions.

Fears of a downturn, which have hammered semiconductor equities this year, are visible in chipmakers’ recent quarterly reports. South Korean memory chip maker SK Hynix announced a 20% reduction in sales on Wednesday, citing an “exceptional worsening in market circumstances.” Intel provided more evidence of a slump in its third-quarter results on Thursday, including a 20% decline in earnings and a $664 million charge to cover cost-cutting initiatives that are expected to include job cutbacks.

The Biden administration struck its blow this month with a wide set of regulations intended to discourage China from leveraging US semiconductor knowledge. The rules restrict gross sales of select superior chips to Chinese customers and prohibit US corporations from serving China in the development of certain types of chips.

This harms semiconductor companies like Nvidia, which develops the graphics processors required in AI applications in China and elsewhere. The Silicon Valley business, which is already dealing with a significant drop in gross sales for online games, recently projected that US limitations will most likely reduce revenues in its current quarter by $400 million.

The sanctions might be heavier on companies that sell chipmaking equipment, which has depended heavily on sales to Chinese facilities in recent years. Lam Research, which makes devices for etching silicon wafers to build semiconductors, predicted that China restrictions would reduce its 2023 revenue by $2 billion to $2.5 billion. “We lost some extremely valuable clients in the China area, and that will continue,” Doug Bettinger, Lam’s chief financial officer, said during an earnings call last week.

Applied Materials, the world’s largest manufacturer of chip production tools, also stated that sales will suffer as a result of the limitations. KLA, another producer of chip production tools, stated on Wednesday that its revenue for the coming year is likely to fall by $600 million to $900 million as it cuts tool gross sales and services to select Chinese prospects.

Concerns about foreign competition are nothing new in the semiconductor industry, which is known for its boom-and-bust cycles. But it has seldom faced a competitor as powerful as Taiwan Semiconductor Manufacturing Co., whose plants on the island produce chips created by companies such as Apple, Amazon, Nvidia, and Qualcomm. China claims Taiwan as its domain, posing a risk to chip suppliers. That contributed to the recent bipartisan support for U.S. chip regulations, which was heavily supported by President Joe Biden.

Last month, he traveled to Ohio for the launch of a $20 billion Intel manufacturing complex. On Thursday, Obama paid a visit to a location outside Syracuse, New York, where Micron has pledged to spend up to $100 billion over 20 years on a massive complex to produce memory chips, a venture he described as “one of the most significant investments in American history.”

Those plants will most likely be required at some point, according to industry officials. However, they are now dealing with a sudden and severe drop in chip demand. The problem is especially severe in processors and memory chips, which do computations and store data in personal computers, tablets, cellphones, and various devices.

During the coronavirus epidemic, these items were hot commodities since customers worked from home. However, that rise has now slowed, with PC gross sales falling 15% in the third quarter, according to International Data Corp. projections. In addition, the research firm forecast that smartphone sales would dip by 6.5% this year. According to observers, demand has been restrained by inflation as well as a lengthy COVID shutdown in China.

Simultaneously, chip inventories grew. According to Dan Hutcheson, a market researcher at TechInsights, computer makers were frightened by the scarcity and purchased more components than they required. When buyer demand fell, they began to reduce orders. “You see a convergence of multiple problems,” said Syed Alam, who leads Accenture’s global high-tech consulting division, which includes semiconductors.

Handel Jones, CEO of International Business Strategies, expects that total gross revenue in the semiconductor industry will grow 9.5% this year. However, he predicts income to fall 3.4% to $584.5 billion in the next 12 months. He expected consistent annual growth for the chip trade from 2022 to 2030 in the previous 12 months. Intel’s second-quarter results, released in July, were among the warning signs. The company reported an unusual loss and a 22% decline in revenue, blaming it on human mistakes and prospects who reduced chip inventory.

At Micron, the mood shifted quickly as well. At an investor event in San Francisco in May, the company delivered positive remarks regarding long-term demand for its memory chips. The next month, it warned of weakening demand and dropping chip prices. The corporation reported a 20% reduction in fourth-quarter earnings in September. It also reduced planned investments in factories and equipment by nearly half in the current fiscal year.

edited and proofread by nikita sharma