Xiaomi denies reports of moving operations to Pakistan

Xiaomi’s operation status regarding Pakistan

In an event of the crackdown on operations handled by government agencies, Xiaomi India has denied claims that the business is shifting its headquarters from India to Pakistan. According to a South Asia Index report, Xiaomi India’s operations in India have “nearly ceased” as a result of the Indian government’s targeting of the company. Xiaomi India may now shift its activities to Pakistan after the Indian government seized property worth $676 million, the report added.

The reporter of the newspaper daily after interviewing told that the information there in the tweet is wholly untrue and unsupported. India welcomed Xiaomi in July 2014. We started our “Make in India” adventure in January 2015, a little more than a year after we started operating in India. Today, India produces 100percent of smart TVs and 99% of smartphones. As a reputable international business, we shall take all prudent steps concerning maintaining the reputation against untrue and misleading claims.

The enforcement department has been looking into Xiaomi India for allegedly sending money abroad illegally while pretending to be royalties. The concerned organization last week confirmed an order from the ED to seize properties related to the company worth Rs 5551.27 crore. Xiaomi asked for a stay order from the Karnataka High Court Court on Thursday, contesting the validity of the confirmation ruling.

To preserve the interests of the company irrespective of putting the company’s operations on hold, the same was not accepted by the concerned court only based on a stay order and instead asked the company to provide collateral of the money that had been confiscated.

Chinese firms are not happy in Pakistan either

Being an aspect of the China-Pakistan Economic Corridor (CPEC), many Chinese businesses were eager to establish operations in Pakistan, but this year, 25 of them reportedly threatened to do so due to unpaid debts totaling Rs 300 billion. In the past, tech giants from around the globe alluded to leaving Pakistan due to legislation that targeted web firms. The best company in Pakistan this year, Airlift, was forced to close its doors as the speedy commerce platform’s funding dried up.

Companies are having issues while installing their units and increasing their manufacturing scope. The funding for the industry is not generating the appropriate benefit as it was expected to be realized at the time of the investment. As a result, all of these corporations are looking for ways to outsource their operations to other emerging countries.

About Xiaomi

Xiaomi Corporation is a Chinese company that designs and produces consumer electronics, home appliances, and other household goods. It is the second-largest manufacturer of smartphones in the world, behind Samsung, and most of its devices use the MIUI OS. The business is the youngest here on Fortune Global 500 and is rated 338th.

Xiaomi sells most of its goods in 18 months, which is more than most smartphone manufacturers. The company relies on inventory levels & sale prices to maintain its inventory low. This helps it keep pricing near to its manufacturing expenses & bill of materials costs. With 216 industrial design registrations produced under the Hague System in 2020, Xiaomi was placed 2nd throughout the world in the 2021 evaluation of WIPO’s yearly World Intellectual Property Indicators. With 111 industrial engineering registrations published in 2019, they moved up a place ahead from the past ranking to this one.

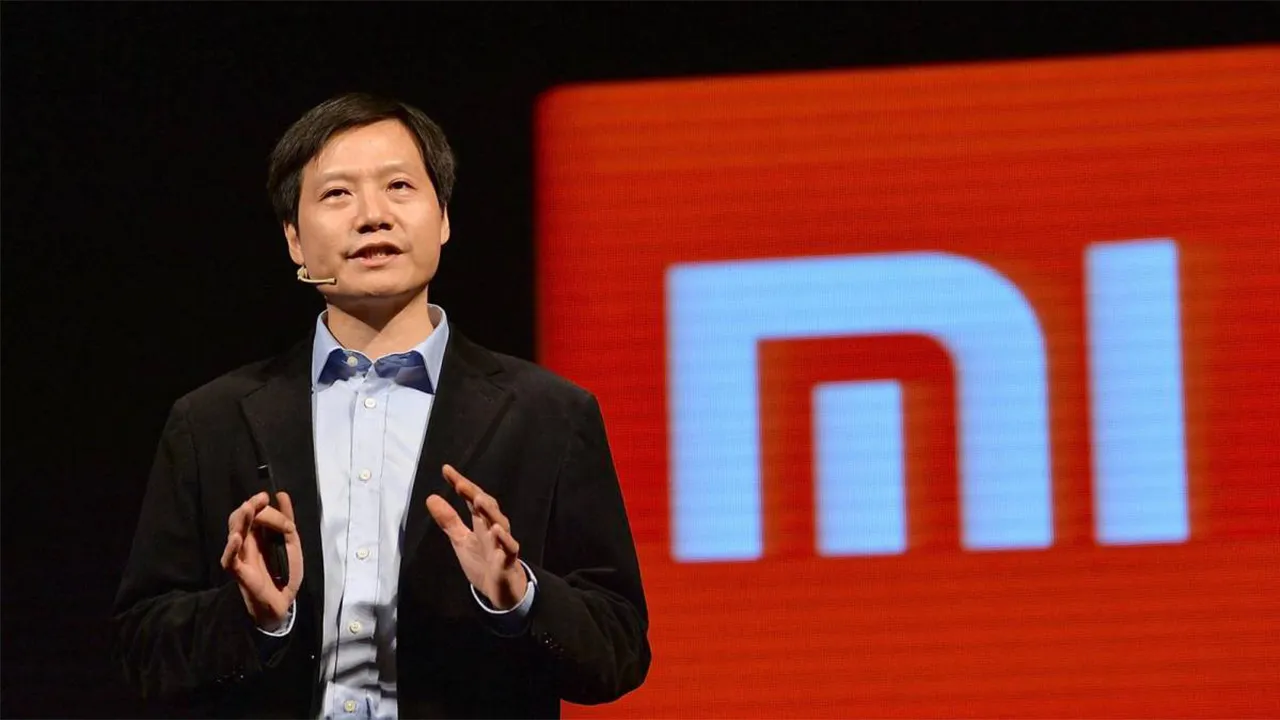

Lei Jun, a current multi-billionaire, and six top-level managers introduced Xiaomi in 2010 when he was 40 years old in Beijing. Lei developed both Kingsoft and Joyo.com, which he sold to Amazon in 2004 for $75 million. By 2014, Xiaomi held the greatest market share of smartphones sold in China. Xiaomi introduced its first smartphone in August 2011. The business started only dealing with its goods online but eventually developed physical locations. It was creating a variety of consumables varieties by 2015.

Xiaomi to invest Rs 100 cr in India over 2 years

Despite a slight fall in India’s smartphone industry this year, the Chinese brand has maintained its rank as, the country’s top seller of smartphones for more than three years. Xiaomi, a Chinese smartphone manufacturer, announced on Thursday that there will be an investment of amount Rs 100 cr in India to double the number of retail units to 30,000 over the next two years.

The funding will aid lower operators in opening and operating such additional units. The corporation said that by investing, it will provide over 10,000 new employment and “promote retail entrepreneurship” in rural communities. Additionally, it will launch a new Retail Academy where it will aim to educate sales and customer grievances in areas including in-store designing, marketing, and retail excellence.

2020 saw a 4% year-over-year fall in the Indian smartphone unit due to the result of covid outbreak and disruption in the supply chain. This has led to worldwide component shortages. In the 4th quarter of 2020, the corporation lost 1% of the market, according to information from Counterpoint Research. Samsung comes in second with a 19% share of the Indian smartphone market, behind Xiaomi with 26% of shipments.

Vivo, Realme, and Oppo, three fellow Chinese companies, round out the top five with respective market shares of 15%, 12%, and 10%. By shipping about 1.5 million devices in 2020, Apple, a premium smartphone manufacturer, increased this year and nearly doubled its share within the country’s market.

Why Pakistan is relucted to invest in India and China?

Since the early 1970s, Pakistan has faced macroeconomic volatility. Savings & corporate investment resulted in a decline due to the country’s ongoing macroeconomic uncertainty, which has led to low investment and unstable output levels. It has one of the poorest investment-to-GDP ratios of 15%, which is less than half the average for South Asia at 30%.

Pakistan had the lowest rates of national investment and saving, at 14 percent & 8 percent respectively in the 2010s, when compared to India and China. China has the largest share of investment i.e. 43% and the largest share of savings i.e. 47%, compared to India’s 30.3 percent investment share and 31.2 percent saving share. Seems that Pakistan has little to no investment and is stuck in a cycle of low savings and poor investment that prevents it from developing fully.

Around 2011, the investment to Ratio of GDP was 12.5%. Pakistan is looked at as a country with weak national security, which is the result of its decision to take part in conflict contradictory to Terror. Due to these restrictions, ineffective government policies, and political unrest, FDI is moving further away from Pakistan and relying more on other nations which provides fewer risks for foreign investors.

The ability of the country to draw in international investors was hampered by the energy crisis and growing concerns related to safety. Following the 2018 elections, the PTI government established a strong financial discipline to reduce excessive government spending & removed tax exemptions.

Political unrest and governmental instability: Pakistan’s mechanism for handling its state-related issues is ineffective. Every political party in Pakistan has a distinct philosophy and set of policies. Nobody wants to talk about Pakistan’s problems or what Pakistan needs; everyone wants to defend their interests.

Unfavorable investment incentives, a financial sector that is underdeveloped and inefficient, a large public, and an uncompetitive trade regime. The government overregulates the market.

Let us know why India stands out in investment

- Due to local industries in the late 1960s, the Indian government adopted a more preventative approach to FDI.

- The revised Foreign Exchange Regulation Act (FERA), which was implemented in 1973, mandated that all foreign businesses operating in India register under Indian corporation law with equity capital of up to 40%.

- As in the 1980s, India implemented historical reforms in its Foreign Direct Investment Policy. Instead of supporting domestic sectors, FDI was now seen as a way to build up foreign exchange reserves.

- Foreign direct investment was allowed in the services in real estate, communications, & banking industries.

edited and proofread by nikita sharma