As Exports to the US triple in a year, India is in the race to be the next China

Orders from the US and Europe have been rising significantly for Indian exporters, with the shift primarily occurring in low-cost, labor-intensive industries. As Exports to the US triple in a year, India is in the race to be the next China.

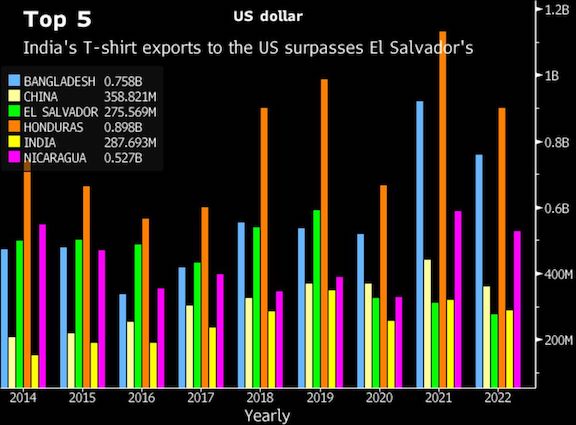

India, which many people think has the potential to overtake China as the world’s largest exporter, is now among the top five countries sending t-shirts and holiday decorations to the US.

According to US customs data, seaborne shipments of festival goods and accessories to America reached $20 million last month, nearly tripling the value from the same time last year. With buyers diversifying their supply sources in response to rising labor costs and disruptions from China’s strict Covid-zero policy, India emerged as the clear winner over the Philippines in this process.

Amit Malhotra, whose Asian Handicrafts Pvt. supplies holiday decorations to major corporations like the Walt Disney Co., London’s Harrods, Target Corp., and Dillard’s Inc., is one of the recipients of the early Christmas gift. He acknowledged that orders are up 20% from a year ago and that he has increased production capacity.

According to Mr. Malhotra, director at Asian Handicrafts, “this year we have shipped over 3.2 million units of Christmas decoration, up from 2.5 million last year.” Even though China exports a sizable portion of Christmas decoration items, he added that many first-time customers have recently begun approaching us.

The craze is not just for Christmas products. The third-largest economy in Asia has seen a sharp rise in orders from the US and Europe, with the shift concentrated in labor-intensive, low-cost industries like apparel, handicrafts, and non-electronic consumer goods. While supply chain diversification started as a result of the US-China trade war in 2018, India hadn’t made any significant progress at the time as nations like Vietnam had monopolized the majority of the orders that were shifting away from Beijing.

The pandemic, which prompted China to impose strict lockdowns, is aiding in this change. India’s exports of goods, which totaled $420 billion in the fiscal year that ended in March, have already fallen by almost half in the five months that started in April. Analysts consider that to be a good starting point for the largest economy on the subcontinent, which is currently expanding at the fastest rate in the world, even though it is hardly comparable to China’s annual $3.36 trillion in exports.

Taiwan, the EU, the US, and Japan are all willing to give India another chance, according to Alex Capri, a research fellow at the Hinrich Foundation, which was founded by US businessman Merle Hinrich to support international ethical trade.

What do the reports and statistics tell?

According to government statistics, India’s exports of Christmas decorations increased by more than 54% from the fiscal year 2020 levels in the year that ended in March, while exports of handicrafts increased by about 32% during the same period.

According to Siddharth Jain, a partner in Kearney’s operations and performance practice, China’s ongoing decoupling from the global economy and the post-pandemic recovery presents an opportunity for India to accelerate its investment in longer-term competitiveness and prioritize “winnable” sectors.

According to a report by Kearney and the World Economic Forum, India is expected to have the most abundant labor force in the world by 2030 and could contribute more than $500 billion annually to the global economy.

With India’s exports in FY22 reaching about $420 billion, significantly higher than in prior years, Mr. Jain said, “We have started to see green shoots of this.” “A combination of internal and external factors were responsible for this,”

In order to rank among the top 5 suppliers of cotton t-shirts to the US this year, India also managed to surpass El Salvador.

According to Gautam Nair, managing director of Matrix Clothing Pvt., a medium-sized garment export company, the apparels sector, where India competes with countries like Bangladesh, saw an uptick due to a number of factors, including a ban on all cotton products from China’s Xinjiang region over allegations of mistreatment of its ethnic Uighur Muslim minority. The massive increase in consumer spending and the supply chain diversification “further accentuated the surge.”

According to Mr. Nair, order books for medium- and large-export companies increased by 30% to 40% in the previous fiscal year. This upswing will be more obvious in the current fiscal year, which ends in March 2023. Orders at Matrix Clothing, which exports clothing to major global brands like Superdry, Ralph Lauren, Timberland, and Napapijri, increased by 45% in the most recent fiscal year compared to the year prior.

Analysts caution that non-labor costs remain a barrier to the expansion of low-value-added manufacturing.

According to Oxford Economics economist Priyanka Kishore, the legacy problems with contract enforcements, tax transparency, etc., are the bigger problems. For India to fully realize its potential as a manufacturing hub, these issues must be resolved because they do present a challenge to its manufacturing ambitions.

India’s Economy grows at a faster pace per year. But how?

India’s economy grew at its fastest rate in a year, giving the central bank more room to concentrate on battling inflation.

According to data released on Wednesday (Aug. 31) by the Statistics Ministry, the gross domestic product increased by 13.5% between April and June compared to the same time last year.

The increase reflects a sharp increase in activity since mid-2021 when the worst coronavirus wave to hit the nation started to subside.

Thousands of people perished every day as a result of that outbreak, overwhelming hospitals, and crematoriums, and it followed a protracted lockdown that severely hurt consumer spending and stopped factories from operating.

The growth rate on Wednesday was the highest since the 20.1% expansion seen during the same time period last year, when business activity was beginning to recover from the effects of the government shutdown.

However, performance fell far short of the 16.2% forecast by the Reserve Bank of India (RBI), the nation’s central bank, as a result of inflation and other signs of a faltering economy.

Even though India’s economy continues to grow at the fastest rate in the world, future growth is expected to slow down because of concerns about a global recession and rising borrowing costs.

In three rate moves since May, the central bank has increased the benchmark policy rate by 140 basis points, and it has vowed to do more to keep inflation below its target ceiling of 6%.

Soumya Kanti Ghosh, the chief economist at State Bank of India, stated that “the numbers are lower than we expected.”

In addition, he predicted that the RBI would likely lower its previous prediction of 7.2% growth for the year ending in March 2023, citing concern over the manufacturing sector’s weakness.

Because of this year’s sharp decline in the value of the rupee and the high price of crude oil, India’s trade balance has gotten worse.

India’s merchandise trade deficit widened to a record US $31 billion in July, compared to the US $10.6 billion in the same month last year, provisional data showed.

Over two times as much money was spent on imports as it was on exports, with coal and petroleum products leading the way.

More than 80% of India’s crude oil requirements are imported, and market shocks following Russia’s invasion of Ukraine have left its 1.4 billion people struggling with higher fuel costs.

This year, consumer inflation has consistently exceeded the central bank’s target range of 2 to 6%, reaching an eight-year high of 7.79% in April before declining to 6.71% in July.

But according to Bank of Baroda Chief Economist Madan Sabnavis, household spending has held up well because of pent-up demand from the economic shock caused by the pandemic.

The purchasing power typically decreases with high inflation, but so far, that doesn’t seem to have happened, he said. India’s growth outlook was cut by the International Monetary Fund last month to 7.4%, which is still higher than the growth rates of all other major economies except Saudi Arabia.