Is blended finance a way to bring private capital into the economy?

Is blended finance a way to bring private capital into the economy?

There is no one-size-fits-all approach to funding the world’s most urgent problems today, such as eradicating extreme poverty or combating climate change. A range of techniques and tactics are required to mobilize the required capital. The function of private money in agriculture has come under more and more attention in recent years. Everyone involved in the agriculture value chain understands that credit is an essential input. For the different players, such as farmers, merchants, input retailers, etc., a tailored strategy is required.

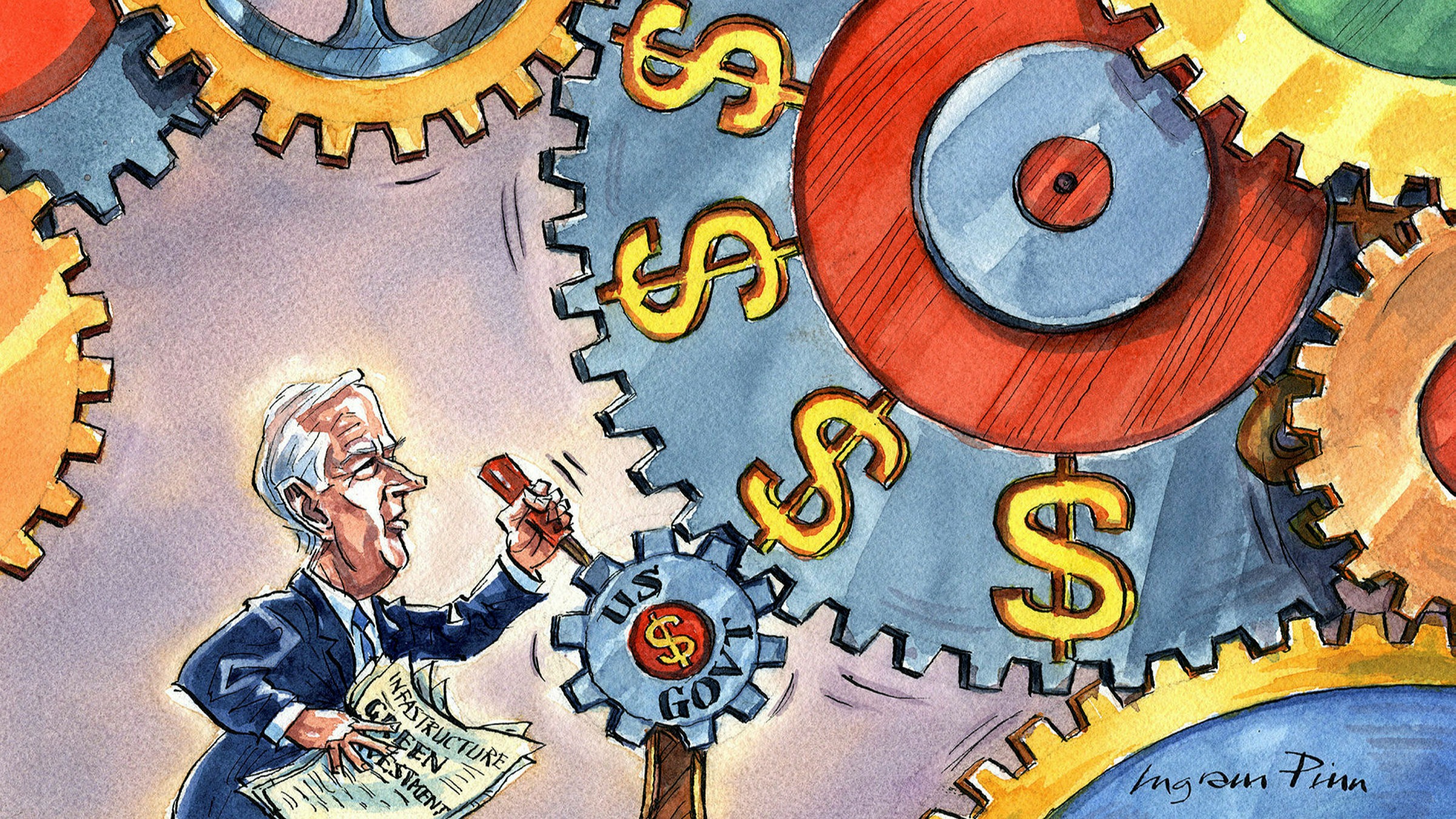

However, there is a requirement to be able to quickly and at fair prices receive credit. To achieve this, agricultural government initiatives have been developed. The government has supplied chiefly credit to this industry, either directly or through entities it owns or controls, notably farmers. To provide access and satisfy the rising demand, private financing is crucial. One tactic for luring private investment is the application of hybrid financing. We’ll look at blended finance in this piece and discuss how it may draw in private money for significant global undertakings.

What is Blended Financing?

To strategically mobilize private money for development, public and charitable resources are used in a process known as “blended financing.” Blended finance may be utilized to efficiently utilize the private sector’s knowledge in finding and implementing developmental investment opportunities and strategies, in addition to enabling the flow of new money into high-impact industries like agriculture.

How does blended finance work?

“Blended finance” describes an approach to financial management that allows organizations to achieve multiple objectives simultaneously, maximizing profits while minimizing environmental impact. In other words, blended finance goes beyond technology to become an investment framework that allows different investors to participate in following their investment goals.

The strategy often uses various funding tools, such as grant money, debt, and equity. The intention is to draw in private sector investment that might not otherwise happen because of perceived risks or a lack of economic viability. Agricultural value chains, rural infrastructure projects, and smallholder farmers may all benefit from blended finance. Blended finance may encourage private investment and help realize development goals when used properly. Blended financing may significantly help the agriculture sector as it grows.

For instance, it has been challenging to finance sustainable agriculture, particularly in India, where most farmers own little to no land. A portfolio guarantee structure was developed as part of a pilot project by the Rabo Foundation and US AID to allow private lenders to lend money to these farmers. They have partnered with two local NBFCs to share the risk using this hybrid financing tool called the Loan Portfolio Guarantee. Due to this, banking institutions were in a position to lend farmers up to $15 million.

Why is blended financing required?

Customers who are empowered and knowledgeable, flexible and adaptable operating models, non-traditional resources and collaborations, a growth and innovation attitude, and an emphasis on responsibility, integrity, and sustainability are some of the themes that will shape agriculture in the future. By mobilizing private finance for initiatives in the agriculture sector, blended financing can help address these difficulties. By doing this, blended finance may assist in ensuring that the agricultural industry can keep up with the always-changing demands of farmers.

The need for blended finance has grown as the global economy continues to become more integrated. Blended financing is the use of many financial instruments to finance a project or business. This can refer to financial aid through grants, loans, equity investments, and other means. Combining several finance sources allows access to a bigger pool of money and more effectively satisfies the project’s requirements. For instance, equity investments may promote riskier endeavours that conventional financiers may otherwise reject.

The interest rates and repayment plans that may change when blended financing are similarly flexible. As a result, blended finance has emerged as a key tool for financing countless projects all over the world. Hybrid finance models provide several benefits, including the ability to attract private investment that would not be practicable without them.

Blended finance may reduce overall risk and increase the probability that a project will succeed by pooling funds from several investors.

By integrating the interests of several investors, blended finance models may make sure that projects achieve both their financial and social goals.