Top 10 Banking Industry trends and themes for 2022.

Top 10 Banking Industry trends and themes for 2022.

Thanks to a nexus of dynamics that are altering the sector, the epidemic can already be considered a level in banking history. Banks are becoming more proactive, questioning their ingrained beliefs, and becoming adjustable and innovative because of the result of COVID-19. Today, people are more likely to be looking ahead at their chances than looking backward at their progress.

Basics of Banking: The Banking Law

A legal contract between a bank and a customer is the foundation of banking law. Any company for which the bank accepts the financial records or businesses is known to the customer in India. The following list of customary rights and obligations includes:

When the financial record is in credit, the bank pays the customer the balance; when the history is short of money, the client owes the bank the recompense. This is the financial standing between the bank and the customer.

- The bank may not collect from the customer’s financial record without a directive from the customer, for example, cheques drawn by the customer.

- The bank may not collect from the customer’s profile without a directive from the customer, for example, cheques drawn by the customer.

- As the customer’s agent, the bank promises to share and collect the checks deposited to the debit and credit the funds to the customer’s financial record.

- Since each financial record is merely an element of the same credit relationship, the bank is allowed to merge the customer’s financial record.

- To the limit that the client owes the bank money, the bank has a lien on any of the checks put into the customer’s financial record.

- Unless the client consents, there is a public responsibility to expose whether the bank’s interests necessitate it or the law requires it. The bank may not divulge specifics of transactions made through the customer’s financial record.

- Since checks are usually amazing for several days during regular business hours, the bank cannot cancel a credit order without providing a proper warning.

Responsibilities of the Banking Industry to be a Business Model

The financial sector is exceeding quickly. The holdings of the 1,000 largest banks are thought to be valued at close to $100 trillion USD. Due to the industry’s expansion, banks now oversee a number of tasks. The bank provides an amazing type of products and services. The meeting that follows outlines the bank’s primary responsibilities:

- Protect consumer savings by ensuring their security.

- Offering interest on deposits made with it and managing the flow of credit and money

- Allocate monies to the parties in need by borrowing from the parties with more money.

Encourage the public reliability and trust in the financial system‘s operation; accelerate and effectively increase savings; prevent concentration of economic power in the hands of a select few people and companies. And establish fair standards and conditions for all types of consumers.

A system of financial companies authorized by the central to provide banking services makes up the modern banking sector. The main services provided involve controlling the risks involved with retaining different types of wealth and storing, transferring, and extending a credit against it.

The specific financial help provided at any moment has differed widely across institutions, over time, and jurisdictions. This kind of difference has happened in response to changes in the industry’s regulatory system, the growth of the economy, and the development of information and communication technologies.

Although the contemporary banking sector, which provides different financial services, is a relatively new development, aspects of banking have existed for centuries. The concept of giving save wealth storage and lending money to promote trade has its origins in the early customs of accepting deposits of valuables (like gold, animals, and grains), making loans, interchanging money between different currencies, and weighing and certifying coins for purity.

Early in this history, the invention of fractional banking allowed for more profitability (by using money to buy income-producing resources instead of holding them in idle money reserves). Still, it exposed the payment bank because the particular risk was later which is needed to convert deposits into the money system on demand at par, even though the market at a time could exceed actual reserves.

For a moment, Douglas Diamond and Philip Dybvig presented in their 1983 article “Bank Runs, Liquidity, and Insurance Contracts” that in such circumstances, a sizable withdrawal of bank deposits can endanger bank liquidity incite insolvency fears, and thus lead to a bank run.

Regulation of banks

Antitrust enforcement, asset limitations, presented challenges, conflict rules, disclosure regulations, regional and product line entry limitations, interest percentage limits, and investment and reporting requirements are a few examples of how banks are regulated.

According to the mainstream perspective, more stringent regulations in this sector are needed because there is a clear public service advantage, it protects consumers by preventing the misuse of financial clout, or because there is a market distortion that must be fixed.

Government intervention may take the form of a fixed number of obligations that are placed on deposit-taking institutions to facilitate the presenting of fiscal policy or in the different ways in which government steers credit to those sectors considered major for some major social purpose where the public sector benefit rationalizes the need for regulations.

Legislation like the American unit banking regulations (where banks were physically that is restricted to a single center of the process) and interest percentage and roofs (ostensibly aimed at stopping high prices), as well as numerous transparency and auditing requirements, have been motivated by limiting concentration and trying to control abuses of power to protect the consumer.

A market failing that legislation may address is the looming prospect of a financial crisis. Here, the market’s incapacity to accurately identify and price risk is what has failed. A bank collapse carries a systemic risk that results in social costs that are not taken into the financial record in private sector actions.

The inference is that managers will build riskier portfolios than is socially acceptable; because a result, there is a need for governmental restrictions, rules, and supervision. The need for a borrower of last resort role for the central bank to protect system stability and the establishment of a government-managed system of consumer banking deposit insurance are examples of state-sanctioned policies intended to lessen the chance of bank runs.

/GettyImages-835807362-a12f1e53b2744999a030f15e684633eb.jpg)

Banks can be classified into several groups depending on the work they engage in. Private citizens and companies can use the services that commercial banks provide. Individuals and families can access retail banking credit, deposits, and money management services.

Neighborhood Banking

Compared to commercial banks, community banks are smaller. They focus on the nearby market. They develop bonds with their customers and provide more individualized services.

Website-based banking

These services are provided by internet banking over the website. E-banking, internet banking, and net banking are other names for the industry. Nowadays, most other banks provide online services. Numerous banks only operate online. They may put away cost savings to the consumer because they don’t have any of the branches.

Banking for Savings and Loans

Banks are specialized financial companies designed to support the purchase of homes at an affordable price. These banks often give depositors a higher interest percentage because they generate funds to lend for mortgages.

Unions of credit

Credit unions are financial sectors that perform many of the same functions to be the traditional banks but have different organizational structures. Credit unions are owned by their members. They are able to provide affordable and more specialized services thanks to their own framework. To join, you must belong to their field of membership. That may include students or staff at institutions of higher learning and locals.

Retail Banking

Small businesses can access similar services through merchant banking. They provide business credit packages, bridge finance, and mezzanine financing.

The most well-liked and popular topics presently greatly affecting the banking sector are listed below.

1. Tension in geopolitics

For several months to come, geopolitics is better to rule. The shifting sanctions regime required swift adaptation on the part of banking institutions. Additionally, they have to expand their knowledge of second-order exposures (for example, specific industrial sectors or industries are exposed due to their reliance on Ukrainian wiring plants) and the longer-term economic effects of the crisis (specifically a fall in global trade and GDP).

Banks are focusing more and more on identifying the “ultimate beneficial owner” of real estate and other unsecured resources when it comes to sanctions.

Banks that fail to control this situation will be subject to severe regulatory penalties, reputational damage, and, last but not least, the moral quandary of their potential involvement in this war.

2. Uncertainty in the macroeconomy

The impact on energy costs and the growing possibility of material inflation are two of the uncertainty’s direct repercussions. Fuel prices and supply chain problems, the two leading underlying causes of hyperinflation before the conflict began, are now better to be magnified.

The pandemic mostly spared banks in terms of revenue, but the favorable effect on earnings could not last. Many times, lending losses did not materialize, mainly due to the government shutdown and other support programs.

The future, though, is less promising. Among other things, the restriction on living expenditure will impact banks and alter their revenue. In addition to increasing bank earnings volatility, people can expect a rise in loss of the loan provisions.

3. Interest rates and monetary rules and policies.

Most businesses have not seen sustained inflation, so companies and banks must think about its financial implications carefully. As expected, central banks are raising interest rates in response to rising inflation. The Bank of England increased its basic percentage from 0.5% to 0.5% on February 3 and from 0.5% to 0.75 percent on March 17, with further rises expected.

Interest rates will rise more as long as inflation is maintained. The current situation indicates that the qualitative easing (QE) and property price inflation of recent years are coming to an end (e.g., Nationwide’s annual house price increased to 14.3 percent in March 2022).

Although banks’ net interest margins (NIM) rise when rates rise, the adverse financial effects because the customers and industries suffer might outweigh this. Higher rates and credit expenditure have generated discussions about a cost-of-living crunch, which will affect both people and businesses. Both could find it difficult to control the money, which could increase defaults and delinquencies.

4. Value created by spending

Banks will seek to cut down on inefficiencies, which can be highly challenging to achieve. Some will act too quickly and deeply, while others won’t act soon or broadly enough. Both could majorly alter operating model assumptions.

We have seen stated cost-reduction targets in recent years. We foresee a higher emphasis on “value for money” and “doing it right the first time” while that aim is still being carried out. However, given the ongoing high costs of remediation, in our opinion, it is still impossible to put an end to “the mistakes of the past” for the majority of larger banks.

5. Duty to Consumer

As the legal bar is increased only once more this year, there will be further behavior issues. The financial services industry is changing due to the FCA’s new consumer laws, including a new Consumer Duty with finalized regulations expected in July.

In addition to acting reasonably, banks will need to think about their client’s best interests. We have seen, for a moment, that insurers are no longer allowed to price-walk back-book customers into higher premiums; the so-called “loyalty tax” has been majorly outlawed. In a similar vein, banks will have to back up their actions on behalf of their customers with proof.

Larger banks with more diverse products offering and income streams may need to make fewer changes. In contrast, small & medium banks may find it challenging to present that their operating strategies are in the best interests of their customers.

6. Financial crime and the opportunity for fraud

Payments fraud is on the rise, with approved push payment (APP) theft now surpassing card payment fraud because the thieves find new ways to target and steal money from their victims. There is an increase in scams involving the interchange of goods and services that are never supplied or materialized.

Strong customer identification (SCA) and Pay. Confirmation UK’s of Payee (CoP) are technical regulatory standards that aim to save consumer cash and lessen fraud-related losses. These reforms and actions, though, present particular implementation difficulties.

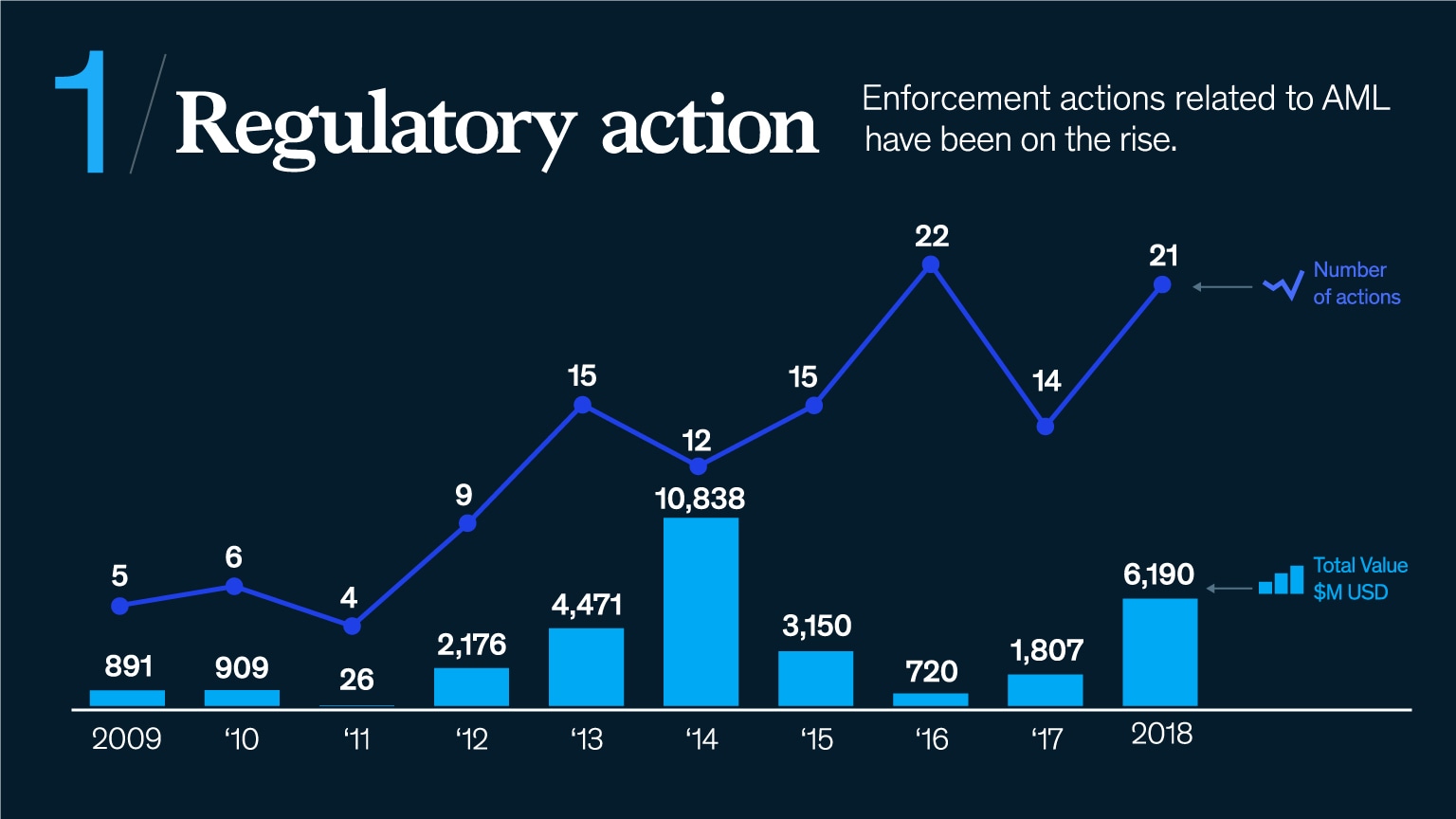

Financial crime continued to be a top priority for the regulator in 2021, given as evidenced by a number of high-profile sanctions in this area. Most financial institutions will need to plow the money in this because the part of rehabilitation or keep up with regulatory expectations because past failings by banks are still coming to light. Recent geopolitical developments and the use of penalties make it unlikely that the regulator will let up on this particular pedal.

7. Regulatory requirements

Regulators are under increasing pressure to make sure the data they receive is accurate and dependable. Firms must maintain compliance with reporting standards and make sure that their processes are actually appropriate for the task at hand. Strengthening reporting is a continuous subject.

Organizations should see this as a chance to modernize their regulatory reporting, risk, and finance teams because using data and analytics to assist reporting is a prevalent trend. The sector will have to support the regulators’ desire to be more data-led since they have made that clear.

8. Journeys of the customer and the value chain

The traditional banking industry’s largest revenue source, net interest margin (NIM), may no longer exist. In comparison to conventional banks and their business processes, equity valuations for payment companies and those that “control” the customer interface are big. The value of banking is increasingly perceived because of the aspect that directly affects the consumer, with other elements becoming less major. In summary, the value is in being in charge of the customers who come to you.

By maintaining strong customer relationships, banks increase their profits. Disintermediation is a major risk that is thus beginning to materialize and that banks must take into the financial record. Banks’ market share may be threatened by the services that other non-banking companies are starting to provide in this region.

9. Nine ESG and moral banking

Banks must take internal sustainability measures and decarbonize their lending practices (Scope 3 carbon emission) (Scope 1 and 2 emissions). Ecological, social, and governing (ESG) issues continue to be in the spotlight, but we are starting to notice nuances concerning other issues besides climate change. These include sustainability in a broad sense, diversity and inclusiveness, and biodiversity.

Society and governance still rank second to weather and the ecosystem (E), but they are moving up the list. For a moment, there is increasing pressure on banks to alter their lending practices and assess the ethicalness of their investments and services.

10. Data collecting and development

Data collection and improvement are becoming increasingly important in the financial services industry. Getting access to this data can help banks make judgments on the inside and the outside. It allows businesses to defend their course of action effectively and support regulatory information requests.

The raw data must be firm to support the larger business and investment in creation and innovation. Banks must take into the financial record which controls the data because different teams may have different opinions about whether the data sources are appropriate or inappropriate.

What can companies presently do?

Around these fundamental topics, the payment and banking business has a range of competing agendas. Future resilience can be increased by swiftly responding to changing stakeholder demands.

Although keeping up with all of these issues may seem overwhelming, banks have the opportunities to change the structures and processes to make them more sustainable, scalable, and future-proof. The alignment of internal kind of frameworks with current and future marketing strategies and goals can be determined by reviewing them.

MACROECONOMIC ACTIVITY AND BANKING

In the history of Western money philosophy, there has been a great deal of discussion and meetings on the connection between credit, bank notes, bank deposits, and macroeconomic stability. It becomes more heated when the meeting that shifts to the relationship between bank failures and economic downturns in the rise of financial crises and crises.

More than 40% of the American banks that were in operation in 1929 collapsed between 1929 and 1933. Without deposit insurance, banking crises destroyed savings and resulted in a sharp reduction in the amount of money in circulation.

According to Milton Friedman and Anna Schwartz (1963), the American central bank’s passivity allowed for a dramatic decrease in liquidity and the amplification of actual economic suffering. Because bank failures increase the financial sector’s cost and impact the virtual economy, Ben Bernanke (1983) contends that money conditions determine actual economic work.

The inability of the Credit-Anstalt bank in Austria, according to Charles Kindleberger (1986), proximally forced a risk of social exclusion of credit from the New York financial markets and, in a domino effect, a contraction of borrowing across the United States. He suggests that non-monetary forces are at the root of the problem.

Financial instability is presented by and explained by Hyman Minsky’s (1982) shifting margins between the sources of property income with the concurrent changes in the cost of borrowing.