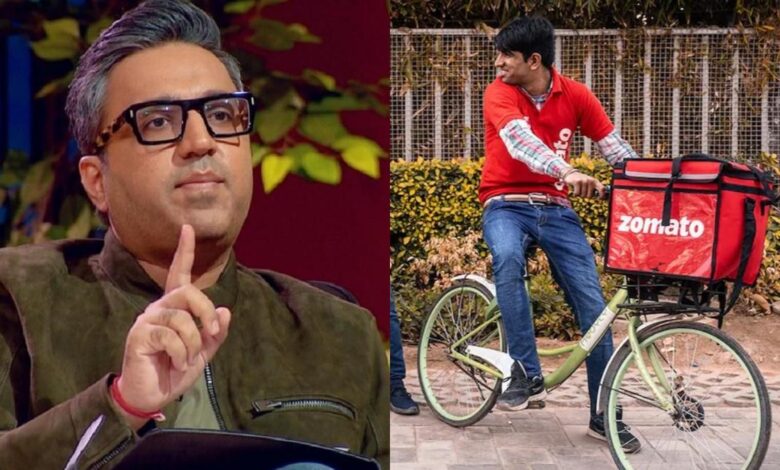

Ashneer Grover says, ‘Zomato stock Rs. 450 ka Hota if….’

Ashneer Grover says, ‘Zomato stock Rs. 450 ka Hota if….’

In New Delhi: Ashneer Grover, a co-founder of BharatPe and previous CEO, stated on Tuesday (July 26) that Zomato’s share stock price would be Rs 450 if it had merged with Swiggy, its only competition in the food delivery market, rather than the grocery delivery service Blinkit. It’s vital to remember that Grover was a founding member of Grofers, the company that used to go by the name BlinkIt.

“In about 10 minutes, @letsblinkit served @zomato steaming hot sorrow on the stock market! Yes, if @Swiggy ko merger Kar Liya hota to 450 ka stock hota”, according to Grover’s tweet.

His remarks come because Zomato’s stock, which has dropped so much as 22 percent in the other two trading days, seems to be in free fall. The share price recently fell against the backdrop of pre-IPO investors’ lock-in period expiring.

Zomato purchased Blinkit for about $568 million, arguing that fast-paced commerce is a logical evolution from its foodservice industry. The food delivery service’s stock hit a new low of Rs 43.05 on Tuesday, shedding much more than Rs 89,000 crore. Grover had said in May that buying shares in Zomato wouldn’t be a bad idea, despite the reason that the company’s stock had been falling for months.

“Everything hinges on perspective. If you were a Zomato worker and used your ESOP (employee share ownership) after the IPO at a price of Rs. 140 or more, you are likely to be paid a higher cost per share in income tax than what you could presently purchase freely on the market. Markets are providing everyone with ESOPs at a price of Rs 56 per share,” he tweeted earlier.

In intra-day trade today, the shares of the online meal delivery service Zomato fell almost 11% and reached a record low. Ashneer Grover, the first founder of BharatPe and a Shark Tank India judge, stated on Twitter that the shares of Zomato would have risen to 450 if Swiggy had merged with the company instead of BlinkIt.

Zomato, a food aggregator company, recently paid $4,447 crore to acquire Blinkit, a cash-strapped quick commerce company. Grofers was the previous name for Blinkit. The acquisition is expected to lower delivery costs and motivate the use of Zomato’s hyperlocal delivery fleet.

In about 10 minutes, @letsblinkit served @zomato steaming hot sorrow on the stock market! Yes, please, if @Swiggy ko combine Kar Liya hota to 450 ka stock hota. Tweeted Ashneer Grover. Following the completion of the required pre-IPO (Initial Tender Offer) shareholders’ lock-in time on July 23, Zomato shares reached an all-time low on Monday.

Despite the reason that being to shares has been declining for several months, Ashneer Grover had suggested in May that purchasing the company’s stock wouldn’t be a bad idea.

“Everything hinges on perspective. If you were a Zomato worker and used your ESOP (employee share possession) at a price of 140 or more after the IPO, you probably paid more percentage in income tax on each share than what you would be paying if you were to buy it on the open market today. Markets are providing ESOPs to everyone at a price of 56 per share, “On May 9, Grover tweeted.

In July of last year, Zomato made a spectacular debut on the public markets. The first public providing of the food aggregator was a complete success because it was leased 38.25 times.

According to information received through Tofler, Ashneer Grover and his wife Madhuri Jain Grover have created a new business named Third Unicorn Private Limited. The information indicates that Grover and his wife are directors of the company established on July 6. The company has a total paid-up stock of 10 lakh rupees and a share capital of 20 lakh rupees.

Grover claims that Deepinder Goyal’s Zomato would have reached Rs 450 per share had Swiggy and Zomato merged. Letsblinkit delivered piping anger to zomato on the share market in under 10 minutes! Yeh, if Swiggy combines with 450 rupees in stock hota! (Zomato’s stock price would be Rs 450 had it merged with Swiggy) Grover tweeted that Zomato purchased Blinkit for roughly $568 million, claiming that rapid commerce is a logical progression from its meal delivery company.

On Tuesday, the shares of the food delivery service hit a new low of Rs 43.05, losing more than Rs 89,000 crore.

Grover previously said that purchasing Zomato shares was a good idea.

Even though Zomato’s stock had been declining for months, Grover had stated in May that purchasing shares wouldn’t be a bad idea. The key is perspective. If you were a Zomato worker and used your ESOP (employee share ownership) after the IPO at a price of Rs. 140 or more, you likely paid a higher cost per share in income tax than what you might currently purchase freely on the market. Markets are awarding everyone ESOPs at the current share price of Rs 56,” he had tweeted.

Grover’s new business endeavour with their wife

According to the information on Tofler, Grover has incorporated a new company called “Third Unicorn Private Limited”, with both husband and wife to be the directors. The authorized share capital of Third Unicorn is Rs. 20 lakh, while the total paid-up capital is Rs. 10 lakh.

Why were BlinkIt and Swiggy talking?

Zomato’s board, earlier in June, approved the purchase of quick-commerce business Blinkit, previously Grofers, for Rs 4,447 crore (about $567 million) in exchange for shares. The transaction takes place against the backdrop of its $100 million investment in the Gurgaon-based fast business last year, where it acquired a roughly 10% share. It was thought that the acquisition would lower delivery costs and allow Zomato’s hyperlocal distribution fleet to operate more efficiently.

In May, Ashneer Grover pushed investors to purchase Zomato shares in free fall.

Interestingly, even though Zomato stock had been declining for months, the former founder of BharatPe requested the investors to acquire shares in May. Even worse, he suggested buying Zomato stock when it was plummeting.

)

He stated in a tweet from May, “Everything hinges on perception. If you were a Zomato worker who activated your ESOP (employee stock participation) after the IPO at a price of Rs. 140 or above, you are likely to pay a higher income tax percentage per share than what it would cost you now to buy it freely on the market. Markets are awarding everyone ESOPs at the current share price of Rs 56.”

Additionally, it was exposed that Grover submitted a personal application worth Rs 150 crore for the Zomato IPO last year.

Edited by Prakriti Arora