How Airtel is Competing with Jio

Airtel is beating Jio through its powerful business strategy.

When Mukesh Ambani announced the debut of Jio in 2016, our lives were profoundly altered by that defining year in Indian history.

However, that same year was a nightmare for the other telecom firms, while we customers were having the time of our lives and revelling in the beautiful luxury of the internet. Their stock prices plummeted, some large corporations went out of business, and the telecom industry as a whole, which had previously appeared to be very congested, now seems to be a deserted battlefield with just a few players left.

But you know what? While all the companies went bankrupt, Airtel was the only company that stood throughout this brutal telecom war. Today it is not just surviving the Jiowave but even going one step ahead to outperform Jio in many vital areas. As of January 2021, Airtel added over 300 more wireless Subscribers in June. In fact, according to the market share of active subscribers as of February 2021, Airtel is the leading telecom provider.

Considering the current situation of businesses like Vodafone and Idea, this telecom battle has only recently begun. What exactly makes this Airtel vs Jio competition unique? Why are they so much more successful than their rivals? And perhaps most significantly, what are the business lessons we can apply to our own businesses.

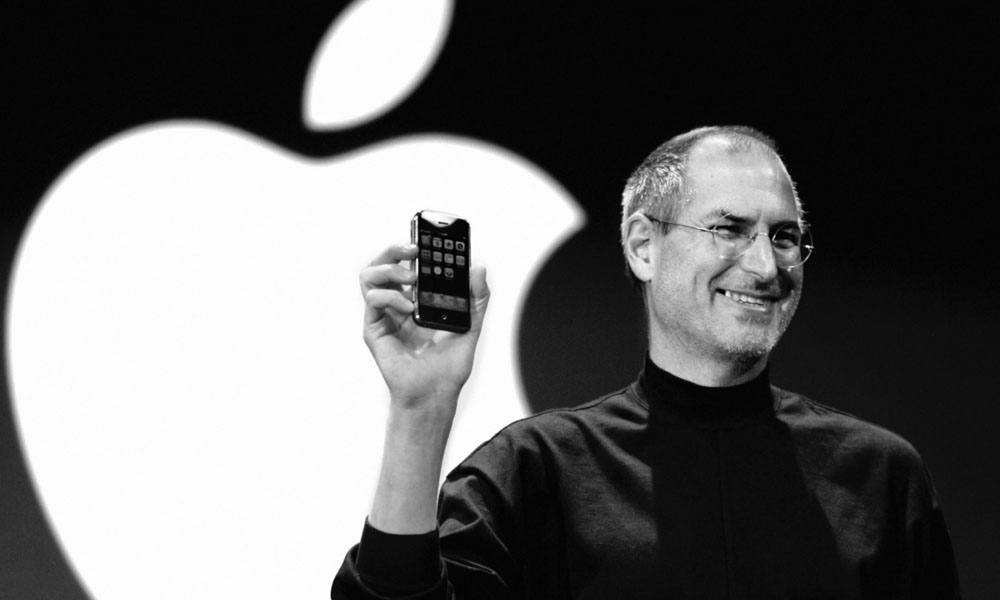

The product service ecosystem, one of the most effective business strategies of the twenty-first century, has the key to this puzzle. The renowned businessman Steve Jobs himself is credited with developing this tactic.

To explain, building a product-service ecosystem is a strategy whereby a company tries to strategically integrate its products into the lifestyle of the consumers such that, over time, the consumers end up purchasing products from the same brand or find it extremely challenging to switch to a different brand.

The easiest way to understand these words would be to know how Steve Jobs created an Ecosystem for Apple users. Now, this Ecosystem model of Apple primarily consists of three types of elements.

- Entry-level Products

- Retailers

- Upsells.

Depending on your specific needs, you will end up with all three of them in a different way. For instance, if you purchase an iPhone, which is your entry-level device, you will be able to use facetime and iMessage right away. That is the time when you invest in the product through talks and file sharing.

Because you can’t use iMessage on Android, your iMessage habit and your chats serve as retainers that force you to stick with Apple. You might ask why I would continue with an iPhone only for a few chats and one app.

There are two reasons for this: First, chat connections are more important than you may realize, and second, investing in more than one app won’t force you to stay with Apple. Some apps include the Apple podcast suggestion app, Apple Fitness Plus, and even a professional camera app like Filmic Pro. So, depending on who you are, the upsell happens when you have the hang of these Retailers.

In this instance, having an iPhone 10 increases your likelihood of purchasing an iPhone 13 this year. Why? Because even though your phone may be ancient, you still want to hang onto your investments, which include iMessages, a fitness tracker, and most significantly, the user interface.

Similarly, In my case, last year I bought a MacBook Pro and then I bought a file control software in order to edit my videos which cost me 25,000 Rupees. Now fast forward to one year later. I am so used to this software, and its user interface that if I switch to another editing software, it will be exhausting, and at the same time, I have already made a heavy investment of 25,000 Rupees. Therefore when I buy my next laptop, it is more likely to be a MacBook Pro because Retailer is a final cut Pro, which I’ve already paid for.

This is the most fundamental level of the ecosystem’s grasp, and once this magic happens, stores like fitness convince you to buy a smartwatch, and giveaways make you dependent on it. The touchpad is so insane that using another touchpad is nearly impossible for at least a week. This is the magic of the week: the three elements of the Apple ecosystem: Entry products, Retailers, and Upsells.

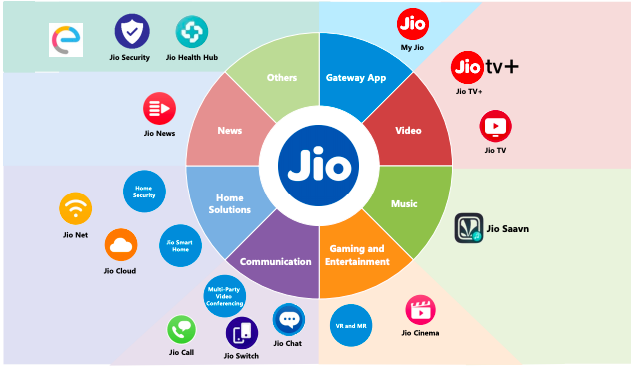

You know what? Suppose you pay close attention to what is going on around you. In that case, you will see that Jio and Airtel are building a complete digital ecosystem and want to integrate your products and services into some of the most important areas of your life. In addition, this is a multibillion-dollar business conflict that is played out as follows:

When you purchase a Jio SIM, a Jio TV is also available. You will also receive a Set Top Box with comprehensive offerings at a meagre cost when you purchase a Jio broadcast connection. And today, a Jio connection is included when you purchase a MI TV. You actually buy into Jio’s Ecosystem when you purchase a product, as you can see. By putting its energy level in an easily accessible manner, Jio is establishing its first layer of the ecosystem in this way.

You know what? The most critical reason why Airtel survived is because Airtel realized the Importance of the Ecosystem, and they started pivoting the ecosystem to building an ecosystem faster than any other player in the market.

How did Airtel make the switch to creating an ecosystem so swiftly is the question? It turns out that Airtel had already accomplished a remarkable feat with its current offerings in 2016–2017; their DTH service was one of the strongest competitors in the industry together with Tata Sky, with a market share fluctuating between 20 and 25 per cent.

Additionally, they had a firm grip on enterprise services. And the majority of people are unaware that their most lucrative commercial venture, Airtel, contributed 14% of the total income in the fiscal year 2021.

Thirdly, Tata Sky dominated the market, while Tata Dokumu was a flop. As for BSNL, we genuinely don’t know whether it performed poorly or whether it was purposefully paralyzed to do badly.

Nevertheless, Airtel made some really audacious moves to smash a home run in this situation. In order to start purchasing lesser players, they went on a shopping spree, buying Videocon Telecommunications in 2016, Telenor, and Tata Tele Service in 2017. They gained more spectrum as a result, and Jio was prohibited from acquiring these businesses and encircling Airtel.

Second, they made the decision to focus primarily on high-value clients in 2018 and implemented a minimum recharge cap. In the end, this allowed Airtel to save a tonne of resources and increase their profitability even though they lost 4.8 Crore consumers in the December quarter of 2018 alone.

They started merging their services last and foremost in order to create an ecosystem similar to Jio. They began to provide with the introduction of a set-top box with a broadband connection and the provision of exclusive access to additional services like Wynk music.

Thirdly, compared to the rest of its competitors, Airtel already provided far better customer service.

Finally, and most crucially, Airtel already had 21 lakh connections in place in 2017 when the groundwork for its broadband service was already established. Now, if you compare this to the other competitors, you will discover that they severely lagged behind Airtel in many areas. Neither Vodafone nor Idea had a substantial DTH presence. However, Videocon had a strong DTH presence.

This is where the game began to alter. In addition to retaining customers, an organization that begins integrating various goods into its ecosystem gains three great superpowers.

1)It Offered multiple challenges for the brand to penetrate into the customers’ lifestyles and present Entry-level products. That is, if the iPhone fails, Apple can always come back to you with a MacBook Pro.

2) It grants you the superpower of employing the loss-leader approach, which encourages people to purchase a high-margin product while selling low-margin products at a loss.

3) Thirdly and most importantly, it gives you the opportunity to break into your Rival Ecosystem.

And guess what? This is what exactly happened during the pandemic, and Airtel broke into the Jio Ecosystem by utilizing all of its superpowers.

What made the epidemic so unique, one would wonder? Well! As we are all aware, the pandemic sparked a dramatic increase in the demand for high-speed internet connections due to a significant change in consumer behaviour, including working from home and homeschooling. You know what, this is what transpired;

(1) Airtel used its the first superpower of existing B2B enterprise clients and offered all the clients and offered all the companies a service to provide all their employees with a high broadband connection with high speed and related to it. Additionally, it spent a lot of money and quickly formed partnerships with local operators, offering them generous incentives to build its lines even in tier 2 and tier 3 cities. They then started capturing these broadband subscribers as soon as feasible.

Airtel, therefore, adopted the internet as an alternative and positioned it as an entry-level offering to break into the customer ecosystem because it could not give out free SIM cards to enter the lifestyles of its customers.

(2) When it offered the customers broadband connections, it also came with an additional offering called the Airtel Extreme Set-Top Box, which gives you one month of DTH HD pack plus Prime Video plus Disney+Hotstar even at the base level plan.

So what is Airtel doing over here? It is using the second superpower of the ecosystem strategy, which is the lost leader strategy.

(3) Last and the most important, by expecting these strategies very well, Airtel successfully placed its products even in those households which already have a Jio SIM. This means that it started breaking into Jio’s Ecosystem

You know what? Reliance only managed to sign up 17 lakh subscribers, while the number of broadband consumers increased by 95 lakh in September 2020. In the end, Airtel managed to sign up 70 lakh users, which indicates that many of them were also given the option of a DTH subscription or even an Airtel SIM Card.

Unsurprisingly, Airtel is catching up rapidly and frequently outperforming Jio in the wireless market. In actuality, Jio only added 19.5 lakh new wireless subscribers in January 2021 compared to Airtel’s more than 58.9 million additions. That is a 300 per cent difference in growth rate. In the Jio Ecosystem, Airtel is acting as the Trojan Horse in this way, and while everyone’s attention is on Jio, Airtel may actually wind up accomplishing something unique. Particularly considering its aggressive integration initiatives like

This raises the question, Is there a possibility that the Airtel Stock might turn a person into a millionaire? Well! That gets us to the most crucial section of the movie, where we discuss the key takeaways from this case study from the perspectives of investors and entrepreneurs.

Lesson 1: In this digital age that we live in, there are typically two categories of products available on the market: stand-alone products and ecosystem products. One’s superiority over the other is already known. In order to satisfy your clients, you must consider how to create an ecosystem of your products from a business perspective.

Because it ultimately aids in avoiding significant threats from rival businesses, and from an investor’s perspective, you must keep an eye on these businesses. To choose the winner before the public finds out, you should have an understanding of how these ecosystems are developed.

Lesson 2: As of the right moment, only entry-level goods have been developed by Airtel and Jio, and neither company has established a robust retail network. Therefore, constantly remember that while entry-level products can provide you with the customers, only upselling and retailers will lead to an exponential increase in revenue. Therefore, please pay attention to how these two businesses are developing their retail networks in order to sell more of their items.

Edited by Prakriti Arora