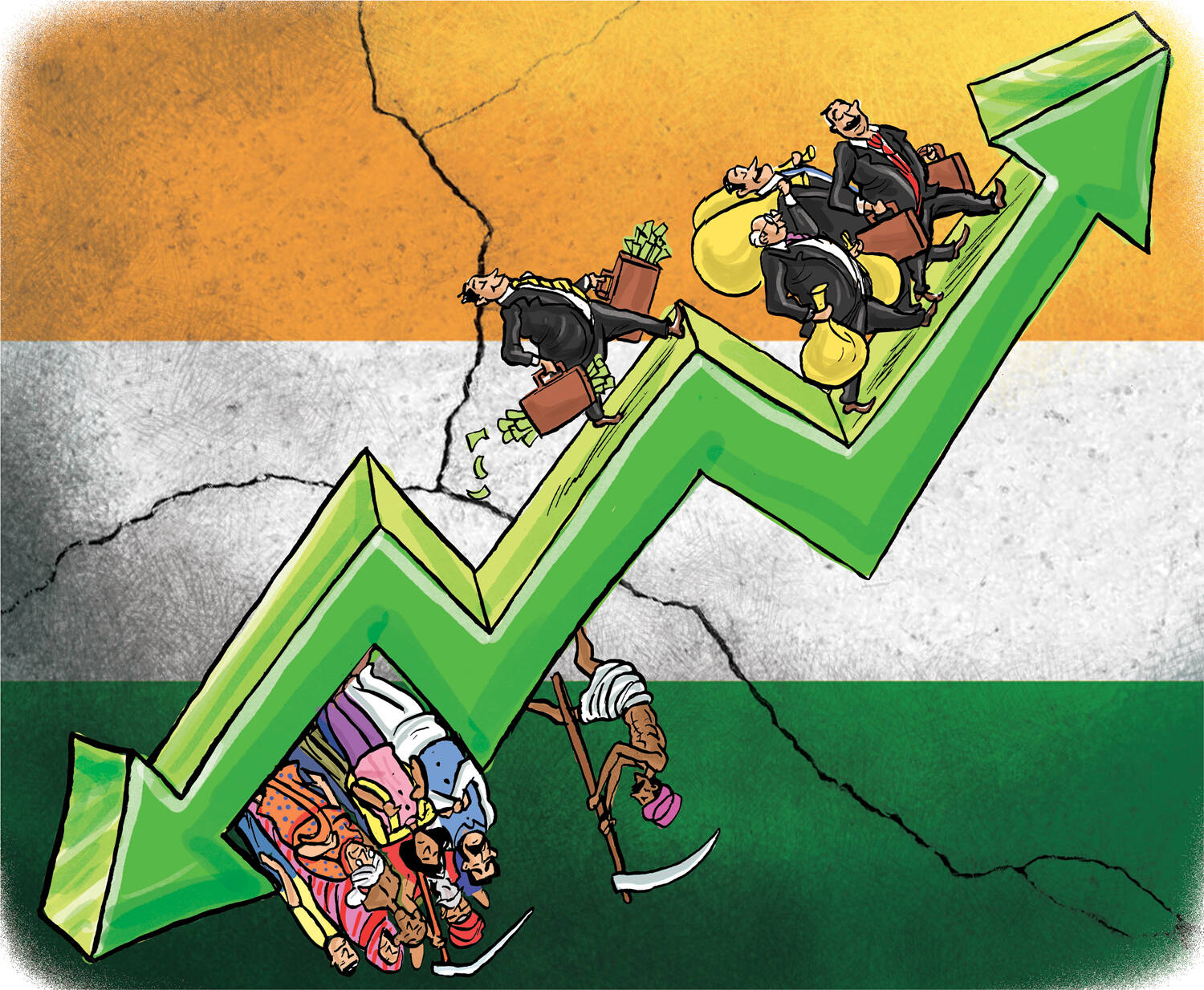

India’s economy waged a courageous battle against downside risks in 2022

India’s economy waged a courageous battle against downside risks

The macroeconomic data issued by the National Statistical Office (NSO) on May 31 demonstrates considerable stability in the recovery of the domestic economy, despite the many obstacles posed by geopolitical and linked threats and actions of central banks of major nations.

Many central banks have recently normalized monetary policy to combat inflation. Raising policy rates, tightening liquidity, halting the bond purchasing binge, and aggressive use of other monetary policy instruments prompted bond rates to skyrocket and financial markets to become very volatile. As a result, the BSE Sensex plummeted to 55818 at the close of business on June 2, down from a high of 62245 reached on October 19, 2021.

Together with other external shocks, these policies resulted in a flight of foreign portfolio investments (FPIs) from developing economies to western destinations, causing a domino effect on the currency’s external value. As a result, between December 31, 2021, and June 1, 2022, the INR lost over 4% of its value. As a result, currency reserves dropped from US$ 642.45 billion on September 3, 2021, to US$ 593.28 billion on May 20, 2022.

It’s worth noting that India’s economy has fared relatively well in the face of tectonic dangers. The IMF has already cut India’s GDP growth forecast to 8.2% in FY22 and 6.9% in FY23.

Due to the economic damage caused by the war in Ukraine, global growth is expected to slow from 6.1 per cent in 2021 to 3.6 per cent in 2022 and 2023. Despite early symptoms of stagflation in various world areas, India’s economy has shown resilience and strong fundamentals.

Despite adverse risks and sluggish growth in some passive industries, the outcome was neither as good as expected nor sufficiently disappointing to undermine future growth forecasts. According to the Chief Economic Advisor (CEA), India’s stagflationary risks are minor compared to those of many other nations. The Indian economy will likely continue to grow shortly.

- Performance indicators:

GDP increased by 8.7% in FY22, compared to a decline of 6.6 per cent in FY21. It was lower than the RBI’s forecast of 9.2% but close to the government’s forecast of 8.8% for FY22 in February 2022. GDP in Q4 of FY22 dropped to 4.1 per cent, down from 5.4 per cent in Q3, 8.5 per cent in Q2, and 20.1 per cent in Q1, owing to the Omicron variant and the war between Russia and Ukraine. In the fourth quarter, gross value added (GVA) at base prices increased by 3.9 per cent, compared to 8.1 per cent in FY22.

Before the epidemic, the economy was slowing, with GDP falling to 6.5 per cent in FY19 and 3.7 per cent in FY20. The agriculture sector’s sturdiness is demonstrated by GDP sectoral growth of 3% in FY22, compared to 3.3% in the preceding year. In FY22, the industrial sector rose by 10.6%, compared to a decrease of 3.3 per cent in FY21. The production of critical industries increased by 8.4% in the industry. The services industry grew by 8.1 per cent in FY22 after contracting by 7.8 per cent in FY21.

Meteorological weather forecasts predict a monsoon of 103 per cent in FY23, which will boost the agriculture sector. The domestic picture is bleak, influenced by continued external uncertainties and crude prices reaching the US $ 123 per barrel. In April, GST receipts slowed by 16 per cent to Rs.1.41 trillion, indicating that tough times are on the way.

Furthermore, according to NSO statistics, real GDP increased slightly to Rs. 147.36 trillion in FY22, up from Rs. 135.58 trillion the previous year. The government’s ability to keep the fiscal deficit at 6.7 per cent in FY22, which is ten basis points lower than the budget forecast and 20 basis points lower than the amended estimate, is noteworthy. Higher-income and fewer capital expenditures are seen in the report, which might help to reduce the deficit.

- Risks to growth

The economy took a hit in FY22 due to a slowdown in government final consumption expenditure (GFCE), which grew at a low rate of 2.6 per cent. Low private financial consumption expenditure added to the problem (PFCE). Low demand hampered revival efforts. The near-term dangers are numerous, with the impact of sanctions on Russia escalating and Russia’s split from OPEC potentially exacerbating the problems. Rising commodity costs may further hamper the industry’s performance in FY23.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QEI5LHRPQBMABNNX3W542LTAJU.jpg)

Significant reliance on crude oil, vegetable oils, fertilizers, and metals for imports may wreak havoc on the current account deficit. Tightening monetary policy in big economies might result in FPI redistribution, affecting exchange rate stability. Continued supply-side interruptions, delays, and input shortages may stymie growth expectations. The recessionary patterns currently escaping us might reappear at any time, slowing down the economy’s recovery.

- Way ahead

The RBI expects GDP growth to be 7.2 per cent in FY23; however, this figure might be revised depending on the economy’s shifting risks. The inflationary dynamics imply that repo rates will rise in FY23, maybe in two spells, to return to pre-pandemic levels of 5.15 per cent, with a graded jump of 75 basis points. With the pandemic fading, the contactless service sector and agriculture sector support may return to their earlier development trajectory. China may begin worldwide supply now that tariffs have been withdrawn, smoothing the route forward.

As banks’ capital bases are comfortable, profits are improving, and provision coverage ratios against bad loans are high, they will be able to speed up lending in FY22, allowing trade and industry to pick up speed and productivity. Credit growth in the single digits in FY22 is predicted to accelerate to 12-13 per cent in FY23. Thanks to the central bank’s straightforward policy, the economy is going towards a higher interest rate curve.

The trip to end the loose monetary policy is marked by higher liquidity absorption and an increase in CRR. The Reserve Bank of India (RBI) kept market players up to date on the state of monetary policy, and the government’s focus on Capex and infrastructure remains unchanged. Food prices and commodity movements are projected to moderate due to the recent heatwaves in India, assisting in the management of inflation.

The economic data points represent a courageous struggle against geopolitical and pandemic dangers while navigating unfavourable economic conditions with timely policy actions. India’s strategy to combat current difficulties while achieving its eventual aim of Covid19 vaccination offers a challenging precedent for how multitasking should be undertaken in the greater economic interest. FY23 should be a faster-paced year despite the economy’s downside risks, clearing the door for more collaborative growth.